Fears of up to three more interest rate rises this year have eased with economists saying the chances are now that there will be just the one, or even none.

Earlier this summer, markets expected interest rates to peak at 6 per cent but this now appears less likely, economists believe in what will come as welcome relief to home owners.

Of six senior economists i spoke to about what rate rises can be expected for the remainder of this year, four said it is possible there will be no more and if there are it will likely be just the one.

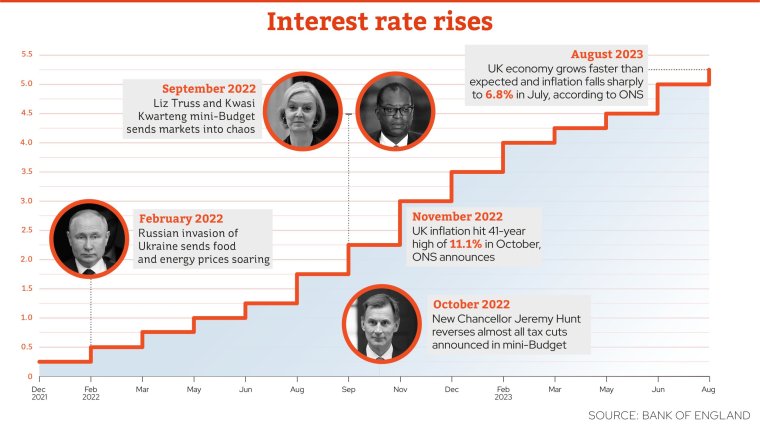

With interest rates having risen a record 14 consecutive times to 5.25 per cent since December 2021, home owners have faced dramatic increases in their fixed rate and variable rate mortgages.

But there are now rising hopes that the peak of interest rates may be closer than previously feared, and was hinted at last week by Andrew Bailey, Governor of the Bank of England which sets interest base rates.

Michael Saunders, a former member of the Bank of England’s Monetary Policy Committee (MPC) – which sets interest rates – said any base rate increase this month would “probably” be the last in the current cycle.

Another expert, Stephen Millard, deputy director at the National Institute of Economic and Social Research, said a “best guess” was one more rise, either in September or November.

Dr Edward Jones, a senior lecturer in economics at Bangor University, agreed, and said a rate rise in September could be the last we see “if the economy continues along its current trend.”

And Dr John Maloney, of Exeter University, believes interest rates might already have peaked and if not, only one more will be imposed this year.

It would be welcomed by mortgage holders as higher interest rates generally result in many people’s mortgage rates increasing. The monthly mortgage repayments for an average-priced home have gone up by £216 – a 23 per cent increase – in the last year according to the property website Zoopla.

However, expectations that interest rates are peaking are by no means unanimous, with two of the economists i spoke to convinced that two or more rises will be needed to rein inflation in.

One of them, Willem Buiter, former external member of the MPC from 1997 to 2000 and ex-chief economist at Citigroup, says the UK is still likely to need to hit a base rate 6 per cent before increases can cease.

Difficulties in controlling both the headline and core inflation rates mean, he said, it is “very likely that we’ll see Bank Rate at 6 per cent by early 2024”.

The base rate – which is the interest level the Bank of England charges to other banks to borrow from it and the yardstick used to price lending – currently sits at 5.25 per cent.

Speaking to MPs last week, Andrew Bailey, the bank’s Governor suggested that rates were close to their peak.

Mr Bailey told MPs on the Commons Treasury Committee that the period when it was “clear that rates needed to rise going forwards” was now over.

He added that he did not know whether he would vote to hike rates again at the next meeting of the Bank’s monetary policy committee on 21 September.

Pressed on the future path of rates, he said: “There was a period where it seemed to me to be clear that rates needed to rise going forwards, and the question for us was how much and over what time frame.

“But we’re not I think in that place anymore and that’s why we shifted our language to being much more evidence and data-driven.

“I think we are much nearer now to the top of the cycle. And I am not therefore saying that we are at the top of the cycle because we still have a meeting to come. But I think we are much nearer to it, on interest rates, based on the current evidence” he added.

As recently as August, several economists said they would take rates to 5.75 per cent in September, with a panel assembled by i only narrowly voting 5-4 for a 0.25 percentage point hike over a 0.5 percentage point one.

And some economists are still suggesting that rates will need to go far higher to get inflation down.

A full set of comments from i‘s panel of economic experts can be seen below:

Michael Saunders, former external member of the MPC from 2016 until 2022 and senior economic adviser at consultancy Oxford Economics:

“I think the September meeting is 50-50 at this stage. I would interpret Andrew Bailey’s comments as saying we’re near the top or at the top. That’s consistent with a rise this time or a hold. On one side you have pay growth has been stronger than expected and on the other there is evidence that the economy is weaker than expected.

“Of course, we have more data coming before the meeting, so it could tilt either way. I think what Andrew was trying to do was create the space for the bank not to hike if that’s what the data justifies but without strongly committing to the outcome.

“He’s not going to know what the data is going to be at this stage and he probably doesn’t yet know how the majority of other committee members are inclined to vote.”

“Based on current data, if there were a hike, it would probably be the last hike. I wouldn’t say I am confident, as that implies too much certainty, but it’s probably the last hike.”

Stephen Millard, deputy director for Macroeconomics at National Institute of Economic and Social Research (NIESR) and former senior research manager at the Bank of England.

“It will depend on the data but our best guess is one more rise either in September or November.

“The question to which I don’t know the answer is whether Andrew Bailey is hinting at a hold in September.

“The key data coming out soon will be the wage inflation number on Tuesday and the number for core inflation on the 20th. If they remain high, then rates will rise on the 21st. If the data weakens then they may hold.”

Dr Edward Jones, Senior Lecturer in Economics at Bangor University

“An increase in rates on 21 September could be the last we see if the economy continues along its current trend.”

It was interesting to see how the markets reacted to Andrew Bailey’s comments, with the sterling falling to a three-month low against the dollar.

“He signaled that interest rates are much nearer their peak than what was previously thought. This message is consistent with what we’ve recently heard from other MPC members.

“I suspect that next week’s Labour market figures, and the inflation data on the day before the MPC decision, will have a big impact on if there will be a pause in interest rate rises. Unless there are major changes in these data, I still expect the MPC to increase rates by 0.25 percentage points this time . One thing I am confident in is that the Bank of England is near the top of the rate rise cycle.”

John Maloney, associate professor of economics at Exeter University

“I’m not sure if there will be another rise in interest rates but, if there is, it will almost certainly be the last.”

Anne Sibert, professor of Economics at Birkbeck, University of London

“The way Mr Bailey’s comments were expressed is slightly befuddling. I would take that to mean he does not rule out a September increase, but he expects inflation to moderate soon.

“I think they will have to raise rates again in September. I am not sure that one more 0.25 percentage point increase will do the trick.”

Willem Buiter, former external ember of the MPC from 1997 to 2000 and ex-chief economist at Citigroup:

“It seems unrealistic that, with headline and core inflation still at the rate they are, the Bank Rate at 5.25 per cent would be at the top.

“I consider it very likely that we’ll see Bank Rate at 6 per cent by early 2024.”