Gary Yeowell

Blackstone Mortgage Trust (NYSE:BXMT) is a classic mortgage REIT, which means that its main business is providing loans secured by real estate. This is a fairly simple and predictable business, which allows the companies that operate in the space to payout large dividends, usually at the expense of high payout ratios. When all is well, investors enjoy their above average yield, but when the economy starts to suffer, the fact that these companies retain very little earnings results in a lot of volatility and often the price declines further than what investors receive in dividends. To avoid such high-yield value traps, it’s important to only look at high quality companies.

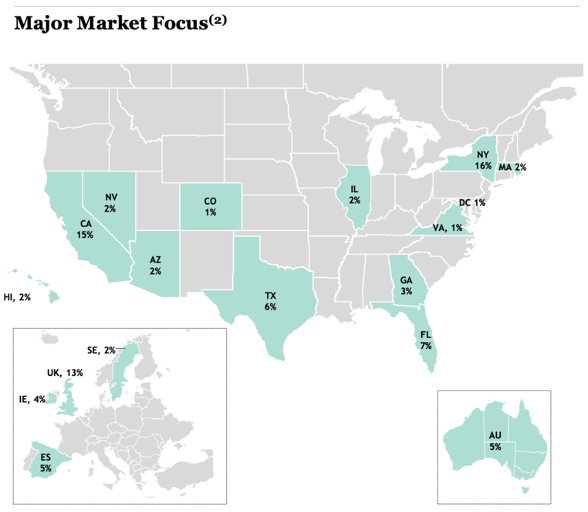

BXMT is one of the most renowned mortgage REITs operated, as the name suggests, by Blackstone (BX). The company owns a portfolio of over 200 loans worth a total of nearly $30 Billion. Their collateral is primarily located in the US (70%), Europe, and Australia. Within the US, they have significant exposure to California (15%) and New York (16%), but also to the faster growing Sunbelt markets (26%) such as Texas and Florida. In terms of assets, the majority (40%) of their loans are secured by office buildings, which has made the REIT quite undesirable at this time as investors worry that commercial real estate is potentially the next shoe to drop. Office is followed by multifamily at 24%, hotels at 18%, and industrial at 8%.

BXMT Investor Presentation

What’s important is that although their office exposure was likely the main factor causing the share price to tumble, these properties are actually in decent shape. BXMT reports that the vast majority of their portfolio consists of loans on newly constructed or substantially renovated buildings. This is huge, because these buildings are likely to be the most resilient to a drop in occupancy, whether due to an economic slowdown or the work from home trend. Moreover, the worst rated properties (4- and 5-rated) only account for under 5% of loans and with 100% collections in 2022, there are no indications of major problems.

As already mentioned, BXMT runs a simple loan business. A high interest rate environment, which we’re in now, essentially acts as a double-edged sword. On one hand, it allows the company to charge higher interest on their loans, but on the other hand, it increases the probability that some borrowers won’t be able to repay their debt and will default, leaving BXMT with the property that served as collateral. Both of these were easily noticeable in the most recent Q1 2023 results.

In the most recent quarter, the company reported a very solid 27% annual increase in earnings, as EPS reached $0.79 (up from $0.62 in Q1 2022). These earnings were some 27% above the declared quarterly dividend, which stood at $0.62 per share. So we have a fairly well covered dividend, that yields almost 15% in annual terms. I don’t know about you, but that’s all I need. No further price appreciation is needed to make this a good investment. But of course, it’s not as easy as just buying and hoping for the best. Let’s see if the dividend is actually sustainable and if the price could fall further, decreasing our total return.

For a company like BXMT, it’s important to look at their CECL reserve, which is the amount of money they set aside for loan defaults. The company almost tripled their CECL in Q4 2022. This last quarter, the increase was rather modest, at just 3% QoQ. This shows that the situation has likely stabilized and management doesn’t see a wave of defaults coming. It’s quite reaffirming because with such strong earnings in Q1, they could have easily put aside some of that money for a rainy day, but they didn’t.

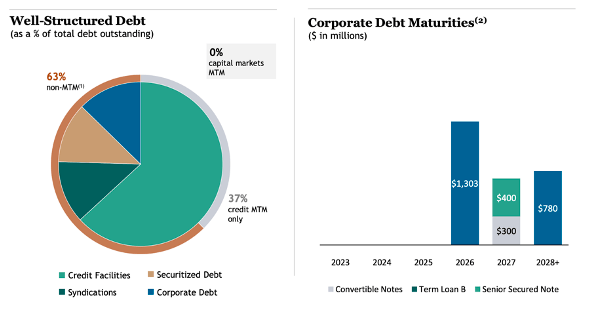

With regards to their debt, there is a lot to like, with abundant liquidity and no debt maturities before 2026. So the main risk worth considering is loan default risk. So far, things are going according to plan with near perfect loan collections, but what if some of the more distressed assets don’t perform and the REIT ends up with the properties that were used as collateral? In that case, it will have acquired properties for a price equal to the remaining loan. With an average LTV of 64%, that gives us a 36% margin of safety compared to the underwriting valuation. For multifamily, and arguably even hotels, that’s a wide enough margin of safety, but given what’s happening in the office market, I’d argue that in case of default, BXMT would probably overpay for some of its properties and there’s no doubt that if defaults pick up, the share price will very likely continue falling faster than dividends are paid out resulting in negative total returns. Still, it’s worth noting that even in case of default, some value will be received from the collateral, so the loan balance won’t be completely wiped out.

BXMT Investor Presentation

Still, there’s a price at which I think BXMT can be a good buy. Arguably the best metric to value a mortgage REIT is price to book value. In particular, we’re looking for a large enough discount to book value to justify the increased risk of default. Currently, the stock trades at 0.65x book value, so essentially the market is pricing in defaults of up to 35% of the loans. Let’s expand on the previous argument that some value will be recouped from the collateral in case of default. So in case an office building defaults, BXMT gets the collateral worth 64% of the underwriting value. Assuming that office values have been cut in third since underwriting, BXMT will report a 50% loss on that loan when they try to sell the building, since they’ll only be able to sell the property for 32% of the underwriting value. Still, this is better than a 100% loss. So going back to P/BV, the market is actually pricing in defaults for 70% of the loans (assuming a 50% recovery rate). I’m not particularly bullish on commercial real estate, but that seems excessive. What this tells me is that the market has likely overreacted and while I recognize that the volatility is likely not over and the almost 15% dividend is not sustainable, I am ready to issue a BUY rating here for BXMT simply because the implied rate of defaults is way too high in my opinion.