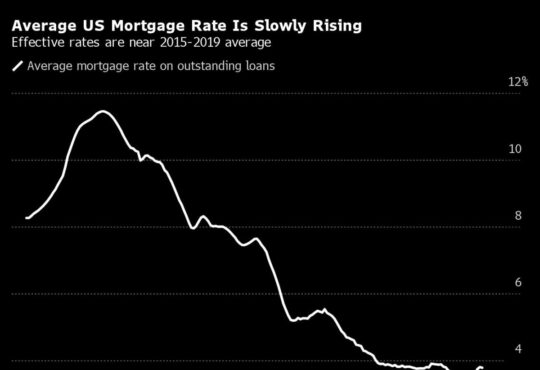

Better.com, the digital mortgage lender in the news earlier this year when its CEO fired roughly 900 workers via Zoom, picked a bad time to go public. “Shares of the Softbank-backed company plunged 93% as it began trading as BETR on the Nasdaq Thursday, falling more than $16 per share to $1.19 by mid-day,” reports Fast Company. It went public via a merger with special purpose acquisition company (SPAC) Aurora Acquisition Corp. Before its merger with BETR, Aurora had a 52-week high of $62.91. From the report: The disastrous public launch comes two years after the company initially filed to go public, but it (and the real estate market) has faced a number of challenges in the time since. The outlook for homebuying is bleak, to put it mildly, for the near- to mid-term future. Mortgage rates are at their highest point since 2000 — hitting 7.31% last week — and showing no signs of a turnaround. Because the majority of American homeowners have mortgages at or well below 5%, they’re reticent to put their homes on the market, which creates a supply shortage, even for those who are willing to accept the high rates. But Better’s own history could be working against it, as well.

The company came under fire in December 2021 for laying off 900 employees via Zoom. (Some didn’t know they’d been affected until they learned they were locked out of company accounts.) A few months later, it cut another 3,000 workers. One month after, that it slashed another 1,000 jobs. Eventually, the company cut 91% of its workforce over an 18-month period. That wasn’t the end of the problems, though. In a leaked video of a town hall meeting following the first round of layoffs, CEO Vishal Garg was shown vacillating on the reasons, blaming everything from marketplace forces to the recently-canned employees’ performance.

.jpg)