The Southwest Rapid Rewards Plus credit card comes with solid rewards at a lower cost than many other cards. It’s ideal for frequent Southwest flyers who aren’t worried about status.

About the Southwest Rapid Rewards® Plus Credit Card

If you love Southwest, you should look into the Southwest Rapid Rewards Plus credit card. Several great benefits come with the card for a low $69 annual fee, like 3,000 points each account anniversary and two EarlyBird check-ins each year. Currently, you can get 50,000 bonus points after spending just $1,000 on purchases within the first three months from account opening.

You earn 2 points per dollar on Southwest purchases, on Rapid Rewards hotel and car rental partners, local transit and commuting, rideshare, internet, cable, phone services, and select streaming services. Even for infrequent Southwest flyers, the card provides moderate benefits at an affordable price.

Southwest Rapid Rewards® Plus Credit Card basics

- Annual fee: $69.

Welcome bonus: 50,000 points after spending $1,000 on purchases in the first three months from account opening. - Rewards: Earn 2 points per dollar on Southwest Purchases, Rapid Rewards hotel and car rental partners, local transit and commuting, rideshare, internet, cable, phone services, and select streaming. Earn 1 point per dollar on all other purchases.

- Regular APR: 20.74% – 27.74% variable.

- Other perks and benefits: 3,000 points each account anniversary, two EarlyBird check-Ins each year and 25% back on inflight purchases, 10,000 points annually towards the Companion Pass.

- Does the issuer offer a preapproval tool? No.

- Recommended credit score: Good to excellent.

Southwest Rapid Rewards® Plus Credit Card details

Southwest Rapid Rewards® Plus Credit Card rewards

Cardholders will earn 2 points per dollar on Southwest purchases when booking with Rapid Rewards hotel and car rental partners, on local transit and commuting, including rideshares and internet, cable, phone services, and select streaming. The card earns 1 point per dollar on all other purchases.

Currently, you can earn 50,000 bonus points after spending $1,000 on eligible purchases within the first three months from account opening. You only need to spend roughly $334 per month to earn this bonus, and since a Southwest flight can go for as little as 3,500 points one way, you could reasonably take several trips using your points. Depending on the route, you could get a redemption valuation of anywhere from one to two cents per point, so the welcome bonus equates to roughly $750 in travel.

Southwest Rapid Rewards® Plus Credit Card rewards potential

Using government data and other publicly available information, we estimate that a household in the U.S. that would be in the market for this card has an annual income of $84,352 and $25,087 in expenses they are likely to be able to charge to a credit card. Here’s a break-down of how many rewards the average cardholders can expect to earn:

- $1,188 in spending on flights x 2 points = 2,376.

- $868 in spending on hotels x 2 points = 1,736.

- $781 in spending on public transit x 2 points = 1,562.

- $1,992 on phone and internet x 2 points = 3,984.

- $564 on streaming x 2 points = 1,128.

- $19,694 x 1 point = 19,694.

This adds up to 30,480 points per year annually.

The value of a point will vary as different flights are worth different amounts of points on Southwest, but you could potentially get multiple flights per year off this amount of points.

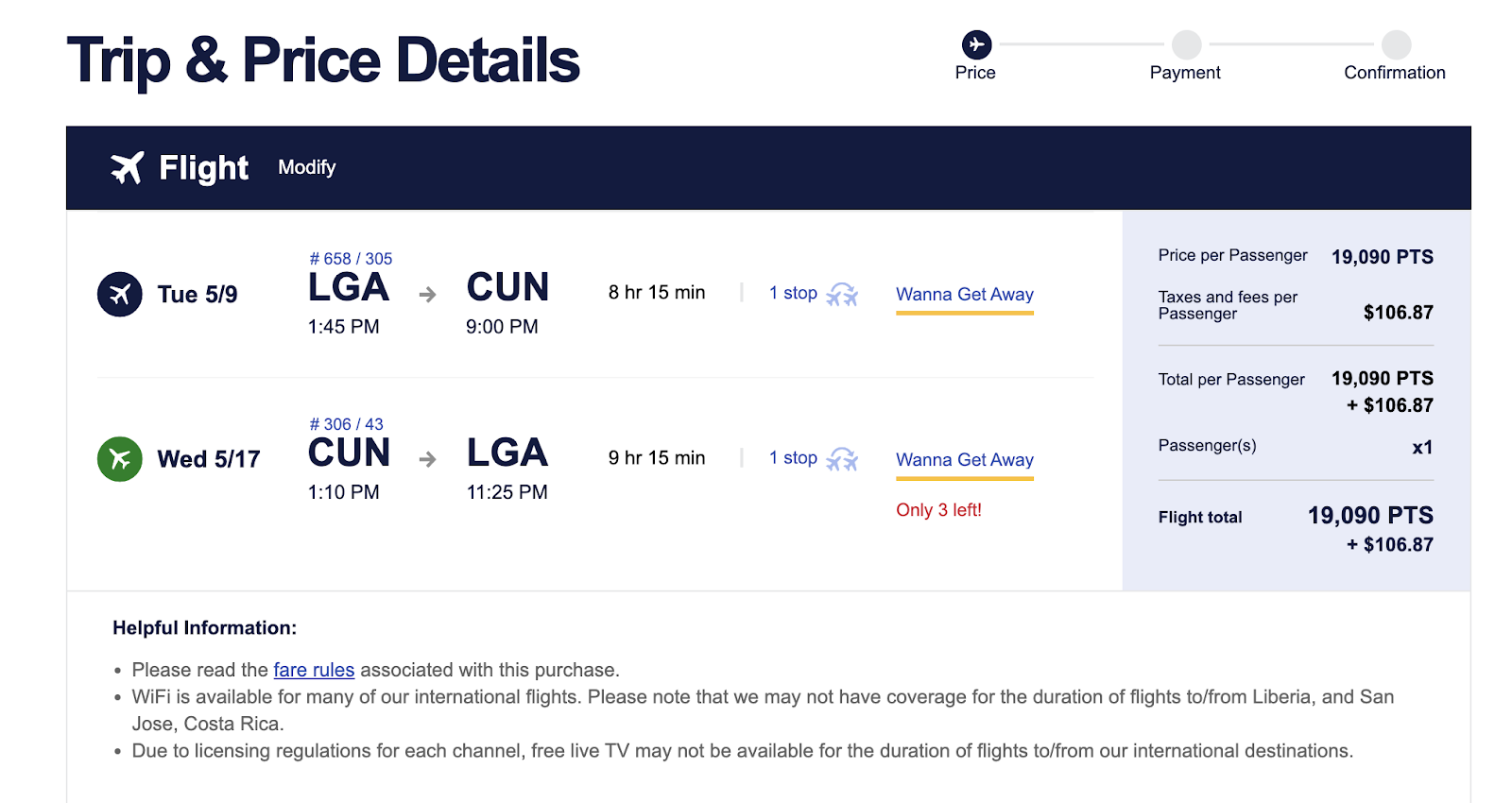

For example, you could fly from New York City (LGA) to Cancun, Mexico (CUN) for just 19,090 points plus $106.87 in taxes and fees.

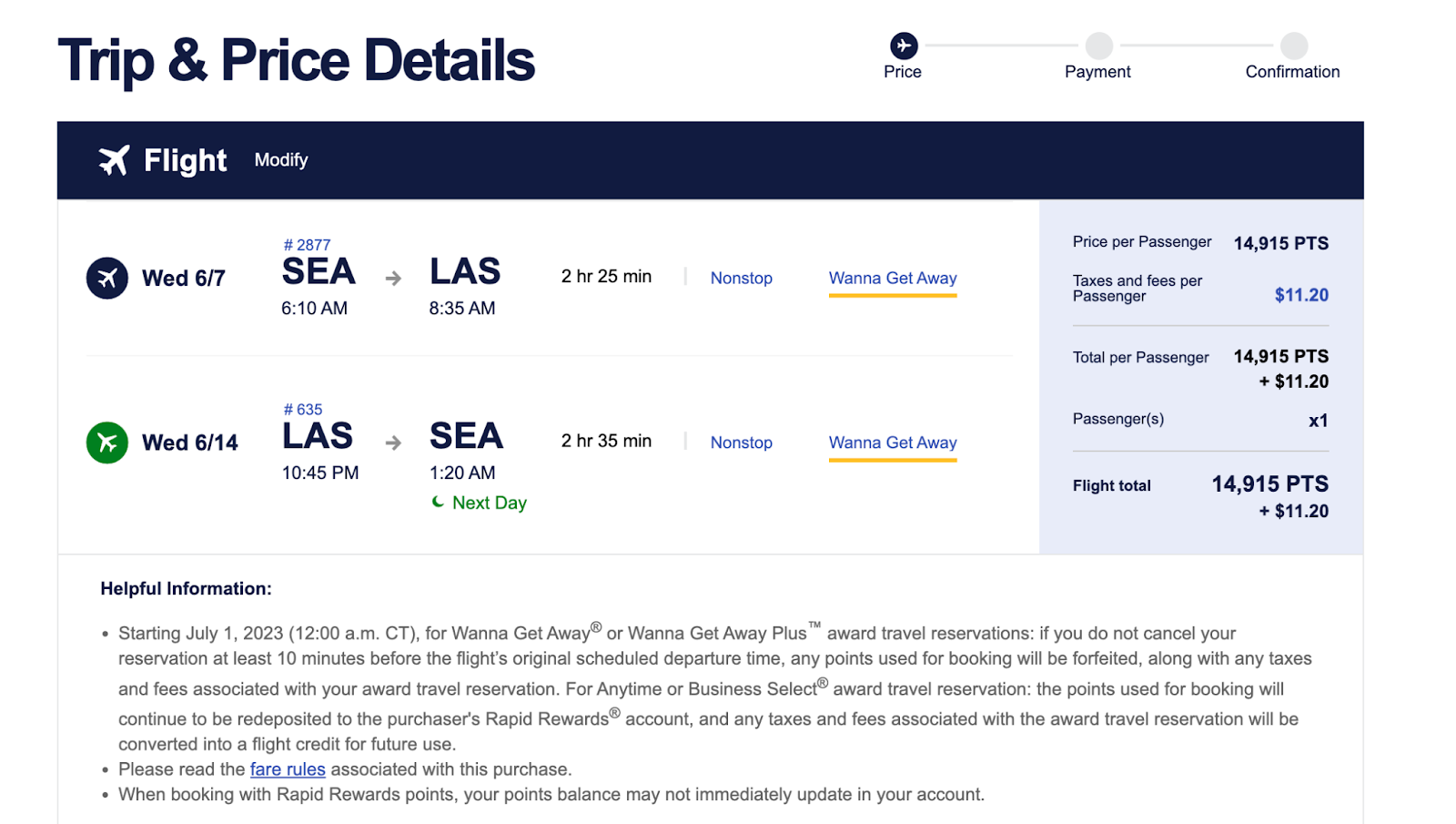

Or, you could fly from Seattle (SEA) to Las Vegas (LAS) in June, round trip and nonstop, for just 14,915 points plus $11.20 in taxes and fees.

Your options are endless and all Southwest flyers enjoy two free checked bags and no blackout dates or seat restrictions.

Southwest Rapid Rewards® Plus Credit Card APR

There is a variable APR of 20.74% to 27.74% based on creditworthiness at the time of application. This applies to all purchases, My Chase Loans, and balance transfers. A penalty APR applies if you fail to make the minimum payment by your due date or if you make a payment that is returned, which could remain in effect indefinitely. There’s an additional late payment and returned payment fee as well.

There is currently no introductory APR period with the Southwest Rapid Rewards Plus card.

Southwest Rapid Rewards® Plus Credit Card pros

- Redemption flexibility: There aren’t any blackout dates, so you can use your points whenever you choose.

- Welcome bonus counts towards Companion Pass earning requirement: If you can earn the Companion Pass through a combination of the welcome bonus and spending, you can substantially cut down on the net cost of future flights.

- Various protections and perks: Even apart from the welcome bonus, there are enough perks to justify keeping the card year after year. The lost luggage reimbursement, baggage delay insurance, extended warranty protection, and purchase protection can give you peace of mind when traveling. The annual point bonus and EarlyBird check-ins also make it worthwhile.

Southwest Rapid Rewards® Plus Credit Card cons

- Foreign transaction fees: Even though Southwest flies to multiple locations in Mexico, Central America and the Caribbean, your card will incur a 3% fee for each transaction you make abroad.

- Annual fee: There is an annual fee, even if it is lower than many other airline cards.

- Low bonus categories: The most you can earn is 2 points per dollar, but many purchases will earn just one point per dollar.

How the Southwest Rapid Rewards® Plus Credit Card compares to other airline cards

Southwest Rapid Rewards® Plus Credit Card vs. Southwest Rapid Rewards® Priority Credit Card

The Southwest Rapid Rewards Priority offers some benefits over the Rapid Rewards Plus card but comes with a $149 annual fee. The welcome bonus is the same between the two cards – 50,000 bonus points after spending $1,000 on purchases within three months from account opening.

However, the Southwest Rapid Rewards Priority earns 3 points per dollar on Southwest purchases compared to just 2 points with the Plus. Cardholders also earn 7,500 bonus points on each account anniversary, $75 Southwest annual travel credit and four upgraded boardings per year.

If you are a frequent flyer with Southwest, it might make more sense to pay the additional $80 to get additional perks. You’ll also be able to reach status by earning 1,500 tier qualifying points for every $10,000 you spend, which the Plus does not offer.

Southwest Rapid Rewards® Plus Credit Card vs. JetBlue Plus Card

JetBlue flies to many of the same destinations as Southwest, so you might consider the JetBlue Plus card. The annual fee is slightly higher at $99, but you earn 6 points per dollar on JetBlue purchases, 2 points per dollar on restaurants and grocery stores and one point per dollar on all other purchases.

You can currently earn 60,000 bonus points after spending just $1,000 in purchases and paying the annual fee in full within the first 90 days from account opening. You get many similar perks, like 5,000 bonus points on each account anniversary, 50% off inflight purchases and no blackout dates.

However, this card does not charge foreign transaction fees, so it has a leg up for those that frequently travel internationally. You can also earn 10% of your points back and a $100 statement credit after spending just $100 on a JetBlue Vacations package of $100 or more.

The card that makes the most sense for you will depend on your loyalty, budget for an annual fee and which benefits seem the most worthwhile.

Southwest Rapid Rewards® Plus Credit Card vs. Chase Sapphire Preferred® Card

If a co-branded airline card doesn’t make sense for you, then a general travel rewards card like the Chase Sapphire Preferred might work better. This is arguably one of the most popular travel cards on the market, and for a good reason. You earn 5 points per dollar on travel purchased through Chase Ultimate Rewards®, 3 points per dollar on dining, online grocery purchases (excluding Target and Walmart), and on select streaming services, 2 points per dollar on all other travel, and 1 point per dollar on all other purchases. You also get a $50 annual Ultimate Rewards Hotel statement credit.

You can earn 60,000 bonus points after spending $4,000 on purchases within the first 3 months from account opening. The annual fee is just $95, which is low compared to the benefits.

The best part about this card is the ability to transfer your points to different airline programs at a 1:1 ratio. These partners include Southwest, JetBlue, and United. So, if you’re struggling to land on an airline-specific card, you could get one that transfers to several of your favorite airlines and hotels.

Should you get the Southwest Rapid Rewards® Plus Credit Card?

Whether you should get this card will depend on if you fly Southwest regularly enough to justify the annual fee but infrequently enough not to need the Priority or Premier cards. If you want the flexibility of flying with multiple airlines and having the opportunity to have higher earn categories, you might get more benefits out of a card like the Chase Sapphire Preferred.

The Southwest Rapid Rewards Plus could be a great addition for any Southwest loyalist, as it comes with many great perks for a low annual fee, especially considering the lucrative welcome bonus.

Southwest Rapid Rewards® Plus Credit Card summary

Frequently asked questions (FAQs)

Yes, an annual fee of $69 is applied to your first billing statement.

You will likely need a good to excellent credit score to increase your chances of being approved for this card. Using the FICO model, you should aim for a credit score of 670 or better for the best approval odds.

The number of points you need to book a flight will depend on a multitude of factors, like the destination, the time of day and date, demand, and fare type, among others. Keep in mind that flights are never entirely free, even when redeeming miles. You are still responsible for paying taxes and fees, which start at $5.60 each way.

The current APR on the Southwest Rapid Rewards Plus card is 20.74% to 27.74% variable based on your creditworthiness at the time of your application. If approved, Chase will notify you of your interest rate.