Kostrikina Myroslava

Dear readers/followers,

Back in February, I wrote my first article on Blackstone Mortgage Trust (NYSE:BXMT) issuing a buy rating for the company. My buy thesis was based on the fact that the dividend (which stood at almost 11% at the time) was well covered and the company was trading at a significant discount to book value (0.87x BV at the time) while fundamentals remained strong. In particular, the company has collected 100% of interest up until that time and although they were being quite cautious and increased their CECL (credit loss) reserve significantly in Q4 2022, there were no indications that any of the loans were close to defaulting.

Despite strong fundamentals the price continued to fall on fears that commercial real estate (and mainly US office) is doomed, resulting in a 20% loss since my last article. It’s never fun to see your investment decline in value, but our job as investors is to try to look through the madness and determine whether there’s a light at the end of the tunnel.

Today, post Q1 earnings, I want to write an update on BXMT. The goal of this article is twofold. Determine whether my original thesis still holds and dive deeper into the company’s leverage and determine how bad an outcome is already priced-in. I encourage you to have a look at the original article for a more basic overview of what the company does and how the current high rate environment affects it (both in a positive and negative way). Now without further due, let’s have a look at their recent earnings.

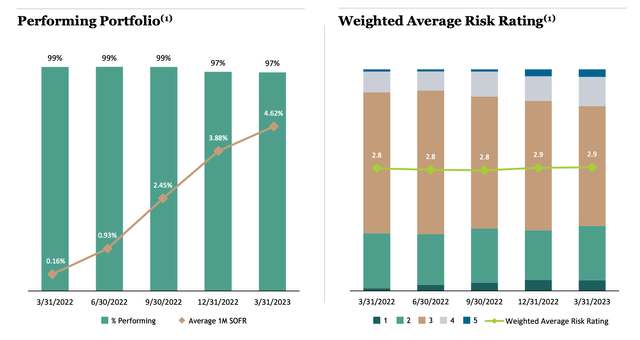

As always, the investor presentation is quite brief and focuses on the positives. Q1 was no different. Earnings during the quarter reached $0.79 per share which was up 27% YoY but down 9% QoQ. This drop was caused by a significant prepayment fee of $0.07 per share which was received in December and therefore somewhat increased their Q4 numbers, excluding this earnings were roughly flat for the quarter. What’s important is that their dividend coverage has remained solid. Note that while the dividend has remained flat ($2.48 per share) since 2020, earnings have continually improved resulting in a gradually improving coverage ratio which increased from 100% in 2020 to 106% in 2021, 116% in 2022 and 127% in Q1 2023.

The CECL reserve which increased 2.7 times last year remained largely flat for the quarter, only increasing by $9 Million (primarily related to asset-specific reserves), which was more than offset by retained earnings in excess of dividends, resulting in a stable book value of $26.28 per share (up 2 cents QoQ). As of the end of Q1, the reserve stood at $352 Million or $2.04 per share. In aggregate, this is enough to cover 36% of 5-rated loans which account for about 4% of all loans.

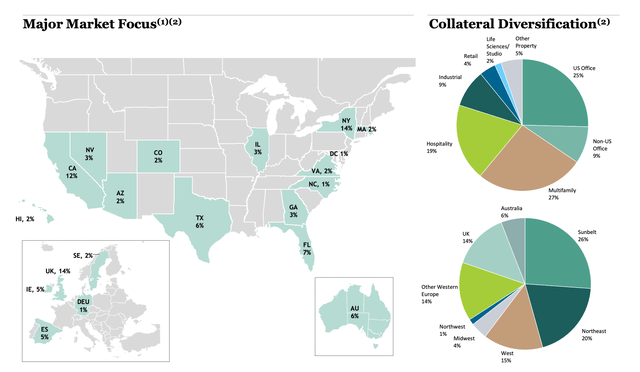

If we add 4-rated loans than combined (4+5-rated) they account for 7% of the portfolio. The weighted average risk rating stands at 2.9 and most loans are 3-rated. Management stated in their earnings call that they collected 100% of interest in Q1 and that the increased income (due to higher rates) on the 97% of loans that are performing more than offset the 3% of loans that aren’t.

BXMT Presentation

I also want to point out that management has continued with their plan to move away from offices. In Q4 2022 offices accounted for 40% of total collateral, while in Q1 this was down to 34% (9% of which was non-US office). The geographical distinction matters, because work from home isn’t nearly as much of a threat in Europe as it is in the US.

BXMT Presentation

So it’s quite clear that results have been good and the company is moving in the right direction. Now because BXMT is a lender, which is very different from being an equity holder, I want to determine how bad an outcome is already priced in given that the stock is currently trading at 0.65x book value. And since we’re trying to determine the rate of defaults, we can add the CECL reserve back to BV to get an even lower multiple of 0.61x book value (assuming no CECL).

Now very simply put, all BXMT cares about is being able to recover their principal balance. In case of default, they only take a loss if the property has lower value that the outstanding amount of the loan. BXMT reports average origination LTV of 64% for the whole portfolio. For office, this was actually a bit lower at 61%. But here’s the thing, a lot of principal has been paid back on these loans already so today the LTV on their office portfolio stands around 50% (assuming values at origination). This means that if office values got cut in half (let’s say since before Covid), BXMT should still be able to recover their principal amount (of course assuming they can find a buyer).

Thankfully there are many publicly traded office REITs so we can get a pretty good idea of what the market thinks office properties are worth today. Before Covid, I doubt you could get a prime office building in a major city for a 5% cap rate, whereas today highest quality REITs such as Boston Properties (BXP) or Highwoods Properties (HIW) trade at implied cap rates of 8.5-10%. To me, this implies that values have been roughly cut in half. What this means for Blackstone is that even in case of default, they should be able to recover the vast majority of the remaining loan balance. This is true in theory, but obviously the market is frozen now so it would be very difficult to find a buyer if many of their loans default.

The thing is that the current discount to book value justifies a total write-down of all of their 4- and 5-rated office loans. Note management estimated that it equates to a 90%+ write down, but their calculation didn’t add back the CECL reserve. With 4x leverage ($20 Billion in liabilities vs $4.5 Billion in equity) and trading at an adjusted multiple of 0.61x book value means that the market is pricing in default and zero recovery for 9.8% of all loans. And since zero recovery is non-sense, realistically defaults are being priced in closer to 20% of the portfolio. In either case, that implies a total collapse of the office market.

That feels way too pessimistic given what we have seen so far. That’s why I’m going to reiterate my “BUY” rating for BXMT stock here at $17.33 per share. I don’t know if the 14% dividend yield will get cut, but so far, I’ve seen no indication that it will as the coverage ratio has continually increased and BXMT continues to collect on all of their loans. While I would never buy the stock for the dividend alone, I think we have a good opportunity to benefit from mispricing here. It simply feels as though the market is too pessimistic.