At the dawn of the newly implemented Eurozone, Lorenzo Bini Smaghi and Daniel Gros argued that three broad issues might present problems for Europe’s Economic and Monetary Union (EMU). Bini Smaghi, then Director for International Affairs at the Italian Treasury, and Gros, then Deputy Director and Senior Research Fellow at the Brussels-based Centre for European Policy Studies and Head of its Economic Policy Programme, wrote and published their concerns in their 2000 book, Open Issues in European Central Banking.

They argued first that there was no clear allocation of monetary tasks between member states’ National Central Banks (NCBs) and the supranational European Central Bank (ECB). The authors noted that this presented uncertainty for outcomes if central leadership of the ECB objected to NCB decision-making, during either routine business or extraordinary circumstances. It also revealed the potential for disagreement between central bank leadership of different member states to hinder nationally focused monetary policies. Second, they argued, EMU law was unclear regarding the prioritization of monetary and financial concerns—and consequently the importance of anti-inflationary policies and exchange rate targeting compared to the resolution of financial crises. The authors also identified a tension between independence and accountability. Would NCBs be held equally accountable for undershooting inflation targets as they might if they failed to contain those targets below mandated levels? Finally, Bini Smaghi and Gros acknowledged the potential tension between the goals of NCBs and the ECB. If NCBs took steps to resolve banking crises that might induce inflation, or raise fears of the specter of inflation, would the ECB be responsible for overriding NCB authority? And, in the case of national or supranational crises, should the NCBs or ECB act as a lender of last resort?

Despite this caution, Bini Smaghi and Gros remained optimistic that the beginning of Europe’s EMU was an opportunity for greater financial and monetary cooperation within the region, and for development across the Eurozone. But two recent crises in the Eurozone have confronted Bini Smaghi and Gros’s predicted challenges—and resulted in dramatically different responses. In 2008, the ECB initially delegated crisis response to the NCBs, but it then overstepped this mandate. As the Eurozone crisis gradually took hold in peripheral members of the EMU, the ECB—citing fears of inflation—intervened to limit NCBs’ abilities to engage extraordinary measures to rescue domestic banks. By contrast, in 2020, the ECB enabled domestic governments and NCBs to respond to the novel challenges of the Covid-19 pandemic through a panoply of measures to increase governments’ spending potential and minimize the cost of government borrowing through different monetary policy measures.

These differing approaches had significant consequences. In 2008, falling asset prices linked with the subprime mortgage backed security market precipitated the failure of major investment banks and internationally connected banks in the US and Europe. Likewise, in 2020, falling stock and government bond prices threatened to rock global financial markets in the absence of major interventions. In both cases, government spending increased to meet the economic challenges of the unfolding crises—both to bolster and bailout banks and large firms, but also support households with unemployment insurance as large recessions unfolded. However, the financial panics early in 2020 did not yield fiscal crises of the sort that occurred in Europe in the aftermath of 2008 and 2009. Thanks to large scale monetary policy, unprecedented willingness by governments to spend, and global agreements to suspend debt limits for internal and external fiscal borrowing, the 2020 crisis did not precipitate major fiscal crises in Europe, as its 2008 analogue had. Its management thus holds lessons not only for future crisis recovery, but for resolving the structural tensions in the EMU which Bini Smaghi and Gros identified.

2008: Causes and consequences of the global financial crisis

Europe’s exposure to 2008’s Global Financial Crisis (GFC) came from two directions: the Transatlantic asset bubble for subprime mortgage backed securities, which appeared to be incapable of falling in value, and the proliferation of shadow banking and the use of repurchase agreements for banks’ short term liquidity operations. Just as Bini Smaghi and Gros had suggested, divisions emerged between banks in Europe’s larger and smaller economies after the creation of the Eurozone. While banks in Europe’s core economies tended to acquire more securities relative to total assets and to engage in more international financial activity, banks in Europe’s periphery tended both to lend more as a share of total assets, and to engage in more domestic activity. Banks in Europe’s core economies, particularly Germany, the Netherlands, and France, were likely to purchase subprime mortgage backed securities, while banks in more peripheral economies, like Ireland, Spain, Italy, and Greece, were unlikely to do so. When the market for subprime mortgage backed securities collapsed in 2007 and 2008, banks that had accumulated large holdings of assets were at greater risk of failure than those that had not.

However, banks in the Eurozone’s periphery that were less exposed to subprime mortgage losses were still indirectly linked to these tensions. Many large investment banks in the US and Europe had acquired subprime mortgage backed securities, putting them at risk of failure when those assets fell in value. Those large financial intermediaries had become lynchpins of the global financial system through their funding of repurchase agreements (also called repos). Repos are short-term liquidity arrangements under which a borrower like a bank sells an asset to a counterparty; the borrower is then contracted to repurchase that asset from the counterparty as soon in the future as twelve or twenty-four hours later. Large investment banks like Bear Stearns and Lehman Brothers helped fund global repo markets, which had grown from 2000 through 2007 in their importance for banks in the US and Europe. The failure of Lehman Brothers in particular created funding problems for hundreds if not thousands of banks that indirectly depended on it for shadow banking liquidity services, and the global financial system appeared to be poised on the brink of collapse.

In the European Union, the European Commission and the ECB delegated crisis responses to the national level. Governments and NCBs would conduct the measures necessary to resolve the financial and economic fallout from the rapidly developing GFC. Most of these governments worked alongside their NCBs to bail out domestic financial institutions. However, European banks that had branches in the US and had purchased subprime mortgage backed assets, qualified for expansive liquidity services from the Federal Reserve, which had promised to purchase now toxic assets to expedite banks’ return to lending. The Federal Reserve’s commitment decreased the fiscal burden for governments of core economies, while governments of more peripheral economies bore a larger share of rehabilitating their domestic banks, and issued more sovereign debt.

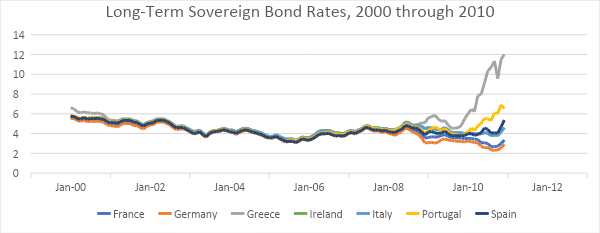

Figure 1: Long-Term Sovereign Bond Rates, 2000–2010

As government debt to GDP levels rose within the Eurozone, private creditors holding European sovereign debt sold off bonds issued by governments of peripheral economies, including Ireland, Greece, Portugal, and, later, Spain and Italy, while continuing to purchase sovereign debt issued by core economies like France and Germany. Figure 1 shows the early phases of this change: bond yields—the relative return on bonds, or the relative cost for governments of funding that debt—grew for debt issued by peripheral economies relative to core economies. Credit rating agencies responded to these growing spreads between peripheral economies’ and core economies’ government bonds by downgrading peripheral economies’ sovereign bonds, which further increased those governments’ costs of responding to ongoing crises.

Monetary policy rules in the Eurosystem exacerbated the costs of these downgrades. As credit ratings on peripheral economies’ sovereign debt fell, those countries’ NCBs paid more to use those bonds as collateral for routine monetary operations. In Greece’s case, credit ratings for Greek sovereign debt fell so low that the Bank of Greece was prohibited from using those bonds as collateral for monetary operations. Downgrades of peripheral economies’ sovereign bonds further depressed private demand for those bonds, which triggered more bond sales, further increasing the cost for those economies to fund their fiscal expenditure, while increasing the costs for their NCBs to support domestic banks. This feedback loop is what is referred to as the Eurozone Crisis’s “Doom Loop.”

When NCBs in peripheral economies ran out of collateral that they could use for monetary policy within the Eurosystem, they attempted to deploy Emergency Liquidity Assistance (ELA) for domestic banks. ELA allows NCBs to use collateral outside of officially approved assets to access funds to lend to distressed banks. However, NCBs must submit their plans to the ECB at least two business days in advance; if two out of three or more members of the ECB’s Governing Board vote against the plan, they may prohibit the NCB from deploying those measures. When the Bank of Ireland attempted to use ELA in 2010 to support Irish banks, Jean-Claude Trichet, then head of the ECB, threatened to veto those measures if the Bank of Ireland and the Irish government did not commit to funding the rescue and paying the ECB back for any incidental support. When banks in Cyprus and Greece petitioned their NCBs for ELA support, the ECB again made the deployment of such measures contingent on the respective NCBs’ and governments’ commitments to paying the ECB back for any ancillary support.

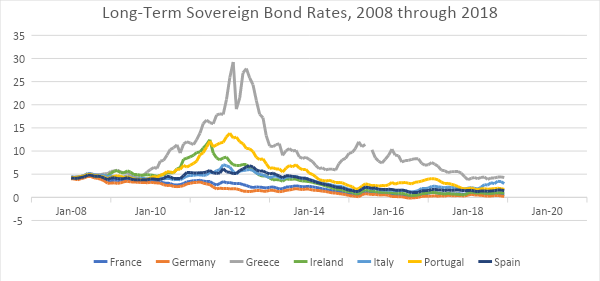

By 2012, financial instability in peripheral Eurozone economies threatened to spill over into markets for core economies’ sovereign bonds. By that point, then head of the ECB Mario Draghi committed in a speech to doing “whatever it takes” to mend the fraying Eurozone. The ECB soon approved measures to backstop sovereign bonds across the Eurozone in the Sovereign Bond Purchasing Programme (SBPP). This program authorized member NCBs in the Eurozone to buy proportional shares of sovereign bonds issued by peripheral Eurozone members with an adequate credit rating, which excluded Greece at the time, in order to stabilize that bond market. Qualifying members’ bond yields began to converge soon after. However, this policy mandated that participating economies commit to austerity and other restructuring measures as a quid pro quo for this liquidity support. Figure 2 shows the effects of these changes on peripheral bond yields during the worst years of the Eurozone Crisis. As peripheral members of the Eurozone came to the brink of default on their sovereign debt, yields spiked higher. When the ECB initiated relief measures, those spreads decreased again. Greece’s exclusion from the SBPP prolonged its heightened cost of spending relative to other European economies. While sovereign bond rates for peripheral Eurozone economies worst affected by the Eurozone crisis gradually decreased, these changes came at the cost of diminished fiscal autonomy, double-digit unemployment rates, and general economic malaise.

Figure 2: Long-Term Sovereign Bond Rates, 2008–2018

2020 and beyond: the Covid-19 pandemic

In 2020, the precipitating event for financial uncertainty in Europe and elsewhere came from growing alarm about the increasingly apparent physical and economic toll of the pandemic. The early epicenter of the spread of Covid-19 in Europe was Italy; as the Italian government responded to mounting Coronavirus cases by imposing shutdowns and increasing payments to firms, banks, and households, its government debt increased relative to GDP. Bond holders responded to these rising debt levels by selling Italian government bonds, triggering an initial increase in Italian sovereign bond rates, and prompting Christine Lagarde, head of the ECB to announce on March 12, 2020 that the ECB was not planning to target spreads. Lagarde’s announcement spurred another large sell-off of Italian sovereign bonds, further increasing the rate on Italian sovereign bonds and widening the spread between Italian government bond yields and German government bond yields. Lagarde reversed course within a day, and echoed Draghi, saying that the ECB would do “whatever it takes” to preserve the Eurozone’s economy, including targeting bond spreads.

The ECB and the European Commission worked in tandem to support government borrowing from that point onward: the European Commission suspended required limits on deficit and debt ratios to GDP, and the ECB initiated the Pandemic Emergency Purchase Programme (PEPP), which allowed NCBs across the Eurosystem to purchase all manner of bonds, with a waiver of existing restrictions on their purchases of Greek sovereign bonds, to facilitate money creation, financial activity, and government expenditure. Bond spreads between core and peripheral Eurozone members converged again, and bond yields on peripheral European governments’ debt fell below zero. These measures provide a stark contrast with the relative unwillingness of the ECB to enable NCBs to act as lenders of last resort in the aftermath of the GFC of 2008.

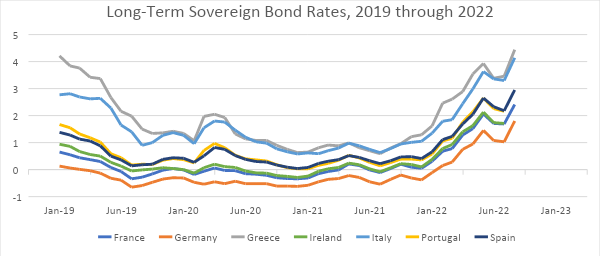

Figure 3: Long-Term Sovereign Bond Rates, 2019–2022

Figure 3 shows the trajectory of sovereign bond interest rates and extraordinary liquidity programs from 2020 through 2022. Early uncertainty about economic consequences of the crisis are reflected in a small spike in rates for economies like Greece, Italy, Portugal, and Spain. By mid-2020, sovereign bond rates throughout the Eurozone decreased thanks to NCBs making consistent purchases of sovereign debt because of PEPP. By late 2021, as governments, central banks, and pundits discussed global recovery and rising inflation rates, sovereign bond rates across the Eurozone began to diverge again. By early 2022, pandemic-related spending and liquidity programs had gradually expired, likely increasing private investors’ uncertainty about bond risk. While sovereign bond rates for Italy and Greece were still less than 5 percent by September 2022, below the heights those rates reached in 2011 and 2012, the fate of these rates is an open question, especially as rates have increased for core members as well.

A discussion of two crises

A divide emerges between how the ECB hindered or facilitated fiscal responses to these two international crises, despite the Federal Reserve’s willingness in both periods to prevent liquidity crises from worsening. In 2008, the ECB resisted implementing a comprehensive European strategy, to deter volatility in credit markets for European sovereign debt. Its limited response to the GFC, compared to the Federal Reserve, increased the national burden for NCBs and domestic governments. However, because banks in core economies with greater exposure to the subprime mortgage bubble retained access to liquidity programs initiated by the Federal Reserve, governments of core economies bore a smaller relative burden in rescuing their domestic financial sectors than did governments in peripheral Eurozone economies. When the ECB relented in 2014 and increased its willingness to facilitate government spending by reducing volatility in markets for peripheral economies’ sovereign debt, it tied these measures with requirements that those economies commit to austerity, nullifying the expansionary potential of these measures.

By contrast, during the onset of the pandemic, the ECB used monetary policy to directly facilitate sovereign debt issuance, and by extension, government spending. Though European law officially prohibited NCBs from directly purchasing government debt, and despite a legal challenge from the Bundesbank, the central bank of Germany, the European Court of Justice ruled that the ECB was empowered to implement such programs. Moreover, by explicitly waiving the Stability and Growth Pact, which mandates that European governments not exceed maximum deficit and debt to GDP limits, the European Commission provided policy ballast to empower governments to spend as much as necessary to address the novel challenges of the global pandemic, including wide-ranging fiscal policies meant to support households at risk of unemployment.

The ECB’s divergence from past practice during the early months and years of the pandemic deserves attention for multiple reasons. First, the ECB’s ability to shift the trajectory of Europe’s economic experience of the pandemic is a reminder of the power of monetary policy to prevent panics in financial markets from hollowing out governments’ abilities to spend expansively to address unprecedented economic challenges. As these liquidity programs have expired, private investors’ mounting uncertainty has had material consequences for the cost of government spending in more peripheral Eurozone economies. If rising sovereign bond rates inhibit spending that can sustain economic recoveries, or address novel physical and economic challenges like climate change, then monetary authorities’ decisions about when to backstop sovereign debt markets may facilitate or inhibit such changes. The ECB’s ability to promote or inhibit fiscal spending is another reminder of the ambiguity of central bank independence. If the European Commission opposes government spending, then an independent ECB may encourage spending despite political opposition. By contrast, if governments believe that spending is desirable, ECB opposition to inflation may curb that potential, with no external check. Finally, the ECB’s ability to change course—to become either more dovish or more hawkish—highlights the importance of political commitments. The ECB demonstrated a commitment to government spending in a moment of global crisis in 2020; whether it believes inflation risks in 2022 and beyond represent a similar crisis may trigger policies that reverse those gains.

Despite rising inflation and successful rate hikes since the beginning of 2022, the ECB appears to remain committed to targeting bond spreads in the Eurozone. In June 2022, the Eurosystem’s leadership debated how to implement the Transmission Protection Instrument, which would authorize NCBs to purchase sovereign debt again, if spreads were at risk of diverging. Whether it implements this policy or not, the Eurosystem appears more structurally open to supporting members’ ability to respond to crises with both monetary and fiscal policy, and to preventing such calamitous divides in the future.

Moreover, the contrast between the ECB’s response to the crises of 2008 and 2020 holds lessons for managing the inherent structural challenges of the Eurozone identified by Bini Smaghi and Gros. In 2008, the ECB’s decisions to delegate policy responses to the national level of the Eurozone reflected its commitment to prioritizing monetary stability over financial stability. The ECB was willing to sacrifice member states’ economic potential until those costs threatened to harm investors’ confidence in debt issued by core economies like Germany and France.

However, in 2020, the ECB appeared to demonstrate a broader commitment to EMU-wide stability as well as to enabling domestic autonomy in monetary and fiscal policy. The ECB’s decision to promote government spending by deliberately backstopping markets for European government bonds proved that the ECB was capable of leveling the field between peripheral and core members. Its apparent commitment to finding ways to minimize bond spreads between government debt issued by the Eurozone’s core and periphery in order to maintain EMU members’ fiscal space even after inflation rates have risen globally provides a source of optimism about whether these tendencies will continue outside of global crises. Whether the ECB persists in raising rates, it has shown a willingness to grant members’ governments and NCBs the agency to respond to crises, whatever the worries of private investors may be.

This essay is derived from the author’s forthcoming paper “Institutional Constraints, Liquidity Provision, and Endogenous Money in the Eurozone Core and Periphery Before and After Crises” in PSL Quarterly Review.