High street banks must think savers are idiots – or at least, ignorant.

There can be no other excuse for them punishing savers with low easy access savings account rates, but all the while hiking up costs for mortgage and loan customers.

Bank customers are currently stuck paying rates of 3.95 to 6 per cent for most mortgages, while savers with big bank easy access deals mostly earn pitiful rates of 1 per cent or below.

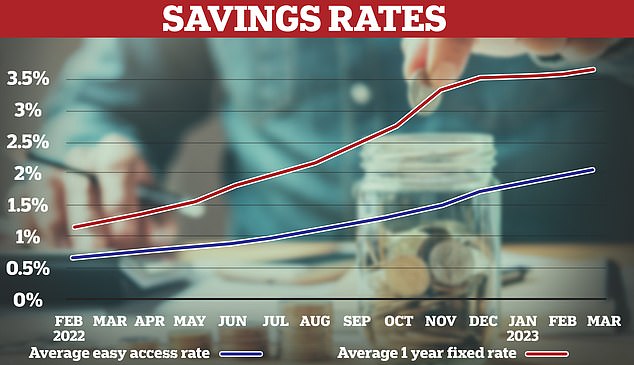

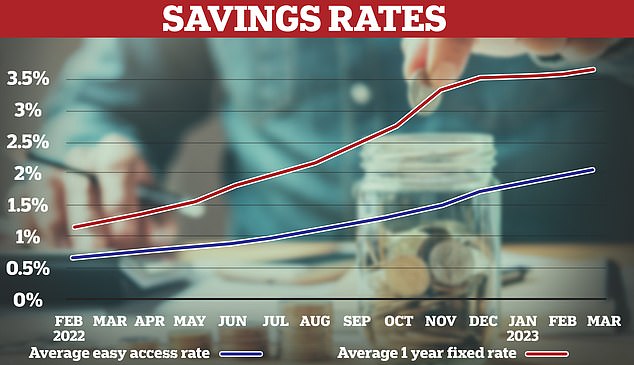

That is because, as the Bank of England makes a series of hikes to its base rate, which is factored in to financial deals, banks pass the increases on more to loans than they do savings rates.

That widening gulf between low savings rates and high loan costs means one thing: more money for the banks. And that cash is coming right out of their customers’ pockets.

Taking with both hands: Savings rates are increasing, but you wouldn’t know it from looking at the interest paid on many high street bank easy access deals

The past few weeks have seen all the big banks publish their 2022 financial results, which all show them making increasing profit from something called the ‘net interest margin’.

In plain English, net interest margin is the cash banks make from a combination of savings rates paid out and loan interest charged to customers, with a few other bits mixed in.

Between them HSBC UK, Barclays, Santander, Lloyds Banking Group (including Lloyds Bank, Halifax and Royal Bank of Scotland) and NatWest Group (including NatWest and Royal Bank of Scotland) made a cool £39.9 billion in 2022 just from this.

Now, it is important for a bank to make some money from its net interest margin, otherwise it would be very badly run indeed – and even risks collapse.

But to give context, that £39.9 billion figure is up by £7billion in just a year – or an average of an extra £106 for every person living in the UK. And the banks predict this figure will only rise during 2023.

The great savings deal ‘switcheroo’

For bank customers, that is bad enough – but it gets worse.

Not content with simply extorting their customers, banks also want to treat them like idiots.

I’ll give you an example. The most common savings deal in the UK is the easy access account. As the name suggests, these let you deposit and withdraw money easily, in exchange for a relatively low level of interest compared to deals such as fixed-rate bonds.

So, when base rate went up, easy access savers were delighted, thinking their savings rates would increase too. And they did – just not for easy access accounts at the big banks.

Instead, big banks pulled a switcheroo and turned their attention to another savings deal: the regular saver.

Regular savers, as the name suggests, pay out interest in exchange for consumers putting in cash in installments. But most will slash the interest rate if cash is taken out before the term ends – normally a 12 month period.

Bosses of several of the big banks were hauled in by MPs recently to answer for why easy access savings rates were so low and mortgage rates relatively high.

What the bank bosses said was that savers, astonishingly, do not want better easy access rates. Instead, they want better regular saver rates, and to be encouraged to develop a habit of saving by using these deals.

There is also nothing stopping the big banks putting up rates on easy access accounts AND regular saver deals, of course.

Now, I think regular saver deals are great – I have one myself. They are a valuable part of the savings world and I applaud any financial firm that offers them.

And, in a way, the big banks are right. We do have a poor track record of saving as a country – squeezed budgets from the cost of living crisis aside. Perhaps a bit of encouragement to save is no bad thing.

These is just one, tiny, problem – savers aren’t that excited by regular saver deals.

Or at least, This is Money readers aren’t. A straw poll of our loyal readers revealed that 94 per cent want better easy access rates, with just 6 per cent plumping for more generous regular saver deals.

Bank bosses may be telling the truth that their customers are crying out for better rates on regular savers. We will never know, as the lenders have never revealed who these mysterious customers with their mysterious requests actually are.

They are also keeping quiet about whether more customers are taking out regular saver deals as a result of this big push, as the banks would not give a breakdown when This is Money asked them.

Now, playing devil’s advocate for a moment, figures from the Bank of England might show a rise in people taking out regular savers, but this is hard to work out. The problem is the way the Bank records figures on savings deals is to put them into two broad pots – products that allow quick access to cash, and products that don’t.

Regular saver deals fall into the latter pot, which the Bank calls ‘time deposits’. In fairness to high street banks, official figures show that customers did put an extra £6.9 billion into time deposits in December 2022, the most recent figures available.

But time deposits also include products like fixed-rate bonds, which are much more popular than regular saver deals, so it is hard to really know which money is going where.

Want good savings rates? Forget the big boys

All this adds up to one thing – if you want half-decent interest rates from a high street bank easy access account, you can officially forget it.

Keeping sizeable sums of cash in big bank easy access accounts is little more than masochistic at this point if you have any other option.

Fortunately, the other options look pretty decent. Savers who want good returns on their easy access account cash should consider best buy deals from other savings firms such as Chip, which pays 3.15 per cent interest, or Shawbrook, paying 3.06 per cent. Both deals are protected by the Financial Services Compensation Scheme, which means your cash is safe up to the level of £85,000 per firm in the case it collapses.

Or, big banks could listen to This is Money readers – many of whom have been lifelong loyal customers – stop treating them like idiots and pay a fair rate on their favourite savings deals.

In the meantime, check what you could be getting in our independent best savings rate tables and vote with your feet.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.