Editorial Note: We earn a commission from partner links on Forbes Advisor. Commissions do not affect our editors’ opinions or evaluations.

Investing in real estate can help you build wealth and achieve financial freedom. Before you take the plunge, it’s essential to understand the current investment property rates available. Knowing what kind of interest rate you can expect to pay on your loan—versus a standard conventional loan—will help determine whether the investment is worth it.

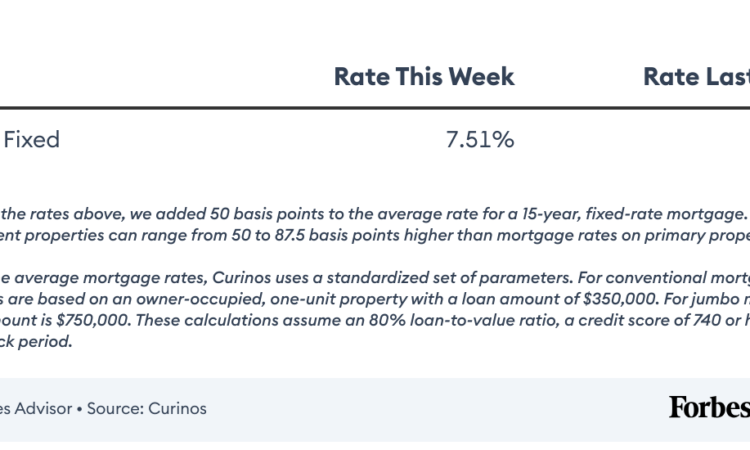

Today’s 15-Year Investment Property Loan Rates

Today’s 30-Year Investment Property Loan Rates

What Are Investment Property Mortgage Rates?

Investment property mortgage rates are the interest charges investors pay to finance a property solely for investment purposes. These rates depend on the investor’s creditworthiness, the cost of the property they wish to acquire and the type of lender they work with. Typically, lenders charge higher interest rates for investment property loans because these properties present more risks than owner-occupied homes.

As a real estate investor, paying close attention to interest rates is crucial because they directly impact your cash flow, profitability and the long-term financial viability of your investment portfolio. Knowing where to find the best rates and how to negotiate them effectively can make all the difference in building a lucrative real estate investment portfolio.

Pros and Cons of Investment Property Loans

Before committing to an investment property loan, consider the pros and cons of taking on this debt.

Pros of Investment Property Loans

- Ability to finance income-producing properties. Investment property loans allow you to finance the purchase of rental properties that generate income. Moreover, the return on investment (ROI) for rental properties is typically higher than other investments.

- Faster approval time. Some types of investment property loans, such as private money loans and hard money loans, can be approved and funded within a few business days.

- Long-term appreciation. Real estate investments can appreciate significantly over the long term, generating a higher ROI.

Cons of Investment Property Loans

- Difficult to qualify for. It can be more difficult to qualify for an investment property loan than a conventional loan due to stricter eligibility requirements imposed by lenders. You may have to provide in-depth financial documents and have a solid credit history to prove your ability to repay the loan.

- Higher interest rates. Because investment properties represent more risk for lenders, they tend to come with higher interest rates than loans for owner-occupied homes and second homes.

- Higher down payment requirements. You may have to put more money down for an investment property loan than a residential mortgage. In some cases, lenders require a minimum of 25% or more.

Pros and Cons of Conventional Loans

Conventional loans, like investment property loans, can be used to invest in real estate—but the features of a conventional loan might make them a better option for you.

Pros of Conventional Loans

- Wider availability. Conventional loans are more widely available than investment property loans, so you may have a better chance of getting approved or finding an option that’s right for you.

- Lower interest rates and down payment requirements. Because conventional loans tend to come with lower interest rates and down payment requirements than investment property loans, they may be more affordable. For instance, conventional loans, in some cases, require as little as 3% down.

- May be easier to qualify. You don’t need excellent credit to qualify for a conventional loan. This can be beneficial if you don’t meet the strict eligibility requirements of an investment property loan.

Faster, easier mortgage lending

Check your rates today with Better Mortgage.

Cons of Conventional Loans

- Limited loan amounts. Because conventional loans are federally regulated, they sometimes have lower maximum loan amounts than investment property loans. This means you may be unable to finance all the funds you need for your investment.

- More intensive underwriting. While overall it’s generally easier to qualify for a conventional loan, even the best mortgage lenders have to follow strict guidelines. You may have a hard time getting approved or experience a lengthier underwriting process if you’re self-employed or are in a unique financial situation.

- Private mortgage insurance (PMI). You’ll need to pay PMI if you put down less than 20% on a conventional loan. This additional cost can eat into how much you can afford to invest.

Investment Property Loans vs. Conventional Loans

Investment property loans and conventional loans can both be used to finance investment properties, but they differ in a few key ways. Here are the main differences to consider if you’re looking at both types of loans: