Top of the table: Pascal Soriot of AstraZeneca

Britain’s top hundred boardroom chiefs took home an average £4.2 million last year as households across the country struggled to make ends meet.

The five biggest earners pocketed £56 million between them, while the 20 highest-paid FTSE 100 bosses took home almost £170 million.

At the pinnacle of the pay table is Pascal Soriot of AstraZeneca, who received £15.3 million for his successful leadership of the pharmaceuticals firm.

At number two is Charles Woodburn, the highly-regarded boss of defence firm BAE, on £10.7 million.

With the median average full-time salary across the UK at £33,000 a year, it would take an ordinary worker more than 127 years to match the average annual pay of a FTSE 100 boss.

The Mail on Sunday has researched the annual reports of every FTSE 100 company. The figures revealed in this year’s Fat Cat Files come as the City is embroiled in a fierce debate over executive excess.

Julia Hoggett, head of the London Stock Exchange, is calling for a ‘constructive discussion’ about pay amid fears that talented bosses could be tempted to ditch UK companies for the US, where potential rewards are higher still.

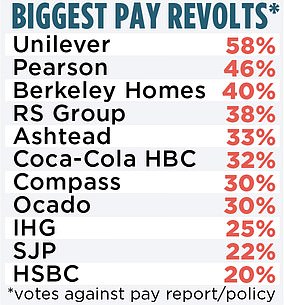

But investor anger is simmering over the largesse shown to some executives. More than a tenth of companies in the FTSE 100 are on a Government list of shame over excessive pay.

Any firm where more than a fifth of shareholders protest are placed on the register, which is compiled by the Investment Association.

The trade body aims to help the 75 per cent of UK households that use an investment manager’s services – knowingly or unknowingly – achieve their life goals by growing their investments. The register it compiles was introduced by the Conservatives in 2017 due to concerns that corporate greed was damaging the capitalist system.

However, companies are not bound by the results of the votes on their annual pay reports – many simply ignore the anger of their own investors.

Today, The Mail on Sunday can reveal that:

- The total bill for chief executive rewards in 2022 in the FTSE 100 index of the biggest 100 companies listed on the London Stock Exchange was £420 million;

- Four men earned £10 million or more last year;

- The highest paid female boss was Dame Emma Walmsley of drugs giant GlaxoSmithKline on £8.5 million;

- Many blue-chip firms are handing lucrative perks to chief executives, from designer clothes and chauffeurs to ‘cost-of-living’ allowances and home security systems;

- Three men have earned more than £100 million during their time as FTSE 100 leaders. They are Erik Engstrom, who has been boss of publishing group Relx, formerly Reed Elsevier, since 2009, Rob Perrins of housebuilder Berkeley, also since 2009, and this year’s highest paid boss, Pascal Soriot.

The latter, a Frenchman who lives mainly in Australia, is widely admired. Shares in the pharmaceuticals giant have risen strongly during his decade-long tenure, and are up nearly 90 per cent in the past five years alone. More than £10.5 million of his pay package was linked to a long-term bonus, which is paid to him in the form of shares if he reaches a number of performance targets.

Soriot, 64, has been at the helm of the £170 billion company for almost 11 years and steered it through the pandemic when AstraZeneca helped create one of the world’s foremost Covid vaccines. Five years ago, he complained that he was one of the lowest paid chief executives in the pharmaceutical sector, a global industry where the bosses of US giants make colossal sums. However, he is the highest-paid person in the FTSE 100 by a wide margin.

BAE Systems boss Charles Woodburn, 52, is the second best paid. The defence giant has also performed strongly following Putin’s war on Ukraine.

Number three in the pay table is Albert Manifold, the boss of building materials firm CRH, the maker of Tarmac, who was handed £10.4 million. CRH has already made headlines this year for its choice to shift its stock market listing from London to the US. The move could open the door for even bigger pay packets for Manifold, as US bosses typically receive more than their British counterparts.

Next in the league table is Bernard Looney, the chief executive of BP, who made £10 million. Just behind him is Ben van Beurden, the former boss of Shell. Both men have seen cash slosh into their companies due to higher oil prices.

In the high-pay game of snakes and ladders, the biggest earner in 2022, Sebastien de Montessus at Endeavour Mining, has slid down to ninth place. Last year he received a bumper payout linked to Endeavour’s stock market flotation.

RUTH SUNDERLAND: The top two are worth it… but many others aren’t

Admired: Charles Woodburn

Astra and BAE bosses deserve big rewards – unlike some money-grabbers. The essence of the capitalist system is that rewards should come as a result of genuine success. Executives should not receive life-altering payouts just for mediocrity, still less be handed millions for failure.

Happily, this year the two men at the top of the Footsie earnings league – Pascal Soriot of AstraZeneca and Charles Woodburn of BAE – run great British businesses and can point to exceptional achievement.

Soriot took a principled stand against a takeover bid by Pfizer of the US back in 2014, when many investors would have preferred to take the Pfizer dollar and sell Britain’s pharma flagship down the river.

Astra is now the UK’s most valuable enterprise, worth more than its one-time predator. Had he surrendered to Pfizer, Astra might well not have played the part it did in producing a leading Covid vaccine or become a major force in defeating cancer.

Woodburn leads the UK’s most important defence company, a major provider of apprenticeships and jobs in some disadvantaged areas of Britain.

He has steered it skilfully through the pandemic and, thanks to the demand for military equipment since the invasion of Ukraine, BAE now has a bulging order book.

Less happily, there are other cases where multi- million pound pay packets do not look so well earned.

The fact that investors have mounted significant protests against top pay at more than one in ten FTSE 100 firms is a disgrace, suggestive of widespread and unchecked greed.

Firms dealing with the public – such as banks, supermarkets and utility suppliers – need to be particularly careful for their reputations when dishing out wads of cash, especially when workers are low paid.

Corporate behaviour has become a battleground in the culture wars being fought in the US and the UK. Very high pay for a few can be socially divisive and breeds resentment. If there is even a whiff it is ill-deserved.

Pay committees and their advisers, who fix executive packages, need to show much more sense and sensitivity.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.