Editorial Note: We earn a commission from partner links on Forbes Advisor. Commissions do not affect our editors’ opinions or evaluations.

A mortgage loan backed by the Department of Veterans Affairs, called a VA loan, is a mortgage option for current or former members of the armed services.

VA loans usually have no or low down payment requirements and lower interest rates than traditional mortgage products. They also tend to be more flexible, allowing for a higher debt-to-income (DTI) ratio and lower credit scores, and don’t require private mortgage insurance (PMI).

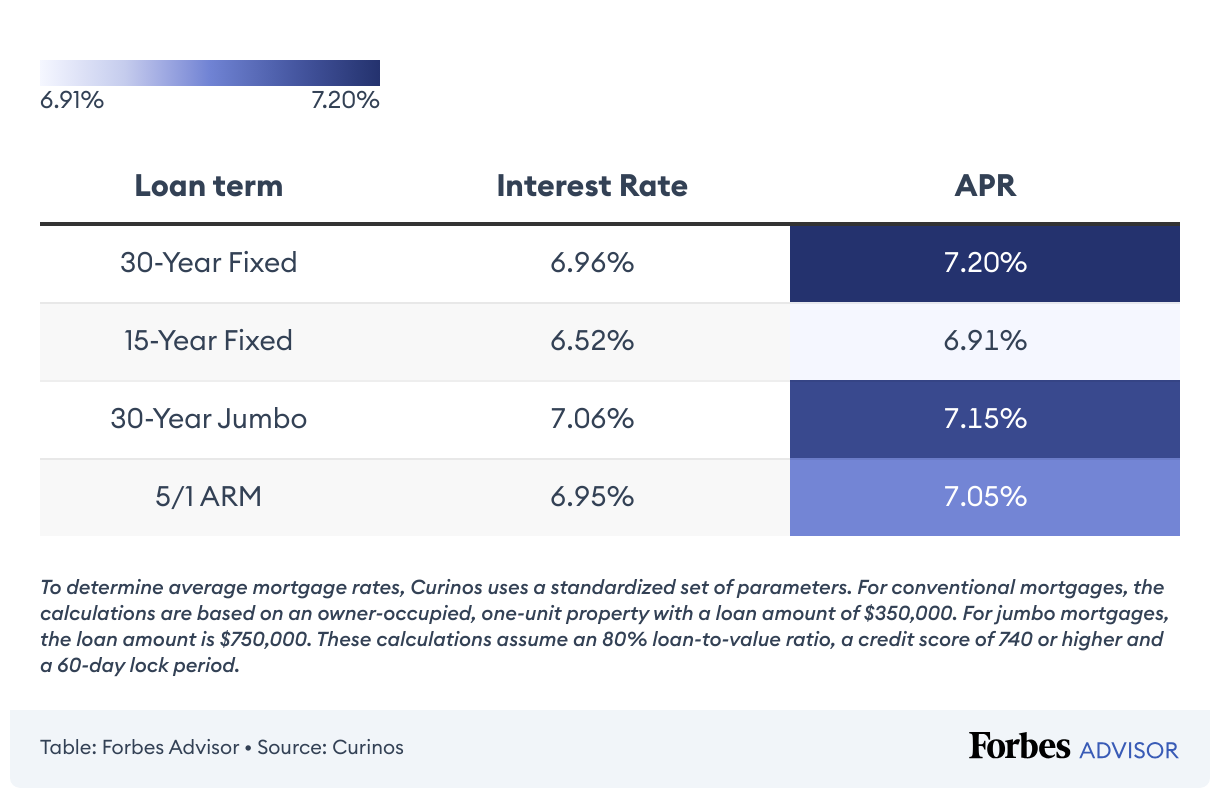

Current VA Mortgage Rates

How To Compare Current VA Loan Rates

The best way to compare current VA loan rates is to submit applications with multiple lenders. Each lender who approves your application will give you an official loan estimate showing the interest rate, closing costs and other key features of the mortgage you qualify for.

When reviewing the estimates, pay close attention to any discount points listed as closing costs. These upfront charges represent prepaid interest and will lower your interest rate for as long as you have the loan. You might be able to get the same rate from one lender without paying points as you can get from another lender who does charge points.

Today’s VA Rates and Your Monthly Payment

To get an idea of what your monthly payment would be at today’s interest rates, you need to know how much you’re borrowing, whether your interest rate is fixed or adjustable, and how long your loan term is.

For instance, if you have a starting loan balance of $350,000 on a 30-year fixed-rate VA home loan, here’s approximately what you can expect to pay in principal and interest every month:

- At a 5% interest rate. $1,879 in monthly payments (excluding taxes, insurance and HOA fees)

- At a 6% interest rate. $2,098 in monthly payments (excluding taxes, insurance and HOA fees)

- At a 7% interest rate. $2,329 in monthly payments (excluding taxes, insurance and HOA fees)

- At an 8% interest rate. $2,568 in monthly payments (excluding taxes, insurance and HOA fees)

What Is a VA Loan?

VA home loans are provided by private lenders such as banks, credit unions and mortgage companies. The VA guarantees a portion of the loan, meaning they are on the hook for a percentage of the amount borrowed in the event of a default. This backstop encourages the lender to provide you with more favorable loan terms.

This loan product comes with low or zero down payment options and no monthly PMI requirement. Most lenders offer VA loans with 10-, 15-, 20-, 25- or 30-year terms, with fixed or adjustable rates.

Types of VA Loans

The VA offers a variety of home loan programs to help buy, build or improve a home as well as refinance your existing mortgage loan.

- VA-backed purchase loan: The most common type of VA loan used to purchase a home. These loans tend to have better terms as well as lower rates and costs than a conventional 30-year mortgage.

- Native American Direct Loan (NADL): A home loan program for veterans who are Native Americans as well as their spouse. This loan can be used to buy, build or improve a home on federal trust land.

- Interest Rate Reduction Refinance Loan (IRRRL): This allows you to refinance into a lower interest rate or switch to a fixed-rate mortgage from an existing VA mortgage loan.

- Cash-out refinance: A cash-out refinance is a type of mortgage refinance that allows you to take cash out of the equity built up in your home or refinance a non-VA loan into a VA-backed mortgage.

Who Qualifies for a VA Loan?

You must be a veteran, active-duty service member, a member of the National Guard, reserve or the surviving spouse of a veteran to qualify for a VA loan. A Certificate of Eligibility (COE) from the VA is required. You can apply for your COE online or by mail, or your lender can get it for you.

You can check the full list of eligibility requirements here.

VA Loan Requirements

VA loans usually don’t require a down payment and carry lower interest rates than traditional mortgage products. They also tend to have less rigid debt-to-income (DTI) ratio and credit score requirements, and no mandatory private mortgage insurance. These are the general guidelines for who can get a VA loan:

- General requirements: Active-duty members of the military are eligible after 90 days of continuous service during wartime. Veterans who served after August 2, 1990, are eligible with 24 continuous months of active-duty service plus a non-dishonorable discharge. National Guard members and reservists are eligible after 90 days of active service, or six years of service.

- Credit and debt requirements: There is no minimum credit score requirement for a VA loan, but it’s recommended that borrowers have a minimum credit score of between 580 to 620 to qualify. There isn’t a maximum DTI for a VA loan either, although anything above 41% may require additional explanation to get approved. The general rule of thumb should be to keep your home costs at no more than 25% to 36% of your take-home pay.

- Income requirements: Your income must be stable, reliable and expected to continue in the foreseeable future—enough to pay back your loan. Lenders must also verify a minimum of two years employment. In addition to those requirements, the VA has residual income guidelines regarding how much money a borrower must have left over after all debts and living expenses are considered.

- Down payment requirements: There is no down payment requirement for VA loans as long as the sales price is at or below the home’s appraised value. If you choose to make a down payment of at least 5%, you can pay a lower VA funding fee, if you are not already exempt.

- Property requirements: A VA loan can only be used to buy a primary residence, not a second home. The VA has established Minimum Property Requirements (MPRs) that the property must meet for your application to be approved. If you are buying a condominium, the VA has a list of approved condos.

VA Loan Limits

If you have a full VA loan entitlement, you can borrow as much as your financial circumstances allow—in other words, as much as a lender says you qualify for.

If you have an existing VA loan or have defaulted on a VA loan, you won’t be able to borrow more than the conventional conforming loan limits. In most parts of the country, the VA loan limit is $726,200 in 2023. In Alaska, Hawaii, Guam and the U.S. Virgin Islands, the limit is $1,089,300 in 2023.

The federal government adjusts these limits each year to reflect changes in average home prices.

How Much Does a VA Loan Cost?

The VA loan includes a funding fee, put in place by Congress to ensure there is enough money in the program to cover its loan commitments and ensure loan terms are always affordable.

Your lender will also charge other closing fees. Many lenders charge a flat 1% loan origination fee, as well as additional fees. It should be part of your checklist while shopping around to know what loan costs may be added to your overall amount.

VA Loan Funding Fee

The funding fee is a percentage of your total loan amount. It varies based on whether this is your first time making use of the benefit, how many times you’ve used this benefit and the size of your down payment. Funding fees typically range between 1.4% to 3.6% for purchase loans.

You can pay the funding fee either by including it in your overall mortgage loan (also known as financing) and pay it off over time, or you can choose to pay the full fee at closing.

If you used a VA loan to buy a manufactured home, you only have to pay the first-time use funding fee.

When To Consider a VA Loan

While there are no prohibitions against using a VA loan more than once, you won’t enjoy the same benefits as a first-time homebuyer, especially if you plan on keeping your previous VA-backed home.

Pros and Cons of a VA Loan

Who Sets VA Loan Rates

The Department of Veterans Affairs does not set mortgage rates. Your lender will determine the rate on your VA loan based on market rates, your credit profile and your financial situation. You may qualify for a lower interest rate if you choose to make a down payment.

Faster, easier mortgage lending

Check your rates today with Better Mortgage.

How To Find the Best VA Loan Rate

There are many companies online that rank lenders offering VA loans, nationally and in your local area, and provide daily interest rates information. Alternatively, you can work with a mortgage broker that specializes in helping veterans and active-duty military.

You should get a loan estimate from multiple lenders and compare the loan offers using the Consumer Financial Protection Bureau’s (CFPB) guide.

What Factors Determine My VA Interest Rate?

Knowing what factors affect your VA loan interest rate could save you money or allow you to borrow more. If you plan on applying for a VA loan in the near future, look to improve some of these aspects of your finances to potentially get a lower rate:

- Credit score. While the VA doesn’t require borrowers to have a minimum credit score, lenders do consider your score and offer lower rates to those with higher scores.

- Loan-to-value ratio. The lower your LTV, the better your rate. Another way of saying this is that the more equity you have, the lower your rate should be.

- Debt-to-income ratio. The less debt you have compared to your income, the lower your interest rate should be.

- Loan term. A 15-year mortgage typically has a lower interest rate than a 30-year mortgage.

- Lender. Rates vary by lender, so it’s important to submit multiple mortgage applications and compare offers.

VA Purchase Rates vs. VA Refinance Rates

VA loan purchase rates refer to the interest on a loan to buy a home, while a VA refinance rate will be your new interest rate after you refinance your mortgage.

VA Loan vs. 30-Year Fixed Mortgage

A VA loan is only available to veterans, active-duty military, reserves or National Guard. A 30-year fixed mortgage, commonly referred to as a conventional mortgage, is available to everyone. It comes with a different interest rate, requires a down payment and might also require PMI depending on how much you put down.

Frequently Asked Questions (FAQs)

Are VA rates lower than conventional?

While it is a commonly-held belief that VA loans have lower interest rates than conventional loans, that’s not necessarily true. Financial institutions that cater to veterans and active-duty personnel may offer lower interest rates compared to conventional loans. So it’s important who you chose as a lender and to shop around at the outset.

How many times can I use a VA loan?

You can use your VA loan benefits more than once during your lifetime.

Can I buy land with a VA loan?

You cannot use a VA loan to purchase land by itself, even if you intend to build a home later. You must be building a house at the same time in order to be eligible.

Can I use a VA loan to build a house?

Yes, you can use it to build a home.

Do VA loans require mortgage insurance?

You do not need private mortgage insurance or have to pay mortgage insurance premiums.

Is there a penalty for paying off a VA loan early?

There is no penalty fee for paying off the loan early.

How long do you have to live in a house with a VA loan?

A VA loan can only be used to fund the purchase of a home that will be your primary residence. The VA has an occupancy requirement mandating that you move in within 60 days after closing. You cannot use the property as a seasonal vacation home.

How long does it take to get a VA loan?

The speed at which you can secure a VA loan will depend on how quickly you can provide the necessary documents to confirm your eligibility, prove your ability to meet the financial commitments and show that the home you want to buy meets the VA’s Minimum Property Requirements.

What credit score is needed for a VA loan?

There is no minimum credit score requirement, but borrowers are advised to have a minimum credit score of between 580 to 620 to qualify for a VA loan.

How do you get preapproved for a VA loan?

To get preapproved for a VA loan, contact an approved VA lender. Once it has confirmed your eligibility, credit profile and financial status, the lender will preapprove you.