With the domestic economy now in a technical recession, UK fixed income portfolio managers Kris Atkinson and Shamil Pankhania provide an insight into how investors should be approaching this weak macro backdrop. They highlight why recent data releases support a longer duration position and a focus on high quality credits with defensive characteristics.

Recently released UK inflation and Q4 GDP data have both surprised to the downside. This may demonstrate to the Bank of England (BoE) that longer-term trends are moving in the right direction, prompting a more accommodative policy stance. Although surprise UK retail sales may offer a glimmer of hope, the broader picture supports our view that biasing to a longer duration position and moving more defensively in credit exposure is the right call. Some of the duration bears rightly point to constructive labour data, which should not be ignored, but we question how reliable this is given poor response rates to the surveys.

UK inflation surprised to the downside…

January headline CPI came in 0.1 percentage points below expectations at 4.0% year-on-year (YoY). However, the bigger surprise came to core CPI (inflation with the more volatile food and energy components stripped out) which again came in 0.1 percentage points below expectations at 5.1% YoY. Core CPI is the stickier component of inflation. The Bank of England is therefore likely to focus on core CPI when assessing the longer-term trajectory of inflation.

… as did GDP growth!

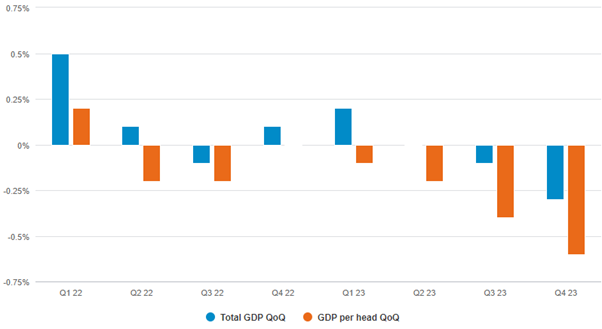

Not only did inflation surprise to the downside, but GDP data released for Q4 confirmed that the UK had entered a technical recession. A technical recession is defined as at least 2 quarters of negative growth. Q3 UK GDP had already been negative (-0.1% quarter-on-quarter, QoQ) and Q4 GDP shrunk by -0.3% QoQ.

The BoE’s Monetary Policy Committee (MPC) had projected 0.0% GDP growth for Q4, meaning that the negative surprise is likely to place pressure on policy makers to cut rates from their 15-year highs sooner rather than later. The Q4 estimate is the weakest quarterly change in real GDP since the global financial crisis in 2009, excluding 2020-21, which was a unique period for data amid Covid lockdowns. GDP per head paints an even bleaker picture: suggesting the UK has been in a technical recession since 2022, masked in the total GDP numbers by population growth.

GDP data has been bleak for some time when you strip out population growth

Labour data remains somewhat strong, but we should take this with a pinch of salt

Inflation and GDP data trending down in the right direction provides confidence that rates have peaked. The question is no longer if the BoE hikes, but when it cuts. However, we should not ignore constructive wage and labour data, which may mean the BoE hold a bit higher for longer and remain more restrictive for a while.

That said, while official employment data continue to suggest that the UK labour market remains tight, it should be taken with a big dose of salt. The Labour Force Survey showing a fall in the unemployment rate to 3.9% in Q4, from 4.2% in Q3, even further below the MPC’s estimate of its equilibrium rate, 4.25%, uses survey data with response rates in the mid-teens, well below the 2010s norm of 40%. As such, the heightened risk of non-response bias has forced the ONS to concede that its data should be “treated with additional caution”.

Moving up in quality and buying duration

Within the Fidelity Short Dated Corporate Bond we have had a tactical long duration bias for some time, given our negative outlook on UK growth and inflation. Since the beginning of 2024, we have been gradually increasing our exposure to UK duration given the negative growth and inflation picture, coupled with more attractive entry points from a yield perspective.

We are biasing the portfolios defensively from a credit perspective too, focussing on higher quality credit, in names which offer more defensive characteristics, such as utilities and securitised bonds.

Learn about the Fidelity Short Dated Corporate Bond Fund

Important information

This information is for investment professionals only and should not be relied upon by private investors. Past performance is not a reliable indicator of future returns. Investors should note that the views expressed may no longer be current and may have already been acted upon. The value of bonds is influenced by movements in interest rates and bond yields. If interest rates and so bond yields rise, bond prices tend to fall, and vice versa. The price of bonds with a longer lifetime until maturity is generally more sensitive to interest rate movements than those with a shorter lifetime to maturity. The risk of default is based on the issuers ability to make interest payments and to repay the loan at maturity. Default risk may therefore vary between government issuers as well as between different corporate issuers. Due to the greater possibility of default, an investment in a corporate bond is generally less secure than an investment in government bonds. Fidelity’s range of fixed income funds can use financial derivative instruments for investment purposes, which may expose them to a higher degree of risk and can cause investments to experience larger than average price fluctuations. Reference in this document to specific securities should not be interpreted as a recommendation to buy or sell these securities and is only included for illustration purposes.

Investments should be made on the basis of the current prospectus, which is available along with the Key Investor Information Document, current annual and semi-annual reports free of charge on request by calling 0800 368 1732. Fidelity only gives information on products and services and does not give investment advice to retail clients based on individual circumstances. Any comments or statements made are not necessarily those of Fidelity. Issued by FIL Pensions Management, authorised and regulated by the Financial Conduct Authority. Fidelity International, the Fidelity International logo and F symbol are trademarks of FIL Limited. UKM0224/386219/SSO/NA