Anna Moneymaker

Investment action

I recommended a buy rating for T-Mobile US (NASDAQ:TMUS) when I wrote about it the last time, as I expected TMUS to continue generating attractive FCF that would be distributed back to shareholders. Based on my current outlook and analysis of TMUS, I recommend a buy rating. My thesis for TMUS is playing out nicely as the business continues to generate cash and return it to shareholders. At the current ~10% FCF yield, I believe the upside remains attractive.

Review

3Q23 results were solid. Total revenue for TMUS came in at $19.3 billion, with $15.9 billion coming from the Service segment. Service revenue saw an acceleration in growth of 80bps to 3.6% growth from the 2Q23 2.8% growth. The focus is on profits as it drives FCF. Due to growing service revenues and greater synergy realization, core adj EBITDA was reported at $7.5 billion, an increase of 12.2%. Finally, TMUS’s $4 billion in FCF was higher than expected, coming in at $3.8 billion.

My thesis of TMUS is playing nicely as the business continues to grow and generates cash.

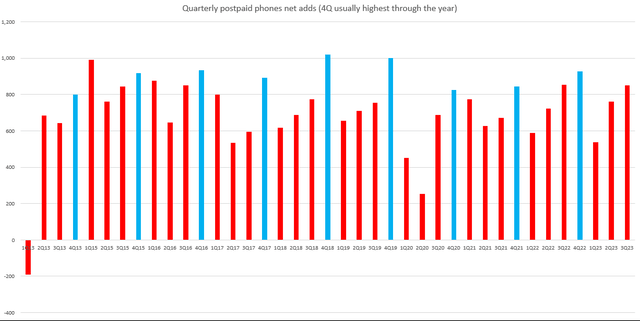

The postpaid phone segment continues to grow steadily. With a churn rate of 0.87% and net adds of 850k for postpaid phones in 3Q23, management is now expecting net adds of around 3mn for the whole year and is now guiding for total postpaid net customer additions of between 5.7 million and 5.9 million, up 50k at the midpoint. This would indicate roughly 850k net additions to the postpaid phone user base in 4Q23 (the same as 3Q23), but I suspect management is understating this number because 4Q is traditionally the strongest quarter of the year in terms of postpaid phone net additions. Therefore, I think that management’s full-year forecast of 3 million postpaid phone net adds is conservative, and we could see a beat in the coming quarter.

Author’s work

Postpaid phone ARPU is also trending well at $48.93. During the conference call, management highlighted rising Consumer phone ARPU, which is in line with the company’s introduction of more expensive plans that provide more value and remain among the most sought-after by new customers. However, given the strong growth in the Business segment, which typically results in lower ARPUs because of significantly smaller account sizes, is likely to cancel out this positive impact, I will not be modeling an increase for ARPU. Investors modeling TMUS should also keep in mind that softness in upgrades is likely to have a negative effect on pricing. The 2.7% branded postpaid upgrade rate for TMUS in 3Q22 was 110bps lower than the 3.8% rate in 3Q22. This is due to the fact that 70% of the TMUS base already possesses a 5G handset, the upgrade rate was lower. My guess is that this means customers are content with the 5G service they have now and are less likely to upgrade.

As for the fixed wireless segment, similar positive strength can be seen. Fixed wireless net adds were 557k and should continue to grow at a healthy pace. In my opinion, TMUS will continue to see quarterly net adds in a similar range given that the service’s penetration is low and its awareness is still growing among TMUS’s mobile customers and consumers.

All in all, TMUS continues to execute very well on all fronts. TMUS has been able to conduct buybacks thanks to the growth in postpaid phone additions, accounts, low churn, improved APRA, and increased service revenue and margins. So far into this year, TMUS has been buying shares every single month, accumulating a total of ~77.5 million shares, or ~6% of shares outstanding as of the end of FY22. Annualizing this figure, TMUS is on track to buy back 103 million of shares, equating to 8.3% of end FY22 shares. Consensus are expecting generate $16 billion in FCF in FY24. At the current share price of $147, TMUS could easily purchase another 100 million shares if they choose to return the entire FCF back to shareholders.

Valuation

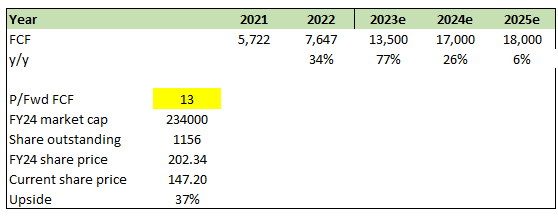

Author’s work

Note I am revising my model to focus on FCF, as it is well guided and, I think, a core indicator of TMUS shareholder returns. Using management FY23 and FY24 guidance, I modeled $13.5, $17, and $18 billion for FY23/24/25, with FY25 benchmarked against the high end of the FY25 FCF guided range. The beauty of investing with TMUS is that ~9% of returns are visible, as TMUS can buy back another 100 million shares based on the FCF outlook. Even if TMUS does not allocate the entire FCF to buy back shares, at the current FCF multiple, the stock upside remains attractive. TMUS currently trades at 10x P/fwd FCF (~10% FCF yield), which is an all-time low over the past 6/7 years. One could argue that because of the high interest rate environment, investors are seeking a higher yield from TMUS. My view is that once rates start normalizing, TMUS FCF multiple should increase back to its historical level of ~13 to 15x FCF (7 to 8% FCF yield).

Risk and final thoughts

A key part of my thesis is that the TMUS will allocate FCF back to shareholders. If, for whatever reason, management decides to use FCF to conduct value-destructive M&As, this will totally decimate my buy thesis. In that case, the market is unlikely to give TMUS credit for the FCF it is generating.

Overall, I reiterate my buy rating for TMUS due to its consistent cash generation and shareholder-friendly approach. While TMUS currently trades at a 10x P/fwd FCF, reflecting an all-time low over the past few years, I anticipate a potential increase in FCF multiples once interest rates normalize.