JuSun

The strong market performance over the past couple of weeks has been nothing short of surprising. However, it’s important to keep in mind that it’s led by just a handful of 5-10 stocks that have outsized influence due to their market capitalizations.

At the same time, many stocks remain in deep bargain territory with high yields if an investor is willing to go against the grain. This brings me to Blackstone Mortgage Trust (NYSE:BXMT), which I last covered here in February, highlighting its robust origination activity. In this article, I provide an update on the stock and discuss why it’s a bargain for value investors at present.

Why BXMT?

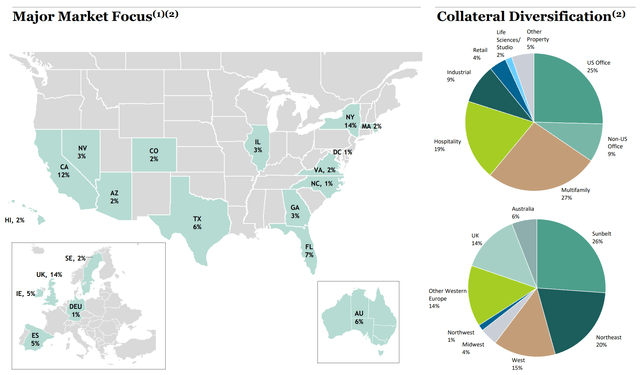

Blackstone Mortgage Trust is a big player in the commercial mortgage REIT space, with a portfolio that spans across North America, Europe, and Australia. It’s externally advised by private equity giant, Blackstone (BX), which runs a number of private real estate funds itself, thereby enabling insights into the commercial real estate market.

At present, BXMT carries a sizable investment portfolio of 199 senior loans worth $26.7 billion secured by institutional quality real estate. The portfolio carries a weighted average loan-to-value ratio of 64%, which means that borrowers have significant skin in the game.

Office properties have made plenty of negative headlines over the past several months with respect to concerns around occupancy and remote work. However, it’s important to keep in mind that office represents just 34% of BXMT’s asset base, with the more stable and growing multifamily, hospitality, and industrial segments being its other loan collateral asset classes, as shown below.

Investor Presentation

Meanwhile, BXMT has no defaults in its loan portfolio, and is generating strong earnings due to higher interest rates. This is reflected by distributable EPS growing by 27% YoY to $0.79, resulting in strong dividend coverage of 127%.

Notably, the strong earnings performance occurred in spite of management preparing for potential turbulence in the market by raising the CECL by a modest amount again on a sequential QoQ basis. Over the past year, BXMT has taken the CECL reserve by 2.7x over the level from last year’s level, and has $1.6 billion in liquidity to help buffer against near-term challenges.

Risks to BXMT include higher leverage than peers Starwood Property Trust (STWD) and Ladder Capital (LADR) with a debt to equity ratio of 3.5x, down slightly from 3.6x at the end of last year. It’s worth noting, however, that BXMT has no debt maturities until 2026, and that its balance sheet debt is match-funded with its loan investments.

Also office real estate continues to be challenged around occupancy. However, I believe the market will eventually turn the corner, as many companies, most notably of which is Meta Platforms (META) have reversed their policies around permanent remote work in favor of employees being in the office at least 3 days a week starting in September this year.

It doesn’t really make a difference whether an employee comes in for all five weekdays or just 3, because the same amount of cubicle/office space will need to be set aside for that employee in either case. As such BXMT should be able to weather near-term challenges around office properties in a similar fashion compared to hospitality properties during 2020-2021, when that asset class was marked for risk due to travel restrictions. Management also emphasized the value of its positioning as a lender with respect to principal, as noted during the recent conference call:

Being a lender is distinct from being an equity owner. Today the divergence is particularly meaningful and the economic experience along the way. As a floating-rate lender, our cash flows are growing and the interest we collect on each loan, each payment date derisks our return and that of our investors with every passing quarter. This is the power of current income, a critical differentiator for any business in a volatile period.

And in addition to the significant cash flow generation of our portfolio, as a senior lender, we start with a 36 point margin of safety. Credit enhancement that ensures value declines are first absorbed by the equity before we feel any impact on our recovery. Put in a different way, if the value of an asset is down 10%, 20%, or even 30%, the expected outcome is the same, full recovery of our loan.

Lastly, BXMT currently sits in deep value territory at the current price of $20.06, which translates to a price to book value of just 0.76x. Notably, book value per share actually rose by $0.02 since the end of 2022. Investors could see potentially strong returns even if BXMT trades at a still modest 0.85x P/Book valuation, which I believe to be reasonable.

Investor Takeaway

Blackstone Mortgage is weathering through the current environment with strong earnings growth. While risks are elevated in the office property space at present, I believe it could manage through these challenges as it had in the past, especially with its lender protections, and the market could eventually turn the corner. Admittedly, BXMT isn’t a sleep well at night stock due to its leverage, however, investors are well compensated for taking on the risks for a turnaround with a well-covered 12.4% yield and a substantial discount to book value.