By Leah Montebello For The Daily Mail

21:56 24 Apr 2023, updated 21:56 24 Apr 2023

LVMH has become the first European company to hit a market value of $500billion (£401billion) as luxury goods defy the cost-of-living slump.

The milestone came after shares edged up 0.3 per cent to €903.7 on the Paris Stock Exchange, making the firm the world’s tenth biggest company, ahead of Visa and just behind Tesla.

The owner of Christian Dior and Tiffany is the sole European name among the top 10 firms in the world by market value, a list dominated by US tech groups led by Apple.

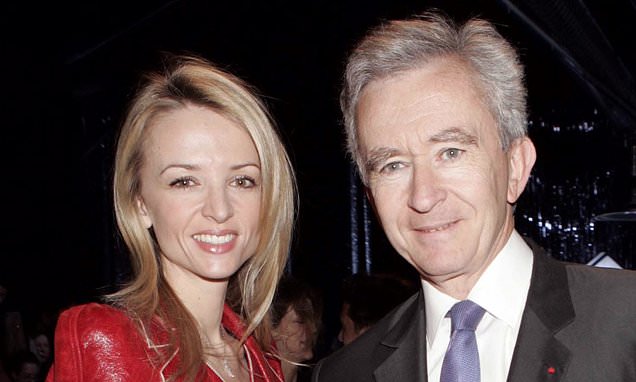

Just two weeks ago LVMH boss Bernard Arnault became only the third person – and the first non-American – in history to amass a fortune of $200billion (£160billion).

Arnault, who has earned the sobriquet ‘the wolf in cashmere’ during his decades at the top, is worth £161billion, according to the Bloomberg Billionaires Index, making him the world’s richest man, beating out both Elon Musk and Jeff Bezos.

In January, the 74-year-old retail mogul appointed his daughter Delphine as the head of Christian Dior – laying the groundwork to keep the company under family control.

But he has shown no signs of slowing down and LVMH has hiked its age limit for chief executives from 75 to 80.

LVMH, whose brands include fashion labels Givenchy, Celine, Stella McCartney and Louis Vuitton, has cashed in on huge post-pandemic growth in China.

The Chinese luxury market has rebounded dramatically following the lifting of the country’s zero-Covid policy, with shoppers flocking for costly designer bags and clothes.

Related Articles

HOW THIS IS MONEY CAN HELP

Europe and the US have also remained resilient despite economic pressures weighing down consumer spend.

Sophie Lund-Yates, lead equity analyst at Hargreaves Lansdown, believes LVMH is ‘well insulated to economic shocks’ owing to its rich customers, who are less likely to cut spending due to rising living costs.

‘The ultra-wealthy aren’t put off by economic ups and downs, and inflation is unlikely to dent their spending habits.’

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.