On April 6, 2023, Citigroup analyst Arren Cyganovich announced that Blackstone Mortgage Trust (NYSE: BXMT) would be maintaining its neutral rating, but with a lowered price target of $17. This indicates that Citigroup believes the stock will perform in line with the market and that the fair value of the stock is $17.

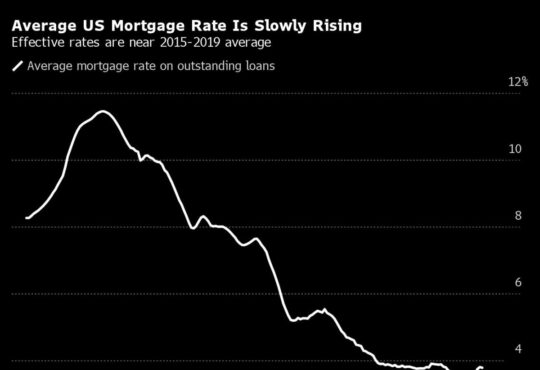

Blackstone Mortgage Trust is a real estate finance company that originates and purchases senior mortgage loans collateralized by properties in the United States and Europe. However, the company’s stock has been struggling lately due to concerns about the impact of rising interest rates on the real estate market.

Citigroup’s decision to maintain a neutral rating on Blackstone Mortgage Trust suggests that the company’s financial performance is not expected to improve significantly shortly. The lowered price target of $17 indicates that Citigroup believes the stock is currently overvalued.

Investors should consider Citigroup’s analysis of Blackstone Mortgage Trust when making investment decisions. However, conducting additional research and analysis is crucial before making any investment decisions.

BXMT Stock Performance on April 6, 2023: A Detailed Analysis of Blackstone Mortgage Trusts Market Cap, Earnings Growth, and More

BXMT Stock Performance on April 6, 2023

On April 6, 2023, Blackstone Mortgage Trust, Inc. (BXMT) opened at $17.70, down 0.78% from its previous close of $17.84. The stock had a day’s range of $17.59 to $17.85 and traded at 256 shares, significantly lower than its three-month average volume of 2,375,065.

BXMT is a real estate investment trust (REIT) that primarily originates and purchases senior mortgage loans collateralized by commercial real estate properties. As of April 6, 2023, the company had a market cap of $3.1 billion.

The company’s earnings growth in the last year was -47.33%, but it has shown a positive growth of +3.38% this year. However, the earnings growth projection for the next five years is 0.00%. On the other hand, the company’s revenue growth in the previous year was +55.60%.

BXMT has a P/E ratio of 12.1, lower than the industry average of 17.4. The company’s price/sales ratio is 2.74, and its price/book ratio is 0.68.

BXMT’s stock performance on April 6, 2023, was not excellent compared to other companies in the real estate investment trusts industry. Vornado Realty Trust’s stock decreased by 0.07%, and Cousins Properties Inc. increased by 0.02%. However, LXP Industrial Trust’s stock increased by 0.10%.

BXMT’s next reporting date is April 26, 2023, and its EPS forecast for this quarter is $0.75. The company had an annual revenue of $1.3 billion and an annual profit of $248.6 million in the previous year, with a net profit margin of 18.85%.

In conclusion, BXMT’s stock performance on April 6, 2023, was not impressive. However, investors should monitor the company’s financial reports and future earnings growth projections to make informed investment decisions.

Blackstone Mortgage Trust Inc (BXMT) Stock Analysis and Forecast for 2023

, 2023

Blackstone Mortgage Trust Inc (BXMT) is a real estate finance company that invests in and originates senior loans collateralized by commercial real estate. The company has operated since 1966 and has a market capitalization of $4.2 billion. BXMT stock has been performing well in recent months, with the current consensus among nine polled investment analysts to hold stock in the company.

On April 6, 2023, BXMT stock was trading at $17.73, with a median target price forecast of $25.00 from 7 analysts. The high estimate was $26.00, while the low estimate was $23.00. This median estimate represents a +41.00% increase from the last price of $17.73.

The company is set to report its earnings for the current quarter on April 26, 2023. Analysts expect earnings per share of $0.75 and sales of $170.0 million. This will be an important event for BXMT investors, providing insight into the company’s financial performance for the quarter.

BXMT stock has been performing well in recent months, with a steady hold rating from investment analysts since February. The company’s focus on senior loans collateralized by commercial real estate has helped it weather economic downturns and maintain a stable financial position.

Investors in BXMT stock should keep an eye on the company’s earnings report on April 26, 2023, as it will provide valuable information on its financial performance for the current quarter. With a median target price forecast of $25.00 from 7 analysts, BXMT stock has the potential for significant growth in the coming months.