serpeblu

Yesterday I wrote an article titled A Case For Avoiding High Yielding REITs, in which I explained that “one of the most valuable lessons that I learned as a developer is that the more debt you use, the greater the potential for gain or loss.”

So, I suppose the best analogy that I can use is the hot frying pan analogy: when you touch a hot frying pan for the very first time, your sense of touch tells you that’s a bad experience and your conscience guides you to never touch it again.

Now, I’ve been burned quite a few times in my life with high-yielding stocks, and I’m sure at some point I’ll do it again. Given that, and as I pointed out in that same article, most “mortgage REITs do not belong in a retirement portfolio.”

So why am I recommending these commercial mREITs today?

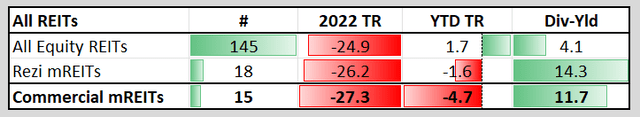

For me, I prefer to invest in commercial mREITs (mortgage real estate investment trusts) because I’m knowledgeable in the sector and because they aren’t as leveraged as residential mREITs. My picks today will be within the commercial mREIT category, versus the more toxic residential mREITs.

Remember that residential and commercial mREITs are both sensitive to interest rates and neither of them typically provides the same transparency as equity REITs (they rarely provide street addresses).

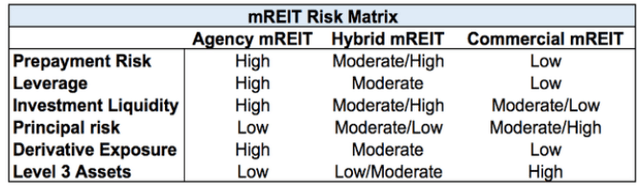

As I explained in a previous article, the business models of the two primary types of mortgage REITs have a lot of overlap, but their portfolios differ dramatically (emphasis added).

“Residential mREITs often engage with U.S. government sponsored enterprises and agencies, such as the Federal National Mortgage Association (“Fannie Mae”), Federal Home Loan Mortgage Corporation (“Freddie Mac”), and Government National Mortgage Association (“Ginnie Mae”).

Unbeknownst to many, and for better or worse, the U.S. federal government is deeply involved in the residential loan market.

In fact, these institutions, rather than the private market, generally dictate acceptable credit scores, leverage ratios, down payment requirements, and other variables for consumers and multi-family housing.

Non-government entities also issue residential mortgages and these are called non-agency mortgage-backed securities. These often carry insurance or other measures to protect the issuer since the federal government isn’t subsidizing the risk to the lender.

Commercial mREITs focus on all property types except residential. These mREITs often have meaningful exposure to retail, lodging, office, and industrial real estate. These companies are arguably less sensitive to government policy and involvement since their loans are sourced, originated, and maintained by private companies rather than government agencies.”

There are big differences between these two types, and these risks can be further diversified, as illustrated below.

So, without further ado, let me provide you with three commercial mREITs that I’m recommending.

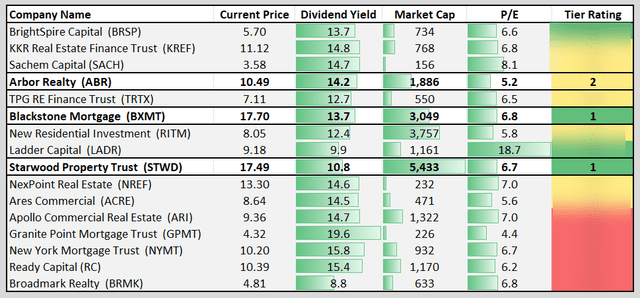

Arbor Realty Trust, Inc. (ABR): 14.2% Yield

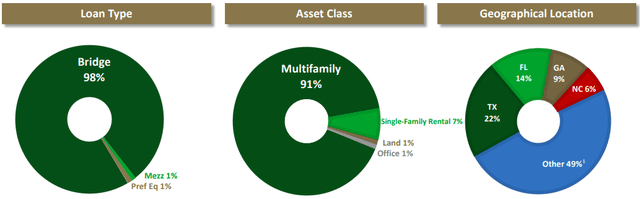

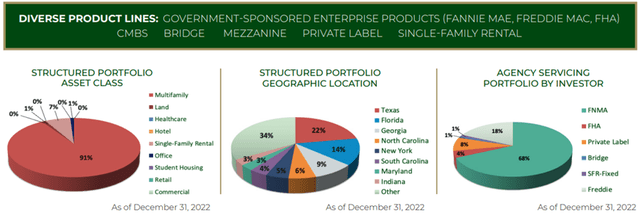

ABR is a mortgage real estate investment trust that operates through 2 business segments, their Structured Business and their Agency Business. ABR derives the majority of its interest income through its Structured Business segment which is primarily made up of bridge loans (98%) and to a lesser extent they issue mezzanine loans (1%) and preferred equity (1%).

By asset class, ABR’s Structured Business primarily issues loans for multifamily properties (91%) followed by single family rental (7%), land (1%) and office (1%). Geographically their largest presence is in Texas (22%) followed by Florida (14%).

Through ABR’s Agency Business they originate and sell a variety of finance products through government-sponsored enterprises (“GSEs”) such as Fannie Mae and Freddie Mac. ABR retains the servicing rights on almost all of the loans they originate and sell through the GSEs programs.

As of the last fiscal year, all of ABR’s servicing revenue was derived from their Agency Business. In addition to the loans originated through the GSEs programs they also issue non-GSE loans which they list as “private label” loans and originate and sell financial instruments through conduit / commercial mortgage-backed securities. ABR’s private label loans are pooled together and securitized and sold to investors while ABR keeps the servicing rights and the highest risk tranche of the securitized loans.

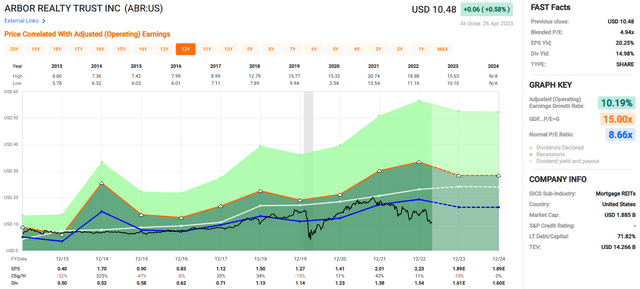

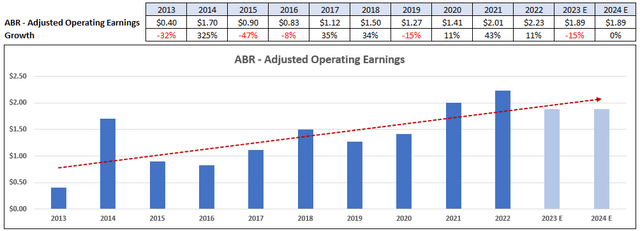

Since 2013, ABR has averaged an adjusted operating earnings growth rate of 10.19%, but the earnings are somewhat erratic with large increases in some years and large declines in others. In 2013, earnings fell by -32%, then increased by 325% in 2014, and then fell by -47% the following year.

The point I want to drive home here is that investors need to have a long-term perspective on earnings and not get too spooked if there is a year with a significant decline. Over the long term, ABR has had an upward trajectory in its earnings, but there has been a lot of volatility along the way.

FAST Graphs (compiled by iREIT)

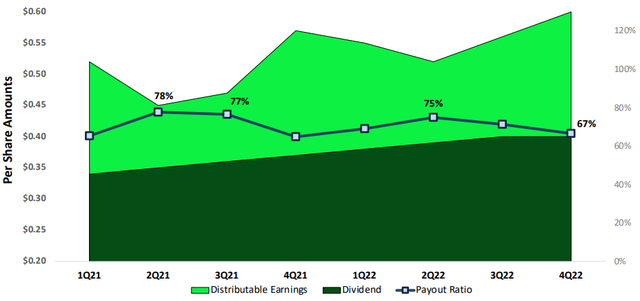

Over the past year distributable earnings have easily covered the dividend with payout ratios ranging from 67% to 78%. ABR increased the dividend 3 times in 2022 and increased it in 10 out of the last 11 quarters. Overall, they have increased the dividend for 10 straight years and have a compound dividend growth rate of 18.38% over that period.

While ABR has experienced quite a bit of volatility in their earnings, over the long term they have delivered a solid growth rate of 10.19%. They pay a 14.98% dividend yield that is covered by their distributable earnings and have an excellent track record of dividend growth.

Currently ABR trades at a P/E multiple of 4.94x which is well below their normal P/E of 8.66x.

At iREIT, we assign Arbor Realty Trust a Tier 2 rating and have a Spec BUY recommendation on the stock.

Blackstone Mortgage Trust, Inc. (BXMT): 13.7% Yield

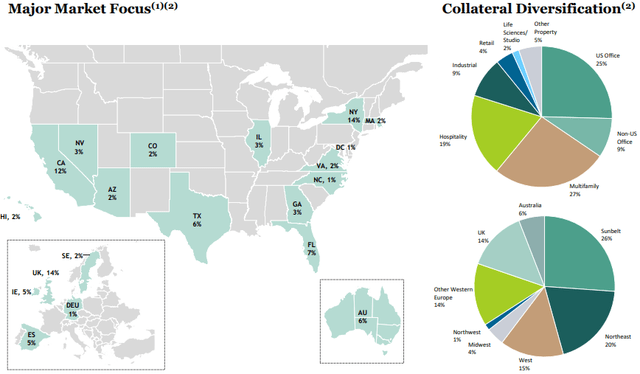

BXMT is an externally managed mREIT that originates senior loans that are backed by commercial real estate in America, Europe, and Australia. They finance the loans they issue by borrowing from their credit facilities, issuing collateralized loan obligations (“CLOs”) and single-asset securitizations. BXMT has a $26.7 billion senior loan portfolio that has 199 loans with an average loan-to-value (“LTV”) of 64%. Additionally, 100% of their portfolio is made up of floating-rate loans.

The collateral backing their loans primarily consists of multifamily properties that makes up 27% of their portfolio, office properties that makes up 25%, hospitality that makes up 19%, and industrial properties that makes up 9% of their portfolio.

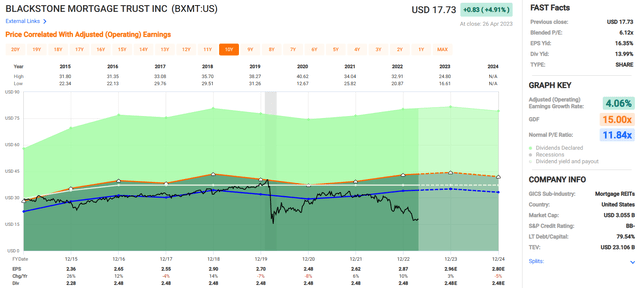

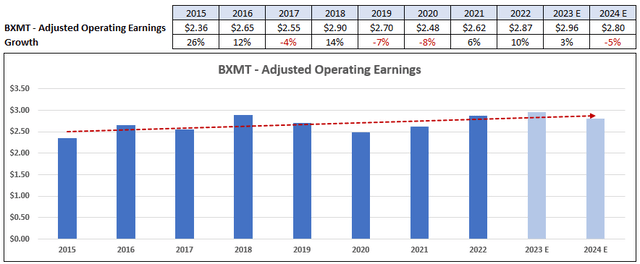

BXMT has an average adjusted operating earnings growth rate of 4.06% since 2015. Earnings have been cyclical in nature with earnings growth in some years and earning declines in others.

Overall, there is an upward trend, with 2015 operating earnings reported at $2.36 per share vs. the 2022 operating earnings that came in at $2.87 per share. Analysts expect earnings to increase by 3% in 2023 and then fall by -5% in 2024.

FAST Graphs (compiled by iREIT)

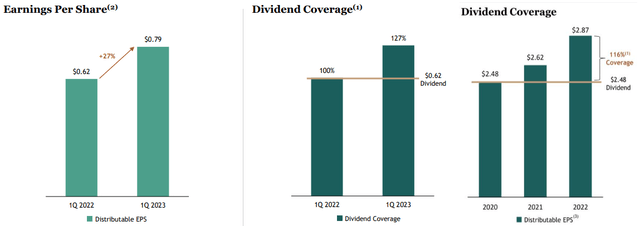

On a quarterly basis, BXMT’s distributable earnings came in at $0.79 per share vs. $0.62 per share for the same period in the prior year. The first quarter distributable earnings in 2022 were 100% of the dividend payout so it just covered the dividend. In the first quarter of 2023, their distributable earnings of $0.79 provided 127% dividend coverage, with earnings coming in at $0.79 per share vs the dividend rate of $0.62.

On a full-year basis, BXMT’s distributable earnings have covered the dividend over the past three years with an average dividend coverage of 116%. Additionally, distributable earnings have increased each year since 2020.

BXMT shares have fallen almost 40% over the past year, which has pushed the earnings yield up to 16.35% and the dividend yield up to 13.99%. The stock currently trades at a P/E of 6.12x which is a significant discount to their normal P/E of 11.84x.

At iREIT, we assign Blackstone Mortgage Trust a Tier 1 rating and have a BUY recommendation on the security.

Starwood Property Trust, Inc. (STWD): 10.8% Yield

STWD is an externally managed mREIT that specializes in originating and acquiring mortgage loans and other investments in the U.S., Europe and Australia. STWD operates under 4 business segments: Commercial and Residential Lending, Infrastructure Lending, Real Estate Property, and Investing and Servicing.

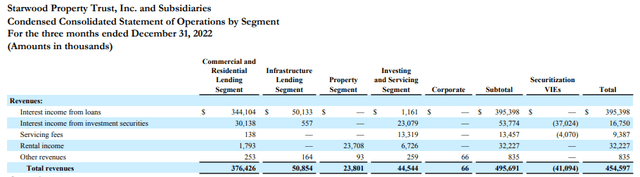

Most of STWD’s revenue is derived from their Commercial and Residential segment which contributed approximately 76% of their revenue in the fourth quarter of 2022. This segment specializes in originating, acquiring, and managing a variety of debt products that include commercial first mortgages, residential mortgages, mezzanine loans, commercial mortgage-backed securities, and subordinate mortgages.

STWD’s Infrastructure Lending segment generates interest income from loans issued for infrastructure projects and makes up approximately 10% of their revenue.

Their Property segment acquires equity interests in commercial real estate and multifamily properties and generates rental income that makes up approximately 5% of their revenue, and finally their Investing and Servicing segment engages in a variety of investment activities including investing in commercial mortgage-backed securities (“CMBS”) and originating conduit loans to securitize and sell to third parties. This final segment makes up approximately 9% of their revenue.

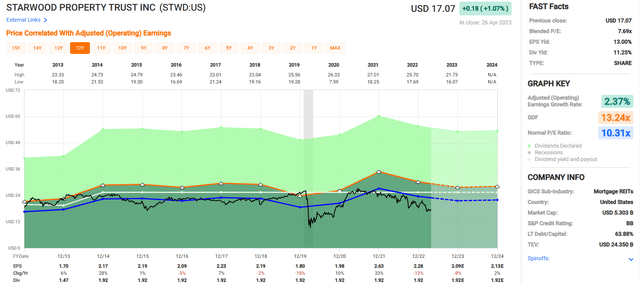

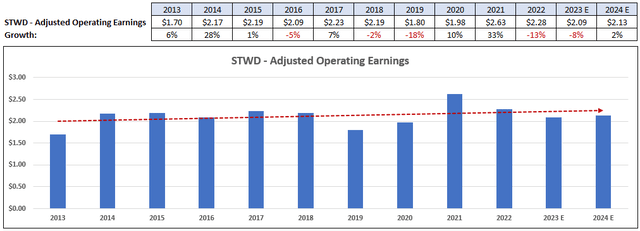

Like the two previously discussed mREITs, STWD’s earnings are volatile but have had a slight upward trend over the past 10 years. Over this period, STWD’s average operating earnings growth is 2.37%. In the past fiscal year STWD’s earnings fell by -13% and analysts expect earnings to fall by -8% in 2023. While earnings have been volatile the company has still grown its earnings at a moderate rate.

FAST Graphs (compiled by iREIT)

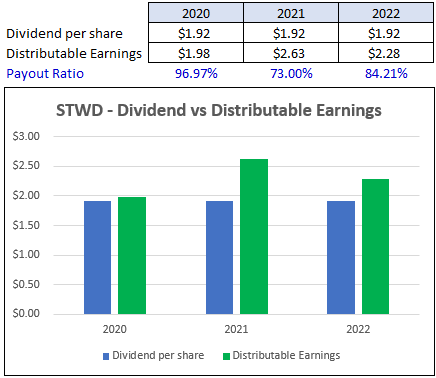

Over the past 3 years STWD’s distributable earnings have covered the dividend. Generally speaking, mortgage REITs tend to have a higher payout ratio than equity REITs and often payout close to 100% of their earnings.

STWD has done a good job over the years of maintaining a conservative payout ratio, especially when compared to many other mREITs. In 2020, their payout ratio came close to 100%, but then dropped to 73% in 2021. In the last fiscal year their payout ratio based on distributable earnings came in at 84.21%.

STWD – Earnings Release

Starwood Property Trust stock price has fallen almost 25% over the past year and now trades at a P/E ratio of 7.69x which is well below their normal P/E of 10.31x. They pay an 11.25% dividend yield that is covered by their distributable earnings and have a conservative payout ratio.

At iREIT, we assign Starwood Property Trust a Tier 1 rating and have a BUY recommendation on the security.

Modest Exposure for Me

I would not recommend overweighting your portfolio with mREITs, and investors should be cognizant of the risks and know whether or not the dividend is safe.

REITs like Annaly Capital Management, Inc. (NLY) and AGNC Investment Corp. (AGNC) have been value destroyers and they keep raising capital to payout investor dividends.

However, for the investor that doesn’t mind performing a little extra due diligence and has the patience, we believe that owning higher-quality commercial mREITs makes sense.

The above referenced mREITs (STWD, BXMT, and ABR) withstood 2020 without reducing their distributions to shareholders or book value per share. For those that knew these firms’ strengths and weaknesses, strong capital gains were generated with significant upside. My new saying for mREITs is something like this…

The safest dividend is the one that’s just been paid!