OlekStock/iStock via Getty Images

Thesis

Blackstone Mortgage Trust, Inc. (NYSE:BXMT) continues to attract investors with its eye watering dividend payout, 11.8% at the time of this article. Management continues to iterate their belief in maintaining that dividend, drawing attention to the 125% dividend coverage during the first quarter. Even many of the analysis pieces here on Seeking Alpha support buying BXMT. But has management been prudent enough? Is that dividend really safe? These are the questions we will seek to answer.

Overview

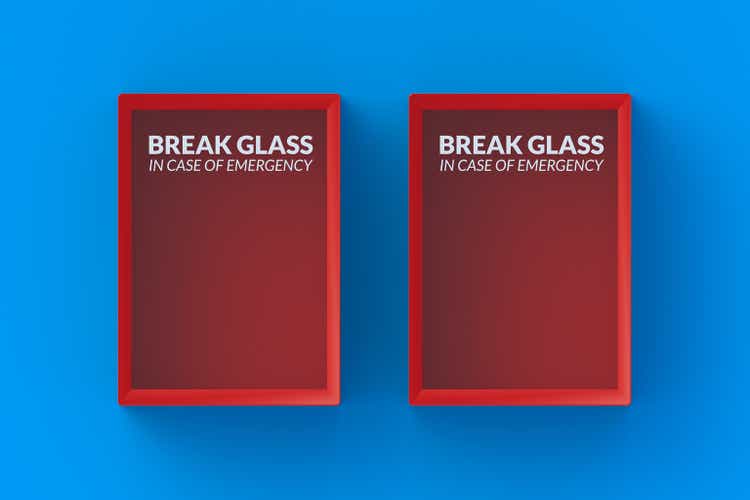

For those looking at BXMT for the first time, BXMT is a real estate company, originating collateralized loans in North America, Europe, and Australia. They manage roughly 25 billion in loans globally spread across a number of property types.

BXMT Presentation

BXMT pays out a quarterly 62 cent dividend that has been flat since 2014. Those seeking dividend growth should already look elsewhere. And unfortunately for existing BXMT the market of rising interest rates has not been kind to investors. BXMT investors have suffered a 25% loss in the last year, despite the high distributions. It continues to trade at a significant discount to book value, 0.8 P/BV which has added further justification for investors to add to their positions.

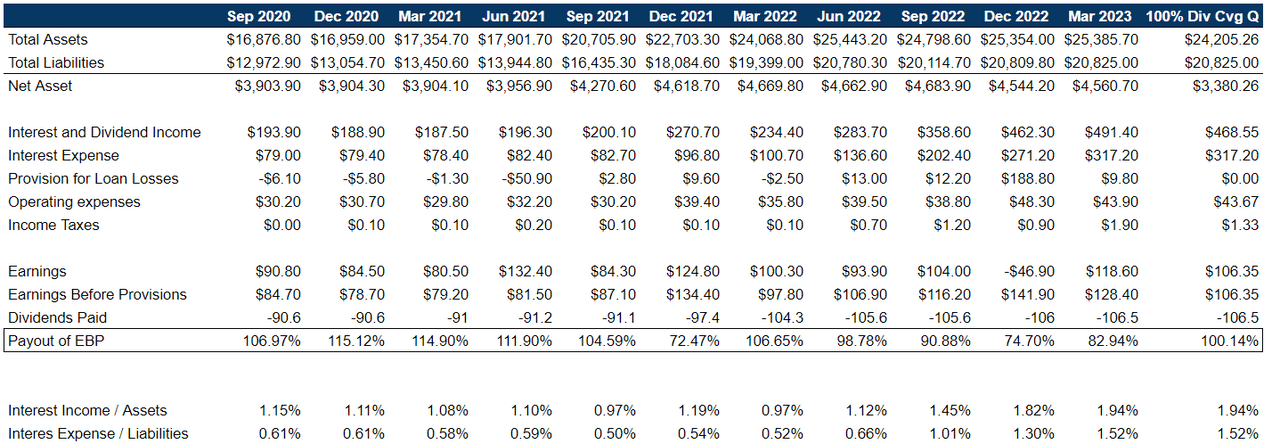

In Q4 22, BXMT management started down the right path and accrued a 189M provision for loan losses, but only 10M in Q1 2023.

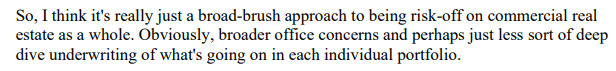

Clearly the market and management are looking through very different lenses as investors as a whole discount the book value of BXMT by 20%. Management attributes the discount to the market not doing their research and just treating all commercial real estate the same.

Katie Keenan – CEO – BXMT Q1’23 Transcript

Portfolio

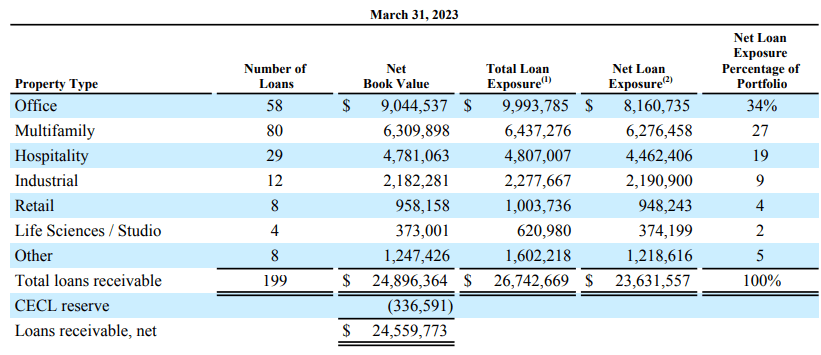

Below is the breakdown of BXMT’s portfolio at the end of Q1. Although they are diversified, the largest exposure remains with arguably the most concerning sub-sector, office.

BXMT

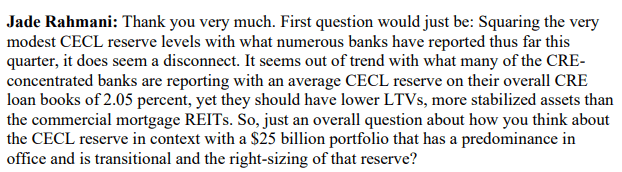

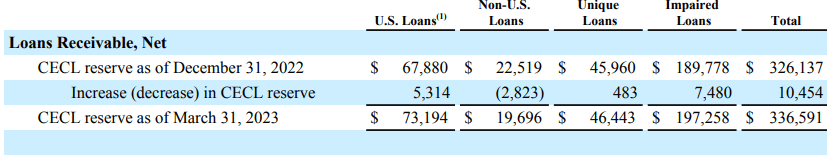

We can define this exposure a bit further by combining the table with other published materials. US Office real estate, according to the Q1 presentation, makes up 25% of their portfolio. This is a significant exposure to an area of real estate that is a constant news headline bait. We should also note the 336M of reserve BXMT has accrued for. This reserve represents 1.35% of their total loan receivable. Is This enough? According to Jade Rahmani of KBW, probably not as they ask management that very same question.

BXMT

Digging further in their Q1 results, we find the breakdown of the provisions. US loans, make up less than a quarter of reserves but as we’ve already shown that the US Office alone represents 25% of their portfolio.

BXMT

Taking Jade’s question one step further and applying it only to the US office exposure, we can point out there is likely a 54.4M gap in their reserve. This is not taking into account any other parts of BXMT’s portfolio, the fact that US office probably deserves an even higher reserve than the average CECL ratio or that the 2.05% is an average for banks with a lower LTV. This gap could likely be much higher, even multiples of the existing reserve.

Author’s Analysis

Commercial Real Estate

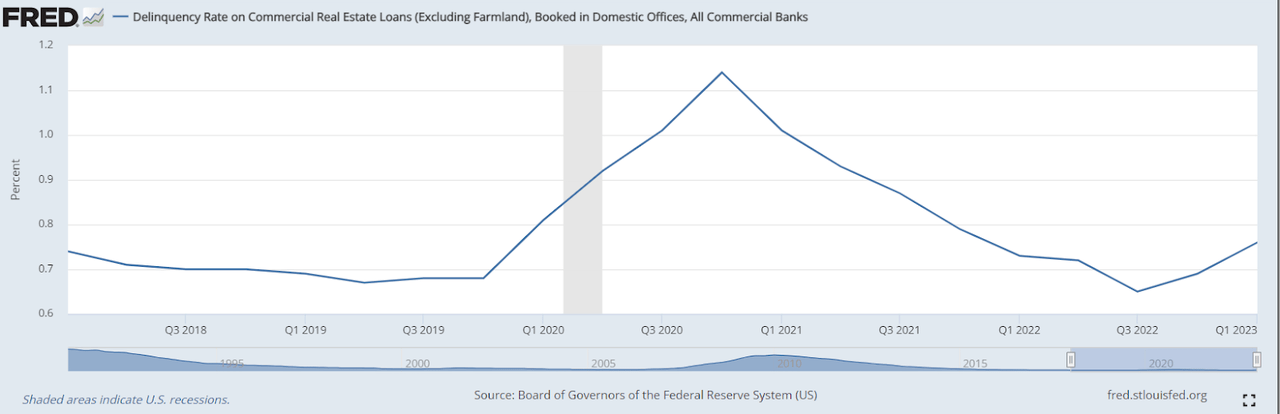

Delinquencies on US commercial loans, as shown in the chart below from FRED, remain relatively muted. Even accounting for the tick up in Q1, they are well below the initial covid levels and tiny when compared to the global financial crisis. Q2 will certainly be a telling data point, but unfortunately for investors it will likely be too late of a warning to react and save portfolios.

FRED

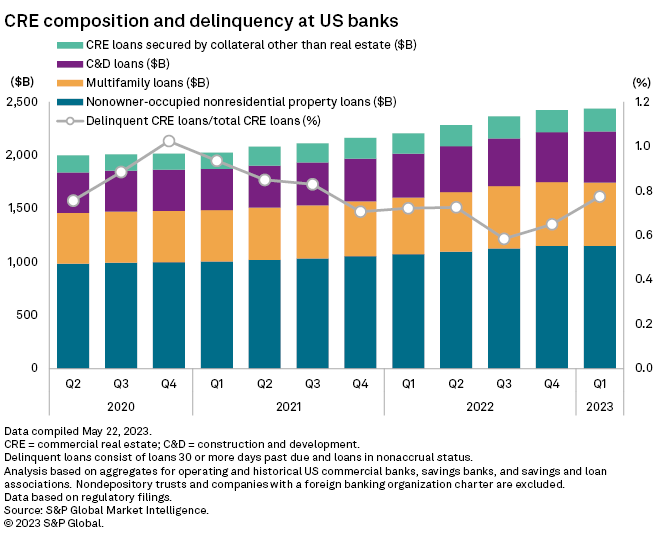

Further data from S&P highlight the increase in delinquencies for CRE.

S&P Global

The data here in both examples is backwards facing, but investors should accept that they are exposing themselves to higher risk even if they disagree with the outcome. In the case of BXMT, it warrants the further question on whether investors are being compensated for this increased risk. Expected returns must more than compensate to make it a worthwhile investment.

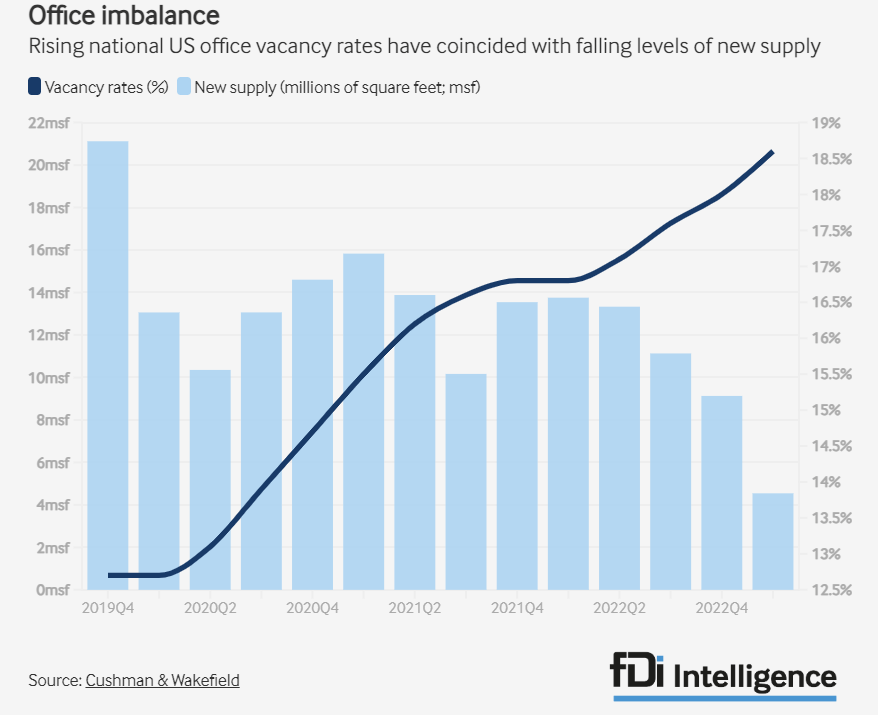

A third data point that precedes delinquencies is the vacancy rate of office real estate. According to Cushman & Wakefield the vacancy rate is hitting recent highs in the US with still more supply coming online. Given that covid is now 3 years deep, we view this as a particularly concerning risk since the time it will take to consume additional supply and reduce the vacancy rate may be longer than lenders can withstand.

Cushman & Wakefield

Although we cannot conclude the BXMT is set to have significant defaults in its portfolio, we can certainly conclude that the portfolio contains a lot of inherent risks. Additionally, we can connect this back to their current reserve balance and conclude that is very likely insufficient given the level of risk and future reserves are prudent.

Stress Test

Ultimately investors in BXMT are likely chasing a dividend yield or at least expect its continued distribution as part of their return. It is therefore important to understand under what conditions a cut would be likely. We will define this condition as when the distribution is no longer supported by earnings before provisions (essentially distributable cash). BXMT does not have any debt maturing until 2026 so we can further simplify the model by assuming no debt repayment.

Approach

-

Assume Q1’23 as starting point

-

Interest expense and income as a % of assets and liabilities continue forward at the same rate of Q1’23. In reality the spread between these two has shrunk over the last few years

-

Operating expenses and taxes are equal to the average of the last 3 quarters.

-

Calculate what level of asset reduction would reduce the payout to 100%, our trigger for the dividend to being no longer sustainable

Author’s Analysis

The level of asset write down is 4.65% or 1.1B, that is the level of asset reduction that provides a coverage ratio of 100%. Not that this is not the same as a 1.1B reserve, as reserved assets can continue to provide income. 1.1B is a lot and in our opinion very unlikely for Q2, however it becomes a lot more possible as that time horizon is extended. As a point of reference, during the peak of the financial crisis delinquencies on CRE loans hit 8.93%.

Additionally it should be noted that in the event of higher defaults, the cost of resolving and supporting recoveries will likely increase as well leading to lower recovery and/or higher operating expenses to support resolutions.

This model, although simple in approach, highlights that very high risk of an extended crisis in CRE. In the event that this situation unfolds, BXMT would likely cut its dividend, have material impairment to its balance sheet and the stock price would react accordingly.

Conclusion

Commercial real estate stands on a precipice in today’s financial markets. On one side there are looming interest rate hikes, climbing vacancies and delinquencies that could be starting to trend upwards. On the other side is the assumption that all of those fundamental issues resolve themselves and we are back to happy times. The skewed distribution of this risk/reward payoff has us recommending investors stay away from BXMT stock. There is no reason to think we are at the bottom of the CRE trough and investors should pursue higher quality names.