One thing to start: What’s gone wrong with the London Stock Exchange? And how did we get to where we are today? That’s the subject of our recent Behind the Money podcast. Listen here

Welcome to FT Asset Management, our weekly newsletter on the movers and shakers behind a multitrillion-dollar global industry. This article is an on-site version of the newsletter. Sign up here to get it sent straight to your inbox every Monday.

Does the format, content and tone work for you? Let me know: harriet.agnew@ft.com

Inside the bearish bet that cost $9bn

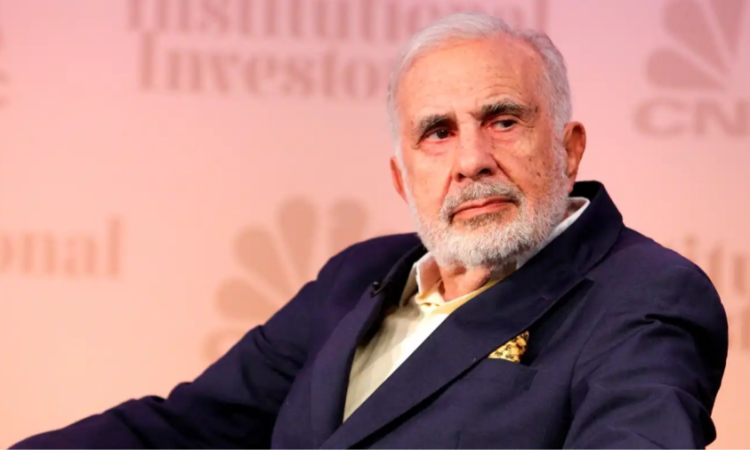

In the aftermath of the 2008 financial crisis, Carl Icahn’s Icahn Enterprises started aggressively betting on a market collapse. The billionaire corporate raider’s positioning became increasingly bolder in subsequent years, deploying a complex strategy that involved shorting broad market indices, individual companies, commercial mortgages and debt securities.

My colleagues Antoine Gara and Ortenca Aliaj in New York have crunched the numbers to reveal that the ill-fated trade cost Icahn’s group nearly $9bn over roughly six years. According to a Financial Times analysis, the prominent investor lost about $1.8bn in 2017 on hedging positions that would have paid out if asset prices had tumbled before losing a further $7bn between 2018 and the first quarter of this year.

This prompted a rare mea culpa from Icahn, one of the first activist shareholders who is credited with making that strategy mainstream.

He said in an interview:

“I’ve always told people there is nobody who can really pick the market on a short-term or an intermediate-term basis. Maybe I made the mistake of not adhering to my own advice in recent years.”

The trades have left Icahn in a vulnerable position and threaten to undermine his status as one of the most feared activist investors on Wall Street. Earlier this month, short seller Hindenburg Research released a report saying it believed the market value of Icahn Enterprises was inflated and its dividend was unsustainable. Shares of the company have fallen more than 30 per cent since the report was published.

Earlier this month, Icahn Enterprises revealed federal prosecutors in New York had contacted the company seeking information on its business, including corporate governance, valuations and due diligence.

The net asset value of Icahn Enterprises fell from $7.9bn in 2017 to $5.6bn this month. That poses a potential problem for Icahn, who has historically taken the large $8 a share annual dividend in stock rather than cash. This has caused the number of outstanding shares to more than double over the roughly six-year period, pushing its net asset value per share down from $33 to roughly $16.

Retail investors who took their dividends in cash would have received more than $40 a share during the same period.

As pressure on his group mounts, Icahn has been forced to rein in his short bets just as some investors fear that a regional banking crisis and the debt ceiling stand-off could result in a sharp market sell-off.

“I still to some extent believe that this economy is not good and there are going to be problems ahead,” Icahn said. “We are still hedged, but not to the extent we were.”

Read the full story here

Amundi shifts assets from US to China

Europe’s largest asset manager Amundi is moving out of US assets in favour of China, attracted by the country’s brighter economic prospects, better valuations and a more benign outlook for inflation.

Vincent Mortier, chief investment officer of the Paris-based fund firm, which has €2.1tn in assets, thinks “too much risk” is priced into Chinese credit and high-quality companies, while markets in the US are “too optimistic” as a recession looms.

“In our allocations we have made a clear shift from west to east,” Mortier said in an interview with my colleague Mary McDougall, predicting that the US economy will not grow next year while China, India and Indonesia will each grow by 5 to 6 per cent.

Mortier’s bullish stance on the world’s second-largest economy comes as political tensions between Beijing and Washington worsen and recent consumer and industrial activity has fallen far short of expectations.

In late January, a top US air force general predicted that the US and China would probably go to war in 2025, and the following month Chinese spy balloons were discovered over the US.

While Mortier sees geopolitics as “a risk”, he thinks the balance of power is such that the US would try to avoid being too harsh on China. Amundi has been gradually increasing its allocation to China and India over the past 12 months, and has accelerated the move this year.

“The US should not underestimate the capacity of China to retaliate, to escalate and then to negotiate,” Mortier said. “I think China can make serious arguments to put pressure on the US as well.”

Read the full story here

Chart of the week

Hedge funds have been upping their bets against Greece’s government debt as the nation heads to the polls this weekend, as they become concerned about the possibility of political paralysis after the election.

The total value of Greece’s bonds borrowed by investors to wager on a fall in prices — known as shorting — hit its highest level since 2014 this week at over $500mn, according to data from S&P Global Market Intelligence — up from around $65mn at the start of the year, writes Mary McDougall in London.

Greek debt has performed better than that of other European countries so far this year, and last month S&P changed its outlook for the country from stable to positive, putting it on the cusp of regaining the investment grade rating it lost in 2010.

“Greek government bonds have outperformed their Eurozone peers for a while so the build in shorts goes against the prevailing [bullish] narrative in Greece,” said Antoine Bouvet, head of European rates strategy at ING. “So far the prospect of the election has not slowed the performance of bonds but we’ll have to see after the results.”

Five unmissable stories this week

Marcie Frost, chief executive of Calpers, says the largest US public pension plan is considering bigger bets on private equity despite growing fears that higher interest rates will curb the industry’s returns.

Jonathan Ruffer‘s investment boutique Ruffer is opening an office in the US to attract some of the world’s largest investors, as it warns of an impending recession and liquidity crunch. It is close to amassing $1bn from US institutions and is aiming to at least quadruple this over the next few years.

Baillie Gifford’s Scottish Mortgage Investment Trust has urged shareholders to remain “disciplined and patient” as it defended its investment approach after a “painful” year in which its shares have dropped by a third.

Entrepreneur Marco Garzetti said he would invest SFr65mn in GAM as an alternative to Liontrust’s planned acquisition and would do “whatever it takes” to keep the Swiss fund management group independent.

Fund managers have cut their allocations to commercial real estate to their lowest level since the 2008 global financial crisis, according to Bank of America’s monthly fund manager survey. It marks the latest sign that investors are becoming concerned about the impact of rising interest rates and falling demand on the sector.

And finally

Norman Foster, the architect behind landmarks such as London’s Gherkin skyscraper is having his first major retrospective at the Pompidou in Paris. “The older I get, the more I realise it’s not about the building but about the city,” he tells Edwin Heathcote.

Thanks for reading. If you have friends or colleagues who might enjoy this newsletter, please forward it to them. Sign up here

We would love to hear your feedback and comments about this newsletter. Email me at harriet.agnew@ft.com