In this issue

- Bolstered by resilient consumer spending and investment, the U.S. economy expanded in 2023, defying expectations of a recession. MORE

- Home sales remain in the doldrums, reflected in historically low pending home sales. MORE

- Mortgage rates have been on the decline after hitting two-decade highs in October, providing some relief to potential homebuyers. MORE

- Our recap of 2023 spotlights the three key trends that defined the year: resilient consumers, the rate lock-in effect and a rebound in house prices. MORE

Recent developments

U.S. economy: The U.S. economy continued to outperform expectations with economic growth reaching a seasonally adjusted annualized rate of 5.2%1 in Q3 2023, the fastest growth rate since Q4 2021. Excluding the volatile COVID years of 2020 and 2021, last quarter’s growth was the fourth fastest growth rate during the last two decades. The two largest drivers of economic growth in Q3 were consumption and investment. Consumption added 2.4 percentage points and investment added 1.8 percentage points of growth during Q3, and these growth rates were nearly twice their typical contributions in the five years prior to the 2020 recession.

The labor market continued to grow at a rapid rate, especially when considering that the unemployment rate was very low by historical standards. Payroll growth for November was 199,000 and for the full year-to-date, employment growth averaged 232,000.2 The growth in employment during 2023 is a considerable feat given that the unemployment rate was at a five-decade low in 2023. For a comparison, the unemployment rate in 2019 was almost as low as 2023, but during 2019 the labor market only generated an average of 163,000 jobs per month, which is 70,000 less per month than in 2023—a substantial difference.

What’s even more remarkable is that despite the very low unemployment rate and strong labor and economic growth, inflation continued to trend lower. The Core Personal Consumption Expenditures (PCE) price index rose 3.5% year-over-year as of October 2023.3 This was the smallest twelve month increase since April 2021 in the Core PCE price index.

U.S. housing market: Despite the strong economic growth, total home sales declined every month since July 2021 and were down 11% year-over-year in October 2023. Existing home sales fell 4% over the month and 15% over the year in October to a seasonally adjusted annual rate of 3.8 million units,4 the lowest level since summer of 2010. Pending home sales fell 1.5% in October 2023 to a historic low index level of 71.4. While new home sales fell 6% to 679,000 units in October,5 they were 18% above levels seen a year ago.

U.S. mortgage market: The average rate of a 30-year fixed-rate mortgage, as measured by Freddie Mac’s Primary Mortgage Market Survey®, fell almost 0.8 percentage points from the last week in October through the first week in December. This decrease in rates is breathing some life back into the housing market with some potential homebuyers taking action that is reflected in home purchase applications, which increased 15% between mid-October and early December.6 However, demand is currently very sensitive to changes in mortgage rates and rates would need to fall further in order for purchase demand to continue to recover.

Outlook

We expect economic growth to modestly slow from the above 2023 trend growth to the longer-term trend in 2024. The pace of growth of consumption spending may decrease from the levels we saw this year and we expect hiring to cool off, leading to a modest uptick in unemployment. The slowing economy will also lead to further moderation in inflation. However, inflation will remain above the Federal Reserve’s target of 2%. But the progress on inflation will allow the Federal Reserve to continue to pause or start to cut rates.

In this environment, mortgage rates are expected to gradually ease throughout the year but remain in the 6% to 7% range. While lower rates will help alleviate affordability issues, they will not be low enough to pull substantial inventory of existing homes into the market. Thus, the home sales market in 2024 will look similar to 2023, characterized by low transaction volume and a severe lack of inventory. Additionally, the weaker economy and slower labor market will reduce demand. However, due to the still tight supply of for sale inventory, we forecast house prices to increase 6.3% in 2023 and 2.7% in 2024 nationally.

The low level of home sales will keep purchase mortgage origination volume down in the number of transactions, but the increase in house prices will drive a modest increase in the dollar volume of purchase originations. The decline in mortgage rates will not be large enough to push many mortgage borrowers into a refinance, so refinance origination volume will remain low in 2024. The market should be significantly better for both purchase and refinance activity in 2025.

December 2023 SPOTLIGHT:

The year in review – top three trends of 2023

- Resilient consumers

- Rate lock-in effect

- Rebound in house prices

Resilient consumers helped the economy avoid recession

At the start of this year, most forecasters were anticipating a recession, unlike what our team of economists was forecasting. The Freddie baseline forecast at the beginning of 2023 and throughout the year was that of “no recession.” For example, in January of 2023, the economic survey by Wall Street Journal economists placed the median probability of a recession in the next twelve months at 65%. Consensus views had the probability of a recession in the next twelve months at or above 60% for most of the calendar year, only falling to 50% in Q4 2023. Even though the economy has avoided a recession in 2023, some economists are still calling the likelihood of a recession next year a “coin flip.”

But why did the U.S. economy not go into a recession in 2023? It’s because of resilient consumers. There was an ongoing war in Europe, several large bank failures in the spring along with the constant and mounting pressure of higher interest rates and tighter financial conditions. Yet despite these challenges, economic growth accelerated through the third quarter of 2023. One major reason these shocks didn’t drive the economy into a recession was the resilience of the U.S. consumer.

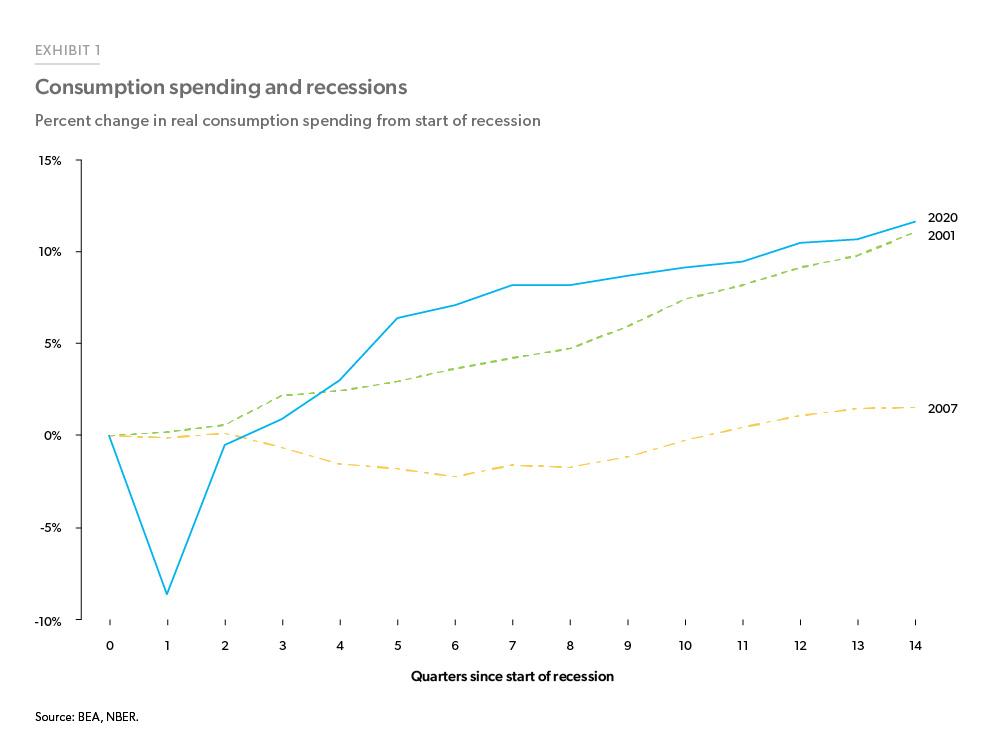

Consumers armed with savings from the pandemic continued to spend even in the high inflation, high-rate environment. As per the latest GDP report for Q3, consumption spending grew at a seasonally adjusted annual rate of 3.6% and contributed 2.4% to the GDP growth in Q3. Consumption spending recovery after the pandemic recession was the strongest among the recessions of this century (Exhibit 1). A strong labor market, rising incomes and the pandemic era excess savings along with low debt service ratios also contributed to this resilient spending.

Enlarge Image

The main source of strength for consumer spending has been the very strong labor market. In no previous recession did we lose as many jobs as during the pandemic recession (22 million), but the recovery has also been very strong. The two recessions preceding the 2020 COVID recession (Q1 2001-Q4 2001 and Q4 2007-Q2 2009) were deemed to be jobless recoveries as it took almost 4 years in the 2001 recession and 6 years in the 2007 recession to add back all the jobs lost. However, during the pandemic recession, not only did we gain back all the jobs lost within 2.5 years, but we also added around 5 million more jobs since then. The unemployment rate has also remained below 4% for around 21 months now, which is the longest streak of below 4% unemployment since the 1960s.

The tight labor market boosted incomes after the pandemic. Real per capita incomes have been on the rise since 2022 and by mid-2023 reached year-over-year growth not seen since early 2015. Rising incomes along with the stimulus payment consumers received during the pandemic also helped boost their consumer balance sheets. As of October 2023, total consumer bank deposits stood at a high of $17.4 trillion. This had two effects: reduction of debt service ratios and an increase in their net worth. Debt service ratios have remained below 10% since 2012 and had reached historical lows during the pandemic due to the stimulus payments. While they are rising now, they remain below the historical average of around 11%. Consumer net wealth has also risen across all income levels.

Excess savings that the consumer accumulated during the pandemic also helped support consumption spending. We discussed excess pandemic savings in our August 2023 Outlook. The total accumulated savings was in excess of $2 trillion and even though consumers have been drawing down on these savings, estimates suggest that consumers still have around $430 billion in excess savings as compared to the trend in the four years prior to the start of the pandemic.7

Mortgage rate lock-in effect froze the housing market

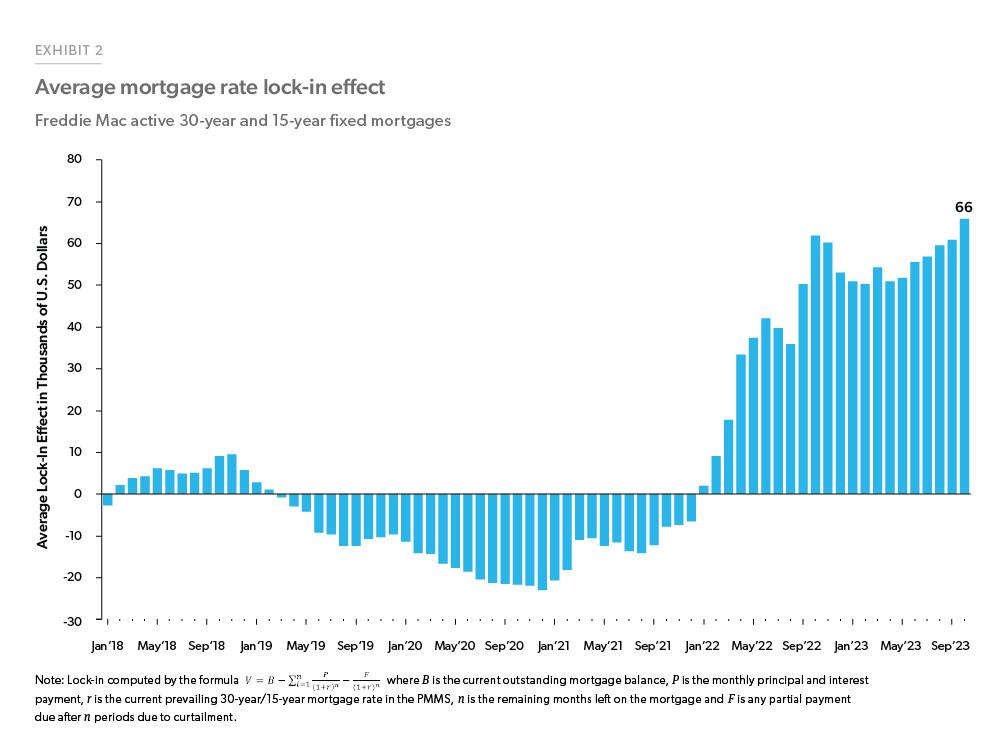

The housing market remained frozen in 2023 due to lack of supply and high mortgage rates adding to affordability pressures. The lack of housing supply was partly driven by the rate lock-in effect. In 2020 and 2021, mortgage rates fell significantly hitting a historic low of 2.65% in January 2021 prompting many existing homeowners to refinance into these lower rates. Nearly 6 out of 10 borrowers now have a mortgage rate below 4%. Since then, mortgage rates have increased from the historical lows to 23-year highs. While rates have come down since the end of October, they remain well above the 4% rates that nearly 60% of existing homeowners are currently locked into. With higher rates, the incentive for existing homeowners to list their property and move to a new house has greatly diminished, leaving them rate locked. As mentioned in our July 2023 Spotlight, we use the term “mortgage rate lock-in effect” to refer to the impact that ownership of a mortgage on a favorable term compared to current market interest rates has on a homeowner’s incentive to sell their house.

Based on our updated analyses of Freddie Mac’s funded loans, as of October 2023 the national average mortgage rate lock-in effect for 30-year and 15-year fixed-rate mortgages is $66,000.8 For active loans in October 2023 in Freddie Mac’s portfolio we estimate that homeowners with fixed-rate mortgages have locked in savings of a collective $800 billion in total value (Exhibit 2). This recent rate lock-in effect surge explains the low supply of existing homes for sale on the market which has pushed existing home sales to 13-year lows.

Enlarge Image

House prices rebounded

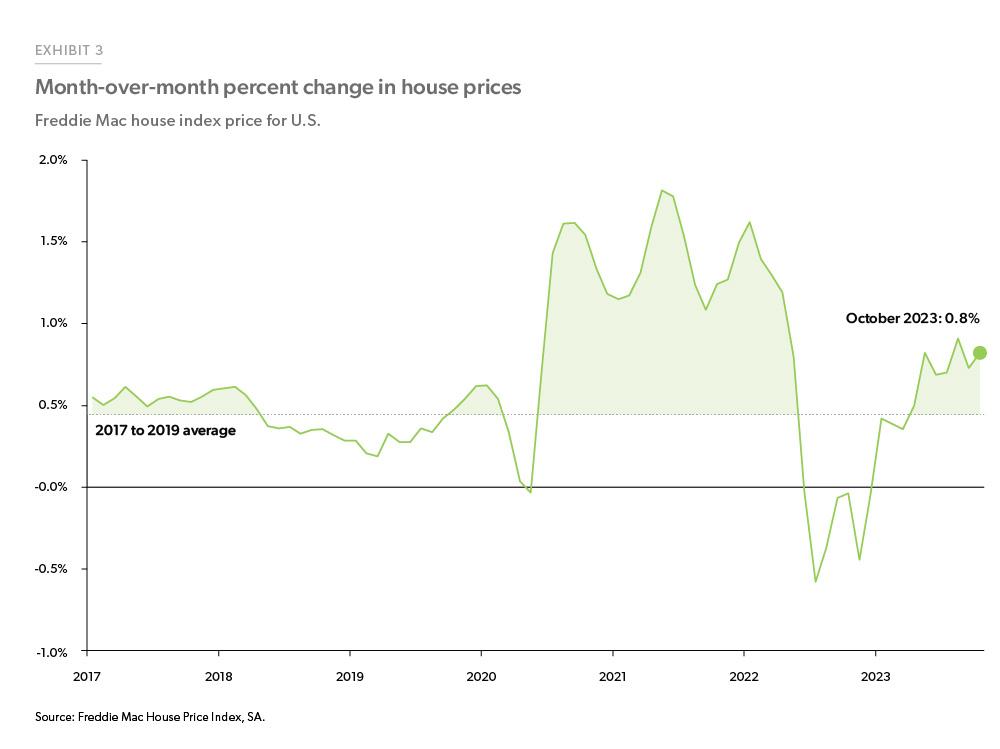

Early in 2023, it appeared we were finally entering the “calm after the storm” phase for house prices where homebuyers would finally see some relief from the post-pandemic demand shocks that resulted in near-20% year-over-year house price appreciation over the previous two years. The latter half of 2022 saw a sharp slowdown in house price growth that carried into the first couple of months in 2023. Specifically, the Freddie Mac House Price Index (FMHPI) annual rate of growth decelerated from 18.8% in February 2022 to 0.9% in April 2023. The slowdown in home price growth was the direct result of the rapid deterioration in affordability that began in 2022 and continued into 2023.

However, market forces prevailed in the second half of 2023 and house price growth re-accelerated. One reason for this rebound, as mentioned above, has been the rate lock-in effect with existing homeowners not willing to give up their low mortgage rates and supply remaining low despite a large drop in home sales. Exhibit 3 shows that house prices grew at a monthly rate of 0.8% in October 2023, which translates to an annualized rate of more than 10%. Additionally, since May 2023, month-over-month house price growth averaged 0.8%, which is above the 2017 to 2019 pre-pandemic average of 0.4%.

Enlarge Image

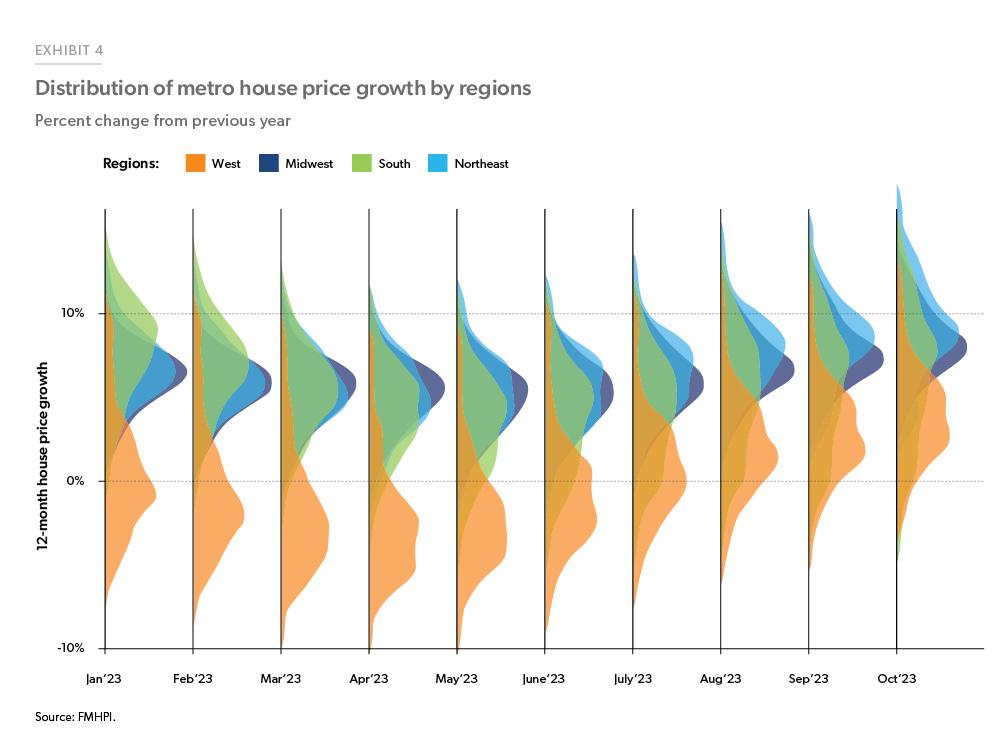

Finally, if we look at the year-over-year distribution of metro-level data by region, we can see that Western urban areas were hit particularly hard but are now making a comeback. Exhibit 4 shows that the distribution of Western metro annual house price growth centered below 0% for the first six months of 2023, but has quickly shifted to above 0% in recent months. Conversely, Exhibit 4 also shows Northeastern urban areas outside of the largest cities have been leading the way in terms of annual house price appreciation, especially in the last couple of months. This new trend likely reflects the fact that these markets remain affordable and have not previously had substantial increases in home prices.

Enlarge Image

Overall, despite the sanguine sentiment, the economy continued to grow rapidly in 2023 due to strong consumer spending and the tight labor market. The rapid rise in mortgage rates caused home sales to significantly decline and as a result home price growth slowed. However, while demand fell, supply did not increase much at all due to the lock-in effect and by mid-2023 home prices were growing rapidly again due to the structural deficit in supply.

-

Footnotes

1 Bureau of Economic Analysis (BEA)

2 Non-Farm Employment, Bureau of Labor Statistics

3 BEA

4 National Association of Realtors

5 U.S. Census Bureau and U.S. Department of Housing and Urban Development

6 Mortgage Bankers Association

8 See our July 2023 Spotlight for a discussion of the analysis.

Prepared by the Economic & Housing Research group

Sam Khater, Chief Economist

Len Kiefer, Deputy Chief Economist

Ajita Atreya, Macro & Housing Economics Manager

Rama Yanamandra, Macro & Housing Economics Manager

Penka Trentcheva, Macro & Housing Economics Senior

Genaro Villa, Macro & Housing Economics Senior

Lalith Manukonda, Finance Analyst