UK inflation rate falls to lowest level in two years in February – what it means for your money

UK inflation fell by more than expected last month to the lowest level in over two years.

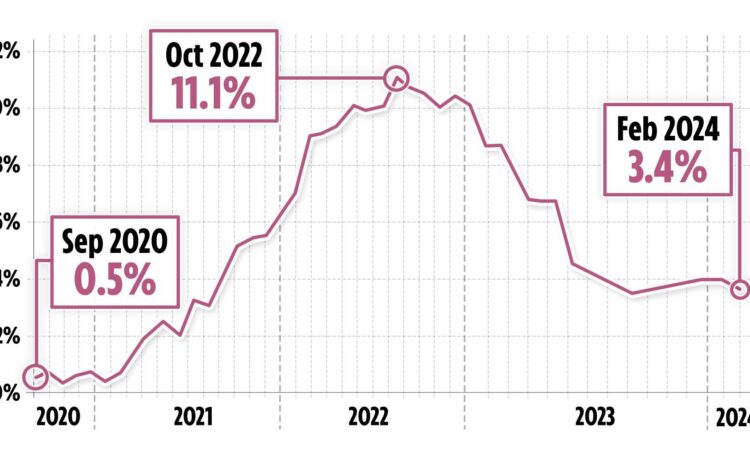

Consumer Prices Index inflation stood at 3.4% in February – down from 4% in January and the lowest since September 2021, according to new data from the Office for National Statistics (ONS).

Most economists had been expecting inflation to stand at 3.5% last month.

Inflation is now closer towards the Bank of England’s 2% target and comes ahead of the latest interest rate decision tomorrow.

Policymakers are widely expected to keep rates on hold at 5.25%, but the steep fall could see the Bank move closer to cutting rates later this year.

Chancellor Jeremy Hunt said: “The plan is working. Inflation has not just fallen decisively but is forecast to hit the 2% target within months.

“This sets the scene for better economic conditions which could allow further progress on our ambition to boost growth and make work pay by bringing down national insurance as we work towards abolishing the double tax on work – but only if we can do so without increasing borrowing or cutting funding for public services.”

Inflation is a measure of how the price of goods and services has changed over the past year.

Grant Fitzner, chief economist at the ONS, said: “Inflation eased in February to its lowest rate for nearly two-and-a-half years.

“Food prices were the main driver of the fall, with prices almost unchanged this year compared with a large rise last year, while restaurant and café price rises also slowed.

“These falls were only partially offset by price rises at the pump and a further increase in rental costs.”

Prices for food and non-alcoholic beverages rose by 5% in the year to February 2024, down from 7% in January.

This figure is the lowest annual rate since January 2022.

On a monthly basis, food inflation lifted by 0.2% – far lower than the steep rises seen a year earlier.

The annual rate for restaurants and hotels also fell in February, from 7.1% in January to 6%.

It comes after the rate of inflation rose unexpectedly to 4% at the end of last year.

It was the first time it had increased since February 2023 and came as a surprise to many economists.

High inflation means the cost of everyday essentials, like food and energy are rising, meaning your money doesn’t go as far.

What it means for your money

High inflation means that the cost of everyday essentials is rising and therefore your money doesn’t go as far.

When inflation drops it doesn’t mean that prices have stopped rising it just means that they are rising at a slower rate.

Alice Haine, personal finance analyst at Bestinvest, said: “Easing inflation will certainly be welcomed by households whose finances have been forced to absorb soaring price rises during the peak of the cost-of-living crisis.

“Of course, prices are still rising, but at a less rapid pace – a huge comfort when you consider inflation hit a worrying high of 11.1% in October 2022.”

But with household bills including Council Tax and the TV licence fee set to rise in April, some experts are warning that there is still pressure on household budgets.

David Cheadle, chief operating officer at National Debtline, said: “This fall in the rate at which prices are increasing is welcome, but the challenges facing millions of people already struggling are far from over.

“With energy arrears at record levels, and higher council tax bills now landing on doormats, for many households it will feel like there is no end in sight to the financial pressure they are under. Without further support, more people will face unaffordable debts.

The Bank of England (BoE) and the UK’s central bank can hike its base rate to try and bring inflation down.

This is good news for people who have savings, as they might see a boost.

It is bad news for homeowners, as it also means interest rates on mortgages rise meaning more pressure for homeowners.

But falling inflation offers some home to mortgage holders and prospective buyers, who will be hoping for interest rate cuts.

The Bank’s base rate currently stands at 5.25%, with the Central Bank set to meet again tomorrow (March 21).

Alice said: “Most households would welcome an interest rate cut tomorrow, but the BoE is expected to keep interest rates at the current level for the fifth successive meeting following 14 consecutive increases between December 2021 and August 2023.

“With the first rate cut not expected until the summer, all eyes are pinned on what the central bank has to say tomorrow to see if there are any hints of earlier action.”

This means borrowing costs could remain higher for longer while the BoE waits for more consistent evidence that inflation is easing.

Do you have a money problem that needs sorting? Get in touch by emailing money@the-sun.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories.