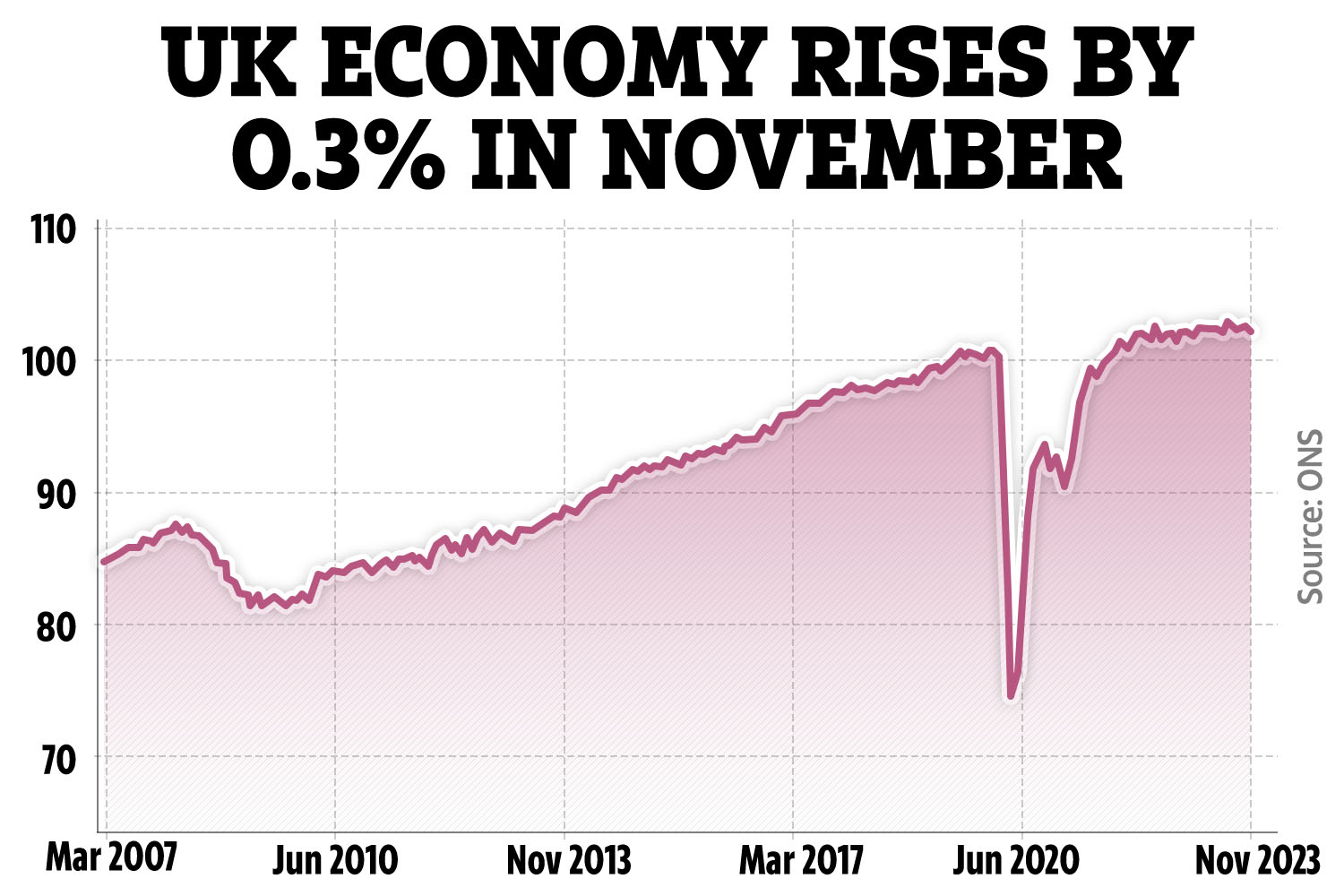

THE UK economy returned to growth, the latest figures show.

Gross domestic product (GDP) rose by 0.3% in November after falling by 0.3% in October, the ONS said.

The uplift was driven by the services sector, which rose by 0.4% during the month, and was the biggest contributor to economic growth.

Economists had been expecting GDP to rise by 0.2%.

Real gross domestic product (GDP) is estimated to have fallen by 0.2% in the three months to November 2023, compared with the three months to August 2023.

Monthly GDP is estimated to have grown by 0.3% in November 2023, following an unrevised fall of 0.3% in October 2023.

Services output grew by 0.4% in November 2023 and was the main contributor to the monthly growth in GDP; this follows a fall of 0.1% in October 2023.

Production output grew by 0.3% in November 2023, following a fall of 1.3% in October.

The construction sector fell by 0.2% in November 2023 after a fall of 0.4% in October 2023.

Chancellor of the Exchequer Jeremy Hunt said: “While growth in November is welcome news, it will be slower as we bring inflation back to its 2% target.

“But we have seen that advanced economies with lower taxes have grown more rapidly, so our tax cuts for businesses and workers put the UK in a strong position for growth into the future.”

These recent figures mean that the UK is teetering on the brink of falling into a technical recession at the end of the year, which can be defined as two consecutive quarters of negative growth.

The economy declined between July and September, according to revised estimates from the ONS.

Therefore, monthly GDP would need to be fractionally below zero in December, 0.02% or more, for the economy to have shrunk between October and December as well.

The ONS’s chief economist Grant Fitzner said: “The economy contracted a little over the three months to November, with widespread falls across manufacturing industries, which were partially offset by increases in public services, which saw less impact from strike action.

“GDP bounced back in the month of November, however, led by services with retail, car leasing and computer games companies all having a buoyant month.

“The longer-term picture remains one of an economy that has shown little growth over the last year.”

What does it mean for my money?

A healthy economy is one that is growing and not in recession.

A recession occurs if there are two consecutive quarters of GDP falling, the year is split into four three-month quarters.

Recessions are bad news because it usually means jobs will be lost and wages will stall.

It can cause businesses to go into administration or bust too.

This, in turn, means the government gets less tax, which could mean cuts to public services and benefits such as Universal Credit. Tax rates might go up too.

How to protect your finances

There are things you can do to try and protect your cash if you are worried about your finances.

Having an emergency savings pot is helpful in times of inflation as this will help to cover any outgoings or unexpected increases.

It is also a good time to shop around for better deals on things such as car insurance, broadband and your mobile phone.

When money is tight it can be tempting to ignore debts – but this will only make things worse.

Stay on top of what you owe and always repay priority debts.

If you are struggling with your bills you should also reach out to you supplier and see what help they have on offer.

There are also plenty of organisations where you can seek debt advice for free.

These include:

- National Debtline – 0808 808 4000

- Step Change – 0800 138 1111

- Citizens Advice – 0808 800 9060