The UK’s biggest wood burner is in talks with the Government over further handouts to cover funding its controversial biomass plant.

Despite whopping profits and a £300m share buyback, Drax wants ministers to provide financial support through to the end of the decade.

It has been handed more than £6billion of subsidies for the power station in Selby, North Yorkshire that generates more than 4 per cent of the UK’s electricity.

But Drax’s green credentials have been queried, given it burns wood pellets from Canada and one of the UK’s top carbon dioxide emitters.

The company will no longer receive Government subsidies when funding ends in 2027.

Controversial: Drax’s green credentials have been queried, given it burns wood pellets from Canada and one of the UK’s top carbon dioxide emitters

It believes a three-year extension will be key to ensuring it can fit carbon capture technology from 2030 as it is unclear whether wholesale electricity prices will be high enough for Drax to cover input costs and to continue running without financial support

It says the process – bioenergy with carbon capture and storage – prevents emissions being released into the atmosphere and can help the UK switch to clean energy.

The previous government was seeking a ‘bridging mechanism’ to keep its power station running without subsidies between 2027 and 2030.

Will Gardiner, chief executive of Drax, said: ‘We look forward to working with the new UK Government to help grow the economy and take steps urgently to deliver a net zero electricity system by 2030.’

He said a decision was needed this year so it could make significant investments in 2025 to meet the deadline.

Matt Williams, of Cut Carbon Not Forests and advocate for US environmental advocacy group Natural Resources Defense Council, said: ‘It is unacceptable this company is burning the world’s forests and making money hand over fist from environmental harm.

‘A large part of profits come from public subsidies Drax is given by claiming that burning forests is good for the planet.’

Drax said profits rose 37 per cent to £463m in the first half, and income should be at the top end of forecasts for 2024.

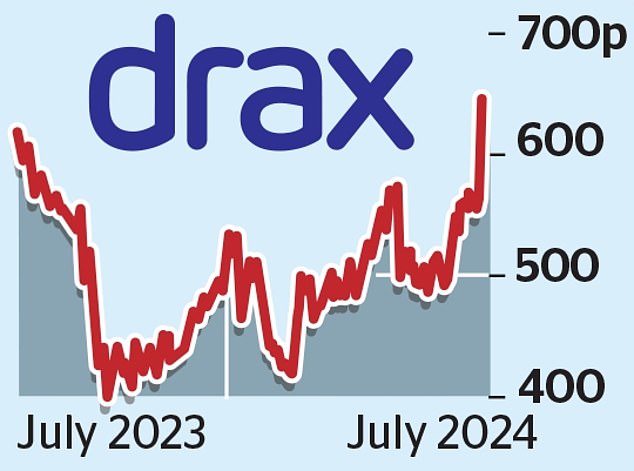

It will return £300m to shareholders over two years. Shares rose 14 per cent, or 79p, to 645.5p.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading fees

Trading 212

Trading 212

Free dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.