What is down payment assistance?

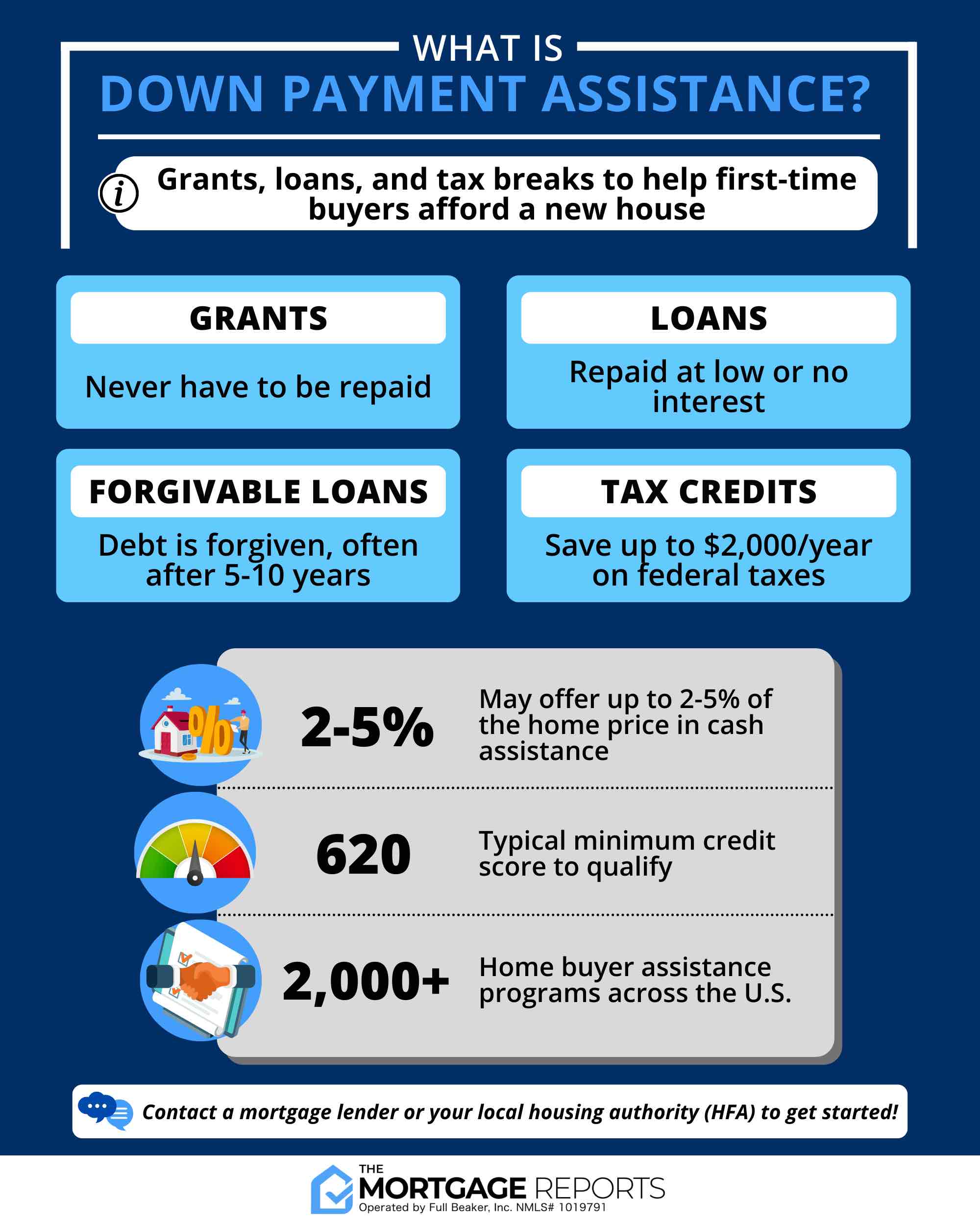

Down payment assistance (DPA) programs offer loans and grants that can cover part or all of a home buyer’s down payment and closing costs.

More than 2,000 of these programs are available nationwide. State, county, and city governments run many of them.

DPA programs vary by location, but many home buyers could be in line for thousands of dollars in down payment assistance if they qualify.

Verify your home buying eligibility. Start here

In this article (Skip to…)

>Related: How to buy a house with $0 down: First-time home buyer

Who qualifies for down payment assistance?

Down payment assistance programs are typically meant for first-time home buyers. However, a repeat home buyer often counts as a “first-time buyer” if they haven’t owned a home in the past three years.

Typical requirements to qualify for down payment assistance:

- First-time home buyer

- Low- to moderate-income

- Buying a primary residence

- Buying within local purchase price limits

- Using an approved mortgage program

- Working with an approved mortgage lender

Keep in mind that every down payment assistance program is a little different. The exact criteria to qualify will depend on where you live and which programs are available.

In addition, you could get more money and qualify easier if you’re buying in a so-called “target area.” Your lender can help determine if your property is eligible.

Verify your first-time home buyer eligibility. Start here

How down payment assistance works

Down payment assistance (DPA) helps homebuyers with grants or low-interest loans, reducing the amount they need to save for a down payment. Provided you qualify, you could receive a forgivable loan or an outright cash gift that never has to be repaid. Some loans must be repaid with low or no interest. Many DPAs can be used for closing costs, too.

Most DPA programs are offered at the local level. And eligibility requirements vary from one program to the next.

Check your first-time home buyer eligibility. Start here

Many DPAs require that you be a first-time home buyer (meaning you haven’t owned a home in three years) with a decent credit score and a low or moderate income. But not all programs have these same rules. Also, note that many DPA programs have a list of “participating lenders” they work with. Therefore, it might be necessary for you to select a lender that your assistance program has approved.

Types of down payment assistance programs

There are four main types of down payment assistance:

- Grants: Gifted money that never has to be repaid

- Loans: Second mortgages that are paid monthly along with your primary mortgage

- Deferred loans: Second mortgages with deferred payments that only have to be paid when you move, sell, or refinance

- Forgivable loans: Second mortgages that are forgiven over a set number of years (often five, but maybe up to 15 or 20). These only need to be repaid if you move, sell, or refinance too early

Verify your home buying eligibility. Start here

Some DPA loans are interest-free, some have lower rates than your first mortgage, and others require the same or a higher rate than that. A quick count of the programs listed below suggests that all four types of DPA are widespread. Grants are the most common, but not by much.

How to find down payment assistance programs

Down payment assistance programs are usually very localized. There are a few national DPAs and many statewide ones, but the majority are run at the city or county level.

The best way to find down payment assistance programs for which you qualify is to speak with your loan officer or broker. They should know about local grants and loan programs that can help you out. They’ll also know which programs the lender can accept (not all lenders work with all DPAs).

Verify your first-time home buyer eligibility. Start here

If you want to do some research on your own, you can also Google “down payment assistance grants in [state, county, or city].” This will help you find current programs specific to your area that you might be able to apply for.

How much down payment assistance can I get?

Down payment assistance programs are something of a ZIP code lottery. Depending on where you want to buy, you could be in line for a few thousand dollars or tens of thousands. And your program will dictate whether the money is a grant or a loan that needs to be repaid.

Verify your home buying eligibility. Start here

For example:

- In Seattle, you could get up to $55,000 as an interest-free loan that you don’t have to pay until you move, sell, transfer, or refinance your home. And that could be decades later

- In New York City, you could qualify for a forgivable loan of up to $100,000, which, if you stay in the home for 10–15 years (depending on loan amount), does not have to be repaid

- In Iowa, you could get a grant of up to $2,500 toward your down payment and closing costs

Of course, some homeowners will qualify for more and some for less. The only way to know how much help you’re in line for is to find local down payment assistance programs in your area and apply.

Is there closing cost assistance, too?

Some homebuyer programs explicitly state that you can use their funds for closing costs as well as your down payment. Others may or may not have rules about that. Check your local down payment assistance programs to see if closing cost grants are included.

What mortgages can be used with down payment assistance?

Almost all DPA programs require you to borrow from an approved lender and use an approved mortgage program. You may have to sign up for a particular mortgage product.

Verify your home buying eligibility. Start here

However, DPA-approved mortgages often include the most popular loan programs, like:

- Conforming loans from Fannie Mae and Freddie Mac

- FHA loans (backed by the Federal Housing Administration)

- VA loans (backed by the Department of Veterans Affairs)

- USDA loans (backed by the U.S. Department of Agriculture)

In other words, the mortgage products allowed by your DPA program may be very flexible.

Down payment assistance programs by state

Depending on whose math you trust, there are between 2,000 and 2,500 DPA programs in the U.S. State and local governments, as well as nonprofit organizations, typically manage these. We list some of the biggest programs in each state below.

Verify your home buying eligibility. Start here

The U.S. Department of Housing and Urban Development (HUD) also lists many homeownership assistance programs, including DPA, on its state pages.1

While we have made reasonable efforts to make sure the information below is correct at the time of posting, it is subject to change without notice. Please check the relevant websites for more information.

Alabama Down Payment Assistance Programs

The Alabama Housing Finance Authority (AHFA) provides various programs and initiatives to make homeownership more accessible and affordable for individuals and families. They provide financial assistance in the form of down payment assistance and closing cost grants, which can help alleviate the upfront expenses associated with purchasing a home.

AHFA Step Up DPA

The AHFA will lend you your down payment in the form of a 10-year second mortgage. That deal comes with conditions:

- Your household income can’t exceed $130,600

- You need a credit score of 640 or higher (680 or higher if you make more than 80% of your area’s median income)

- Debt-to-income ratio of 45% or lower.

- Your new first (main) mortgage must be a Housing Finance Authority Advantage conventional loan, FHA, or VA loan from a participating lender.

AHFA Affordable Income Subsidy Grant

In addition to the down payment assistance currently offered through Step Up, borrowers who opt for financing through the HFA Advantage loan receive a grant to help with closing costs. To qualify, your annual income cannot exceed 80% of the area median income (AMI) for the property’s location. You’ll also need to meet AHFA’s standard guidelines for credit score, debt-to-income ratio, and more.

Get more details on the Step Up homepage. And take a look at HUD’s list1 of alternative programs for Alabama.

Check your home buying eligibility in Alabama. Start here

Alaska Down Payment Assistance Programs

The Alaska Housing Finance Corporation (AHFC) can provide both down payment assistance and closing cost assistance.

Affordable Housing Enhanced Loan program (AHELP)

AHELP provides qualified borrowers with down payment assistance that may come in the form of a grant, deferred payments, a forgivable loan, or a combination of these options. The funds come through Alaska Housing’s network of local and federal governmental agencies, nonprofit agencies, or regional housing authorities

To be eligible, borrowers must meet the participating provider’s requirements.

- Borrowers may not own other residential real estate in the same general area

- Eligible properties are limited to owner-occupied single-family homes, condominiums, and manufactured homes

- An authorized home inspector must examine any homes that are ten years old or older

- You must complete an approved home buyer education class

However, the website doesn’t provide much information about how much help is available. So your best bet is to speak with one of the many participating providers. You’ll find a list on the program’s website.

Closing Cost Assistance program

Alaska Housing can also offer a grant toward your closing costs and down payment. This grant is equal to either 3% or 4% of the loan amount, depending on your credit qualifications.

- You must have a score of 640 or above to be eligible

- You can get up to 4% of the purchase price of the home you’re buying. However, you may get only 3% if your credit score is particularly low

- You must be buying (not refinancing) a single-family home that you’re going to occupy yourself

- You must be financing that with a 30-year, fixed-rate mortgage backed by the Federal Housing Administration (FHA), Department of Veterans Affairs (VA), or U.S. Department of Agriculture (USDA)

As of now, the program’s status is a bit of a puzzle. Some information on the website suggests it’s not running at the moment, but other details seem to say otherwise.

To add to the confusion, there’s no word on whether any hiatus is temporary or here to stay. If you’re scratching your head like we are, the surefire way to get clarity is to give Alaska Housing a call. They’re just a toll-free dial away at 888-854-3884.

Regardless, you can learn more at the AHFC’s Closing Cost Assistance Program webpage. And take a look at HUD’s list1 of alternative programs for Alaska.

Check your home buying eligibility in Alaska. Start here

Arizona Down Payment Assistance Programs

Home buyers in Arizona have the option of choosing between two down payment assistance programs, depending on the location of the property they wish to purchase.

Home Plus Arizona

The Arizona Industrial Development Authority (AZIDA) offers the Home Plus program, which provides up to 5% of the initial balance on your new mortgage. The amount you might get will depend on the type of mortgage you choose.

- Funds can be applied to both down payment and closing costs

- You’ll need a minimum credit score of 640 to qualify for the program

- To be eligible, your annual income must not exceed $126,351

- You’ll also need to complete a homebuyer education course prior to the loan closing

Home Plus is a three-year deferred second mortgage. That means there is no interest and no monthly payments, provided you do not sell or refinance the property within the first 36 months of homeownership. Find out more at the Home Plus homepage.

Pathway To Purchase DPA

The Arizona Department of Housing’s Pathway To Purchase program provides a 10% grant for down payment and closing costs, up to $20,000, for qualifying individuals or families looking to buy homes in 17 select cities across Arizona.

While you don’t have to be a first-time home buyer, there are specific qualifications: a minimum FICO score of 640, a maximum 45% debt-to-income ratio, and standard loan guidelines.

The program supports the purchase of existing homes, condos, or townhouses, but not new construction or spec homes, with a 30-year fixed rate mortgage where the first loan is 95% or less.

All participants are required to complete a homebuyer education course and home inspection. To be eligible, you can’t own another home and the maximum home purchase price is set at $371,936.

Learn more on the program’s website. And take a look at HUD’s list1 of alternative programs for Arizona.

Check your home buying eligibility in Arizona. Start here

Arkansas Down Payment Assistance Programs

The Arkansas Development Finance Authority (ADFA) has a couple of helpful programs.

ADFA’s home loan program, “ADFA Move-UP,” offers home buyers an “affordable” mortgage and can be used in conjunction with a conventional, FHA, VA, or USDA mortgage loan.

Those taking advantage of the Move-Up loan might also be able to access down payment assistance through the ADFA. The organization offers a few assistance programs:

- The Arkansas Dream Down Payment Initiative (ADDI): Up to $25,000 in down payment and closing cost assistance for low-income buyers, forgiven over 5-10 years depending on loan amount

- The ADFA down payment assistance program (DPA): Between $1,000 and $15,000 as a second mortgage paid off over 10 years

- ADFA mortgage credit certificate (MCC): A dollar-for-dollar tax credit worth up to $2,000 per year

Visit the web pages of the ADFA Move-Up Choice and AFDA Down Payment Assistance programs to discover more, including income limits for your county. And take a look at HUD’s list1 of alternative programs for Arkansas.

Check your home buying eligibility in Arkansas. Start here

California Down Payment Assistance Programs

The California Housing Finance Agency’s (CalHFA) MyHome Assistance Program provides down payment help for eligible buyers. This takes the form of a second mortgage of 3–3.5% of the home’s purchase price.

- The program provides 3% for homes financed with CalHFA loans

- It provides 3.5% for homes financed with FHA loans

This is a first-time home buyer’s down payment assistance program. So it won’t help if you already own an existing home.

However, CalHFA defines a first-time home buyer as “someone who has not owned and occupied their own home in the last three years.” So many who’ve previously owned homes may qualify.

Check out the MyHome Assistance Program webpage for more information. You’ll find some income limits there. If you’re a teacher or fire department employee, certain program limits may not apply.

Also, take a look at HUD’s list1 of alternative programs for California.

Check your home buying eligibility in California. Start here

Colorado Down Payment Assistance Programs

For qualified Coloradans, the Colorado Housing and Finance Authority (CHFA) and the Colorado Housing Assistance Corporation (CHAC) both offer down payment assistance grants and second mortgages.

CHAC Down Payment Assistance

Colorado Housing Assistance Corporation is a nonprofit organization that offers down payment assistance and affordable loan programs to low- to moderate-income home buyers in Colorado.

CHAC’s assistance is intended for first-time buyers. To qualify, you’ll need to have a low or moderate income compared to others in the area in which you live.

- You need to save up at least $1,500 of your own money (not a gift) toward your down payment to be eligible. If you’re part of the state’s disability program, that $1,500 is reduced to $750

- This down payment assistance comes in the form of a second mortgage loan that must be repaid via monthly payments. Borrowers must also take a homebuyer education course

For more, visit CHAC’s website. And consult HUD’s list1 of alternative programs for Colorado.

Check your home buying eligibility in Colorado. Start here

CHFA Down Payment Assistance

The Colorado Housing and Finance Authority provides valuable assistance to first-time home buyers in the form of down payment assistance grants and second mortgage programs. These programs make it easier for families with moderate and low incomes to buy a home.

Home buyers who use CHFA first mortgage loan programs to finance their home purchase may qualify for additional assistance with the down payment and closing costs. You are still allowed to use one of the following options, even if you contribute to your down payment:

- CHFA Down Payment Assistance Grant: Qualified borrowers can receive up to 3% of their first mortgage (loan amount capped at $25,000). The help comes in the form of a grant, so you’re not required to repay those funds

- CHFA Second Mortgage Loan: This program offers a forgivable loan of up to 4% ($25,000 maximum) of your first mortgage rather than an outright grant. The loan balance won’t have to be repaid unless certain events occur, like when your first mortgage is paid off, when you sell or refinance your house, or when you stop using it as your primary residence

To be eligible for either program, you must meet the standard requirements, which include a minimum credit score, income limits, and completion of a homebuyer education course. Visit the program’s website for next steps or more information.

Connecticut Down Payment Assistance Programs

The Connecticut Housing Finance Authority is usually the first stop for first-time home buyers looking for down payment assistance. The organization provides a number of programs and services to help low- and moderate-income families purchase their first home.

Down payment assistance, closing cost assistance, and affordable mortgage options are all part of these programs. In addition to these services, the Connecticut Housing Finance Authority offers education and counseling to assist homebuyers in navigating the complicated process of purchasing a home.

CHFA Down Payment Assistance Program (DAP)

The Connecticut Housing Finance Authority (CHFA) offers up to $20,000 in down payment assistance (DPA) in the form of a second mortgage at 1% interest. However, some borrowers may be entitled to lower DPA rates.

- The minimum DPA loan amount is $3,000

- You can normally borrow between 3% and 3.5% of the purchase price of the home (no more than the minimum required down payment)

- Borrowers are required to attend a free home buyer education course

You must first receive mortgage approval from a participating lender in order to apply for this program.

The CHFA Down Payment Assistance Program webpage includes a list of participating lenders. And check out the HUD’s list1 for other programs in Connecticut.

Check your home buying eligibility in Connecticut. Start here

Delaware Down Payment Assistance Programs

The Delaware State Housing Authority (DSHA) has several ways to make home buying easier, including a down payment assistance program.

- DSHA First State Home Loan: Formerly known as the “Preferred Plus,” this is a second mortgage loan of up to 4% of your home’s purchase price. You can put the money toward your down payment or closing costs. You’d need to repay the money when you sell the home, refinance, or stop using it as your primary residence

- DSHA First-Time Home Buyer Tax Credit: If you qualify for a Preferred Plus loan, you can combine it with a federal tax credit of up to 35% of your annual mortgage interest, up to a maximum of $2,000 per year

You’d have to use a participating lender and meet the maximum income limits, which vary by county.

Find details on the DSHA’s website. And find other DPA programs for Delaware on HUD’s website.1

Check your home buying eligibility in Delaware. Start here

Washington, D.C. Down Payment Assistance Programs

For those looking to buy a home in Washington, D.C., the DC Housing Finance Agency (DCHFA) and the Department of Housing and Community Development (DHCD) offer useful assistance.

They provide down payment and closing cost assistance, competitive mortgage financing options, and resources through programs like DC Open Doors and the Home Purchase Assistance Program (HPAP) to make homeownership more feasible for individuals and families in the District of Columbia.

DC Open Doors Down Payment Assistance Loan (DPAL)

You can get a no-interest loan for as much as you need for your down payment through the DCHFA’s DC Open Doors program.

The DAPL is a deferred down payment loan, which means there are no monthly payments. Instead, you repay the loan in full without paying interest if any of the following events occur: 30 years after the loan’s closing date; the property is sold or transferred; it is no longer your primary residence; or you refinance your first mortgage.

Additionally, if you meet the requirements, you may be eligible for a DCHFA Mortgage Credit Certificate (MCC), which entitles you to a federal tax credit equal to 20% of the mortgage interest you pay each year.

DHCD Home Purchase Assistance Program (HPAP)

The HPAP program, administered by the Department of Housing and Community Development (DHCD), provides down payment and closing cost assistance to low-to-moderate-income first-time home buyers in Washington, D.C.

HPAP offers zero-interest, deferred-payment loans that are repaid when the property is sold or refinanced.

- Qualified low-income applicants: Get an interest-free loan of up to $4,000. There are no monthly payments. The loan falls due when the home is resold or refinanced and must typically be repaid only then. Borrowers who make less than 80% of their area’s median income may qualify

- Qualified moderate-income borrowers: Can also get $4,000 as an interest-free loan. However, they have to start repaying that after five years. Borrowers who make 80% to 110% of their area’s median income may qualify

Read more at the HPAP home page.

DHCD Employer-Assisted Housing Program (EAHP)

The Employer-Assisted Housing Program (EAHP) is designed to assist eligible District government employees in buying their first single-family home, condominium, or cooperative unit in the District. It provides a deferred, 0% interest loan and a matching funds grant to cover down payment and closing costs.

Since the loan is a deferred second mortgage, no repayment is required until you sell, refinance, or no longer occupy the property as your primary residence. You can find more details on the EAHP website. And see other possible DPA programs on HUD’s website.1

Check your home buying eligibility in Washington, D.C. Start here

Florida Down Payment Assistance Programs

The Florida Housing Finance Corporation (FHFC) is a key resource and a buyer’s first stop in Florida. With programs such as down payment assistance, low-interest loans, and homebuyer education, FHFC plays an important role in assisting Florida first-time home buyers.

Florida Assist

The Florida Assist is a deferred second mortgage with a 0% interest rate of up to $10,000 that can be used for a down payment, closing costs, or both. The loan has no monthly payments and is repaid only when you sell, refinance, or pay off your first mortgage.

Florida Homeownership Loan Program (FL HLP)

The Florida Homeownership Loan Program (FL HLP) is designed to provide eligible first-time home buyers with up to $10,000 to use towards their down payment and closing costs. This is a second mortgage with a 15-year amortizing loan at 3%.

3%, 4%, and 5% HFA Preferred Program

The HFA Preferred Program provides assistance in the form of a forgivable second mortgage that’s either 3%, 4%, or 5% of the first mortgage. Your income and the location of the home will determine how much of a loan you are eligible for. Furthermore, for the duration of its 5-year term, the loan is forgiven by 20% each year.

HFA Advantage PLUS Second Mortgage

The HFA Advantage PLUS Second Mortgage is nearly identical to its sister program, with the main difference being that it offers a 0% deferred second mortgage of up to $8,000 that is forgiven at a rate of 20% per year for five years. This is a great option for first-time home buyers who are using one of Florida Housing’s conventional loans.

Florida Hometown Heroes Housing Program

The Florida Hometown Heroes Housing Program was created to help people who provide valuable services to their communities, such as teachers, healthcare workers, law enforcement officers, firefighters, and veterans. Borrowers who qualify can get up to 5% of the first mortgage loan amount, or a maximum of $35,000. This helps with the down payment and closing costs.

That’s a 30-year, no-interest loan that the buyer repays when they sell, refinance, or pay off their first mortgage.

Discover more at the FHFC’s website. And check HUD’s list of alternative programs1 for Florida.

Check your home buying eligibility in Florida. Start here

Georgia Down Payment Assistance Programs

The Georgia Dream Homeownership Program (GDHP) offers various down payment loan options to assist Georgia first-time home buyers or those who haven’t owned a home in the past three years. These programs are designed to make homeownership more accessible and affordable.

- The Standard Loan option provides all eligible homebuyers with up to $10,000 to use towards their down payment or closing costs. This opens up opportunities for individuals and families who may otherwise struggle with these upfront costs.

- The Protectors, Educators, and Nurses (PEN) program goes a step further, offering $12,500 to individuals who work in public service roles such as public protectors, educators, healthcare providers, and active military personnel. This program supports these professionals’ homeownership because of their vital contributions to society.

- The CHOICE program, similarly offering $12,500, is specially designed for families living with a member who has a disability. It recognizes the financial strain that disability care can put on families and offers this generous assistance to help them buy a home.

To qualify, borrowers will need to be within local household income limits and have liquid assets of no more than $20,000 or 20% of the home purchase price (whichever is greater).

You can get all the details from the GDHP website. And check out HUD’s list1 of other DPA programs in Georgia.

Check your home buying eligibility in Georgia. Start here

Hawaii Down Payment Assistance Programs

There isn’t an official statewide down payment assistance program for Hawaii. But help is still available for Hawaii’s first-time home buyers.

The Hawaii Home Ownership Center is a non-profit mortgage brokerage offering both down payment assistance and a 15-year deferred closing cost loan.

- DPAL: This program features a low 3% down payment requirement with no mortgage insurance and no prepayment penalty

- Deferred Closing Cost Loan: Buyers may qualify for up to $15,000 with this 15-year term deferred loan with no interest and no monthly payments. The funds can be applied to both down payment and closing costs. Eligible borrowers must have low to moderate income (120% AMI or below), attend a first-time home buyer education course, and use the property as their primary residence

Take a look at HUD’s list1 of other homeownership assistance programs in Hawaii.

Check your home buying eligibility in Hawaii. Start here

Idaho Down Payment Assistance Programs

The Idaho Housing and Finance Association (IHFA) runs two programs designed to aid with down payments and closing costs, not in the form of grants but as forgivable second mortgages.

Both programs require borrowers to take a homebuyer education course to qualify.

Idaho Housing Second Mortgage

The first option is a second mortgage with a fixed interest rate of up to 7% of the home purchase price to cover most of your down payment and closing costs. This loan has a 2% interest rate and is paid back over 15 years with the same amount each month.

You must be a first-time home buyer to get this help. At least 0.5% of the sale price must come from your own money, and your income can’t be more than $150,000.

Idaho Housing Forgivable Loan

The alternative option is a forgivable loan. This loan is typically more favorable, offering a 0% interest rate and no monthly repayments, although the loan amount is capped at 3% of the property’s purchase price.

Each year, 10% of the loan is waived, meaning that by the end of the tenth year, no debt remains. However, if you choose to relocate, sell, or refinance during the ten-year period, you must instantly repay any portion of the loan not yet forgiven.

The forgivable loan is not without its costs. As stated on the website, for each 0.5% of forgivable loan used, the interest rate of the first mortgage will be increased by 0.125%.

Visit the IHFA website for complete details, which include income limits in some cases. And check HUD’s list1 of alternative programs for Idaho.

Check your home buying eligibility in Idaho. Start here

Illinois Down Payment Assistance Programs

The Illinois Housing Development Authority (IHDA) has multiple down payment assistance loan options. To get any of these loans, you’ll have to put up $1,000 or 1% of the purchase price (whichever is greater) yourself. And you must be buying an existing home; new builds are excluded.

Opening Doors

The Opening Doors program offers up to $6,000 worth of assistance for down payments and closing costs as a forgivable loan with no monthly payments. However, if you sell or refinance your home within the first five years of the loan term, you must repay the loan.

IHD Access Forgivable

The IHD Access Forgivable program provides a forgivable loan to help with the down payment and closing costs. This program provides up to 4% of the purchase price (capped at $6,000) in the form of a forgivable loan. Parts of this loan are forgiven over time, which means that if you stay in the home for a set period of time (usually 10 years), you will not have to repay the loan.

IHD Access Deferred

The IHD Access Deferred program provides an interest-free loan of up to 5% of the purchase price (capped at $7,500) for down payment and closing cost assistance. This is a deferred loan, meaning that no payments are required until you sell, refinance, or pay off your first mortgage. The advantage of this program is that it allows you to become a homeowner with minimal upfront costs, and you can repay the loan at a later stage when your financial situation might be more comfortable.

IHD Access Repayable

The IHD Access Repayable program offers a loan of up to 10% of the purchase price (capped at $10,000) for assistance with your down payment and closing costs. Unlike the Access Forgivable and Access Deferred programs, this loan requires repayment, but it does offer a higher assistance limit. This program is particularly beneficial for home buyers who have the financial capacity to handle regular payments but need help with the upfront costs of purchasing a home.

SmartBuy

The SmartBuy program is a unique offering from IHDA that not only assists with down payments and closing costs but also helps home buyers with student loan debt. You may be eligible for $5,000 in down payment assistance and 15% of your purchase price (up to $40,000) toward student loans through SmartBuy. However, you should check to see if the program is still available because it was temporarily suspended at the time of writing.

Learn more at the Illinois Housing Development Authority’s website. And consult HUD’s list1 of alternative programs in Illinois.

Check your home buying eligibility in Illinois. Start here

Indiana Down Payment Assistance Programs

The Indiana Housing and Community Development Authority (IHCDA) has two programs that offer down payment assistance.

- First Place (FP) Program: Offers up to 6% of the purchase price for first-time home buyers. Must be used with either an FHA or conventional loan and requires a credit score of 640 or higher depending on debt-to-income ratio (DTI)

- Next Home (NH) Program: First-time home buyers can get up to 3.5% of the home’s purchase price. Must be used with either an FHA or conventional loan and requires a credit score of 640 or higher depending on debt-to-income ratio (DTI). This program can also be combined with IHCDA’s Mortgage Credit Certificate

The IHCDA also offers a mortgage credit certificate that can help first-time home buyers and veterans qualify for a better mortgage loan.

For more information on these, visit the IHCDA’s website. And check HUD’s list1 of other programs in Indiana.

Check your home buying eligibility in Indiana. Start here

Iowa Down Payment Assistance Programs

The Iowa Finance Authority offers grants and loans as down payment or closing cost assistance.

First-time home buyers and veterans may qualify for assistance. Others can also qualify if they’re buying a home in a low-income census tract. And the Iowa Finance Authority runs a similar program for repeat home buyers.

All programs have income limits and price caps on eligible homes. You’d also need a credit score of 640 to qualify.

First Home DPA Loan

The First Home Down Payment Assistance (DPA) Loan program is designed to assist eligible first-time home buyers with their down payment and closing costs. The program offers a no-interest loan of up to $5,000. While this loan will have to be repaid eventually, no payments are due until the home is sold, refinanced, or the first mortgage is paid in full.

First Home DPA Grant

The First Home DPA Grant, also offered by the IFA, is a program that provides eligible first-time home buyers with a grant of up to $2,500. This grant can be used to cover the down payment and closing costs. As it’s a grant and not a loan, it doesn’t need to be repaid.

Homes for Iowans DPA Loan

The Homes for Iowans program aims to help both first-time and repeat homebuyers. This program provides a no-interest loan of up to 5% of the home purchase price to be used for a down payment and closing costs. Like the First Home DPA Loan, no repayments are required until the home is sold, refinanced, or the first mortgage is paid in full.

IFA Military Homeownership Assistance

The Military Homeownership Assistance program is a special initiative by the IFA designed to honor and support military personnel and veterans. This program offers a $5,000 grant for the down payment and closing costs to eligible service members and veterans purchasing a home in Iowa.

Learn more at the IFA’s website. And take a look at HUD’s list1 of alternative programs in Iowa.

Check your home buying eligibility in Iowa. Start here

Kansas Down Payment Assistance Programs

The Kansas Housing Resources Corporation (KHRC) offers special mortgage loans as well as several down payment assistance options for buyers in the Sunflower State.

Kansas Housing First-Time Homebuyer Program

As a silent second mortgage, buyers can borrow 15% or 20% of the cost of the home without having to make any monthly payments.

- The loan is forgiven after 10 years, provided the borrower remains in residence and hasn’t sold, transferred, or refinanced their mortgage by the end of that period

- If you move, sell, transfer ownership, or refinance within those 10 years, you still owe the portion of the loan that has not been forgiven

- Eligibility requirements include meeting income limits (annual income can’t exceed 80% of the area median income) and contributing 2% of the home’s purchase price from your own pocket

Due to preexisting DPA programs, this one isn’t available in Topeka, Lawrence, Wichita, Kansas City, or Johnson County. Get more details at KHRC’s website.

Kansas DPA

Although Kansas DPA is not affiliated with KHRC, this statewide assistance program can help with closing costs or a down payment. Furthermore, it may also offer you a 30-year mortgage loan with a fixed interest rate.

- Eligibility requirements include meeting income limits and having a credit score of at least 640

- Buyers also need to use an approved lender

The website doesn’t provide much detail about the amount of assistance you can receive. So it’s best to reach out to one of the many participating lenders or speak directly to Kansas DPA. You’ll find contact details on the program website.

Please be aware that the program’s availability is tied to the health of the Kansas real estate market.

FHLBank Topeka Homeownership Set-Aside Program (HSP)

For homes that need work, this program can help with home improvements and repairs in addition to down payment and closing costs.

- Qualified applicants can receive a grant of up to $7,500, which is entirely forgiven after five years

- If the buyer sells their home or refinances before that, they must repay the grant

- To apply, your household income cannot exceed 80% of the area median income, and you must be an FHLBank member

There’s not much more information online. So if you’re interested in learning more, register for the HSP program through its website for more details. And find alternative programs for Kansas on HUD’s website.1

Check your home buying eligibility in Kansas. Start here

Kentucky Down Payment Assistance Programs

The Kentucky Housing Corporation (KHC) offers a special loan program to help future home buyers with down payments, closing costs, and prepaid expenses.

KHC Regular DAP

The Regular DAP (Down Payment Assistance) program is available for homes priced up to $481,176. It offers assistance in the form of a loan, which can go up to $10,000 and is repayable over a 10-year term at an interest rate of 3.75%.

Additionally, there is no liquid asset review, and there’s no limit on borrower reserves.

This program is open to all KHC first-mortgage loan recipients, but you must use a KHC-approved lender. Check the KHC’s website for more details.

Check your home buying eligibility in Kentucky. Start here

Meanwhile, consult HUD’s list1 of alternative homeownership assistance programs in Kentucky.

Louisiana Down Payment Assistance Programs

Louisiana has one of the most generous down payment assistance programs. The Resilience Soft Second Loan offers:

- A “soft loan” of 20% of the home purchase price, up to $55,000

- Up to $5,000 in closing cost assistance for a total of up to $60,000

Better yet, the loan is forgiven after ten years. So as long as you remain in your home for at least that long, you won’t have to repay anything.

You would need to meet income requirements for this program, run by the Louisiana Housing Corporation. You can’t earn more than 80% of your area’s median income.

And only first-time homebuyers can participate. Louisiana includes single parents who owned a home while married as first-time buyers.

Only homes in the following parishes qualify: Acadia, Allen, Ascension, Avoyelles, Beauregard, Bienville, Bossier, Caddo, Calcasieu, Caldwell, Catahoula, Claiborne, De Soto, East Carroll, East Baton Rouge, East Feliciana, Evangeline, Franklin, Grant, Iberia, Iberville, Jackson, Jefferson Davis, Lafayette, LaSalle, Lincoln, Livingston, Madison, Morehouse, Natchitoches, Ouachita, Pointe Coupee, Rapides, Red River, Richland, Sabine, St. Helena, St. James, St. Landry, St. Martin, St. Tammany, Tangipahoa, Union, Vermilion, Vernon, Washington, Webster, West Baton Rouge, West Carroll, West Feliciana, and Winn Parish.

For more information on this program, visit LHC’s website. And look at HUD’s list1 of alternative homeownership assistance programs in Louisiana.

Check your home buying eligibility in Louisiana. Start here

Maine Down Payment Assistance Programs

MaineHousing’s First Home Loan Program makes buying a home easier and more affordable by offering low fixed-interest mortgages. And if you require assistance with the cash for closing costs, MainHousing offers two programs that may suit your needs.

MaineHousing Advantage Down Payment Program:

Extra help is available for people who get a mortgage through one of the MaineHousing loan programs.

- Borrowers may be eligible for up to $5,000 in cash to use towards their down payment, closing costs, and any prepaid escrow expenses

- The assistance comes as a grant, not a second mortgage. However, borrowers might need to repay the funds if the home is sold or refinanced

- Borrowers must contribute at least 1% of the loan amount to the home purchase, but this contribution can come from gift funds

- Homebuyers are required to complete a home buyer education class to qualify

MaineHousing Multi-Unit Advantage Program

This program helps with closing costs and down payments for properties with one to four units. The help ranges from $8,000 to $14,000.

- The eligibility requirements, income restrictions, and purchase price caps are the same as for the First Home program.

- Homebuyers must complete both a landlord education course and a home buyer education course.

- Buyers are required to contribute at least 1% of the loan amount towards the purchase.

In both plans, help comes in the form of a grant, and the borrower can use gift money to help pay for a portion of the home. But the details of each program are different, so people who want to buy should look carefully at both to see which one meets their needs best.

Discover more at MSNA’s website. And check HUD’s list1 of other homeownership assistance programs in Maine.

Check your home buying eligibility in Maine. Start here

Maryland Down Payment Assistance Programs

The Maryland Department of Housing and Community Development (MDHCD) can offer home buyer assistance through its Maryland Mortgage Program. Borrowers using the 1st Time Advantage home loan may have access to one of the following DPA options:

- Flex 5000: An interest-free loan of $5,000 with no monthly payments for down payment and closing costs. The initial $5,000 must be paid back, though, when you sell, refinance, transfer, or finish paying off the mortgage

- Flex 3% Loan: You can borrow 3% of your first mortgage under the same terms as the Flex 5000 loan

- Partner Match: The money comes in the form of a no-interest, deferred loan that can be used for the down payment and closing costs. Only available with select MDHCD mortgages

- 1st Time Advantage 6000: An interest-free loan of $6,000 with no recurring payments. But if you sell or refinance before paying off your mortgage loan, you must repay the loan

- 1st Time Advantage DPA: You can borrow up to 3%, 4%, or 5% of your first mortgage loan to pay for your down payment and closing costs

- HomeStart: DPA of up to 6% of your loan amount if your income is greater than or equal to 50% of the area median income (AMI)

Visit MDHCD’s website for more information, as each of these plans has different qualifications. And look for other homeownership assistance programs in Maryland on HUD’s website.1

Check your home buying eligibility in Maryland. Start here

Massachusetts Down Payment Assistance Programs

MassHousing, an independent housing agency in Massachusetts, can offer up to $50,000 in down payment assistance, depending on where you plan to buy a home.

- Up to $50,000 in multiple cities, including: Attleboro, Barnstable, Brockton, Chelsea, Chicopee, Everett, Fall River, Fitchburg, Framingham, Haverhill, Holyoke, Lawrence, Leominster, Lowell, Lynn, Malden, Methuen, New Bedford, Peabody, Pittsfield, Quincy, Randolph, Revere, Salem, Springfield, Taunton, Westfield, and Worcester

- Up to $30,000 in all Massachusetts communities

To find out whether you’d be eligible for this program, you’d need to speak with a loan officer. MassHousing doesn’t publish program details on its website.

Check your home buying eligibility in Massachusetts. Start here

For a list of other local programs in Massachusetts, visit HUD’s website.1

Michigan Down Payment Assistance Programs

The Michigan State Housing Development Authority (MSHDA) offers a DPA program to assist potential buyers with closing costs and a down payment.

MI 10K DPA Loan

The M1 10K DPA Loan provides up to $10,000 in down payment assistance in specified ZIP codes if you finance your home purchase with the M1 Loan, a unique mortgage for first-time buyers.

The program is available to repeat purchasers in particular areas as well as first-time homebuyers throughout the state (those who haven’t purchased a property in the previous three years). Household income limits apply, and they vary depending on family size and property location. The maximum sales price for all properties in the state is $224,500.

A minimum credit score of 640 is needed to be eligible, or 660 if you want to buy a manufactured home with numerous sections. Completing a housing education course is also required.

MSHDA offers a homeownership education program and a mortgage credit certificate, which lowers your federal tax bill.

You can find a list of eligible zip codes on the MSHDA website. And find a list of other homeownership assistance programs in Michigan on HUD’s website.1

Check your home buying eligibility in Michigan. Start here

Minnesota Down Payment Assistance Programs

The Minnesota Housing Finance Agency (MHFA) provides two types of down payment assistance loans to eligible borrowers:

- Monthly Payment Loan: Borrow up to $18,000 at the same rate you pay on your first mortgage. Pay that down each month over 10 years

- Deferred Payment Loan: First-time buyers can borrow up to $16,500 free of interest. You make no payments, but the balance will come due when you finish paying off the mortgage, refinance, or sell the home

- Deferred Payment Loan Plus: Get a 0% APR loan up to $18,000. The loan has no monthly payments, but you must pay it back in full when you relocate, sell your home, refinance, or pay off your primary mortgage. This is harder to qualify for than a regular Deferred Payment Loan

Discover more at the MHFA’s website. And check HUD’s list1 of other homeownership assistance programs in Minnesota.

Check your home buying eligibility in Minnesota. Start here

Mississippi Down Payment Assistance Programs

The Mississippi Home Corporation (MHC) offers three different mortgage programs that each come with their own brand of down payment assistance.

- Smart6: A 30-year fixed mortgage with a $6,000 down payment loan that carries 0% interest and comes due when you sell the home

- MHC MRB7: A 30-year fixed-rate mortgage with $7,000 in down payment assistance that is forgiven after 10 years

- Housing Assistance for Teachers (HAT): Teachers can receive up to $6,000 in down payment and closing cost assistance if they want to live and work in Mississippi counties where there is a shortage of teachers. The loan will be forgiven if the teacher works for the district for at least three years.

Smart6 is available to both first-time and repeat home buyers, while MRB7 is only for first-time home buyers (including those who haven’t owned a home in the previous three years).

Find out more at the MHC’s website. And consult HUD’s list1 of other homeownership assistance programs operating in Mississippi.

Check your home buying eligibility in Mississippi. Start here

Missouri Down Payment Assistance Programs

The Missouri Housing Development Commission (MHDC) provides two DPAs for both first-time and repeat buyers.

MHDC First Place Program

Eligible homebuyers can get up to 4% of the home’s purchase price to help with the down payment and closing costs. Here are the essential points:

- The money provided is a forgivable loan, not an outright grant. This means you’ll have to repay some or all of the funds if you move, sell, or refinance the home in less than 10 years

- However, starting at the end of year 5, MHDC begins to forgive the loan at the rate of one-sixtieth of its value each month. By the end of year 10, you’ll owe nothing

- To qualify, you’ll need to use one of MHDC’s mortgage loans, which means you’ll need to meet household income and purchase price limits, among other criteria.

MHDC Next Step Program

In addition, qualified applicants may be eligible for a 4% cash assistance loan to help with a down payment or closing costs. Like the First Place DPA, Next Step is completely forgiven after ten years if you stay in the house.

Get more information from the MHDC’s website. And check out HUD’s list1 of other homeownership assistance programs in Missouri, including one operated by the Delta Area Economic Opportunity Corporation.

Check your home buying eligibility in Missouri. Start here

Montana Down Payment Assistance Programs

To assist with down payments and closing costs, Montana Housing offers two types of down payment assistance. It should be noted that these are loans, not grants, and must be repaid.

Bond Advantage Down Payment Assistance Program

This program offers a second mortgage that is repaid alongside your primary mortgage over a period of 15 years. Here are the main points:

- You can borrow up to $15,000 or 5% of the purchase price, whichever is less

- The loan offers relatively low monthly payments. Your lender will ensure that you can comfortably afford these payments

- To qualify, you must have a credit score of 620 and contribute $1,000 of your own money towards the purchase

MBOH Plus 0% Deferred Down Payment Assistance Program

Due to the fact that it is a “silent mortgage,” this plan has no interest and no monthly payments.

- Repayment is due “upon sale or transfer of the property to another party or if the outstanding loan secured by the first mortgage is refinanced.”

- Higher income limits than the Bond Advantage program. At the time this information was written, the limit was $80,000 for a one- or two-person household and $90,000 for a household of three or more

- A credit score of 620 or higher

Keep in mind that you must use one of Montana Housing’s mortgage products in order to be eligible for either of these assistance programs.

The program has lots of options and rules, so read up on the details on the website. And check HUD’s list1 of other homeownership assistance programs in the state.

Check your home buying eligibility in Montana. Start here

Nebraska Down Payment Assistance Programs

The Nebraska Investment Finance Authority (NIFA) offers DPAs of up to 5% of the sale price (whichever is less) via its Homebuyer Assistance Program. To qualify, borrowers must contribute at least $1,000 out of pocket. The assistance takes the form of a 10-year loan with a 1% interest rate.

Check the NIFA’s webpage for more information. And take a look at HUD’s list1 of other homeownership assistance programs in the state.

Check your home buying eligibility in Nebraska. Start here

Nevada Down Payment Assistance Programs

If you are a prospective homebuyer in Nevada, you have several notable DPAs to choose from.

The Nevada Housing Division’s (NHD) Home Is Possible and Home First DPAs are two of these programs. However, the NHD is not the only source of assistance available. Nevada Rural Housing (NRH) administers two additional DPA programs with slightly different approaches.

NHD Home Is Possible (HIP)

The State of Nevada Housing Division’s Home Is Possible Down Payment Assistance Program can provide up to 4% of your loan amount toward the down payment and closing costs. This takes the form of an interest-free loan that’s forgiven after seven years.

To be eligible for Nevada’s DPA program:

- You must be a first-time home buyer, meaning you haven’t owned a home in at least three years

- You must have a minimum credit score of 640

- The home must be your primary residence

In addition, you’ll need to meet your lender’s financial requirements to qualify for the mortgage.

NHD Home First

Home First is a Nevada first-time homebuyer program that offers $15,000 in down payment assistance, forgivable after three years if the buyer stays in the home. The program also has liberal home price limits and offers a 30-year fixed rate mortgage.

To qualify for the Home First program, you must be:

- A first-time homebuyer (you have not owned a home in the past three years)

- A Nevada resident for at least six months

- Have a credit score of at least 640

- Complete a homebuyer education course

- Have an income that falls within the program’s household income limits

For more details, visit the Nevada Housing Division website.

NRH Home At Last DPA

Nevada Rural Housing’s Home At Last DPA helps low- to moderate-income borrowers purchase a home in Nevada. It provides a second mortgage with no interest and no payments for 30 years. The second mortgage is forgiven at the end of the 30-year term, or if the borrower sells, refinances, or prepays the first mortgage prior to the end of the 30-year term..

This assistance can be used to cover your down payment as well as your closing costs. Furthermore, the Home At Last program provides eligible homeowners with refinancing options.

NRH Home Means Nevada Rural DPA

This program is designed specifically for people looking to buy in rural areas of Nevada. If you qualify, you could receive up to $25,000 in down payment assistance. This assistance, like Home At Last, is a second mortgage that is completely forgiven unless you sell or refinance within the first three years.

You’ll find more detail about NRH’s offerings on its website. And check out HUD’s list1 of other homeownership assistance programs in Nevada.

Check your home buying eligibility in Nevada. Start here

New Hampshire Down Payment Assistance Programs

New Hampshire Housing offers mortgage programs that extend cash assistance for prospective homeowners, aiding them in covering down payment and closing expenses. Up to $10,000 is awarded, which can be used for the down payment as well as related closing costs.

This loan comes in the form of a second mortgage, which is forgiven in full after five years. However, exceptions apply if the homeowner decides to sell, refinance, or declare bankruptcy within this five-year timeframe.

The program income limits determine your eligibility for aid:

- Home First: Income limits vary by county

- Home Flex Plus: Allows for incomes reaching up to $169,900

- Home Preferred Plus: Geared towards those earning up to 80% of the Area Median Income (AMI) as outlined by Fannie Mae

- Home Preferred Plus Over 80% AMI: This is conventional financing tailored for those with incomes that surpass 80% of the AMI but remain below $169,900

Completing New Hampshire Housing’s homebuyer education course is a mandatory requirement to be eligible for this program.

Get more information from the authority’s website. And take a look at HUD’s list1 of other homeownership assistance programs in New Hampshire.

Check your home buying eligibility in New Hampshire. Start here

New Jersey Down Payment Assistance Programs

First-time buyers in New Jersey can get up to $15,000 in down payment assistance through a five-year, forgivable loan with no interest or monthly payments required.

The loan must be paired with a first mortgage from the New Jersey Housing and Mortgage Finance Agency (NJHMFA), which can be a 30-year HFA, FHA, USDA, or VA loan.

For more information, visit the agency’s website. And consult HUD’s list1 of other homeownership assistance programs operating in the state.

Check your home buying eligibility in New Jersey. Start here

New Mexico Down Payment Assistance Programs

The New Mexico Mortgage Finance Authority (MFA) assists first-time and repeat buyers with closing costs and down payments. Here’s what to expect.

MFA FIRSTDown DPA

If you’re a first-time home buyer in New Mexico or if you haven’t owned a home in the last three years, MFA may offer you up to 4% of the home purchase price to assist with closing cost and down payment.

- This program must be used in conjunction with New Mexico’s FIRSTHome mortgage financing program

- There are caps on household incomes and home purchase prices. But those may be higher if you’re buying in a target area

MFA HOMENOW DPA

An alternative program, called HomeNow, also offers up to $7,000 in down payment assistance. The difference is that this loan can be forgiven after 10 years and is only available to borrowers with an income below 80% of the area median income (AMI).

MFA Home Forward DPA

Through this initiative, repeat buyers who do not qualify for MFA’s first-time buyer programs may be eligible for down payment assistance of up to 3% of the home’s sale price. While Home Forward does provide mortgage loans, it can also be used as a stand-alone DPA for those who do not have an MFA mortgage. Because the website doesn’t provide much information about the terms of this second mortgage, speaking with an approved lender should be high on your priority list.

You can find full details on the authority’s website. And read HUD’s list1 of other homeowner assistance programs in New Mexico.

Check your home buying eligibility in New Mexico. Start here

New York Down Payment Assistance Programs

The State of New York Mortgage Association (SONYMA) offers a variety of home loans and down payment assistance programs for first-time buyers.

- Down Payment Assistance Loan (DPAL): Can offer up to 3% of the purchase price or up to $15,000 as a second mortgage with 0% interest. This is forgiven after 10 years as long as you don’t sell or refinance within that time

- DPAL Plus ATD: Can offer up to $30,000 for lower-income home buyers who make less than 60% of their area median income (AMI)

In addition, New York City has its own HomeFirst Down Payment Assistance Program that could offer up to $100,000 for eligible buyers. To qualify, borrowers must have a household income below 80% of their area median income (AMI) and pay at least 1% of the purchase price out of pocket.

Check your home buying eligibility in New York. Start here

For links to other statewide and local programs in New York, check HUD’s list1.

North Carolina Down Payment Assistance Programs

For all kinds of buyers throughout the state, the North Carolina Housing Finance Agency offers generous loans for down payments.

- NC Home Advantage Mortgage: First-time and repeat home buyers may be eligible for a down payment loan of up to 3% of the mortgage balance

- NC 1st Home Advantage Mortgage: First-time home buyers and military veterans are eligible for a down payment loan of up to $15,000

With either option, the assistance loan begins to be forgiven in year 11 of your mortgage and is fully forgiven by year 15. However, it’s worth noting that if you sell, transfer, or refinance before year 11, you must repay the entire amount.

Additionally, for those looking for even more assistance, you can explore pairing the NC Home Advantage Mortgage with the Community Partners Loan Pool DPA program, which could provide an extra $50,000 in financial support.

More information is available on the North Carolina Housing Finance Agency’s website. And review HUD’s list1 of other homeownership assistance programs in the state.

Check your home buying eligibility in North Carolina. Start here

North Dakota Down Payment Assistance Programs

The North Dakota Housing Finance Agency (NDHFA) has two programs, called “Start” and “DCA,” that are intended to help with upfront home buying closing costs. Both programs can offer up to 3% of the mortgage amount toward your down payment, closing costs, and prepaid items.

To qualify, you’ll have to have a household income below certain caps. And the value of the home you’re buying may also be limited.

You can find details here. And take a look at HUD’s list1 of other homeownership assistance programs in North Dakota.

Check your home buying eligibility in North Dakota. Start here

Ohio Down Payment Assistance Programs

If you’re buying a home in Ohio, either the Ohio Housing Finance Agency (OHFA) or Communities First Ohio can help you with your down payment and closing costs.

OHFA Your Choice! DPA

The Ohio Housing Finance Agency has a down payment assistance program that provides either 2.5% or 5% of the home’s purchase price.

- This DPA comes in the form of a loan, which is forgiven after seven years. Sell, transfer, or refinance before then, and you’ll have to repay the loan

- You’ll need a credit score of 640 or better with a conventional, USDA, or VA loan. Buyers with FHA loans will need a FICO of 650 or more

- Limits apply to incomes and purchase prices

OHFA Grants for Grads

If you are a recent graduate, OHFA also offers a 2.5% or 5% assistance loan to cover the down payment and closing costs. This loan is forgiven after five years if you do not refinance, move, or sell your home.

To be eligible, you must have received an associate’s, bachelor’s, master’s, doctorate, or other post-graduate degree from an accredited college or university within the last 48 months. In addition, you must take a free home buyer education course from a HUD-approved counseling agency.

Get more information from MyOhioHome’s website.

Communities First Ohio DPA

If you’re eligible, Communities First Ohio might offer you a grant of 3%, 4%, or 5% of your home’s purchase price to help cover down payment and closing costs. Since it’s a grant, you don’t have to pay it back.

Rules and eligibility criteria will be similar to those for OHFA programs. However, qualified buyers will also require:

- FICO score of 620 or more

- Not exceed maximum income limits (varies by county)

- Use an approved lender

- Property must be your primary residence

You may also be able to qualify for one of these grants more easily than you would for an OHFA loan. Because only the borrower’s income is considered, not the income of the entire household.

You can find more details on the program website. And consult HUD’s list1 of other homeownership assistance programs in Ohio.

Check your home buying eligibility in Ohio. Start here

Oklahoma Down Payment Assistance Programs

The Oklahoma Housing Finance Agency (OHFA) and REI Oklahoma both offer down payment and closing cost assistance to homebuyers in the Sooner State.

OHFA Down Payment Assistance

The Oklahoma Housing Finance Agency offers its OHFA Homebuyer Down Payment Assistance program. This provides down payment assistance loans to eligible borrowers using a 30-year fixed-rate mortgage. Those secondary loans are 3.5% of the primary mortgage amount.

To qualify, you’ll likely need a credit score of 640 or better. And your household income will be capped according to family size and the county of purchase.

Learn more at OHFA’s website.

Check your home buying eligibility in Oklahoma. Start here

REI Home100

REI Oklahoma, a well-known nonprofit organization, provides affordable home financing in the form of a conventional or government loan, along with down payment assistance for qualified borrowers.

Down payment assistance is provided as a gift or as a seven-year forgivable second mortgage. Depending on your first mortgage, you could receive up to 5% of your loan.

You do not have to be a first-time home buyer to qualify. However, to be eligible for the REI Home100 program, you must meet the following criteria:

- A minimum credit score of 640

- Your debt-to-income ratio shouldn’t be higher than 45%

- Your income must be within the limits set by REI Oklahoma, which change depending on your mortgage type

- Use an REI Oklahoma approved lender

You’ll find more information and a list of approved lenders on the program’s website. And take a look at HUD’s list1 of other homeownership assistance programs operating in Oklahoma.

Oregon Down Payment Assistance Programs

Oregon Housing and Community Services (OHCS) offers down payment assistance programs for first-time buyers. They’re intended for low- and very low-income families and individuals, with particular focus on underserved populations. The state agency sends money to various local agencies that provide direct assistance to home buyers.

There’s a list of those agencies on the OHCS website, along with the county or counties each serves. Links are provided there for every agency. Also check out HUD’s list1 of other homeownership assistance programs in the state.

Check your home buying eligibility in Oregon. Start here

Pennsylvania Down Payment Assistance Programs

The Pennsylvania Housing Finance Agency (PHFA) offers a variety of down payment assistance programs.

- PHFA Grant: Provides a $500 grant that can be used in conjunction with an HFA Preferred loan

- Keystone Advantage Assistance Loan Program: Provides a second mortgage up to $6,000 or 4% of the purchase price, whichever is less. Paid off over 10 years at zero percent interest

- Keystone Forgivable In Ten Years Loan Program (K-FIT): Offers up to 5% of the purchase price or appraised value (whichever is less). Forgiven over ten years at a rate of 10% per year

- Access Down Payment and Closing Cost Assistance Program: You might be eligible for a no-interest loan of up to $15,000 for a down payment and closing costs if you or a family member has a disability. There are also additional funding options for accessibility modifications.

- HOMEstead DPA: Assistance of up to $10,000 in the form of a zero-interest second mortgage loan. Funds are forgiven at a rate of 20% per year, so if you haven’t sold or refinanced by year five, you’ll own nothing

- Employer Assisted Housing (EAH) Initiative: If your employer is part of an EAH program, then you may qualify for up to $8,000 in down payment and closing cost assistance in the form of an interest free loan amortized over 10 years.

Each program has its own eligibility criteria and a list of acceptable mortgage loan programs. You can get details from the agency’s website. And consult HUD’s list1 of other homeownership assistance programs in Pennsylvania.

Check your home buying eligibility in Pennsylvania. Start here

Puerto Rico and the U.S. Virgin Islands Down Payment Assistance Programs

Home buyers in Puerto Rico and the U.S. Virgin Islands may benefit from programs that offer down payment assistance, low-interest loans, and other valuable resources to make homeownership more attainable.

Puerto Rico Housing Finance Authority (PRHFA)

The Puerto Rico Housing Finance Authority (PRHFA) program is a valuable resource for low and moderate-income homebuyers in Puerto Rico.

This program provides low-interest loans and down payment assistance, making homeownership more accessible for those who need it. Eligible households may receive up to a maximum of $55,000 in assistance, and properties in certified Urban Centers by PRDOH can potentially receive an additional $5,000 towards the purchase price. This support significantly eases the path to homeownership for residents of Puerto Rico.

Check your home buying eligibility in Puerto Rico. Start here

Read more about meeting the program’s requirements as well as qualifying properties on its website.

Virgin Islands Economic Development Authority

“VI Slice” Moderate Income Homeownership Program is a valuable resource for home buyers in the U.S. Virgin Islands. This program aims to increase homeownership rates among moderate-income households in the U.S. Virgin Islands. It offers opportunities such as down payment and closing cost assistance, home purchase with rehabilitation, and new home construction.

Check your home buying eligibility in the U.S. Virgin Islands. Start here

You’ll find eligibility guidelines and property requirements in the program’s online brochure.

Rhode Island Down Payment Assistance Programs

For qualified first-time home buyers, Rhode Island Housing (RIHousing) offers a combination of grants and repayable down payment assistance loans to be used in conjunction with a RIHousing mortgage. The maximum purchase price for all DPA programs is $546,752, with income limits of $112,555 for a 1-2 person household and $129,438 for larger households.

RI Statewide DPA Grant

This is a more recent service from RIHousing that offers non-repayable grants for up to $17,500 in down payment and closing cost assistance. To qualify, a person must be a first-time buyer, purchase a primary residence, and satisfy the standard requirements for credit score, income, and homebuyer education.

10kDPA program

This initiative is meant for people who need to borrow up to $10,000 for a down payment. This is a no-interest loan that is repayable when the home is sold, transferred, or refinanced. To qualify, you must have a credit score of at least 660.

Extra Assistance program

This program offers a larger loan amount of up to 6% of the purchase price, up to a maximum of $15,000. This is a traditional second mortgage that requires equal monthly payments for 15 years at the same interest rate as the new mortgage. The advantages include a lower credit score requirement of just 620 and the ability to use it for both down payment and closing costs.

FirstGenHomeRI program

A dedicated program for first-generation homebuyers in select cities, offering a $25,000 forgivable loan to be used for a down payment and closing costs. This is a zero-interest loan with no monthly payments that is forgiven after five years. Use of an approved lender and completion of a homebuyer education course are also requirements of the program.

Discover more at Rhode Island Housing’s website. And explore HUD’s list1 of other homeownership assistance programs in the state.

Check your home buying eligibility in Rhode Island. Start here

South Carolina Down Payment Assistance Programs

The South Carolina State Housing Finance and Development Authority, or SC Housing, provides both mortgage loans and several down payment assistance options.

SC Housing Forgivable Down Payment Assistance Program

For first-time home buyers in South Carolina, SC Housing offers a forgivable second mortgage loan when financing their initial home with one of SC Housing’s mortgages. These loans have 0% interest, no monthly payments, and terms of 10 or 20 years, depending on household income.

If the borrower continues to live in the property throughout the term, the loan is fully forgiven at the end. If the borrower relocates before this date, a portion or the entire loan may be required to be repaid.

The money can be used for down payments, closing costs, and prepaid items like property taxes and homeowners insurance.

SC Housing Palmetto Home Advantage Program

There is an option for a DPA of up to 3% or 4% of the loan amount. A minimum credit score of 640 is required for eligibility. This is a ten-year forgivable loan with a 0% interest rate, similar to the SC Housing Homeownership Program.

SC Housing Choice Voucher Homeownership Program (HCV)

A chance for current Housing Choice Voucher program participants to move from renting to owning a home. If a family meets the following criteria, the rental voucher can be converted into a home purchase voucher. To qualify, the head of the household must have leased a home for at least one year using an HCV/Section 8 voucher, be in good standing with all HCV program standards, and have had continuous full-time employment for at least one year.

For more details, visit the agency’s website. Also check out HUD’s list1 of other homeownership assistance programs operating in South Carolina.

Check your home buying eligibility in South Carolina. Start here

South Dakota Down Payment Assistance Programs

The South Dakota Housing Development Authority (SDHDA) offers down payment assistance via the Fixed Rate Plus loan. This can provide 3% or 5% of the purchase price to help with your down payment and closing costs.

Fixed Rate Plus takes the form of a second mortgage with 0% interest and no monthly payments. The loan amount comes due when you sell the home or refinance.

For more information, visit SDHDA’s website. And check HUD’s list1 of other homeownership assistance programs in the state.

Check your home buying eligibility in South Dakota. Start here

Tennessee Down Payment Assistance Programs

The Tennessee Housing Development Agency’s Great Choice Home Loan offers up to $6,000 or 6% in down payment assistance in the form of a second mortgage loan.

- Deferred DPA option: Receive $6,000 as a forgivable second mortgage. This loan has zero interest and payments are deferred until the end of the 30-year loan term when the loan is forgiven. Repayment will be due in full if the home is sold or refinanced

- Amortizing DPA option: Receive 6% of the home’s sale price as a second mortgage that must be repaid over 15 years at the same mortgage rate as your primary home loan

You can use the funds from both loans towards closing costs and a down payment. All borrowers must first register for the state’s homebuyer education course.

For more details, go to the agency’s website. And read HUD’s list1 of other homeownership assistance programs in Tennessee.

Check your home buying eligibility in Tennessee. Start here

Texas Down Payment Assistance Programs

The Texas Homebuyer Program can help with all steps of the home buying process, including coming up with the cash for a down payment.

Via My First Texas Home or My Choice Texas Home, buyers can receive down payment assistance of up to 5%. This takes the form of a low- or no-interest second mortgage that might be forgiven, depending on which program you qualify for.

The Texas Home Buyer Program also offers mortgage credit certificates (MCCs) to veterans and first-time home buyers. These can provide a dollar-for-dollar reduction in your federal taxes.

Find more details about the program here, or see HUD’s list1 of other homeownership assistance programs in Texas.

Check your home buying eligibility in Texas. Start here

Utah Down Payment Assistance Programs

The Utah Housing Corporation (UHC) offers three down payment assistance loans for home buyers who secure their primary mortgage through UHC. These programs can potentially cover the entire minimum required down payment and some, or all, of the closing costs.

All three programs provide a 30-year second mortgage with an interest rate that is 2% higher than the primary mortgage rate. The FirstHome program is only available to first-time homebuyers, whereas the HomeAgain and Score programs are available to repeat homebuyers as well.

Furthermore, UHC provides grant funds to first-time home buyers who are either law enforcement officers or military veterans.

- UHC FirstHome Loan DPA: For first-time buyers, up to 6% of the loan amount is available towards a down payment and closing costs, given a minimum credit score of 660.

- UHC HomeAgain Loan DPA: For repeat buyers, up to 6% of the loan amount is available towards a down payment and closing costs, given a minimum credit score of 660.

- UHC Score Loan DPA: Up to 4% of the loan amount. To qualify, you must have a credit score of 660

- UHC HFA Advantage Loan DPA: This assistance can be as much as 6% of the primary mortgage loan amount, but it’s worth noting that the maximum they’ll provide is $25,000

- Utah Homebuyer Veteran Grant: Military veterans and active-duty service members can receive a $2,500 grant to help with the down payment and closing costs. Because this is a grant, no repayment is required

- First-Time Homebuyer Law Enforcement Grant: If you’ve served the state as a law enforcement officer for a minimum of five years, UHC may issue you a grant of up to 3.5% of the purchase price that’s capped at $25,000. No repayment required

Learn more about these loans at UHC’s website. And explore HUD’s list1 of other homeownership assistance programs in Utah.

Check your home buying eligibility in Utah. Start here

Vermont Down Payment Assistance Programs

Home buyers in Vermont may be eligible for assistance with down payments and closing costs from one of two statewide agencies.

VHFA ASSIST Down Payment and Closing Cost Assistance

The Vermont Housing Finance Agency (VHFA) can provide a loan of $10,000 or $15,000, depending on your income, with 0% interest and no monthly payments. The loan comes due when you sell the home.

This down payment assistance must be paired with one of the VHFA’s home loan programs.

You can learn more at the VHFA’s website.

NeighborWorks of Western Vermont DPA

NeighborWorks of Western Vermont claims it can offer statewide loans of up to $50,000 or 20% of the home purchase price, whichever is less, if you need to borrow more money than the VHFA allows.

However, these hard loans must be repaid in monthly installments over a 15-year period. The interest rate will be 2% higher than the rate on your mortgage.

To learn more, go to the website or call (802) 438-2303. And check out HUD’s list1 of other homeownership assistance programs in the state.

Check your home buying eligibility in Vermont. Start here

Virginia Down Payment Assistance Programs

In Virginia, first-time home buyers can choose from a variety of special mortgage loans and receive assistance with their down payment and closing costs from two statewide agencies.

DHDC Down Payment Assistance