Savers struggling to fix state pension top-up problems stretching back years say it is unacceptable the Government has sat on their money for so long.

Chris Taylor, 72, spent £740 nearly eight years ago on top-ups that turned out to be worthless, but was not issued a full refund until This is Money intervened.

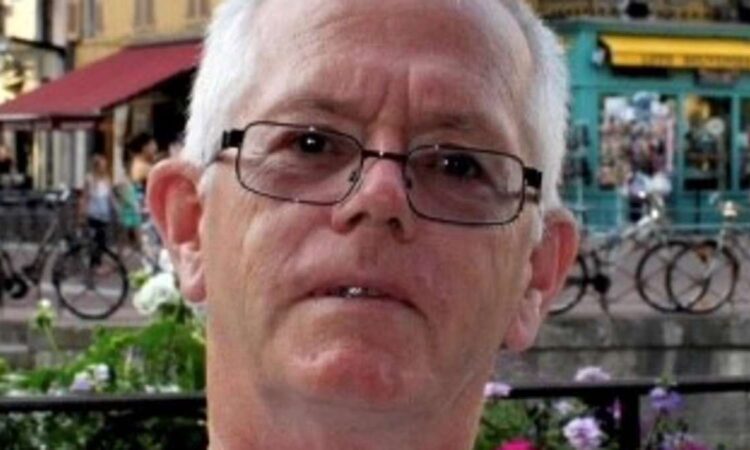

The retired head teacher, who lives in Spain and is pictured right, contacted us after we reported on other cases of people wasting thousands of pounds in the confusing state pension top-ups system.

‘My big question is why do they pay it back when you chase it but not to me at the time?

‘How much money are they holding from people and claiming interest,’ he says.

Martin Ryves, 65, paid £4,900 to boost his state pension in May 2023, but his money vanished until we and his MP asked the Government to investigate.

A retired teacher from London, Mr Ryves contacted This is Money after searching the internet for help, and told us: ‘I came upon your site and find that there are many in my situation. I am due to receive my state pension in July.’

We have previously reported that untold sums of top-ups cash could be sitting in government coffers, instead of being processed to boost state pensions or repaid to people who are still in the dark about what has happened to their money.

Today we cover FIVE more cases in total of lost cash, botched records, and staff giving wrong information or unable to help.

Related Articles

HOW THIS IS MONEY CAN HELP

Why are there problems with state pension top-ups – and will new online tool help?

Frustrated savers have complained of state pension top-ups chaos since early 2023, though problems with the complicated rules go back years.

The Government used to routinely refuse refunds to savers who made innocent errors, but backed down following a campaign by This is Money and our sister publication Money Mail.

It now issues refunds on a case by case basis, and recently launched an online service which it is hoped will prevent people falling into the most common traps.

Buying state pension top-ups can give a huge boost to retirement income, but people are often baffled over whether this will be worthwhile for them personally.

The new online tool lets people check which years are best to top up and buy on the spot, but they will still be able to phone up and pay offline if they prefer.

> Use the online top-ups service here or go to the HMRC app.

The system was overwhelmed in early 2023 when a rush of buyers jammed phonelines ahead of a crunch deadline to buy top-ups going back to 2006, rather than the usual six years

That ultimately forced the Government to extend it twice, now to April 2025.

The scheme, run jointly by two departments – HMRC and the DWP – is confusing and it is easy to make errors.

There is a pile of ‘unallocated’ cash to be dealt with, where payments have not been processed for unknown reasons, or refunds are owed.

Former Pensions Minister and This is Money retirement columnist Steve Webb has criticised the system in the past, saying: ‘No-one in Whitehall seems to think it is their job to make sure you get your money back.

Webb, who is now a partner at LCP, added: ‘In other cases, contributions have been made but sit in some sort of suspense account, not even getting as far as being added to the correct NI record.

‘Once again, it doesn’t seem to be anyone’s job to go through these unallocated contributions and either do something with them or pay them back.’

The DWP and HMRC were asked for comment, but cannot respond at present due to pre-election rules.

In the past, they have stated that the vast majority of voluntary contributions paid result in records being updated within days.

However, some particularly complex cases requiring specialist caseworkers can take longer to resolve, they said. There is more Government information about buying top-ups and getting refunds below.

‘Someone should have queried 18 digit code being linked to two different people’

The £4,900 paid by Martin Ryves last May went astray due to an incorrect reference number, according to the Government, which did not say who made the original mistake.

The money that Mr Ryves intended to improve his state pension remained unallocated to his National Insurance record for a year, and it is unclear why HMRC did not try to sort this out sooner.

Steve Webb and This is Money have attempted to find out how much money spent on state pension top-ups is sitting in Government accounts, and what efforts are being made to process unallocated payments or refund them.

We have also asked if, when individuals contact DWP or HMRC about unallocated payments – rather than via MPs or the media – their cases are investigated. However, we have received no response so far.

Mr Ryves told us: ‘Thanks to you, the payments have been added and show in my pension projection.

‘I’m usually careful with codes and numbers. I guess I may have made a mistake, but someone should have queried the 18 digit code being linked to two different people.’

‘How much money are they holding from people and claiming interest’

Chris Taylor spent £740 on top-ups in late 2016 after receiving a letter from the Government that led him to believe it would increase his state pension.

He was subsequently informed by letter the payment would make no difference, but he would not receive a refund.

Although he repeatedly challenged this in letters and emails, he got no reply.

Seven and a half years later, Mr Taylor contacted us after spotting our recent story about other people receiving refunds after making innocent errors over top-ups payments.

When we asked for Mr Taylor’s case to be reconsidered, it turned out he was issued a partial refund of £212 in 2018. However, as it arrived in the form of a cheque from HMRC he didn’t realise any connection to his state pension top-ups at the time.

HMRC has now issued a further refund of £527, and apologised for the delay.

Mr Taylor says: ‘Thanks for what you did but their apology is far too late and not acceptable at all.

‘Surely interest is payable? How much money are they holding from people and claiming interest.

‘Fortunately, I could afford to let it go – what about those who could not, yet still lose their money.’

> After complicated rule changes in 2016, many people lost thousands of pounds buying worthless state pension top-ups, and were refused refunds. Did you miss out after the Government belatedly relented on refunds? Contact us at pensionquestions@thisismoney.co.uk.

Government blunder creates year-long admin nightmare for pensioner

Carol Andrews (name changed) had her state pension reduced due to a catalogue of errors by the Government, and her efforts to find out what was going on were ignored until we intervened.

The 70-year-old was suddenly informed last spring that small gaps in her state pension record for two years between 2015 and 2017 had been discovered.

This was news to her, but the retired self catering proprietor from Hampshire was told paying a top-up of £31.70 would fix these holes, so she did.

But after she handed over the money, Mrs Andrews was notified this payment would make no difference after all.

She received no further explanation of why her state pension was being reduced, despite her pleas to staff for help.

After This is Money asked for an investigation, it turned out there had never been a problem with two qualifying years being short after all.

The £31.70 payment was therefore unnecessary and will be refunded. Meanwhile, Mrs Andrews was owed around £580 in lost state pension, racked up since the original blunder a year ago.

She has now received the arrears, had her state pension hiked from £206 to £219 a week, and received an apology from the Government.

Her husband told us the experience had been ‘a nightmare’, and added: ‘Once again THANK YOU for your support.

‘Three times we asked HMRC to review the National Insurance contributions and three times we were told [they were] correct with no substance why.

‘Your intervention not only pushed HMRC into revising the NICs and confirmed their assessment was incorrect, but got a backdated payment of over £500 too!’

Expat told she faced a 40-week wait for state pension increase

Barbara Smith (name changed) paid nearly £7,400 to top up her state pension last autumn but received no increase for six months.

When she rang to chase up her payment in February, the 66-year-old was told it could take 20 weeks for her money to be processed.

When she tried again two months later, she was told it could take up to 40 weeks.

After the retired florist, who lives in Portugal, asked us for help her state pension was increased from £164 to £221 a week and she received arrears of £1,340 and an apology.

Holes in state pension record belatedly filled

Peter Collins has paid around £4,300 in state pension top-ups over the years since 2016, but struggled to get them allocated correctly.

The 72-year-old retired export agent, who lives in Thailand, turned to This is Money to get the longstanding issues resolved after reading our previous stories about top-up problems.

His state pension is set at around £500 a month due to his residence in Thailand.

Around 500,000 elderly expats live in a country where state pensions remain frozen at whatever amount they were when they moved there or reached retirement age.

After we raised Mr Collins’s case with the DWP and HMRC, an unallocated payment of £221 made last year was used to make 2013-14 and 2014-15 qualifying years towards his state pension.

He received an arrears payment of £135, and the DWP said he could still pay to fill two further gaps in 2011-12 and 2012-13.

What does the Government say?

The DWP and MRC provided the following information on the state pension top-ups system.

– The new online tool allows people to check for and fill any gaps in their National Insurance record to help increase their state pension.

– Most people can use the service without needing to phone HMRC or the DWP, including those living abroad who want to pay voluntary contributions for years they were resident in the UK.

– The Government has extra staff answering phone calls and dealing with correspondence on voluntary contributions.

– System improvements made since May mean the vast majority of payments made via bank transfer, for all years dating back to 2006, are being processed within days.

– Other payments requiring manual processing, for example made by cheque, are being completed within eight weeks.

– The DWP aims to update state pension records as soon as possible once notified that HMRC have allocated a payment to someone’s National Insurance record.

– If someone is receiving the state pension when voluntary contributions are allocated by HMRC, the DWP would review their claim, increase the entitlement based on the revised National Insurance record, and pay arrears back to the date HMRC received payment.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.