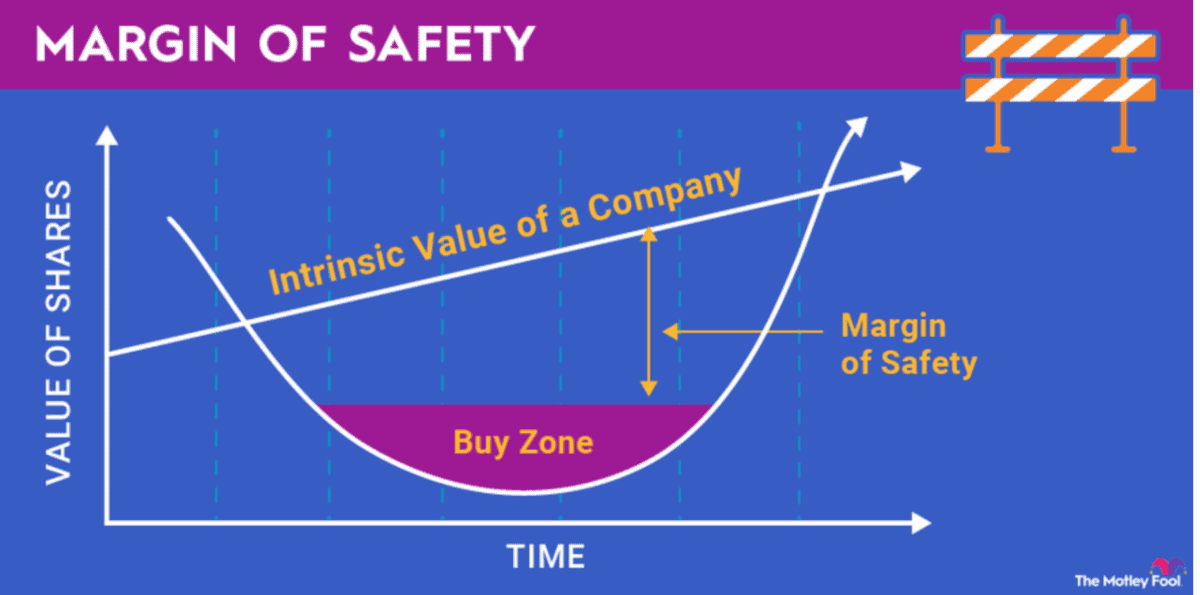

Image source: The Motley Fool

Warren Buffett‘s first rule of investing is simple but incredibly useful. He tells us: “Don’t lose money.”

While it may sound obvious, it’s often overlooked by many investors. That’s because we can get caught up in the excitement of chasing high returns and making risky bets.

The impact of losing money

If I were to lose 50% of my investment, it’s more than just a 50% loss. It’s also the sobering realisation that I need to achieve a 100% return to recover what I’ve lost. This concept has become a fundamental principle in my approach to investing, echoing the wisdom of Buffett.

Capital preservation

For the ‘Oracle of Omaha’, it all starts with capital preservation. He tells us that before seeking substantial gains, we need to focus on protecting our initial investment.

So how do I do this? Well, it’s going to require me to do my research and due diligence before making any investment decisions.

I must carefully assess the fundamentals of the companies I’m interested in, including their financial health, competitive advantages, and growth potential.

Buffett is known for his meticulous analysis of businesses, and I can follow his lead by adopting a patient and cautious approach to my investments.

He uses something called the ‘Margin of Safety’. This is a concept whereby an investor seeks a discount versus what they consider to be a fair value for the stock in question.

In the near term, we can look at metrics like the price-to-earnings ratio or the EV-to-EBITDA ratio. This gives an idea of a company’s valuation versus its peers.

However, for a more thorough approach, I can use a Discounted Cash Flow analysis. There are plenty of online resources to help me with this. This gives me an idea of a company’s value relative to its forecast future performance.

But there’s also a more obvious place to start. It’s about momentum. Stocks that are surging could quickly go in the wrong direction if sentiment changes. Buffett tells us not to follow the crowd or we could lose out.

Diversification

Another step is diversification. Buffett advocates spreading investments across different asset classes and industries to reduce risk.

By diversifying my portfolio, I can mitigate the impact of poor performing investments and avoid putting all my eggs in one basket.

This principle underscores the importance of avoiding excessive concentration in a single investment, which could lead to significant losses if that investment takes a downturn.

Building wealth

It’s only after I’ve successfully implemented the above that I can start thinking about building wealth. For Buffett, it’s about investing in undervalued, quality stocks and taking a long-term approach.

He tops up his positions when stocks fall, and he waits for companies to reach his valuation before selling. His long-term strategy also allows him to harness the power of compound returns.

It might not sound like a winning strategy, but it really is.