Published as part of the ECB Economic Bulletin, Issue 5/2023.

Consumer expectations can be of help in making timely assessments of the transmission of monetary policy to economic activity. Using data from the ECB’s Consumer Expectations Survey (CES), this box documents i) the extent to which consumer expectations about interest rates on mortgages and bank deposits have adjusted to the tighter policy stance; ii) how different groups of households perceive the tightening of monetary policy; and iii) to what extent these changes have affected households’ expectations about their future spending.[1] These are important elements in the ongoing assessment of the transmission of tighter monetary policy to household spending.

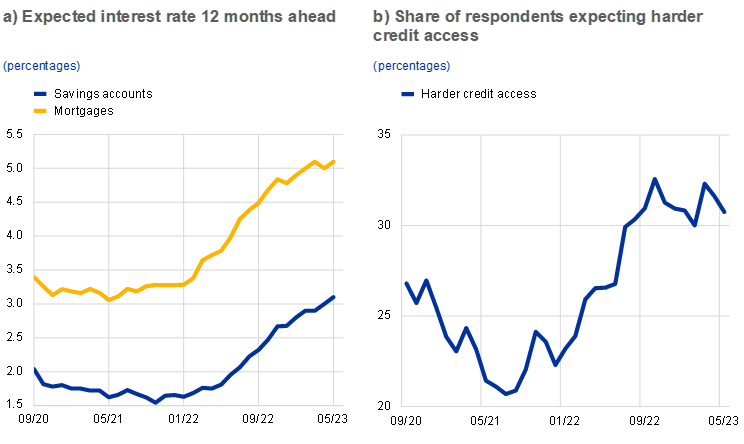

In line with actual interest rate developments, consumers’ expectations for interest rates have increased. Expectations for interest rates on mortgages and savings accounts in 12 months’ time have increased by almost 2.0 percentage points and 1.5 percentage points respectively since the beginning of 2022 (Chart A, panel a). The share of respondents expecting that it will be harder to obtain credit (of any type) increased steadily from the beginning of 2022 until October 2022 and has hovered around 30% since then.

Chart A

Households’ expectations about interest rates and credit access

Source CES.

Note: The latest observations are for May 2023.

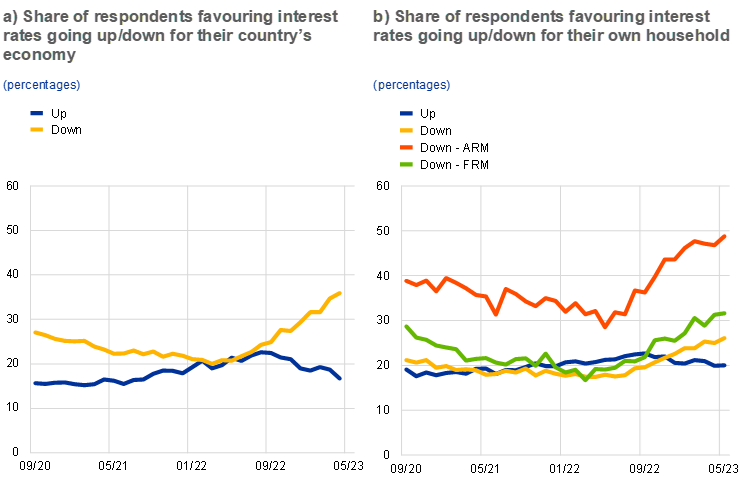

Since June 2022 an increasing share of respondents, particularly among those with an adjustable rate mortgage (ARM), has favoured lower interest rates. In June 2022 the share of respondents reporting that lower interest rates would be best for their country’s economy had already exceeded the share favouring higher interest rates (Chart B, panel a).[2] Similarly, in the autumn of 2022 the share of consumers who thought lower interest rates would be best for their own household exceeded the share reporting that they preferred higher interest rates. The growing preference for lower interest rates is particularly visible among households with an ARM mortgage who are arguably more directly affected by the rise in interest rates. Conversely, households with a fixed rate mortgage (FRM), who are not as exposed – or at least not as immediately – to higher interest rates, have changed their attitudes toward interest rates by much less.

Chart B

Households’ preferences as regards interest rate changes

Source CES.

Notes: Panel b) shows the results for all households in the survey, as well as for households with an ARM and households with an FRM. See also footnote 3 for further details. The latest observations are for May 2023.

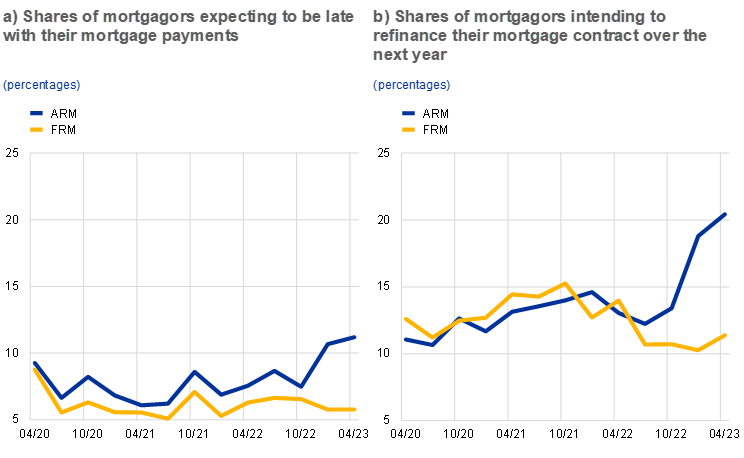

There is considerable divergence between respondents with different types of mortgage in terms of their expectations about their household’s financial situation. The share of households with an ARM reporting that they expect to have difficulties in meeting their mortgage payments in the next quarter has risen notably, especially in the first half of 2023. In contrast, expectations regarding difficulties in meeting future payments have remained broadly stable overall among households with an FRM.[3] In line with this divergence, the share of households with an ARM who intend to apply for mortgage refinancing over the next year increased in the first two quarters of 2023 (Chart C), while the analogous share of households with an FRM steadily declined over the same period.

Chart C

The burden of higher interest rates, by mortgage type

Source: CES.

Note: The latest observations are for April 2023.

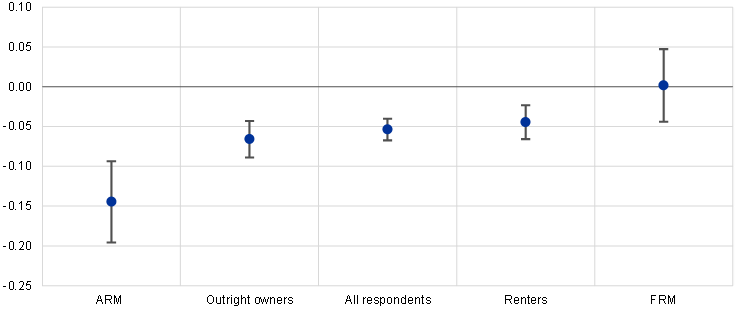

Expectations for spending of households with an ARM are more sensitive to changes in expected interest rates. On average, respondents tend to reduce their expected real spending growth when they increase their expectations about future mortgage rates (with expected spending growth falling by -0.05 percentage points in response to a 1.0 percentage point increase in mortgage rate expectations). Distinguishing between renters, homeowners without a mortgage, those with an FRM, and those with an ARM, the empirical analysis shows that households in the latter group expect to reduce their consumption growth by three times as much as the average household in the population, in line with the higher interest rate exposure of households with an ARM. At the other extreme, the expected consumption growth of households with an FRM seems to be unaffected by an increase in interest rate expectations (Chart D).[4] Overall, the results of the CES suggest that over the past year consumers have been progressively incorporating the impact of higher interest rates into their spending decisions, which reflects the ongoing transmission of tighter monetary policy to economic activity.[5]

Chart D

Impact of expected mortgage rates on expected consumption

(percentage points)

Sources: CES and ECB calculations.

Notes: The dots show the sensitivity of expected consumption to an expected change in mortgage interest rates by type of household. These parameters are estimated in a panel regression of the monthly change in expectations of household real consumption growth one year ahead (nominal consumption growth minus the expected inflation rate 12 months ahead) on the change in expectations of mortgage interest rates that also controls for the expected nominal income growth for the year ahead and unobserved heterogeneity across households. The 95% confidence intervals of the estimated parameters are shown by the vertical whiskers. The estimation period is from April 2020 to May 2023.