Growing numbers of Britons are being forced to turn to a digital-only bank as a result of local bank branch closures.

As many as 16 per cent of Britons have opened or plan to open a digital-only current account due to traditional bank branch closures in their local area, according to research by the comparison site Finder.

High street banks have shut 5,355 branches since January 2015, according to consumer group Which?.

Smartphone banking: Over the next 12 months, a further 10 per cent of the population said they plan to open a digital-only bank account, according to Finder

Already this year 102 bank branches have been earmarked for closure. If closures continue at this rate for the rest of the year, they will likely eclipse the figure of 619 for 2022.

Overall, a quarter of adults currently have an account with a digital-only bank, up from just 9 per cent of the population when the research was first conducted in 2019.

This is not surprising given how quickly some of the online-only banks have grown in recent years.

Monzo claims to have picked up more than 7 million customers since it launched back in 2015, while Starling Bank has picked up roughly 3.5 million customers since 2014.

JP Morgan’s bank brand Chase, which launched in the UK in September 2021, picked up more than 1 million within its first year.

Over the next 12 months, a further 10 per cent of the population said they plan to open a digital-only bank account, according to Finder.

Bank branch closures is unlikely to be the only reason behind increasing numbers of people setting up digital-only bank accounts.

Digital banks are offering some of the best easy-access savings rates at a time when many of the high street banks are paying sub-standard rates.

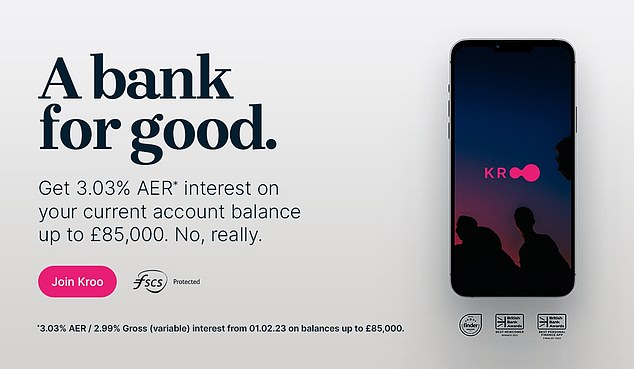

For example, Kroo pays 3.03 per cent in-credit interest while Chase and Monzo both have linked instant access savings accounts paying 3 per cent.

Digital-only banks also almost always allow free transactions abroad, which many of the high street banks do not.

Many of the big banks, will charge a transaction fee when using its debit card abroad. For example, Lloyds and Barclays charge 2.99 per cent while NatWest and HSBC charge 2.75 per cent. They will also typically charge ATM withdrawal fees.

The UK’s digital-only banks tend to spare their customers from these sneaky fees.

We decided to take a closer look at the four most popular digital-only bank accounts on offer to Britons right now.

What is it?

Chase is part of US financial giant JP Morgan, and launched in Britain in September 2021.

During its first year of offering bank accounts in the UK it hoovered up more than one million customers.

However, it is by no means a new player on the banking scene as it also has 56 million digital customers in the US, and its parent company JPMorgan manages trillions of pounds of assets.

Chasing customers: Chase has attracted more than 1million Britons in its first year in the UK

Standout features

- One per cent cashback on card spending for 12 months (capped at £15 a month)

- Cashback offer extends for one-year if you deposit £500 a month into the account

- Access to linked easy-access savings account paying 3 per cent

- Round up transactions to put saving on autopilot with 5 per cent interest

- From April 2023 you can earn 1 per cent interest on current account balances

- There are no charges for using the Chase debit card abroad

- It also has a numberless card for an extra layer of security

App rating:

- Apple app store: 4.9

- Google Play: 4.6

Watch out:

It is worth noting you will need a relatively new smartphone to run the account.

Your smartphone will need to run iOS 14 and above, or have access to Google Play on Android 8.1 and above, which means some devices are not supported due to hardware limitations.

The bank also does not currently offer joint accounts, so it will not necessarily work for everyone.

Chase does not allow overdrafts, so the limit on the payments you can make is the amount you hold in your account.

What is it:

As online-only banks go, Monzo has one of the longest history and biggest customer base.

It was founded in 2015 and claims to be the UK’s largest digital bank with more than 7 million customers, adding 150,000 new ones every month.

Big player: Monzo was founded in 2015 and claims to be the UK’s largest digital bank with over 7 million customers, adding 150,000 new ones every month

Standout features:

- Monzo has a linked 3 per cent instant-access account

- Instant spending notifications and spending budgets on things like groceries

- Categorises spending into groups such as transport, groceries and eating out

- No fee for using card abroad

App rating:

- Apple app store: 4.6

- Google Play store: 4.1

Watch out:

There are three types of personal current account to choose from: the standard free account, the £5 a month Monzo Plus and the £15 Monzo Premium.

Most people opt for the free account. The other two accounts offer extras such as phone insurance or rounding up spare change into savings.

Overdraft rates are either 19 per cent, 29 per cent or 39 per cent, depending on credit score.

What is it:

Originally a smartphone-only bank with an offering aimed largely at holidaymakers, Starling has increasingly grown into a legitimate, profitable, challenger to Britain’s biggest banks.

It currently has more than 2,000 employees and serves roughly 3.5 million current account customers.

It has consistently gained the highest number of net accounts through the official Current Account Switching Service since the start of 2020.

Most popular: Starling Bank one the best current account provider at the British Bank Awards this year

Standout features:

- No fees overseas

- Instant payment notifications

- Round up transactions to put saving on autopilot

- Your spending categorised

- Instant card locking security

- Split the bill with friends

App rating:

- Apple app store: 4.9

- Google Play: 4.5

Watch out:

Starling offers an arranged overdraft option. Rates are charged at 15 per cent, 25 per cent or 35 per cent depending on credit score.

What is it:

Although founded back in 2016, Kroo is very much the new kid on the block, having launched its current account at the end of last year after being granted a full UK banking licence.

Kroo is also aiming to appeal to people by promising to plant two trees for every account opened, with the aim of planting one million trees by the end of 2023.

Join the Kroo? The digital challenger bank has increased its current account interest rates to 3.03 per cent on balances up to £85,000

Standout features:

- It is paying 3.03 per cent in-credit interest on balances up to £85,000

- No additional charges when spending abroad

- It will plant two trees for every current account opened

- Bill splitting feature allows its customers to spend, track and settle up with friends

- Instant spending notifications

- Breaks spending into categories, such as transport, groceries and eating out

App rating:

- Apple app store: 4.7

- Google Play: 4.4

Watch out:

As the newcomer this is the most untested of all four bank accounts. There have been reports of long wait times due to high demand for those wanting to sign up.

Kroo does offer an arranged overdraft option. The rate is charged at 24.9 per cent.

THIS IS MONEY’S FIVE OF THE BEST CURRENT ACCOUNTS

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.