UK inflation rate falls AGAIN in election boost for Rishi Sunak – what it means for your money – The Sun

THE UK’s rate of inflation hit the Bank of England’s target last month in a boost for Rishi Sunak and with just over two weeks left until the General Election.

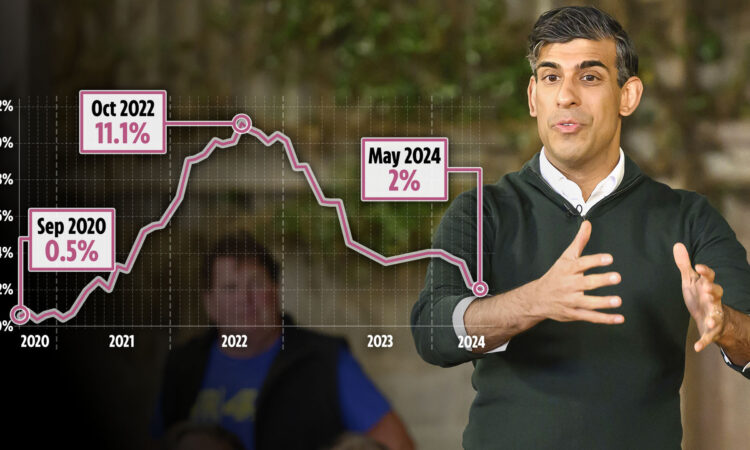

Consumer Prices Index (CPI) inflation stood at 2% in May according to fresh numbers from the Office for National Statistics (ONS).

This is down from 2.3% in the 12 months to April, which marked the lowest level in around three years.

It is also down from a peak of 11.1% in October 2022, which was driven by soaring gas and electricity prices.

The latest figures mean inflation has hit the BoE’s target of 2% for the first time since July 2021.

They will come as a boost to Rishi Sunak who made lowering inflation one of his party’s five pledges in January last year.

Posting on X earlier this morning, the Prime Minister said: “Great news this morning that inflation is back to normal at 2%.

“That’s lower than Germany, France and America.

“When I became Prime Minister inflation was at 11%, but we took bold action, we stuck to a clear plan and that’s why the economy has now turned a corner.”

Meanwhile, Jake Finney, economist at PwC, added: “Today marks a decisive moment in the fight against inflation as it is the first time it has been confirmed that CPI inflation has returned to the Bank of England’s 2% target in almost three years.

“This is the longest period that inflation has exceeded the 2% target since the early 2010s, when it took four years to return to target.”

Inflation is a measure of how much the prices of everyday goods such as food and clothes, and services such as train tickets and haircuts, have increased compared to a year earlier.

It’s important to note when inflation falls that doesn’t mean prices have stopped rising, they are just increasing at a slower pace.

The BoE will be watching today’s figures closely as it decides whether to lower its base rate tomorrow (June 20).

However, the central bank is not expected to cut interest rates until after the General Election on July 4.

It offers hope to mortgage holders and prospective buyers that interest rates could come down sooner rather than later though.

It comes with interest rates at a 16-year high of 5.25%.

Analysis: Good news for Rishi

By Jack Elsom – Chief Political Reporter

FOR a man who prides himself on economic competence, this is the day Rishi Sunak has been waiting for.

Inflation has finally returned to the Bank of England’s two per cent target after a three-year battle to tame price rises.

For ordinary families, it means goods in the shops are getting more expensive less quick – a good thing.

But it also marks a political victory for the PM, who made wrestling down rates his flagship mission upon entering No10.

When he first pledged to halve inflation in January last year, it was running at a crippling 11 per cent.

That task was ticked off earlier this year, and progress to return inflation to a comfortable 2 per cent continued.

Critics will inevitably try to deny Sunak the credit – instead praising the Bank’s tight grip on interest rates or the fading aftershocks of the twin Covid and Ukraine crises.

But the PM can legitimately point to decisions he has taken to help drive down inflation – not least refusing to give in to mammoth pay demands from some unions.

Yet will this really shift the dial in an election campaign where the Tories are languishing around 20 points behind in the polls?

Conservative hands have long clung to the “it’s the economy stupid” strategy – that people will reward governments who make them feel better off.

But there’s the rub: do people actually FEEL better off?

While the cost of things like food, energy and clothes have fallen – they are still a fifth more expensive than they were just three years ago.

So you can forgive people who are still struggling to have looked at today’s stats and just shrugged.

What it means for your money

Because inflation is a measure of how much the price of a basket of goods is rising, if it slows it’s good news for your pocket.

However, even if inflation is slowing, it still means prices are rising, just at a slower pace.

Alice Haines, personal finance analyst at BestInvest, said: “Hitting the 2% inflation milestone will be a major moment for the BoE after a long, drawn-out battle to bring rampant inflation down from the double-digit levels seen just over a year ago.”

She added the news inflation has slowed to 2% would be “comforting” for households.

However, she said it would be unlikely to lead to an interest rate cut any time soon.

The analyst said: “It is unlikely to result in an immediate rate cut tomorrow as CPI services inflation has slowed but remains stubbornly high and core inflation, which strips out the more volatile items such as food, alcohol and tobacco, has eased but continues to sit above the 3% mark.”

Whether inflation will stay at the 2% rate for the foreseeable future is yet to be seen too.

Why does inflation matter?

INFLATION is a measure of the cost of living. It looks at how much the price of goods, such as food or televisions, and services, such as haircuts or train tickets, has changed over time.

Usually people measure inflation by comparing the cost of things today with how much they cost a year ago. The average increase in prices is known as the inflation rate.

The government sets an inflation target of 2%.

If inflation is too high or it moves around a lot, the Bank of England says it is hard for businesses to set the right prices and for people to plan their spending.

High inflation rates also means people are having to spend more, while savings are likely to be eroded as the cost of goods is more than the interest we’re earning.

Low inflation, on the other hand, means lower prices and a greater likelihood of interest rates on savings beating the inflation rate.

But if inflation is too low some people may put off spending because they expect prices to fall. And if everybody reduced their spending then companies could fail and people might lose their jobs.

See our UK inflation guide and our Is low inflation good? guide for more information.

Luke Bartholomew, deputy chief economist at Abrdn, said: “The big question now is whether underlying inflation pressures in the economy are consistent with inflation staying around 2% in the medium term, or whether inflation will start to edge higher again once favourable base effects fade.

“On that front, there is still evidence of residual stickiness in services inflation, reflecting the strength of wage growth recently.

“That is why an interest rate cut tomorrow is still very unlikely.

“But we think the Bank’s communication tomorrow will set out a path for a cut in August, which is now looking increasingly likely.”

The National Debtline said although inflation was slowing, those on the lowest incomes were still struggling.

Steve Vaid, chief executive of the Money Advice Trust, the charity that runs National Debtline said: “Our National Debtline advisers continue to hear from people grappling with debts for essential costs including energy, council tax, and rent or mortgage repayments.

“I would urge anyone worried about their bills to seek free, independent debt advice from National Debtline.

“No one needs to struggle alone – our advisers are here to help.”

Do you have a money problem that needs sorting? Get in touch by emailing [email protected].

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories