The Bank of England’s “omnibus” account was introduced in 2021 to spur innovation and competition in payments As Huw van Steenis, who was an advisor to the former Governor Mark Carney said at the time, commented on the future of finance saying that “this is what to watch, not the Bahamas’ sand dollar”. Wise words.

Where’s The Money?

One of the first users of the new type of account is Fnality, formerly known as the Utility Settlement Coin (USC), which has just gone live. Fnality’s backers (who include Goldman Sachs, Barclays, BNP Paribas, BNY Mellon, CIBC, Commerzbank, DTCC, Euroclear, ING, KBC, Mizuho, MUFG Bank, Nasdaq Ventures, Nomura, Sumitomo Mitsui, State Street and WisdomTree) think that tokenised Sterling that can be in cross-border, round-the-clock wholesale transactions will reshape financial markets. Now that it has made its first transactions, it is a good time to look at what might happen when everything is tokenised, when tokenised securities are traded for tokenised money everywhere and all the time.

A report from by the Global Financial Markets Association, Boston Consulting Group and others earlier this year estimated that the value of tokenised illiquid assets will increase from roughly $0.3 trillion in 2022 to about $16 trillion by 2030. That’s serious business. When I was at the Financial Times Crypto and Digital Asset Summit in London earlier this I enjoyed an informed panel discussion about this business and its potential to bridge the gap between traditional finance and “crypto” markets. Staci Warden, CEO of the AlgorandALGO Foundation, made a brilliant point about the tokenisation of money market funds in passing and I wasn’t sure that the audience picked up on the significance of her comment. What she said was that a token for a “sliver” of such a fund is “indistinguishable from money”.

She is right, of course, but I would have made the point even more strongly: I would say that such tokens remove the need for money completely. If you can keep all of your wealth in assets all the time, and you can trade those assets in 24/7 liquid markets, then why would you “cash out” into fiat currency or stablecoins or BitcoinBTC or anything else?

Tokenisation is moving to the mainstream. Not because of technologists, but because the serious finance players see it as a better way to work. Luke Brereton, head of client engagement and strategy at investment company State Street Digital, says tokenisation is attracting significant interest and activity with a majority of its asset manager clients for precisely that reason: “In short, this technology can help funds, and the industry, achieve two goals: improved efficiency and enhanced asset utility — with the former providing increased margins and the latter driving capital inflow for funds”. As that article in The Banker goes on to explain, the improved efficient comes from automation not only because automation makes the transaction and post-trade processes cheaper, but because it can eliminate some of the processes completely.

Fungible and Non-Fungible

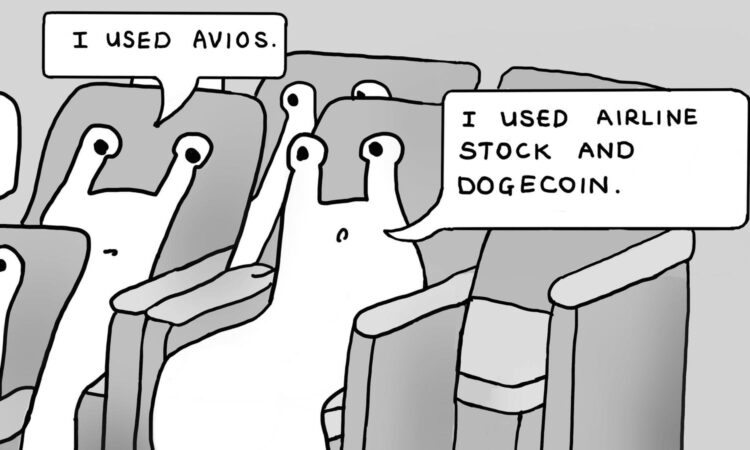

The implications are huge. Staci made a very good point about the impact of taking things that are non-fungible (such as tickets) and turning them into non-fungible tokens (NFTs). She used the example of Flybondi, an Argentinian budget airline, and its “Ticket 3.0” initiative, which includes turning all flight tickets into NFTs (known as NFTickets). NFTNFT ticketing company TravelX provides a decentralised P2P marketplace for such products (using Algorand’s blockchain) so that ticket holders can sell, exchange, transfer or auction their tickets after purchase.

Now, let’s go back to that point from Luke about what he called “enhanced asset utility” and think about the marketplace of the future where non-fungible tokens such as airline tickets are bought using fungible tokens such as slivers of money market funds. The logic of Staci’s argument is straightforward. In an always-on world, what is the point of paying fees to sell assets, buy currency and then transfer currency to someone who is going to sell it to buy other assets. In a time before networks, when strangers came to do business, they preferred to trust money rather than each other. Now we use networks to “authorise”, but in the future, that won’t be necessary. If you can be sure of the ownership and value of the assets, then you can just trade the assets.

It’s all money.

© Helen Holmes (2023).

You sell me your NFT for a flight to Buenos Aires next Tuesday and I’ll pay you half in Bitcoin and half in IBMIBM stock. I sell you a car, you pay me in Giants tickets, office space and a square inch of the Mona Lisa. It doesn’t matter whether you want Giants tickets or not. There is no problem with what economists refer to as the “double coincidence of wants” because assets can traded away, instantly, around the clock and across the Metaverse. Somewhere out there is someone who has the tabletop model of a Tarrasque that I want and who wants the Giants tickets or something that I can swap the Giants tickets for. These trades can be completed between supercomputers in milliseconds to deliver to the counterparties with precisely what they want.

Crazy? No!

Sir Jon Cunliffe, who was the Deputy Governor for Financial Stability at the Bank of England gave his final speech about this. He said that he technologies that are loosely grouped under the broad heading of tokenisation (including cryptography, distributed ledger, atomic settlement, blockchain, fractionalisation and programmability) enable “new ways of representing money” that allow for greater automation of the transfer of money and the deeper integration of that transfer – the payment – into other processes. He is of course correct about this, but there are people (eg, me) who think that this vision is not radical enough because in the long term, liquid assets will not be new ways of representing money, they will serve in the place of money.

What this means is that instead of thinking about the future of money as cryptocurrency, central bank digital currency or private currencies of one form or another, we can think about the future of money as no money at all. That world, in which assets are constantly on the move, sounds crazy – but when the noted fintech investor Matt Harris talks about “the end of money”, and I think he and Staci (and for the matter the noted lateral thinker Edward de Bono) are absolutely right.

Follow me on Twitter or LinkedIn. Check out my website or some of my other work here.