Meme stocks roar back: The shares grabbing attention – and safer British bets that may make you money

Roaring Kitty has come roaring back. The meme stock craze is once again gripping global financial markets.

But what on earth is a meme stock and who is Roaring Kitty? Can investors make their fortunes – or should they stay well clear?

The meme stock craze dates back to the dark days of the pandemic when investors turned to weird and (occasionally) wonderful ways to get through lockdown.

Shares in GameStop soared after Keith Gill posted on social media, under the usernames Roaring Kitty or Deepf***ingValue, urging ordinary investors to buy into the games retailer

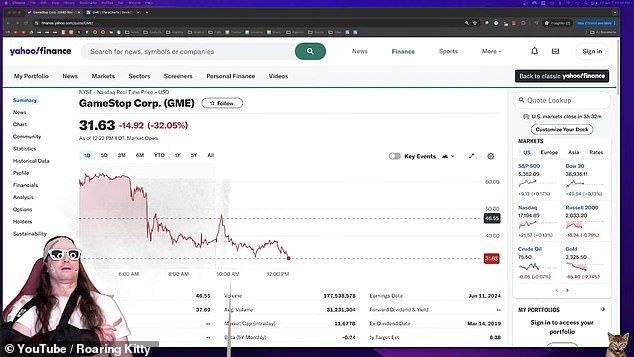

Mr Gill (bottom left with his arm in a sling) shares his screen showing GameStop share data during his livestream

One person who shot to prominence in investing circles is Keith Gill – known to his followers on Youtube as Roaring Kitty and the rather more profane Deepf***ingValue on social media site Reddit.

The former financial analyst first shot to prominence before Covid struck in 2019 when he piled his life savings into Gamestop, a bricks-and-mortar video game retailer in the US.

His net worth – on paper – has been estimated to run into hundreds of millions of dollars.

On Friday shares in Gamestop gyrated wildly as he returned to his Youtube channel for an impromptu livestream watched by over 600,000 viewers.

With his arm in a sling and sporting a trademark bandana, Gill reiterated his faith in the video games retailer, which had earlier announced falling sales, narrowing losses and plans to sell 75million of its shares.

The news caused Gamestop’s share price – and Gill’s fortune – to plunge.

In its latest intervention, Roaring Kitty posted a cryptic drawing on Twitter last month, which could be interpreted as a renewed declaration of support for GameStop

As this volatility shows, anyone considering emulating him should be aware of the risks.

Gill, 38, who often broadcasts his views wearing a baseball cap on back to front, has an unlikely background for a financial hotshot.

The son of a truck driver and a nurse, he was brought up in the small city of Brockton, Massachusetts. His career pre-Kitty includes a stint working for a family friend at a tech start-up and a role in ‘financial wellness education’ at an insurance company.

He joined Twitter ten years ago as Roaring Kitty, and has been pouncing on opportunities ever since.

As for Gamestop, for a while his enthusiasm looked misplaced.

By January 2021, the company, whose sales have been in decline, had become one of the most widely ‘shorted’ US companies – as hedge funds bet the shares would fall.

Gill and a group of ordinary investors decided to strike back against the short-sellers through a mass buying of shares.

Gamestop climbed above $120 a share in early 2021 from as little as $3 in the space of three months.

Traders who piled in at the right time enjoyed major windfalls before Gamestop shares crashed back down to earth.

On the other side, hedge funds lost billions.

But the David and Goliath-style episode sparked a backlash from politicians and regulators.

Concerns mounted that this mass buying – although not inherently illegal – distorted the market and undermined prices.

The US watchdog the Securities and Exchange Commission investigated the meme stock craze.

But the cat – or Roaring Kitty – was out of the bag. Other meme stocks were also gripping traders’ imaginations including American homeware retailer Bed, Bath & Beyond and Odeon Cinemas owner AMC.

The craze died down, but Roaring Kitty is on the prowl again.

Gill last month broke a near-two-year silence – returning to social media to post a cryptic image of a man leaning forward in a gaming chair.

In an instant, meme stock mania returned, and Gamestop shares almost doubled in a matter of hours. They came crashing down once again, but in the chat rooms there was talk of little else.

At the start of this month, Gill posted a screenshot revealing a £91m stake in Gamestop and the shares took off.

Other meme stock favourites such as AMC have been caught up in frenzy.

Not everybody is pleased with this revival.

Boaz Weinstein, US hedge fund manager and founder of Saba Capital Management, says it is ‘bewildering’, adding: ‘In some ways you could say it makes a mockery of the challenge of investing. It can’t be justified on anything other than pure speculation.’

Former financial regulator Jay Clayron, who ran the Securities and Exchange Commission under former president Donald Trump, said: ‘It bothers me on many levels. It’s a lot closer to gambling than it is to trading and it’s certainly not investing.’ Regulators are now sniffing around.

The Massachusetts securities regulator said earlier this month it is looking into Gill’s social media shenanigans.

City experts counsel caution.

Kyle Rodda, senior market analyst at Capital.com, told the Mail: ‘I don’t think we will see a repeat of early 2021.

‘Brokers are more wary and prepared for speculative attacks by armies of angry retail traders, meaning such behaviour is more likely to be shut down before it can take off.’

He added: ‘Another trend is the persistent resentment towards Wall Street and the financial establishment and an almost nihilistic desire to strike back against it.’

Buyer beware, is the advice from experts to anyone considering meme stocks.

Lindsay James, investment strategist at Quilter Investors says that many private investors who were caught up in the craze have been hit by ‘substantial losses.’

As Dan Ives, tech analyst at Wedbush Securities, says: ‘The meme stock phenomenon is a dangerous and slippery slope for many retail investors who just jump in to make money.’

‘Stocks at the end of the day are based on fundamental value and meme stocks could have massive volatility that cause huge swings up and also huge swings down. In Vegas you don’t put all the chips on the table at 3am playing craps.’

Five solid UK anti-meme shares

By Jessica Clark

Not keen on the memes? Here’s what you could buy instead…

Long term investors should avoid too much speculation – if you do fancy a flutter on a meme stock, only put in money you can afford to lose.

If the excitement is all too much and you’d rather give volatile meme stocks a miss, experts say there are plenty of shares in fundamentally strong businesses, that also pay out a decent dividend to provide an income. Here are five ‘anti-meme’ stocks:

BP

After a scandal that saw former boss Bernard Looney leave in disgrace, BP is back on firm footing with company veteran Murray Auchincloss at the helm.

Susannah Streeter, head of money and markets at Hargreaves Lansdown, said the oil major’s focus on fossil fuels with ‘one-eye’ on renewables and low-carbon energy makes it a reliable long-term option.

‘It already generates enough renewable energy to power around 2 million homes and has a pipeline of projects that could see this capacity increase more than 20 times over,’ she said.

‘This emerging focus on cleaner forms of energy is highly capital-intensive but the business has a strong record of cash generation, which has been particularly impressive post-pandemic.’ BP offers a dividend yield of 4.86pc.

NatWest

Interest rate cuts this year will reduce the bumper profits banks made during the cost-of-living crisis. But UK lenders are strong ‘anti-meme stock’ contenders.

The bank has in the past been prone to banana skins, the most recent of which was the row over ‘de-banking’ Nigel Farage. Conservatives had planned to sell off the remaining government stake in NatWest to investors. That is now on ice due to the election.

Nevertheless, the lender is ‘showing signs of promise’, according to Streeter, and will benefit from easing conditions in the mortgage market.

More rate reductions have been priced in by management than markets now expect so ‘revenue guidance also looks conservative’ – in plain English, it may rake in more money than anticipated.

The bank offers a dividend yield of 5.4pc.

Greggs

Another share Streeter likes is Greggs.

Sales at popular bakery chain beat market expectations last year and analysts expect changes at the company to boost performance even further.

The nation’s favourite sausage roll seller has revamped its menu, refreshed stores and added extra delivery options to lure in more customers.

It is preparing to launch an evening hot food menu, which experts believe has ‘big potential’.

Greggs offers a dividend yield of 2.1pc.

AstraZeneca

AstraZeneca has gone from strength-to-strength since CEO Pascal Soriot took the reins in 2012.

The pharma giant last month revealed plans to almost double revenues to £60bn by the end of the decade.

It will roll out 20 new drugs – some of which have blockbuster potential – with a focus on cancer treatments which currently make up a third of sales.

The drugmaker’s growth in rare disease medicines also offers diversification, Streeter says.

AstraZeneca’s dividend yield stands at 1.8pc.

Nichols

Nichols – the 116-year-old maker of soft drink Vimto – is another London-listed stock that could provide steady returns.

Russ Mould, investment director at AJ Bell, said the ‘pricing power conferred by its brands’ means Nichols has a ‘history of double-digit operating margins and returns on equity’.

The company has a dividend yield of nearly 3pc.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.