Image source: Getty Images

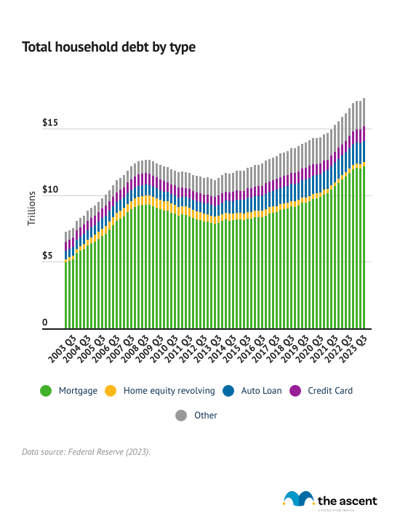

American households carry a total of $17.29 trillion in debt as of the third quarter of 2023, and the average household debt is $103,358 as of the second quarter of 2023.

How is that debt split between mortgages, auto loans, credit cards, and other types of loans?

The answers to questions like these can give us insight into the financial state of the average American household. The Motley Fool Ascent pulled together as much data as we could find on Americans’ average household debt in 2023 to provide an overview into the debt Americans carry.

Keep reading for more detailed statistics on each type of debt, including comparisons of average debt over time and breakdowns by race, age, and more.

Key findings

| FIGURE | AMOUNT |

|---|---|

| Total household debt, Q3 2023 | $17.29 trillion |

| Average household debt, Q2 2023 | $103,358 |

| Total credit card debt, Q3 2023 | $1.08 trillion |

| Average credit card debt, Q2 2023 | $6,365 |

| Total mortgage debt, Q3 2023 | $12.14 trillion |

| Average mortgage debt, Q2 2023 | $241,815 |

| Average mortgage payment, 2021 | $1,427 |

| Total home equity revolving debt, Q3 2023 | $350 billion |

| Average HELOC value, 2022 | $41,045 |

| Total auto loan debt, Q3 2023 | $1.6 trillion |

| Average auto loan debt, Q2 2023 | $23,479 |

| Average monthly new car payment, Q2 2023 | $729 |

| Average monthly used car payment, Q2 2023 | $528 |

| Average personal loan debt, September 2023 | $11,850 |

Data source: Experian, Federal Reserve, TransUnion, U.S. Census Bureau (2023). Editor’s note: This table includes the most up to date information for each category. Some data is not available on a quarterly or annual basis.

Inflation, supply chain issues, and Americans’ finances in 2023

The economy has roared back from the COVID-19 pandemic, bringing with it supply chain issues and inflation that have stressed Americans’ wallets.

Throughout 2022, inflation reached levels not seen since the late 1970s, adding to the cost of goods already pushed higher by global supply chains snarled by shortages and the ongoing COVID-19 pandemic.

While inflation cooled in 2023, average debt is up in nearly every category compared to 2020. This includes total household debt, credit card debt, mortgage debt, and auto loan debt. Total debt is up by over $2.5 trillion since 2020.

The percentage of personal loans and auto loans in hardship are also above 2020 levels.

Average consumer household debt in 2023

| DEBT TYPE | Total, Q3 2023 unless otherwise specified |

|---|---|

| Total consumer debt (including types not listed below) | $17.29 trillion |

| Average household debt, Q2 2023 | $103,358 |

| Total mortgage debt | $12.14 trillion |

| Total revolving home equity debt | $350 billion |

| Total auto loan debt | $1.6 trillion |

| Total credit card debt | $1.08 trillion |

Data source: Federal Reserve Bank of New York (2023), Experian (2023).

The New York Fed’s quarterly Household Debt and Credit Survey (HHDC) shows that total consumer debt stands at $17.29 trillion as of the third quarter of 2023. That’s a record high.

According to Experian, average total consumer household debt in 2023 is $103,358. That’s up 11% from 2020, when average total consumer debt was $92,727.

Average American debt payments in 2023: 9.8% of income

The Federal Reserve tracks the nation’s household debt payments as a percentage of disposable income. The most recent debt payment-to-income ratio, from the second quarter of 2023, is 9.8%.

That means the average American spends nearly 10% of their monthly income on debt payments. Despite debt increasing overall, Americans are still spending less of their income on debt than in most of the 2000s.

Average credit card debt in 2023

| FIGURE | AMOUNT |

|---|---|

| Total credit card debt, Q3 2023 | $1.079 trillion |

| Average credit card debt, Q2 2023 | $6,365 |

| Average store card balance, Q3 2022 | $1,110 |

| New credit card delinquencies (90 days or more), Q3 2023 | 5.78% |

Data source: Experian (2023), Federal Reserve (2023).

According to the latest Household Debt and Credit survey results from the Fed, Americans owe $1.1 trillion in credit card debt as of the third quarter of 2023. That’s a record high, up from $1 trillion in the second quarter of 2023.

This could be because Americans are relying more on their credit cards due to inflation.

So what does that mean for individual credit card holders?

According to Experian, Americans had an average of $6,365 in credit card debt in the second quarter of 2023. Americans carry less debt on store credit cards, with an average of $1,110 in 2022, per Experian.

Average revolving credit card balance: $6,365

A revolving credit card balance is one that persists between payments — in other words, it’s what people pay interest on. It’s one of the most important figures when looking at credit card debt.

The average credit card balance is $6,365 as of the second quarter of 2023, per Experian. That’s up from $5,699 in 2022.

Gen X carries the highest average credit card balance, $8,870, while Gen Z carries the lowest average credit card balance, with $3,184.

Credit card balance by generation

| Generation | 2022 | 2023 |

|---|---|---|

| Generation Z (18-25) | $2,692 | $3,148 |

| Millennials (26-41) | $5,309 | $6,274 |

| Generation X (42-57) | $7,781 | $8,870 |

| Baby boomers (58-76) | $6,134 | $6,601 |

| Silent Generation (77+) | $3,305 | $3,434 |

Data source: Experian (2023). Data is from the second quarter of 2022 and 2023.

Delinquent credit card payments: 2.77%

Americans remained surprisingly steady in paying their credit card bills on time. In the second quarter of 2023, the delinquency rate (at least 30 days past due) of credit card loans from commercial banks was 2.77%, according to the Federal Reserve. That’s up from 2.43% in the previous quarter.

After hitting a record low in the third quarter of 2021, the delinquency rate of credit card loans from commercial banks has slowly increased, although it remains well below levels over the past 30 years.

In the third quarter of 2023, 5.78% of existing, non-seriously delinquent credit card debt became delinquent by 90 days or more, which is referred to as “serious” delinquency. That’s a significant jump from 5.08% in the previous quarter and 3.69% in the third quarter of 2022.

Millennials, low-income borrowers, and to a lesser extent Gen Z, were most responsible for the spike in serious delinquencies due to expensive auto payments and other loans coming due.

Average mortgage and HELOC debt in 2023

| FIGURE | AMOUNT |

|---|---|

| Total mortgage debt, Q3 2023 | $12.140 trillion |

| Average mortgage debt, Q2 2023 | $241,815 |

| Average (mean) mortgage payment, 2021 | $1,427 |

| Average (median) mortgage payment, 2021 | $1,001 |

| Average mortgage rate, Q3 2023 (30-year fixed) | 7.04% |

| Total home equity revolving debt, Q3 2023 | $349 billion |

| Average HELOC value, 2022 | $41,045 |

Data source: Experian (2023), Federal Reserve (2023), Freddie Mac (2023).

Mortgage debt makes up 70% of American consumer debt. That number has risen consistently since mid-2013 and has recently accelerated as home prices hit record levels.

How much mortgage debt does the average American have? The average mortgage debt among Americans is $241,815, per Experian’s 2023 State of Credit Report.

That’s up from the average mortgage debt reported by Experian in 2022: $232,545.

Average mortgage rate in 2023: 7.04%

The average 30-year fixed mortgage rate for the third quarter of 2023 is 7.04%, up from 6.51% in the first quarter.

Mortgage rates have been rising since 2022 after hitting lows in 2020 and 2021.

Average mortgage payment: $1,427

According to the U.S. Census Bureau’s American Housing Survey, the average (mean) mortgage payment in 2021 was $1,427, while the median was $1,001.

Average HELOC amount: $41,045

Based on data from Experian, the average value of a home equity line of credit in 2022 was $41,045.

Average auto loan debt in 2023

| FIGURE | AMOUNT |

|---|---|

| Total auto loan debt, Q3 2023 | $1.60 trillion |

| Average auto loan debt, Q2 2023 | $23,479 |

| Average monthly new car payment, Q2 2023 | $729 |

| Average monthly used car payment, Q2 2023 | $528 |

Data source: Experian (2023), Federal Reserve (2023).

Auto loan debt has been creeping up over the past several years and hit $1.60 trillion in the second quarter of 2023.

The average auto loan debt is $23,479 as of the second quarter of 2023.

Average new car payment: $729

The average monthly payment on a loan for a new car was $729 in the second quarter of 2023, according to Experian. Monthly payments on loans for new cars, by credit score, are as follows for the second quarter of 2023:

- Deep subprime (300-500): $744

- Subprime (501-600): $767

- Nonprime (601-660): $769

- Prime (661-780): $736

- Super prime (781-850): $694

- All: $729

Average used car payment: $528

The average monthly payment on a loan for a used car was $528 in the second quarter of 2023, according to Experian. Monthly payments on loans for used cars, by credit score, are as follows for the second quarter of 2023:

- Deep subprime (300-500): $523

- Subprime (501-600): $543

- Nonprime (601-660): $542

- Prime (661-780): $523

- Super prime (781-850): $508

- All: $528

Auto loans in hardship in 2023: 4.03%

According to TransUnion, 4.03 % of auto loans were in hardship in September 2023, up from 3.63% the previous year.

TransUnion says that a loan is in hardship if the borrower has a deferred payment, forbearance program, frozen account, or frozen past-due payment.

Rising vehicle prices and overall inflation may be responsible for a higher percentage of auto loans being in hardship compared to previous years.

Average personal loan debt in 2023: $11,850

| FIGURE | AMOUNT | Previous year |

|---|---|---|

| Average unsecured personal loan amount, July 2023 | $7,462 | $7,543 |

| Average unsecured personal loan balance per consumer, September 2023 | $11,850 | $10,877 |

| Average finance rate on 24-month personal loans from commercial banks, August 2023 | 12.17% | 10.16% |

| Personal loans in hardship, September 2023 | 3.30% | 3.50% |

Data source: Federal Reserve (2023), TransUnion (2023).

Personal loans are versatile financial products. They can be used for a variety of financial needs, including weddings, renovations, vacations, or debt consolidation.

According to TransUnion, the average unsecured personal loan amount in July 2023 was $7,462, down from $7,543 in July 2022.

The average balance per consumer as of September 2023, however, is $11,850, indicating that many people who have one unsecured personal loan have at least one more. That’s higher than the level recorded per consumer in September 2022, which was $10,877.

Average personal loan interest rate in 2023: 12.17%

The St. Louis Federal Reserve tracks the average unsecured personal loan interest rate. In August 2023, the average interest rate for a 24-month personal loan was 12.17%, the highest since November 2007.

Personal loans in hardship in 2023: 3.3%

In September 2023, 3.3% of unsecured personal loans were in hardship. That’s down from September 2022, when 3.5% of unsecured personal loans were in hardship, according to TransUnion.

TransUnion says that a loan is in hardship if the borrower has a deferred payment, forbearance program, frozen account, or frozen past-due payment.

American medical debt

Medical debt can be difficult to track. However, it’s clear that it’s a growing problem.

According to The Urban Institute, 13% of Americans — over 43 million people — had medical debt in collections in 2022. That number is higher in communities of color, at 15%.

Some states have significantly higher numbers, too. For example, 24% of West Virginians have medical debt in collections.

The median debt also varies quite a bit. In the United States overall, the median medical debt in collections is $703. In Wyoming, Utah, Wisconsin, and Florida, that number is over $900.

While statistics are scarce, it seems likely that rising healthcare costs — especially during a global pandemic — have pushed these numbers higher in recent years.

Bankruptcy, delinquencies, charge-offs, and foreclosures

When Americans can’t handle their debts, we see foreclosures, bankruptcies, delinquencies, and charge-offs. When those numbers go up, it’s clear that Americans’ personal finances are in trouble.

So what happened this year?

Personal bankruptcy statistics

According to the American Bankruptcy Institute’s most recent release, there were 89,224 declarations of bankruptcy in the United States by the end of March 2022.

Interestingly, that’s 17% less than the number we saw at the same point in 2021.

Personal bankruptcies by state

Here are the 2022 bankruptcy filings through March per capita of all 50 states and D.C. The total number of year-to-date (YTD) personal bankruptcy filings per capita in the country as a whole is 1.38.

Charge-off and delinquency rates on consumer loans in 2023: 2.36%

The Federal Reserve Board collects statistics on charge-offs and delinquencies by loan type. Here’s how they’ve changed since 2010:

Charge-offs and delinquencies for consumer loans, credit cards, and real estate loans were up in the first quarter of 2023 compared to the previous quarter.

The delinquency and charge-off rate for consumer loans (which includes credit cards) was 2.36% in the second quarter of 2023, while the overall rate, which includes real estate and commercial loans, was 1.26%.

Foreclosures in 2023

There were 37,679 foreclosures in September 2023, according to ATTOM. That’s up 18% from September 2022.

Average buy now, pay later monthly payment

The average monthly buy now, pay later (BNPL) payment made in 2023 is between $1 and $100, according to a survey from The Ascent, a Motley Fool service.

| Average total monthly BNPL payment | Percentage of respondents |

|---|---|

| $50 or less | 25% |

| $51 to $100 | 26% |

| $101 to $250 | 21% |

| $251 to $500 | 15% |

| $501 to $1,000 | 8% |

| Over $1,000 | 4% |

Data source: The Ascent (2022).

Using buy now, pay later financing is akin to taking out a loan. While most BNPL providers say they don’t charge interest, some do, and late fees can be steep while negatively impacting your credit score. And unlike using a credit card, making BNPL payments on time doesn’t boost your credit score.

Fifty percent of Americans surveyed have used BNPL and, worryingly, a third of those users have made a late payment or incurred a late fee.

The popularity of buy now, pay later took off between 2020 and 2021, but has since declined.

Americans are using buy now, pay later to finance a range of purchases. Forty-six percent of respondents surveyed say they’ve used BNPL to buy electronics and another 46% say they’ve financed clothing and fashion buys with BNPL. Nineteen percent used BNPL to pay for groceries.

Paying off debt

It may seem like Americans are swimming in too much debt to get out of, but there are ways to pay off debt.

The first step towards paying off debt is understanding the total amount of debt you have. From there you can determine what type of debt you hold, like credit card debt, a mortgage, or auto loan. Then it is important to note how much you owe, what the interest rate is, and what the minimum payment amount is for each type of debt you own.

With that information, you should be able to figure out how you can fit paying off debt into your personal budget. Our debt snowball calculator can help you organize your debts and explore repayment options.

Debt payoff apps can help you keep track of all those numbers, plus offer useful budgeting features like debt calculators and expense tracking.