Recent UK buy-to-let statistics show that consumer buy-to-let mortgages were valued at around £955 billion in 2022.

Buying a property to rent out can prove to be a good source of income, and millions of people are choosing this as an investment opportunity.

However, there are associated risks, and specific rules to follow. If you are a landlord, or considering becoming one, then comparing buy-to-let mortgages available on the market will ensure you find a product that is right for you and your circumstances.

Our research has collated various buy-to-let statistics for the UK in 2024, to analyse trends, judge how the buy-to-let market has evolved over time, and make predictions about the years to come.

Quick overview of buy-to-let statistics 2024

-

In 2023, more than 83,000 buy-to-let mortgages were approved by UK lenders, and occupied 7.5% of total mortgage lending for the year.

-

Consumer buy-to-let mortgages in 2023 are valued at approximately £24.4 billion

-

Buy-to-let mortgages were responsible for 7.5% of the total gross mortgage advances in Q3 2023.

-

500 buy-to-let mortgaged properties were taken into possession during Q2 2023 – a rise of 11% from the previous quarter.

-

Buy-to-let mortgage advances were valued at £4.7 billion for Q3 2023 – 10% more than the previous quarter but 57% less than the same time in 2022.

-

Lloyds is the company with the largest share of the UK mortgage industry, occupying just under 17% of the market.

-

Around a third (30%) of landlords claimed they intend to sell a property within the next 12 months in Q4 2023.

Buy-to-let mortgage lending statistics

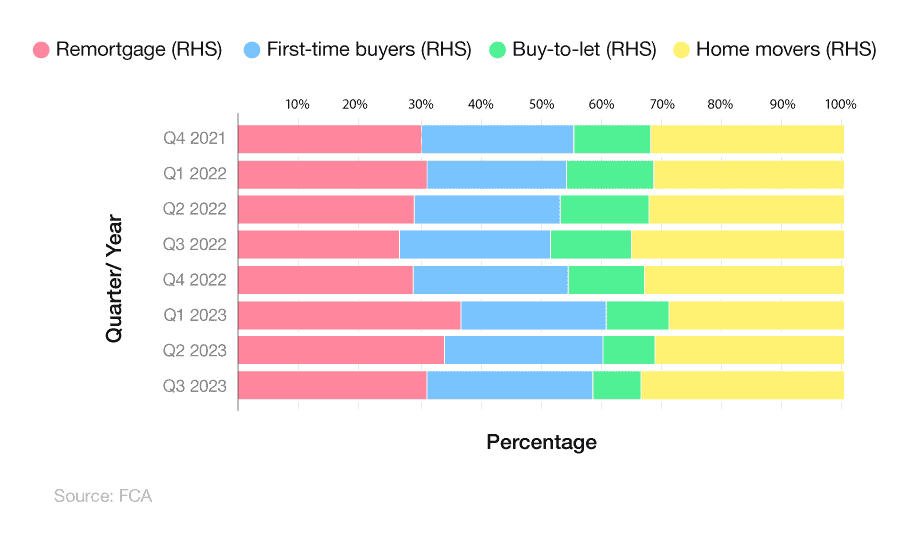

Recent buy-to-let statistics indicate that in Q3 2023, buy-to-let mortgages occupied 7.5% of total gross mortgage advances – the lowest recorded figure since 2010. This equated to just under £4.7 billion worth of lending and was 0.7 percentage points (pp) lower than the previous quarter. Additionally, this amounted to a decline of 5 percentage points from the same period a year earlier.

A breakdown of UK buy-to-let mortgage lending statistics by purpose, between 2021 and 2023

| Q4 2021 | Q1 2022 | Q2 2022 | Q3 2022 | Q4 2022 | Q1 2023 | Q2 2023 | Q3 2023 | |

|---|---|---|---|---|---|---|---|---|

| Total (£bn) | 70.2 | 76.9 | 78 | 85.9 | 81.6 | 58.8 | 52.4 | 62.2 |

(Source: FCA)

By comparison, this was the lowest percentage share across all other mortgage purposes. As of Q3 2023, home movers accounted for the largest share of mortgage lending (31.7%), followed by remortgaging (29.4%), and then first-time buyers (25.8%).

According to research by the BVA BDRC Landlord Panel, more than half (51%) of landlords in Q4 2023 intend to take out a buy-to-let mortgage to fund their next property purchase. The proportion planning to buy a property within the next 12 months also increased, rising from 8% to 11% between Q3 and Q4 2023.

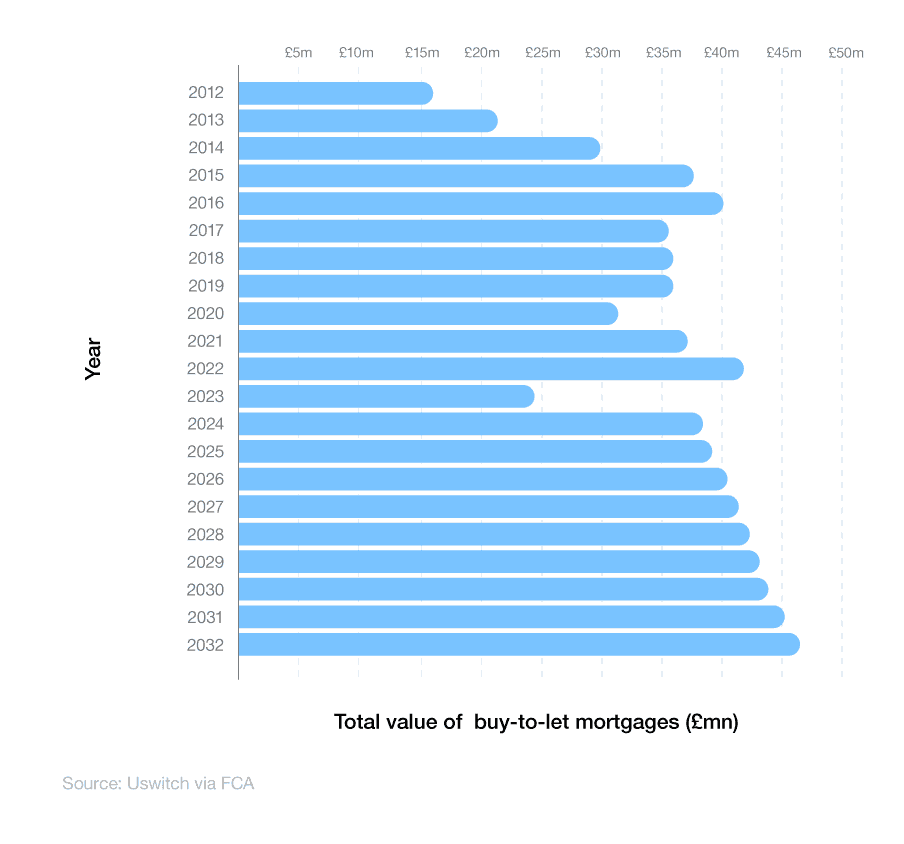

What is the overall value of buy-to-let mortgages in the UK?

Buy-to-let stats for 2023 show that UK buy-to-let mortgages are worth around £24.4 billion, in total. This is around 50% more than the total market value from 2012 when it was valued at just under £16.2 billion. However, this represents a sharp annual decline of 41% from 2022 when the overall value of buy-to-let mortgages was more than £41.3 billion.

A breakdown of the value of UK buy-to-let mortgages between 2012 and 2032

There was a consistent rise in mortgage values for 10 years between 2012 and 2022, with the total value rising from £16.2 billion to £41.1 billion over the decade (+155%). These increases are predicted to resume in 2024, rising by 57% to £38.4 million. By 2032, buy-to-let mortgages should be worth more than £46 billion.

If these forecasts are correct, this would represent a rise of 89% between 2023 and 2032.

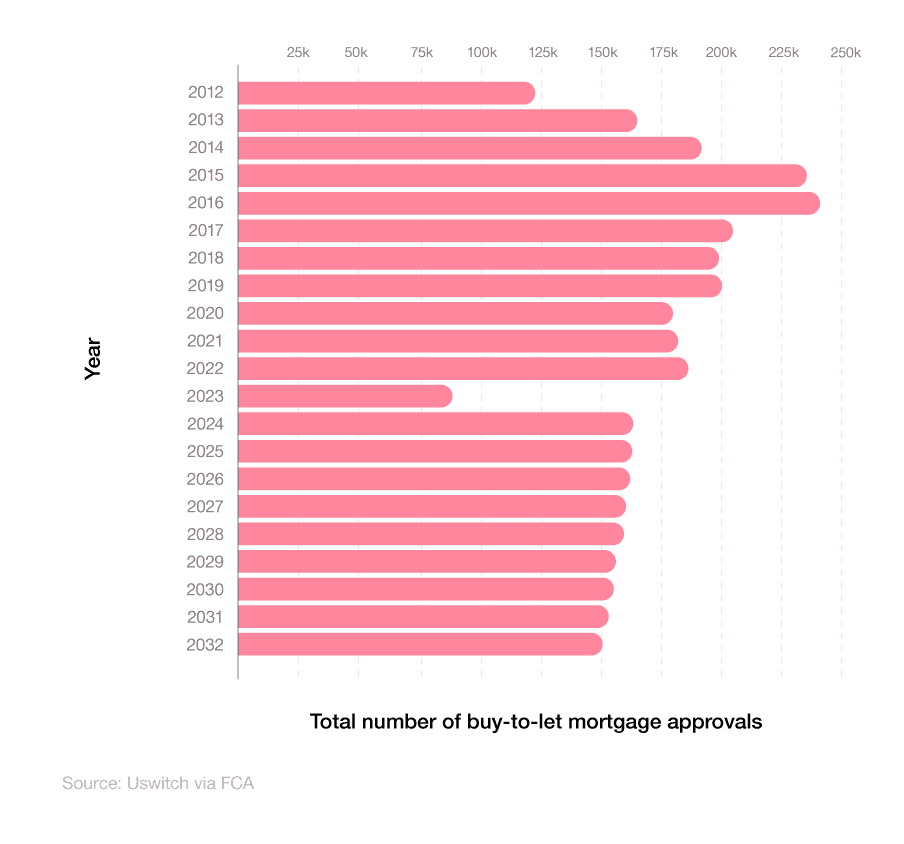

Buy-to-let mortgage approvals

The private rental sector (PRS) is currently the UK’s second-largest housing tenure, consisting of roughly 4.6 million UK households (or 20% of the total).

It’s estimated that PRS supply will have to increase by 227,000 homes a year over the next decade, to meet the forecasted demand for 1.8 million new households by 2032.

A breakdown of buy-to-let mortgage approvals in the UK between 2012 and 2032

In 2023, there were around 83,400 buy-to-let mortgages authorised by UK lenders – less than half the number from 2022 when there were over 187,000 approvals. Approval numbers for buy-to-let mortgages peaked in 2016, at just less than 240,000, before dropping down to about 179,000 in 2020. The latest numbers for 2023 represent their lowest total since before 2012.

In 2024, numbers are forecasted to rise, reaching nearly 168,000 – a rise of more than 100% from 2023. From here, numbers are expected to decline year-on-year, falling below 151,000 by 2032. If these projections are correct, then the number of approvals will fall by around 10% between 2024 and 2032.

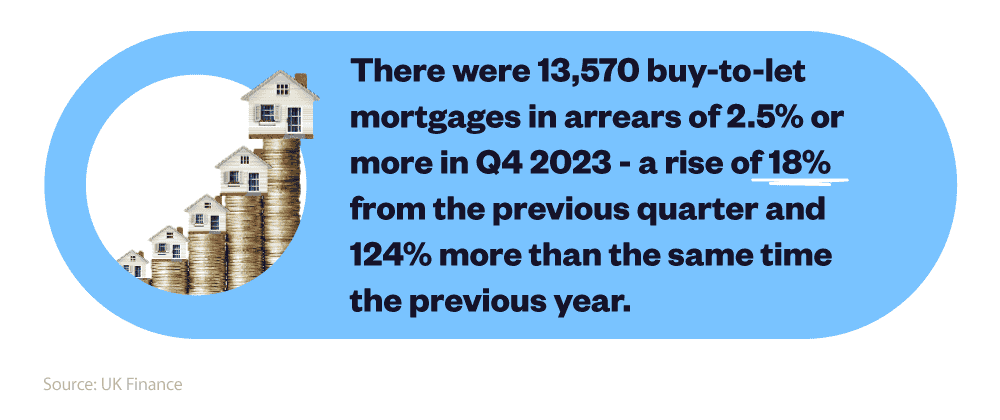

How many UK buy-to-let mortgages are in arrears?

According to recent UK buy-to-let statistics, 500 buy-to-let mortgaged properties were taken into possession during Q4 2023.

In the final quarter of 2023, the total number of possessions fell 3.7% across all property types compared to Q3 2023. However, the number of buy-to-let mortgage possessions increased by 11%, while the number of homeowner possessions fell by 14%.

During the same period, 13,570 buy-to-let mortgages were in arrears of 2.5% or more of the outstanding balance. This was around a fifth (18%) more than in Q3 2023, and a 124% increase on the previous year.

UK buy-to-let remortgaging statistics

Remortgaging a buy-to-let property involves switching to a new mortgage deal for a property you already rent out. This could involve moving to a different lender, or staying with your existing one and negotiating a new deal.

Research by Foundation Homes Loans, via the HomeOwners Alliance (HOA), found that in Q3 2023, more than a quarter (27%) of landlords planned to remortgage within 12 months, with the intention of releasing equity from their portfolio – a fall of 3% from the previous quarter. This figure increased to almost two-fifths (38%) for landlords with four or more mortgaged buy-to-let properties, falling to less than a fifth (18%) for those with 1-3 properties.

In August 2023, UK interest rates rose from 5% to 5.25%. The 12-month CPI inflation rate was 4% in January 2024, down from 10.1% in January 2023 but unchanged from the previous month.

Both of these factors could have a significant impact on whether landlords choose to remortgage, as the cost of living crisis continues to grow and people are looking to save money where possible.

Research by the BVA BDRC Landlord Panel (via Foundation Home Loans) indicated that if interest rates rose by 2%, then just under a fifth (18%) of landlords would be forced to sell a property, compared to 10% for a rate increase of 1%.

On 3 August 2023, the Bank of England (BoE) chose to raise the base rate to 5.25% – the highest level in 14 years. The BoE suggests this could fall by autumn 2024. Research from the BVA BRDC in 2022 found just under a third (30%) of landlords claimed they would have to diversify all, or part, of their portfolio if the base rate exceeded 4% (for context, the base rate stood at 3% in November 2022).

More recent research from the BVA BRDC in Q4 2023 found that an identical percentage (30%) of landlords claim they intend to sell a property within the next 12 months – a 2% rise from the previous quarter.

If remortgaging a buy-to-let property is something you might be considering, you will need to:

-

Calculate the Loan to Value (LTV) you require. For example, if your rental property is worth £400,000 and you need to borrow £200,000, your LTV would be 50%. Generally speaking, lower LTVs can access a wider range of mortgages with better rates.

-

Compare remortgage deals via an expert mortgage broker to find the best one for you.

When it comes to buy-to-let mortgages, lenders will treat your application differently compared to a standard residential mortgage. This is because your borrowing is based on how much rent you can potentially generate. Therefore, how long it takes to get a mortgage can vary from lender to lender.

Rental income will typically need to meet at least 125% of the monthly mortgage payments, but this can rise to 145%, depending on the lender. A minimum salary is also normally required of around £20,000 to £25,000.

You can start looking for buy-to-let remortgage deals around six months prior to your current deal ending. This is because most mortgage deals are valid for six months, meaning you can lock in a new rate and switch your mortgage when your current deal comes to an end, avoiding an early repayment charge (ERC).

Buy-to-let market statistics

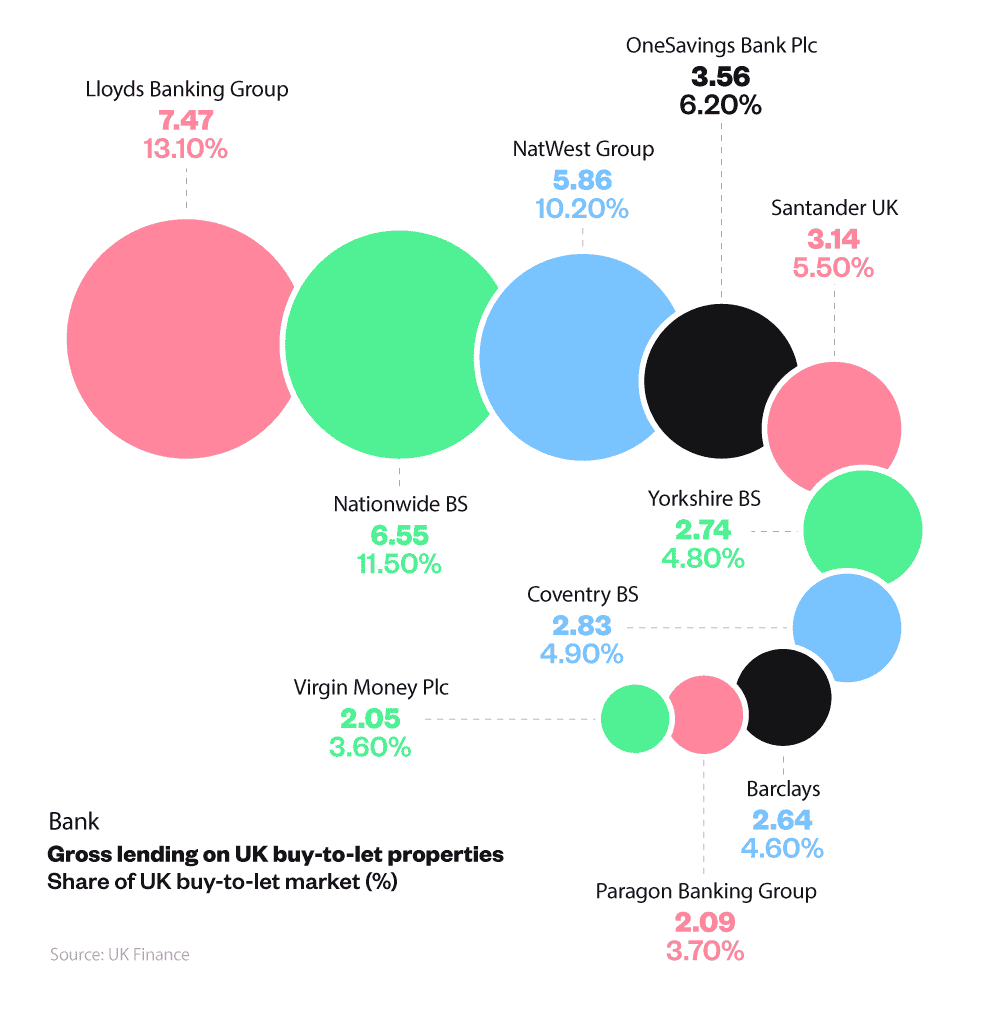

Since 2010, UK gross buy-to-let mortgage lending has gradually increased. By 2022, the 10 largest UK mortgage lenders occupied approximately two-thirds (68%) of the buy-to-let mortgage market, with nearly half (46.5%) belonging to the top five.

By comparing mortgage lenders, we can still see that Lloyds Banking Group had the largest overall market share in 2022. More than one in eight (13.1%) UK buy-to-let mortgages were assigned by them in 2022, constituting around £7.5 billion in lending for the year.

A breakdown of UK mortgage lenders by market share and gross lending

As of 2023, Nationwide BS and NatWest Group each accounted for 11.5% and 10.2% of the buy-to-let market, respectively, with combined gross buy-to-let lending exceeding £12 billion. Nationwide’s market share fell from 15.3% in 2021 (-3.8%), while Natwest’s climbed from 4.4% (+7.1%).

The top five was rounded off by One Savings (6.2%) and Santander (5.5%), with combined gross lending of over £9 billion. These were the only other banks to exceed £3 billion each in gross buy-to-let lending for 2023 and the final lenders to occupy more than 5% of the overall market share.

Lloyds invested £180 million in its buy-to-let business programme in 2022, so its dominance is likely to continue for years to come.

What is the average value of buy-to-let loans in the UK?

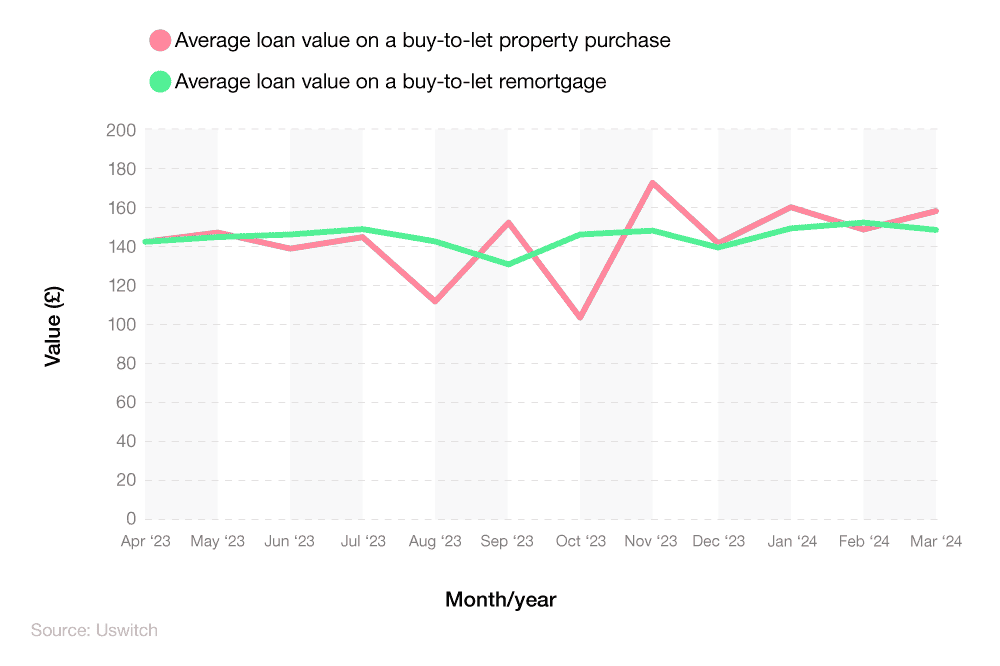

The latest UK buy-to-let statistics found that the average loan value on a buy-to-let property purchase was just below £158,500 in March 2024 – a rise of 6% from the previous month.

At the same time, the average loan value for a buy-to-let remortgage fell from nearly £155,000 in February 2024 to around £149,000 in March (-3.9%).

A breakdown of the average value of buy-to-let loans by loan type (April 2023-March 2024)

The average value of buy-to-let property purchase loans fluctuated consistently between 2023 and 2024, standing at just over £142,000 in April 2023 before exceeding £150,000 in July (+5.7%).

Between July and August 2023, the average loan value fell by nearly a quarter (-24.2%) to just under £114,000, before rising by more than a third (34%) in September to £153,582. After falling below £106,000 in October 2023, the average loan value climbed above £172,000 in November (+63%) and has remained above £140,000 ever since.

The average loan value for buy-to-let remortgages has been similarly volatile, standing at around £143,000 in April 2023, before falling to less than £134,000 in September (-6.4%). Since then, figures have remained consistently above £140,000, with the latest figure for March 2024 marking the first time in 12 months that the average buy-to-let remortgage loan value has exceeded £150,000.

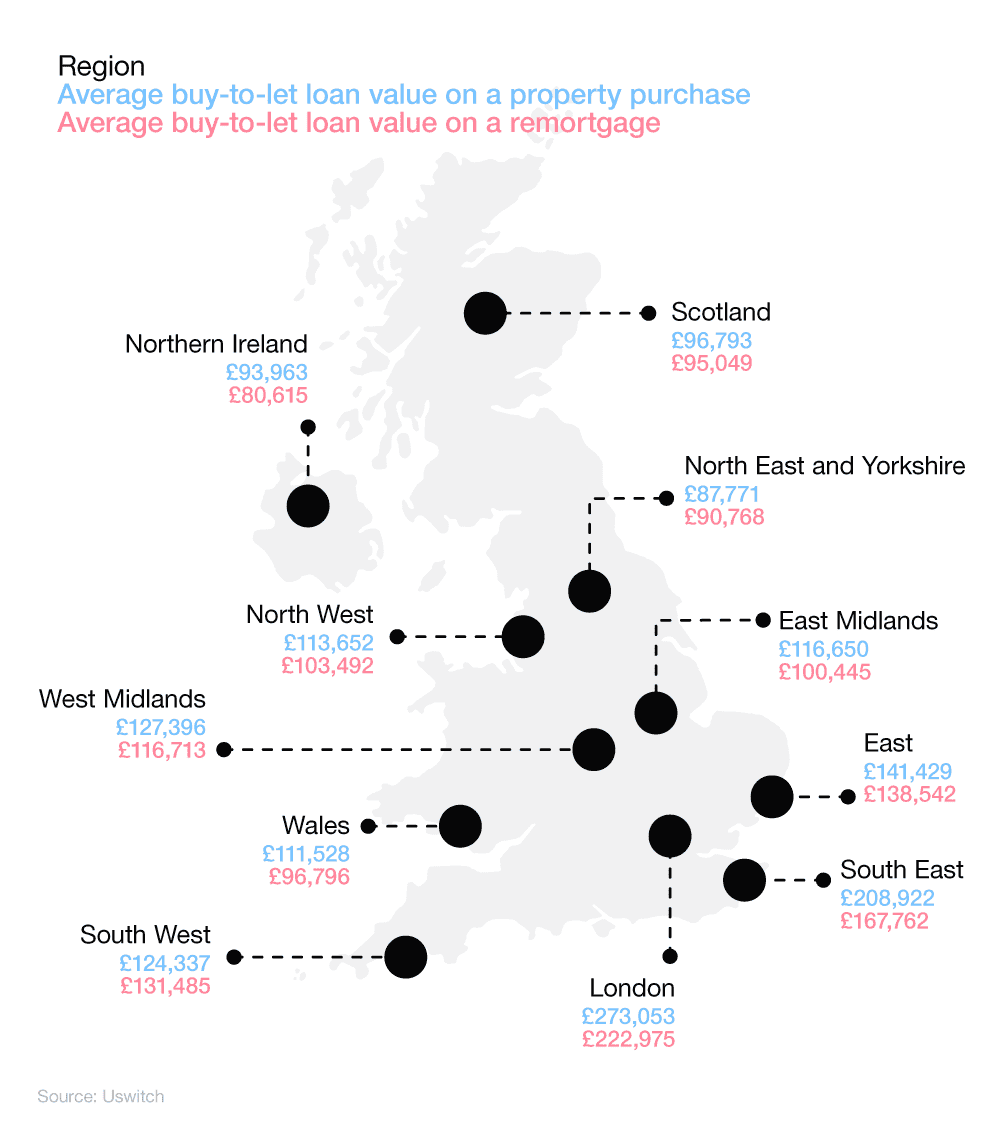

Which region has the highest buy-to-let loan value?

Buy-to-let statistics show that London has the highest average buy-to-let loan value of any region in the UK. The average value of a buy-to-let loan for a new property purchase in the capital stood at £272,052 in March 2024 – almost a third (30%) more than any other region.

London’s average loan value for buy-to-let remortgages was also substantially higher at just under £223,000. This was around a third higher (33%) than the next highest region (the South East) and made London the only region with an average buy-to-let remortgage loan above £200,000.

A breakdown of the average value of buy-to-let loans by type and region

The South East had the next highest loan value on both new buy-to-let purchases and remortgages. With an average loan value of £208,922 on new buy-to-let properties, the South East was the only other region with a loan value exceeding £200,000, and was 48% more than the East of England – the region with the third highest loan value.

At the other end of the scale, the North East and Yorkshire was the only English region with typical loan values below £100,000. The region’s average loan value of £87,771 on new purchases was more than two-thirds (68%) lower than London, while it’s average remortgage value of £90,768 was nearly three-fifths (60%) lower than in the capital.

Aside from England, Wales recorded the highest average buy-to-let loan value of the remaining UK nations for both purchases and remortgages (£111,528 and £96,796, respectively). Wales was followed by Scotland (£96,793 and £95,049) in third, with Northern Ireland having the lowest rates for both loan types (£93,963 and £80,615).

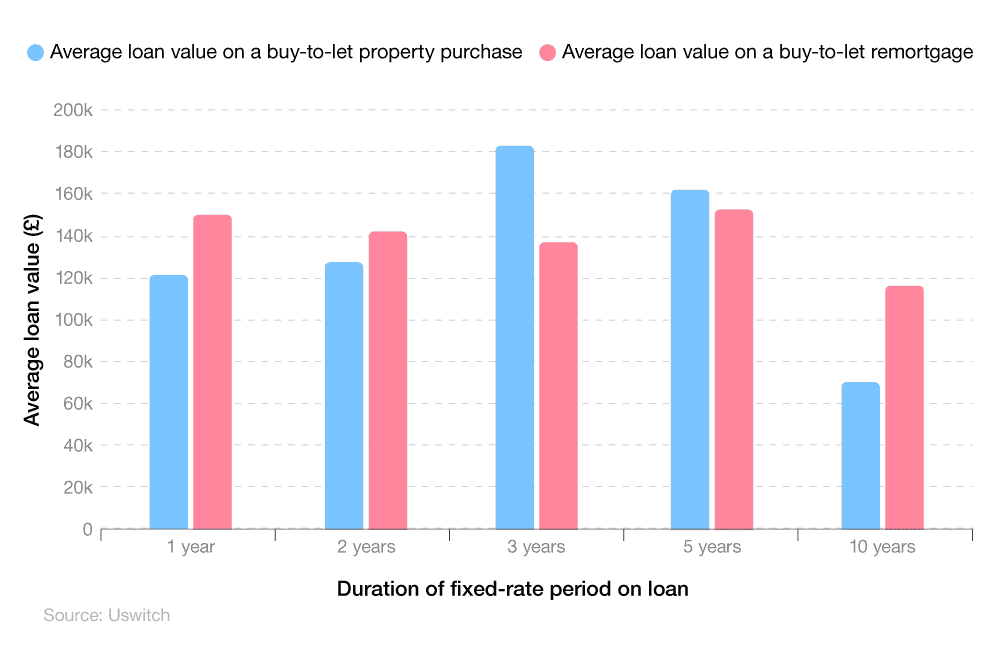

Average buy-to-let loan value by fixed rate duration

When it comes to purchasing a buy-to-let property, those on a 3-year fixed rate loan have the highest average loan value. With a typical loan value of £183,894, those on 3-year plans had loans worth at least 14% more than any other fixed-rate period.

5-year fixed rate customers had the next-highest average loans, at just over £161,000. This was around a quarter (25%) higher than the next highest loan (2-year fixed-rate mortgages) and the only other plan to exceed £130,000.

Customers on 10-year fixed rate deals had the lowest average loans at just under £71,000 – more than three-fifths (61%) lower than 3-year fixed rate customers and 56% less than those on 5-year plans.

A breakdown of the average value of buy-to-let loans by fixed-rate period

When it came to buy-to-let remortgages, customers on 5-year fixed rate deals had the highest loan value, at £154,625. This was around 2% more than one-year fixed-rate customers and 8% higher than those on 2-year plans.

10-year fixed rate customers also had the lowest average loan value for remortgaging. With a typical loan value of just over £117,000, these customers receive loans of around a third (32%) less value than 5-year fixed rate customers, on average.

Which age group takes out the biggest buy-to-let loans?

Buy-to-let statistics show that those in the highest age group typically take out the highest buy-to-let loans when purchasing a new property. Those aged 70 and above have an average loan value of more than £416,000 – more than double the number of any other age group.

Those aged 50-59 had the next highest average loan value, at £175,808. This was almost a third (29%) more than any other age group and the only other group with average loan values exceeding £150,000.

Less than 0.2% separates the loan values of those in the 30-39 and 40-49 age groups, with both having average loans of around £136,000. Those aged between 60 and 69 had the lowest loans for buy-to-let property purchases, at £117,011 – a third (33%) lower than those aged 50-59.

Updated 3 April 2024

| Age group | Average loan value on a buy-to-let property purchase | Average loan value on a buy-to-let remortgage |

|---|---|---|

| 20-29 | £124,357 | £118,102 |

| 30-39 | £135,867 | £141,456 |

| 40-49 | £135,686 |

£152,963 |

| 50-59 | £175,808 | £151,621 |

| 60-69 | £117,011 | £147,814 |

| 70+ | £416,750 | £144,557 |

(Source: Uswitch via Mojo)

When it comes to buy-to-let remortgages, those aged 40-49 typically borrowed the most in 2023-24. With average loans of £152,963, this age group received fractionally more (+0.7%) than those aged 50-59 (£151,621).

Those aged 20-29 had the lowest loans for buy-to-let mortgages, with average loans of just over £118,000. This was almost a fifth (19%) less than the next lowest age group (30-39) and the only group with average remortgage loans below £140,000.

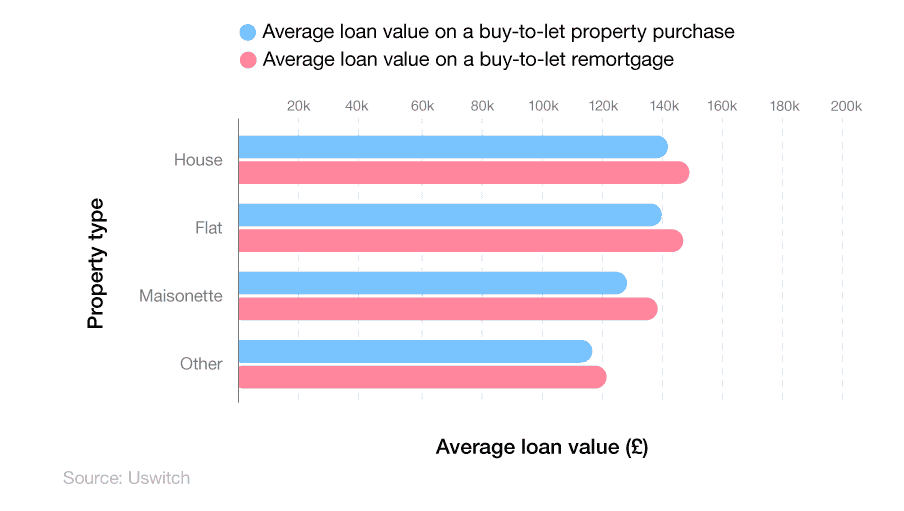

Average buy-to-let loan by property type

House purchases are the property type that generates the highest buy-to-let loans, on average. Those purchasing a new house typically receive loans of £143,751 – around 3% more than those buying a flat and 13% more than maisonette buyers.

Property types categorised as ‘other’ had the lowest average loan value, at £117,167 – almost a fifth (18%) less than houses and 16% less than flats.

A breakdown of the average value of buy-to-let loans by property type

Houses also generated the highest average loans when it came to buy-to-let remortgages. With an average loan value of £149,239, the typical house loan was just over 1% more than flats and 8% more than maisonettes.

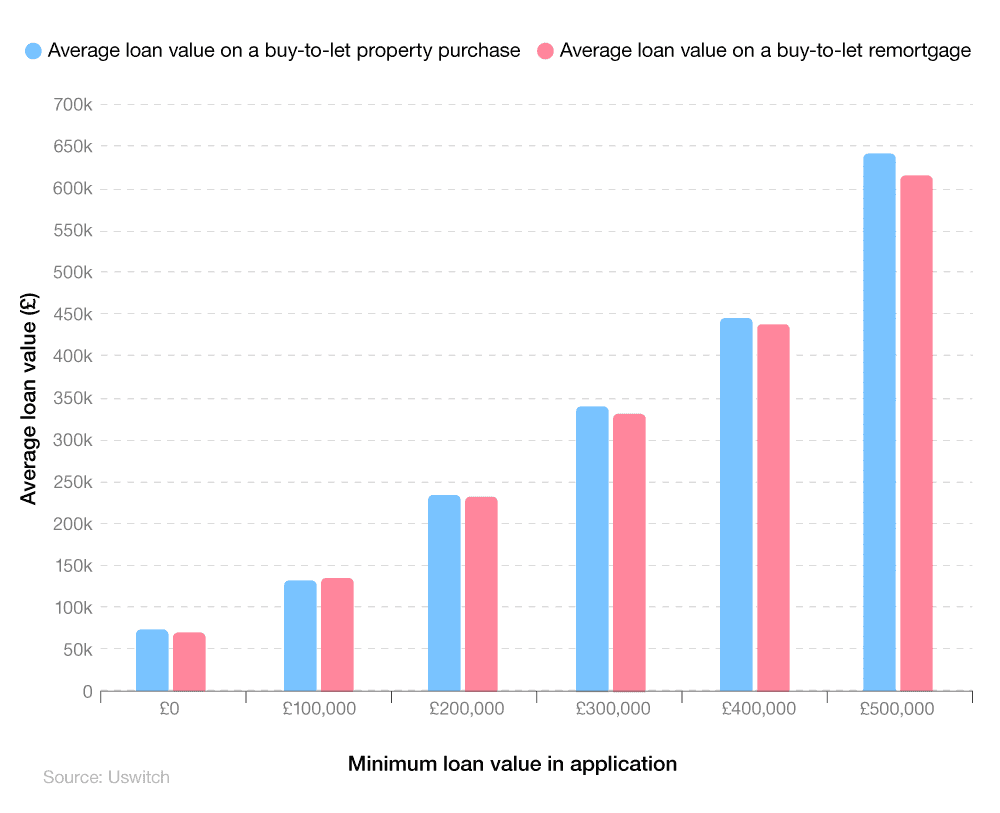

Average buy-to-let loan by the amount applied for

Recent buy-to-let statistics show those applying for a buy-to-let loan typically receive a minimum of £30,000 more than the lowest requested amount. Those who did not request a minimum amount (£0) received an average loan of just over £72,000 for a buy-to-let property purchase and just under £72,000 for a buy-to-let remortgage loan.

Those applying for a minimum buy-to-let loan of £100,000, received average loans of around 36% more for property purchases (+£35,840) and 38% higher for remortgages (+£38,406). While buyers applying for £200,000 minimum loans received average loans of around £39,000 more for property purchases, this equated to a lower percentage rise of almost a fifth (+19%).

A breakdown of the average value of buy-to-let loans by the amount applied for

The percentage rise falls as the application value increases for each bracket between £100,000 and £400,000. Those applying for a £300,000 loan receive average loans of £342,206 for property purchases (+14%) and £333,666 for remortgages (+11%). However, these percentage rise drops to 11% and 10%, respectively, for those applying for minimum loans of £400,000.

The percentage increase for those in the highest loan category (£500,000) is substantially higher than those in the previous three loan brackets. Those in this bracket receive average loans of £642,656 for property purchases (+29%) and £617,273 for remortgages (+23%).

UK short-term let statistics

The impact of short-term lets on the UK housing market

Consent-to-let agreements can often be seen as an effective solution for an under-utilised dwelling, which is regarded as somewhere that is uninhabited for more than 30% of the year. It can be furnished or unfurnished, as well as unoccupied for the short or long term. The property might even be inhabited for most of the year, apart from when the owner is away for a length of time.

Research by Property Mark found that 70% of the British public have let out a property in which they usually live, with 16% letting out part of their existing home. 12% used STLs as a gap filler between longer rentals.

When surveyed by Property Mark:

-

58% of people reported the number of STLs in their local area had increased between 2018-22.

-

28% said that it had remained constant.

-

13% indicated a reduction in the number of STLs over this period.

Airbnb and the short-term letting (SLT) market

A popular option for short-term holiday lets in the UK is via Airbnb. As of November 2023, there were over 223,000 active Airbnb listings in the UK. The average Airbnb occupancy rate was:

-

16% in Glasgow

-

14.9% in Edinburgh

-

13.7% in Manchester

-

11% in London

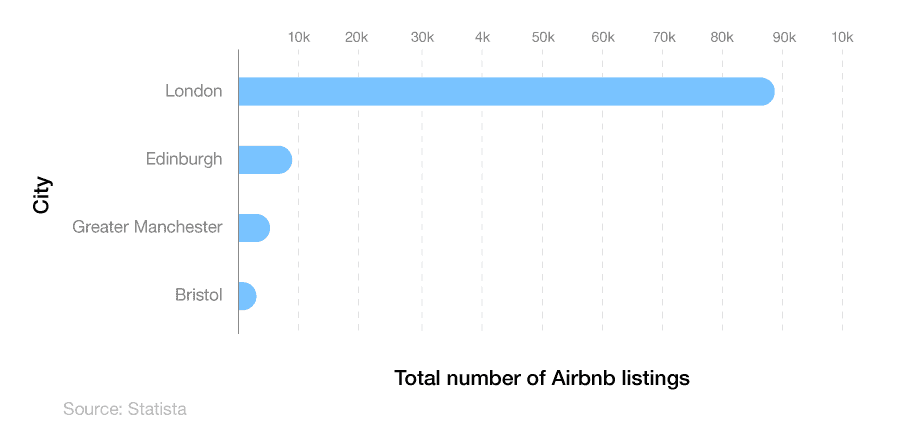

Despite the lower occupancy rate, there were nearly 90,000 Airbnb listings in London in September 2023 — more than 10 times the total found in Edinburgh (8,044).

A breakdown of the total number of Airbnb listings by city in September 2023

Greater Manchester’s total of 5,625 Airbnb listings was almost a third (30%) lower than the Edinburgh total and nearly 94% fewer than the London figure. However, this was more than double the total found in Bristol, where there were just under 2,700 Airbnb listings.

Which cities are best for Airbnb mortgages?

A recent Uswitch study found that Manchester and London ranked second and tenth, respectively, in the best European cities for Airbnb mortgages, in terms of how quickly you could pay off your mortgage.

On average, a property in Manchester would require at least seven nights a month to cover the monthly mortgage repayments, and just over 2,000 nights to fully repay the mortgage. This is contrasted by London, where the average property would require 11 nights a month to cover monthly mortgage costs, and almost 3,300 nights to repay the mortgage.

Based on these figures, it would take the average landlord around five-and-a-half months to repay their mortgage in Manchester, compared to almost nine years in London.

Reasons for the growth in short-term lets (STLs)

Of those who reported seeing growth in the number of STLs:

-

38% said the primary reason was a transfer of property from the private rental sector (PRS).

-

34% believed this was due to a specific property purchase to let in the STL market.

-

23% claimed the growth was linked to the letting out of a second home that wasn’t in use.

In addition to this, there have been other factors at play, to cause a rise in the number of UK STLs:

-

The Covid-19 pandemic (as more people are opting for staycations, rather than travelling abroad).

-

The impact of government legislation and taxation that discourages the PRS.

-

A rise in rent-to-rent practices (when a property is let with the intention of sub-letting to a third party).

Agents have reported an increase in STLs due to rent-to-rent, as budding entrepreneurs look to cash in on the STL market without purchasing or owning the property in which they live. They also reported a growing trend of ‘try-before-you-buy’ when it comes to housing, where potential homeowners will take out an STL before making a purchase, to see if they like the area first.

Short-term lets (STLs) versus second homes

44% of respondents from Property Mark’s survey stated STLs were more popular due to incentivised investment in second home mortgages.

Data from the Department for Levelling Up, Housing & Communities (DLUHC) shows there are almost twice as many dwellings listed as empty as there are for second homes (468,000 vs 253,000, respectively).

However, the issue is that these properties aren’t evenly dispersed across the country. For example, 76% of people who felt STLs had increased in their area lived in a tourist hotspot, compared to 33% for non-tourist hotspots. In addition, just under 80% lived on the coast, compared to 50% in non-coastal settings.

As an investor, deciding on the best place to buy a holiday home in the UK is no easy task. Both the ownership of second homes and STLs come with their own benefits and drawbacks, both from the perspective of the homeowner and also for the communities in which they are situated.

A breakdown of the benefits and drawbacks of short-term lets

-

High yield

-

Flexibility to use property how you want

-

Reduced regulatory environment (compared to private renting)

-

A rise in house prices will benefit those looking to sell

-

Flexibility for tenants

-

Try-before-you-commit to an area (long term)

-

Can be utilised for holidays/short breaks

-

Agents can expand business and profits

-

Economic boost to the local area from tourism

-

Occupation of an otherwise empty property

-

Additional traffic/congestion associated with holidaymakers

-

Security concerns with the frequent footfall of people

-

Incentives for landlords to leave the private rental sector (PRS), meaning less for locals to rent

-

Additional effort required to manage the property (e.g. complaints from neighbours and late-night calls)

-

Rising house prices will make it less affordable for people looking to buy

-

Drives up property prices, making it difficult for locals to get on the property ladder.

Research by the Greater Manchester Tenants Union (GMTU) and Greater Manchester Tenants Action (GMTA) found that with a 60% occupancy rate, the average cost for a two-bedroom flat in the Manchester area was £95. This would generate £1,710 a month. This compares to £800-£1,000 a month for the average long-term rented apartment. With an 80% occupancy rate, the landlord could push their earnings up to £2,300 a month.

As it stands, STLs aren’t regulated, and not required to meet the same standards set out by the PRS. This has made STLs appear a much more attractive option for investors, landlords, and agents. Between 5-10% of agents have at least one STL on their books. However, in the grand scheme, STLs made up less than 2% of the average agent’s portfolio in March 2022.

Impact of STL on sales property market

When surveyed by Property Mark, 57% of estate agents believed the rise of STLs would have no impact on the sales market, whereas 23% thought it would have a positive impact.

The main reasons for this included:

-

Providing an incentive for investment

-

The ability to keep market chains flowing

-

As people became disenchanted with STLs, this would lead to more re-sales and increased market stock.

However, 21% of estate agents thought STLs would have a negative impact on the property sales market.

This was largely due to:

-

Antisocial behaviour making it more difficult to sell a property

-

Properties not being looked after in the same way as standard rented accommodation

-

Owners holding onto properties for longer, reducing supply

-

Increased demand and price of properties will make it harder for people to save for a deposit and get onto the property ladder.

As part of the survey, 37% of property agents reported problems with antisocial behaviour, which mainly complaints from local residents surrounding excessive noise and parties. Many also reported difficulty in selling adjacent properties, due to concerns by prospective buyers of living in such close proximity to an STL property.

Impact of STLs on the private rental sector (PRS)

More than two-thirds (69%) of letting agents believed STLs would have a negative impact on the PRS, according to private rental statistics. A further 22% believed there would be no impact, and 9% stated the effect would be positive.

Of those letting agents surveyed by Paragon, around two in five (41%) were concerned about the impact of STLs on the PRS, compared to 54% of those who said the impact would be negative.

The reasons for this centred around the following:

-

Reduced supply as properties switch from the PRS to STLs

-

Additional pressure on rent and affordability

-

Putting agents out of business due to low supply.

Anyone who lets out a room can benefit from initiatives such as rent-a-room relief, allowing people to claim up to £7,500 tax-free from renting out a spare room.

In contrast, landlords of rented accommodation have seen their tax burden increase over recent years, including:

-

Higher rates of stamp duty for buy-to-let properties

-

Removal of tax relief on mortgage interest costs and replaced with a 20% tax credit

-

Removal of the 10% ‘Wear and Tear Allowance’ for fully-furnished properties and replaced with an at-cost relief scheme

-

28% Capital Gains Tax (CGT) for a rented property, when it was reduced to 18% for other assets

-

A rise in corporation tax from 19% to 25% from 2023.

The growth of STL properties managed by agents is also reflected in the figures, rising from 1% of their total portfolio in March 2019, to 1.7% in March 2022.

Recent regulatory changes in the UK short-term let (STL) market

Scotland

The Scottish Government introduced legislation for local authorities (LAs) to require STLs to be licenced. The scheme came into force on 1 October 2022 but, so far, only Edinburgh has outlined plans to enforce the scheme. Once in place, all STLs will require a licence before new booking can commence.

Wales

The Welsh Government has consulted on proposals to create new use classes for second homes and STLs. This will enable local planning authorities to manage their development through the General Permitted Development Order (GDPO) 1995, as well as extend powers to instil occupancy restrictions on any new-build property.

From April 1st 2023, changes were made to the categorisation of short-term lets in Wales. Previously, any holiday let registered as a business could pay business rates instead of council tax provided they were available to let for a minimum of 182 days a year and occupied for at least 70 days. This often resulted in no tax being paid instead of higher rate bills for second homes in some counties.

Now, a home must be available to let for a minimum of 250 days per year and occupied for at least 182 days.

England

The UK Government recently concluded a consultation on developing a tourist accommodation registration scheme in England. The Deregulation Act 2015 caused a relaxation in restrictions, meaning dwellings in London could be used as temporary visitor accommodation (for up to 90 days in a calendar year), without the need for planning permission.

Analysis by Property Mark, using Inside Airbnb data, shows that as of September 2022, 40% of properties listed as ‘entire home/apt’ were available for more than 90 days. This equates to 16,640 homes that could otherwise be occupied by long-term tenants, which would ease pressure and supply in the PRS.

68% of agents surveyed by Property Mark would welcome a licensing scheme with physical checks by the UK Government. This figure rose to 74% for those in coastal areas, 74% for tourist hotpots, and 79% for those concerned about the impact of STLs on the PRS.

Buy-to-let FAQs

What is a buy-to-let mortgage?

Buy-to-let mortgages are mortgages designed specifically for people who want to buy a property in order to rent it out. The vast majority of buy-to-let mortgages are provided on an interest-only basis. This means that landlords are only required to pay the monthly interest on the loan each month and none of the amount owed on the mortgage (known as the capital).

Instead, the full loan amount must be paid off at the end of the agreed term.

What happens if you get caught living in a buy-to-let property?

Living in a buy-to-let property you’re not supposed to be living in is a serious offence and is considered banking fraud. If you’re caught doing this, it can lead to legal penalties such as fines, sanctions, and even imprisonment, depending on the circumstances.

How does a buy-to-let mortgage work?

Unlike standard mortgages, most buy-to-let mortgages are interest-only. This means that monthly repayments will only pay off the interest from the loan and not the mortgage balance (known as the capital). Instead, the capital will be paid off at the end of the agreed fixed term.

How many houses do most landlords own?

As of 2023, the average UK landlord had between six and 12 properties on their portfolio. Regionally, those in Central London had the highest number of properties per landlord (11.6), with the lowest average found in the South West (6.4).

How much deposit do you need for buy-to-let?

Buy-to-let mortgages typically require higher deposits than a standard residential mortgage. Usually, lenders require a minimum deposit worth 25% of the property value. However, this can vary from 20% to 40% based on various factors such as the lender, the property value, and your own credit record.

How to work out the yield on a buy-to-let?

Working out the rental yield on a Buy-to-let property is simple. All you need to do is divide your annual rental income by the property’s value and multiply by 100.

Why are buy-to-let mortgages more expensive?

Buy-to-let mortgages typically require higher deposits and come with slightly higher interest rates. This is because lenders often view buy-to-let owners as a bigger risk as they have no control over who you let your property out to.

As tenant information is typically not passed onto the mortgage lender, they have no way of knowing whether or not your tenant can be trusted to make payments, resulting in higher rates and more stringent checks for the landlord.

How many buy-to-let mortgages can I have?

There is no limit on the number of buy-to-let mortgages you have, with many landlords having large portfolios of properties bought under the scheme. While there is no set limit on the number of buy-to-let homes a person can own, you will require approval from a lender every time you wish to purchase a new home. Like with any home purchase, approval will be subject to financial checks and reviews from the lender.

Buy-to-let glossary

Buy-to-let glossary

Arrears

Arrears refers to money that is owed that should have already been paid. In mortgage terms, this would mean a homeowner is behind on their agreed monthly payments.

Buy-to-Let

Buy-to-let is a specialised mortgage type aimed at buyers who wish to rent out the property they are purchasing.

EPC rating

An EPC rating is a score given to a property to grade its overall energy efficiency. Properties are graded from A (highest) to (G) and the rating is valid for up to 10 years.

Gross mortgage advances

The total value of mortgage loan payments paid to lenders over a given period.

House Price Index (HPI)

The HPI is a metric that measures the percentage change in the value of house purchases over a given period.

Private rental

Private rental refers to the renting of accommodation from a private landlord or anybody not associated with a government organisation or council.

Remortgaging

Remortgaging is when you move your mortgage on your existing property, from one lender to another.

Stamp duty land tax

Stamp duty land tax (SDLT) tax imposed by the U.K. government on the purchase of any land or property with value exceeding a set threshold.

Short-term letting

Short-term letting is when a residential property is rented out for a period of less than 90 nights. This includes renting out your property on sites such as Airbnb or Booking.com.

Tenant

Tenant refers to anyone who occupies a property rented from a landlord