U.S. Money Supply Is Shrinking the Most Since the Great Depression. Does It Spell Doom for the Stock Market in 2024?

Predictions about how stocks will perform in the new year are already beginning to circulate. Some think the prospects should be good since the S&P 500 typically rises during U.S. presidential election years. Others foresee a mild recession on the way, which would likely cause stocks to fall.

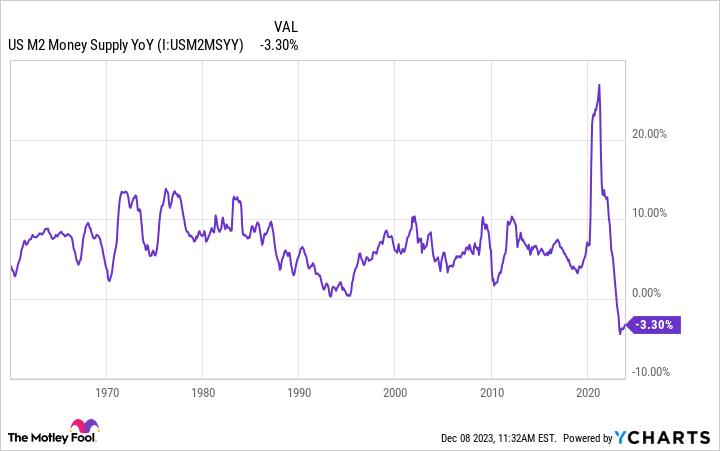

But perhaps the most intriguing prognostications dive into especially arcane economic waters. Some point out (correctly) that the U.S. money supply is shrinking the most since the Great Depression. Does this spell doom for the stock market in 2024?

Image source: Getty Images.

Plunging money supply

Money supply is simply the total amount of money in circulation. The two most common ways to measure money supply are called M1 and M2. M1 is the total amount of money held by the public in cash, coins, and traveler’s checks and in banks, regular savings accounts, and credit unions. M2 is M1 plus money held in short-term time deposits such as certificates of deposit (CDs) and in money market funds.

Economists closely track the money supply. And the U.S. money supply is indeed shrinking quite dramatically.

US M2 Money Supply YoY data by YCharts

The year-over-year change in M2 money supply is now negative for the first time in decades. But the chart shown above only goes back to the 1960s. The current U.S. money supply shrinkage reflects the steepest decline since the Great Depression of the 1930s.

Doom and gloom for 2024?

There are several implications for a shrinking U.S. money supply. Interest rates rise. Economic growth slows. Unemployment increases. If you think that none of those sound great for the U.S. economy or the stock market, you’re right.

U.S. money supply has declined by 2% or more only four times since 1870 other than the current contraction. In each of those previous cases, a major U.S. economic downturn followed. It’s understandable why some think that the current money supply shrinkage portends doom and gloom for the stock market in 2024.

However, such dire predictions could be dead wrong. Goldman Sachs economist Manual Abecasis wrote in a report earlier this year that measures such as M2 money supply haven’t been reliable in forecasting what the economy will do for a long time. Things are different now, according to Abecasis, because of major changes that have reduced the demand for cash.

George Washington University economics professor Pao-Lin Tien is on the same page as Abecasis. He told Marketplace in June that the “connection between money stock [supply] and economic activity has been declining over time.” Tien pointed out, “These days, very few of us carry cash.”

The reality is that cash is no longer king. Physical currency has been replaced significantly by credit cards and digital payments such as Apple Pay, Cash App, and Venmo. Money supply still matters — just not nearly as much as it once did.

This time it’s different

So does the shrinking U.S. money supply spell doom for the stock market in 2024? I don’t think so. I usually cringe when I hear the four words: “This time it’s different.” However, there’s a good argument that this time truly is different than the past cases when the U.S. money supply contracted.

However, I wouldn’t rule out the possibility that stocks could fall next year. There are plenty of other potential culprits that could cause the stock market to stumble. On the other hand, I won’t be surprised if the market rises with continued economic growth, relatively mild unemployment, moderating inflation, and stable (or perhaps even lower) interest rates.

No one knows for sure whether 2024 will bring a boom or doom for stocks. The one prediction that I can make with confidence about the stock market is that it will go up — over the long term.

Keith Speights has positions in Apple. The Motley Fool has positions in and recommends Apple and Goldman Sachs Group. The Motley Fool has a disclosure policy.