Remitly is a mixed bag. It boasts several methods for receiving money, such as via a mobile device or with home delivery. Plus, it charges low to no fees for transfers to some countries. But some transfer methods are limited, and fees for money transfers to certain countries can be high.

- Low or no fees for transfers to certain countries

- Ability to receive money via bank account, mobile device, cash pickup or home delivery

- 24/7 customer service

- High fees for transfers to certain countries

- Confusing array of transfer fees

- Limited availability of some transfer methods

Table of Contents

Show more

Show less

Who should use Remitly?

Thanks to its global reach, Remitly’s free-to-download money transfer app will benefit someone who regularly sends money to friends and relatives in other countries.

Senders in 30 countries, including the U.K., can transfer money to recipients in more than 170 countries. Depending on the country, someone can send money via methods such as a debit card, credit card or bank account. Money can be transferred to more than 3,000 banks and over 460,000+ cash pickup locations, and cash might be available to a recipient through mobile or home delivery.

Remitly says its service is designed to help immigrants send money home “in a safe, reliable and transparent manner.” This type of money transfer is often called a remittance.

Who should not use Remitly?

Remitly might not be ideal for someone who sends money to friends or relatives in a lot of countries. Fees and exchange rates vary widely depending on which country the recipient is in and the delivery speed. In other words, the fees and exchange rates are all over the map. This differs from bank transfers available from major U.K. banks that offer easier-to-understand details about fees and exchange rates.

Remitly’s features

One notable feature of Remitly is the number of transfer options available to senders. Among them are Mastercard and Visa debit and credit cards, as well as bank accounts. The chart below summarises the alternatives for sending money.

Recipient options

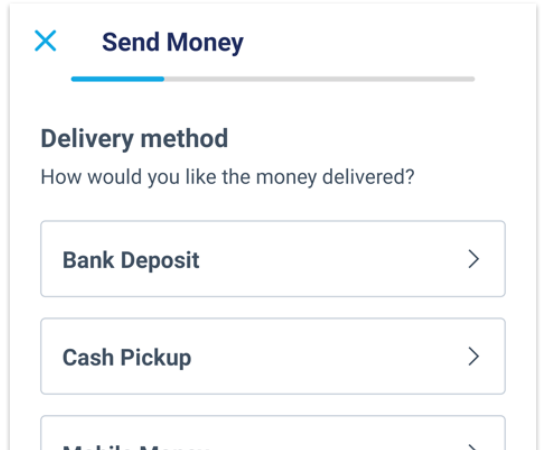

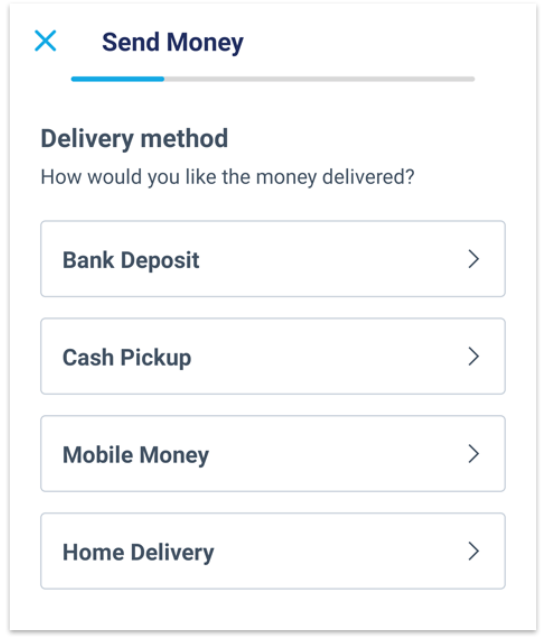

A recipient can get money that’s transferred via Remitly through a bank account, a pickup location, a mobile device or home delivery, depending on where they live. The service is available to recipients in more than 100 countries and senders in 30 countries, including the UK.

Remitly’s pricing

Remitly doesn’t charge anything to set up an account. But it does charge fees.

Below is a sampling of Remitly’s fees, which vary greatly based on the recipient’s country. On top of transaction fees, a sender must consider the exchange rate. In addition, Remitly tacks on a 3% fee for some transfers sent by credit card from the UK depending on your bank.

Based on the amount of information you supply, a sender can transfer anywhere from £5,000 to £50,000, depending on the window of time in which money is sent: 24 hours, 30 days or 180 days.

The lowest limit during a 30-day period is £5,000; the highest limit during a 180-day period is £50,000. You can request a higher sending limit by contacting Remitly in the “sending limits” section of your account and providing any required information or documentation. Approval typically takes 48 hours.

Remitly’s ease of use

As of March 2022, more than 90% of customers who used Remitly did so from their smart phones. Remitly also can be accessed through a web-based browser on a computer or another electronic device.

Remitly’s free mobile app can be downloaded from the App Store for use on iOS devices or from Google Play for use on Android devices. The app can run on devices with either iOS 11.0 or higher, or Android 5.0 or higher.

The Remitly app enables a sender to do business in one of 14 languages:

- English

- Chinese

- Dutch

- French

- German

- Italian

- Korean

- Polish

- Portuguese

- Romanian

- Spanish

- Thai

- Turkish

- Vietnamese

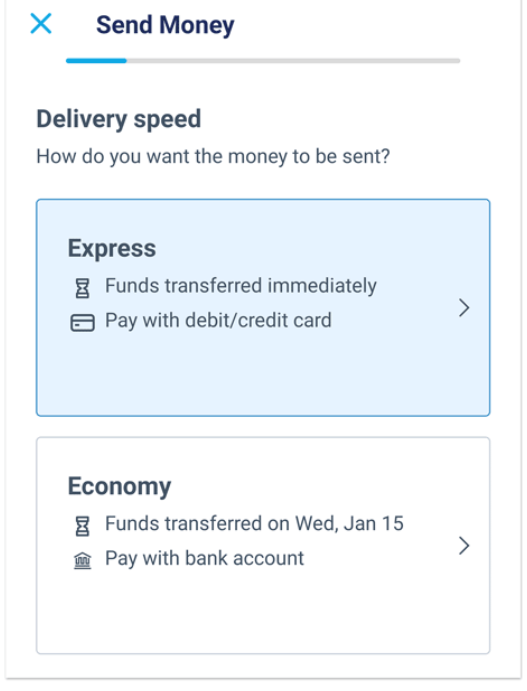

Remitly provides easy-to-follow directions for using its service. This includes a screen where you can choose the delivery option for sending money, and another screen where you can select the speed of the delivery (the Express option or the Economy option).

With the Express option, you can send money with a debit card, and the recipient typically receives it within a few minutes. Funds sent with the Economy option are delivered within three to five business days.

Remitly’s support

Remitly provides customer support by phone or chat. Help via phone is available 24/7 in English and Spanish, and chat is available 24/7 in English, French and Spanish.

In a test of Remitly’s customer service, we placed a call to Remitly’s charge-free number at 11:58am on a Saturday. It was initially answered by an automated operator.

The operator said there was trouble verifying information for our account, so we were going to be transferred to a customer service representative. The operator then told us there was a five- to 10-minute wait and offered to hold our place and have a customer service agent call us back. We chose that option.

Within five minutes, Remitly called back. However, there was nothing but silence for a couple of minutes, and then the call dropped out. We called the customer service department again and, after initially being told there’d again be a five- to 10-minute wait, we were quickly transferred to a live customer service agent.

The customer service agent initially was hard to hear, but this technical problem was resolved within seconds. The agent we spoke with was polite and knowledgeable, correctly answering a couple of questions about transferring money from the UK to Mexico.

How Remitly stacks up against the competition

Here’s how Remitly stacks up against three of its competitors.

Senders in 30 countries, including the UK, can transfer money to recipients in more than 170 countries. Depending on the country, someone can send money via methods such as a debit card, credit card or bank account. Money can be transferred to more than 3,000 banks and over 350,000 pickup locations, and cash might be available to a recipient through mobile phone transfer or home delivery.

- OFX. Remitly allows transfers to more than 170 countries, which is less than OFX’s 190 countries. However, one of Remitly’s advantages is that a recipient can pick up transferred money or have it delivered to their home. OFX doesn’t offer those options

- Wise. Remitly doesn’t give you the ability to send money via Apple Pay or Google Pay, while Wise does. But Remitly beats Wise when it comes to recipients being able to get money through home or business deliveries. Those options aren’t available from Wise

- Xoom. A Xoom user can pay international bills or add money to a prepaid mobile phone account, while a Remitly user can’t take advantage of these features. However, Remitly offers a slower Economy method for sending money that might be cheaper than sending money via Xoom.

Frequently Asked Questions (FAQs)

How much is the transfer fee for Remitly?

The transfer fee for Remitly varies widely, based on the transfer method, the delivery speed of the transfer, the country where the recipient is, the amount of money being sent and which currency is used.

How safe is Remitly money transfer?

Remitly says it places a big emphasis on security. For instance, it relies on several methods to authenticate a user’s identity in order to prevent fraud and money laundering.

In addition, it encrypts data at the same level that banks do and employs an in-house team of security experts. In 2021, Remitly handled £16 billion in money transfers.

How long does Remitly take to transfer money?

If a sender picks the Express method, a transfer typically takes just a few minutes. With the Economy method, the transfer takes three to five business days.