By Helena Kelly Consumer Reporter For Dailymail.Com

17:29 15 Jul 2023, updated 17:37 15 Jul 2023

- America is becoming a nation of ‘accidental landlords,’ realtors say

- Soaring mortgage rates have left owners wanting to cling onto their cheap deals – so they’re choosing to rent out their properties instead of sell

- Dailymail.com speaks to two households that consider themselves ‘accidental landlords’

America is becoming a nation of ‘accidental landlords’ because soaring mortgage rates have left homeowners unwilling to give up their cheap deals, experts say.

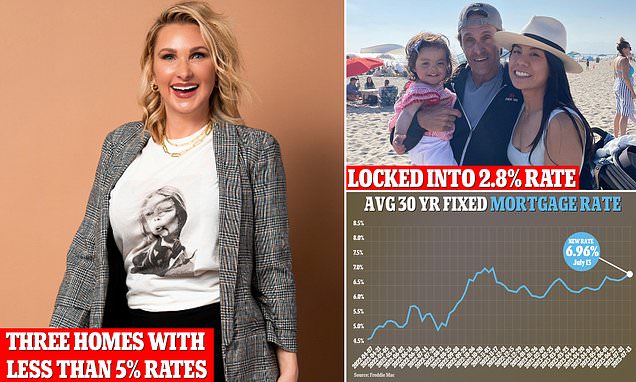

Interest rates are now hovering just below 7 percent but many households secured 30-year deals when they were a sweet 2 percent around two years ago.

Determined to cling onto their low rates – but in need of more space – some are opting to rent out their homes instead of sell. But many say they aren’t even profiting from the venture, they are simply breaking even.

Among them is advertising exec Gino Sesto, 52, who outgrew his $460,000 West L.A. condo after the birth of his daughter Penelope 15 months ago.

He and his wife Bettina, 37, pay a rate of 2.8 percent on the one-bedroom property – from when they bought it four years ago.

Last year, they quickly moved out to a bigger, rented home – while letting out their condo – but planned to buy as soon as they could.

They had budgeted to spend $7,000 a month on their mortgage but, after rates suddenly shot up, they are now looking between $11,000 and $12,000.

Feeling stuck, the couple have decided to carry on renting a 3-bedroom property – for $7,000 a month – while letting out their condo.

‘We are netting zero from renting our home, we aren’t making any money,’ Sesto, who runs his own advertising agency DashTwo, told Dailymail.com.

‘But it just made the most financial sense. It would have been crazy to give up the rates we have.’

Sesto rents out his home for $2,800 a month which covers the cost of their $1,970 mortgage and extra taxes and house insurance incurred from being a landlord.

And the family are not alone. Homeowners are increasingly cautious about putting their properties on the market because they do not want to part ways with their low mortgage rates.

The issue is compounded by a volatile real estate landscape which has seen prices plummet in some areas – while remain steady in others. It has prompted owners to delay putting their homes on the market.

According to data from property portal Redfin, new home listings were down 25 percent in May – the third lowest level on record.

Separate findings from government-backed lender Freddie Mac found that 82 percent of would-be homebuyers felt they were ‘locked into’ their homes because they fixed mortgages when rates were low.

Indeed it is little surprise given that the average homeowner now faces paying more than $1,000 a month on their mortgage than if they would have done two years ago.

For example, if a family bought a $400,000 home – with a 5 percent downpayment – in July 2021, they would have faced a monthly bill of $1,582. At the time, rates were 2.9 percent, according to Freddie Mac.

In all, they would have paid $189,403 in interest over the course of their 30-year loan.

However, the same family in the same home would now pay $2,505 at a rate of 6.91 percent. What’s more, over a 30-year term, they would pay $521,880 in total – a difference of 332,477.

Realtor Adie Kriegstein, who founded the NYC Experience Team at Compass, told Dailymail.com: ‘We are seeing more people interested in renting across the board, with properties of all different sizes.

‘There is so much uncertainty, it’s making people very wary. I have one client on my books who recently decided to move out of the city so rented out his apartment here while he pays to rent somewhere else. It’s definitely becoming a trend.’

Author and life coach Ginny Priem, 43, is among those to consider herself an ‘accidental landlord’ – after acquiring three properties in ten years.

Priem, from Minneapolis, Minnesota, said she first became a landlord after failing to sell her first home in 2013.

And when she moved again in 2017, she decided to do the same – keep her old property on as a rental.

Currently she pays 4 percent interest on her first home, 3.75 percent on the second and 4.375 percent on the third. All three properties are in Minneapolis.

She rents out the two properties for $1,575 and $2,695 respectively.

‘When I purchased my second home, my previous home wasn’t selling so I rented it out,’ Priem – who also works as a keynote speaker – told Dailymail.com.

‘I never intended to turn either of those into rentals but now they both are! The interest rates are so low on them, it hasn’t made sense to sell.

‘I want to sell them next year but now that rates are so high a lot of people don’t want to buy.’

Although becoming a landlord is typically seen as lucrative business, there are often complaints that it can be a tax headache.

The Internal Revenue Service (IRS) treats rent money as a form of income and taxes it at the same rate. You must also report advanced rent – including security deposits – on your tax return.

The lowest federal tax rate is 10 percent and is applied to anybody earning up to $11,000 a year in rental income.

By comparison, the highest levy is 37 percent – but that is reserved for anybody who generates more than $578,125 from letting out their properties.

However, landlords are eligible for some deductions. For example, you can have your mortgage interest, property tax, depreciation, repairs and maintenance, insurance and legal fees deducted from your tax bill.

Landlords must also then pay state income tax – which can vary widely. And they are also responsible for covering the property tax on any homes they possess.

As with all homeowners, they must also pay Capital Gains Tax upon selling the property. This levy is imposed on any asset that is sold at a profit.

It is currently 18 percent for basic tax-rate payers and 28 percent for additional rate payers.

The rate you pay is dependent on how much profit you made on the sale, the tax bracket you fall into, your deductible costs and any tax relief you’re eligible for.