Throughout the decade thus far, the U.S. economy has been defined by a series of shortages, which has affected virtually everything consumers could put in their baskets. From Grape Nuts cereal to personal shelter, shoppers either needed to compromise or find a substitute until supplies returned.

Most of those shortages are behind us now. Even our nation’s car dealer lots now have a healthy inventory for would-be drivers to choose from. However, one item remains in short supply: housing.

As part of Experian’s review of consumer credit and debt trends in 2023, we take a look at what to watch for as both the supply and demand of homes begin to creep back up.

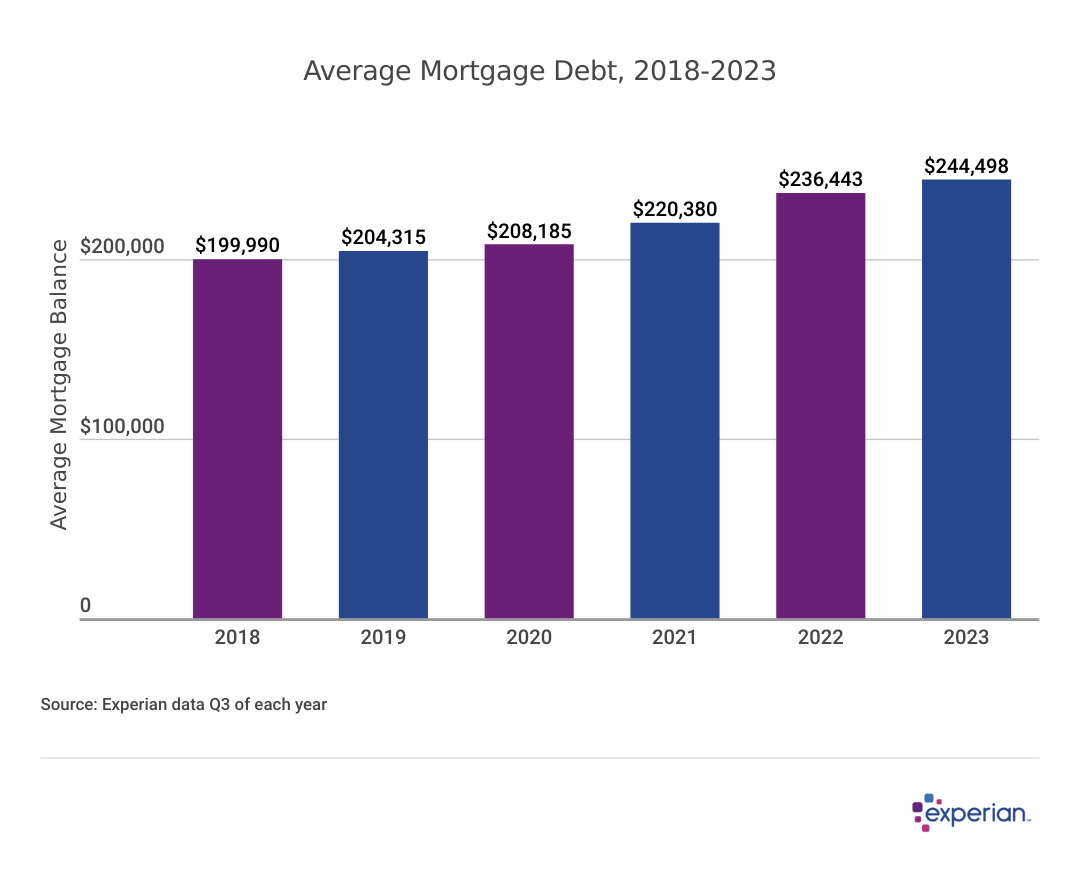

Total mortgage balance up slightly in 2023

One of the better pieces of news, at least from a would-be homebuyer’s perspective, is that home prices increased only modestly in 2023—up 5.5% annually through September 2023, according to the Federal Housing Finance Agency (FHFA). (For comparison’s sake, home prices increased by 18% in 2021.) As a result, the collective amount of mortgage debt assumed rose only slightly, up 3.2% from the third quarter (Q3) of 2022 to Q3 2023.

However, housing supply is still pretty bare. Years of under-building new housing in the U.S. throughout the 2010s led to an acute shortage that was only made worse by the many dislocations caused by the pandemic. In 2020 and the years that followed, existing housing inventory was snapped up by buyers when mortgage rates were at historical lows—bottoming out at 2.65% for a 30-year fixed rate mortgage in January 2021.

Now, mortgage rates are higher—close to 7%. While that rate may seem high for younger consumers, it’s more or less in line with the long-term historical average for 30-year mortgages. Nonetheless, higher rates receive much of the blame for making homes seemingly unaffordable.

But higher-rate mortgages are far from the primary cause of higher mortgage costs. Although new construction of residential homes is picking up, the costs of building—construction worker wages, supplies and properly zoned land—have also increased. Additionally, there is less construction of the smaller and more affordable “starter homes” typically geared toward first-time homebuyers. Instead, footprints above 2,400 square feet are now the norm, according to U.S. Census Bureau data.

Another factor working against buyers, either first-time or otherwise: A smaller share of homes are purchased using a mortgage, with all-cash deals comprising more than a quarter of all home sales. These cash sales are often made either to investors, who intend to rent the house to tenants, or to existing homeowners trading down (or even perhaps up, if they profit from their home sale).

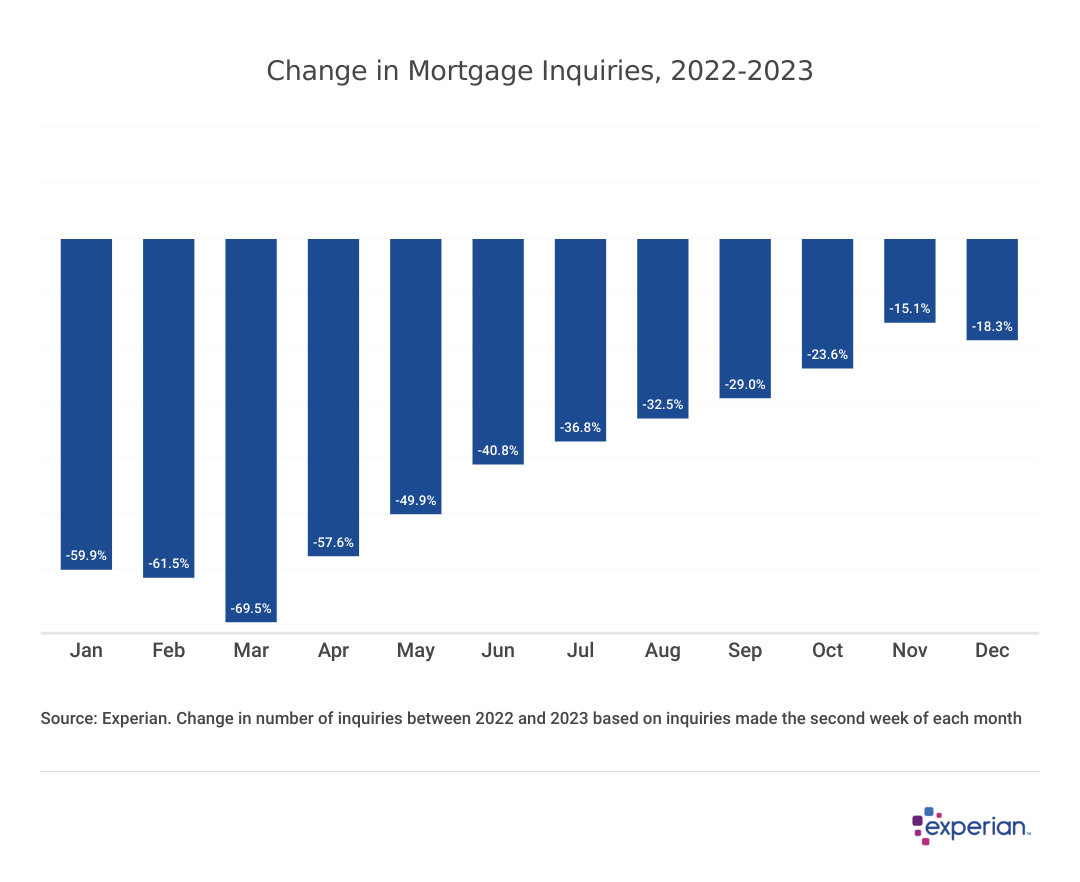

Mortgage inquiries decline as mortgage rates increase in 2023

Market factors are seemingly discouraging home shoppers, as evidenced by Experian data that tracks credit inquiries associated with mortgage loans. The number of mortgage inquiries is down from 2022 levels, marking the second consecutive year inquiries decreased every single month of the calendar year.

Average mortgage balances increase $8,000, half as much as in 2022

Despite the low volume of home sales and mortgages in 2023, the increase in average mortgage debt to $244,498 was slower than observed in prior years. The slowing was reflective of other factors observed in the housing market. Home prices nationwide only increased by 5.5% annually through Q3 2023, according to the FHFA, down from the 12% increase from 2021 to 2022. Also, the total number of mortgages, both new and existing, remained virtually unchanged from 2022 as the small number of mortgages that were created in 2023 were balanced by as many paid-off mortgages.

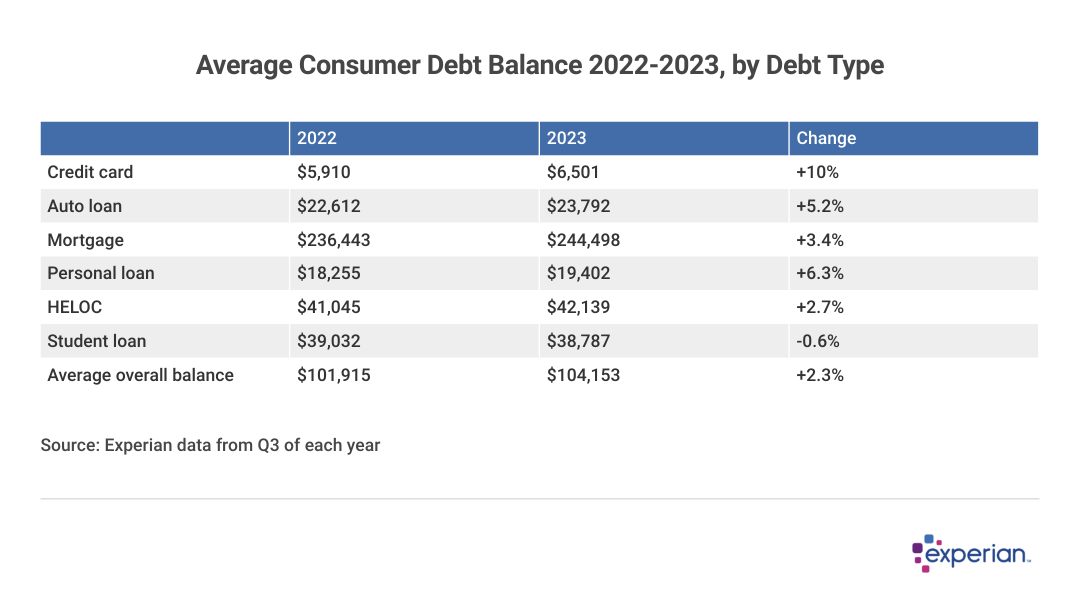

Mortgage balances growing more slowly than credit cards, personal loans

Average mortgage balances increased more gradually than most types of other consumer debt: Credit card spending rebounded after the initial disruptions caused by the pandemic, auto loan balances jumped along with car prices and personal loan balances increased as more qualified borrowers refinanced their growing higher-interest debts. Comparatively, mortgages haven’t joined the rebound party.

As of September 2023, the average rate on a fixed 30-year mortgage was at 7.31%, a 0.61 percentage point increase from September 2022. The move was less pronounced in mortgage rates than with credit cards and auto loans. Average car loan rates increased by more than 2 percentage points, to 7.88%. And average credit card APRs increased more than 6 percentage points to nearly 23%.

Average credit scores among homeowners—while higher than average scores overall—may have plateaued, as mortgage holders sported an average FICO Score of 758 in 2023, a one-point increase from the year before.

Demographics of homeowners skew older than the population at large. And while a consumer’s age does not directly impact their credit scores, the length of their credit history and their payment history do. In addition, having a mortgage can improve an individual’s credit mix, which could help improve a borrower’s FICO Score.

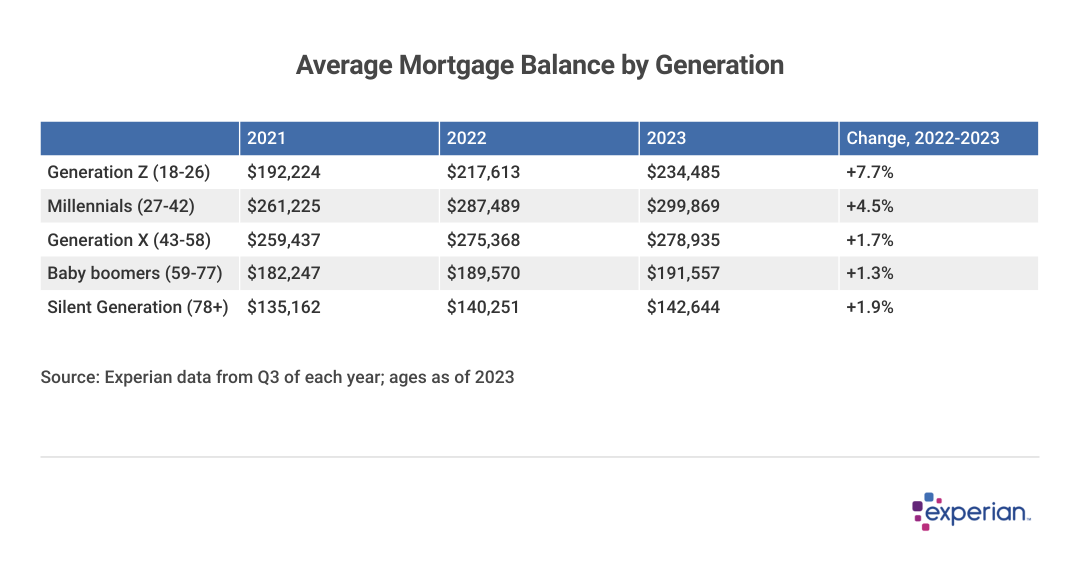

Millennials carry highest average mortgage balance at nearly $300,000

Millennials continue to face hurdles on their way to homeownership. Even those who managed to find and finance a new home are paying more for the privilege than older generations. With an average mortgage balance just shy of $300,000, millennials owe 50% more on their mortgage than baby boomers with mortgages.

Older homeowners, on the other hand, saw very little increase in average mortgage balances. Many who may have otherwise traded down their perhaps empty-nest three-bedroom are staying put—and keeping their lower monthly mortgage payments. Despite the famed lock-in effect, some buying and selling still takes place. Some homeowners trading into a new higher-priced mortgage contributed to an increase in the average balance among older generations.

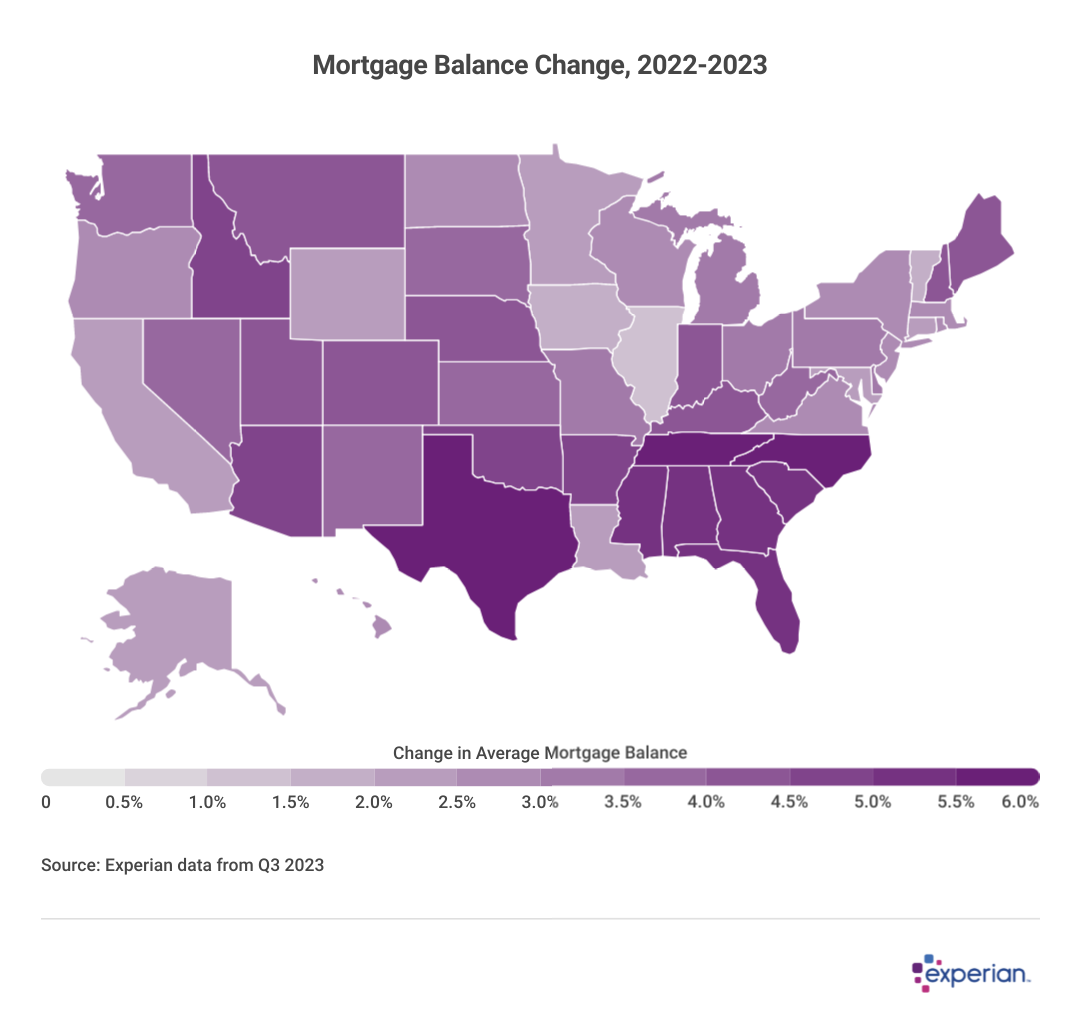

Mortgage debt increases in all states

Mortgage balances increased the most in Southern states in 2023, a change from prior years, when most Western states saw significant climbs in their average balances. Mortgage debt in California, which has the highest average mortgage balance of any state by far (well north of $400,000), didn’t grow quite as much as in neighboring states on a percentage basis. This could, however, be evidence of a common belief: that ex-Californians are driving up home prices in the neighboring states they’ve migrated to.

North Carolina, Tennessee and Texas saw average mortgage balances increase by more than 6%, while Alabama, Florida, Georgia, Mississippi and South Carolina grew average mortgage balances more than 5%.

A primary reason for the Southern bump in 2023 was due in part to new home construction. With many homeowners staying put until mortgage rates decrease and/or there are more houses to choose from, new construction is taking the spotlight. And Southern states typically have less stringent zoning ordinances than the rest of the nation, meaning that residential construction starts are easier to complete in quantity there. And while new mortgages aren’t anyone’s idea of a bargain in 2023, at least homes are available to finance in the South, versus housing starts in the rest of the United States.

Outlook for mortgage borrowers in 2024

The housing market, even in ordinary economic times, is slow to move. Many prospective, and now impatient, homebuyers are beginning to ask not only when but if the housing market will ever become more accessible. Some good news: At least we can dispense with the “if,” according to Susan Allen, senior vice president of Experian Mortgage.

“The one constant is change, and we know that economic cycles always cycle between buyer’s and seller’s markets,” Allen says. “We may not know when, but the industry consensus is that the historical low levels of affordability are unsustainable.”

The when, however, is still a question mark. Many market observers are looking to mortgage rates for the entire answer: As soon as rates decline, the thinking goes, the housing market will thaw as quickly as it froze beginning in 2022. But Allen suggests prospective homebuyers don’t necessarily need to wait for rates to decline first. Rather than focus solely on mortgage APR, important as it may be, homeowners may want to place more weight on whether or not the purchase is affordable.

“The issue of affordability is not limited to interest rates. Interest rates in the 6% to 7% range are not historically high,” Allen says. “In fact, interest rates were greater than 7% for most of the ’70s, ’80s and ’90s, and plenty of people became first-time homebuyers during those three decades.”

Although this and other research unavoidably speaks in terms of averages, Allen reminds us that homebuying is (at least for non-investors) a personal choice: “Homebuying is 100% about whether it’s a good time for you. Consumers with solid credit, stable employment, a reasonable down payment, sufficient income to afford the monthly cost, and who stay put for at least seven to eight years, have historically done very well improving their wealth through homeownership.”

This story was produced by Experian and reviewed and distributed by Stacker Media.