|

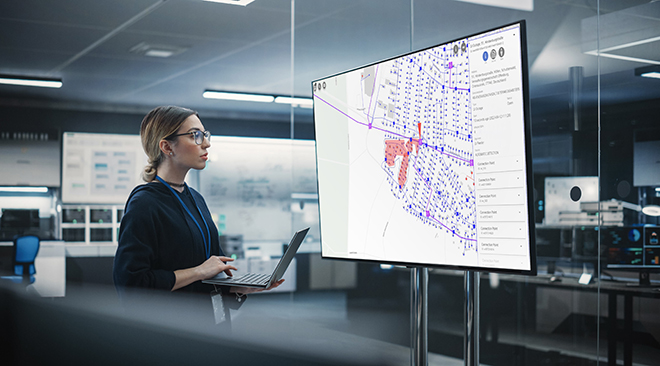

A Siemens employee uses the company’s new software designed to help distribution grid operators increase the capacity of their networks. |

➤ Digital software can help increase grid capacity by improving system visibility and manageability.

➤ Utilities and grid operators have a harder time getting remunerated for spending on digital investments than for physical grid infrastructure.

➤ Flexibility is the “next frontier” in terms of getting more capacity out of existing grids.

Policymakers and executives at the Eurelectric Power Summit 2023 in Brussels on June 20–21 laid bare the challenges facing Europe’s aging and strained electricity grids. Not only are billions of euros needed for new poles and wires, but the influx of distributed energy resources means existing grids also need to be future-proofed. That means incorporating digital software. Indeed, without full digitization of the grid, Europe will be unable to run its electricity system in the future, according to Leonhard Birnbaum, CEO of German utility E.ON SE.

Among the companies pioneering the grid’s digitization is German industrial giant Siemens AG, which recently launched software known as LV Insights X to help utilities and grid operators increase their capacity by actively managing the low-voltage distribution grid. Unlike physical infrastructure that typically takes years — or even decades — to get approved and built, digital software can often be deployed in a matter of weeks.

S&P Global Commodity Insights spoke with Sabine Erlinghagen, CEO of Siemens’ grid software business, on the sidelines of the conference. The following conversation has been edited for clarity and length.

S&P Global Commodity Insights: What is the biggest challenge facing Europe’s power grid?

Sabine Erlinghagen:

The question now is, how can we increase grid capacity? And the problem is not only increasing the grid capacity but increasing it extremely fast. Now, if anything is not fast, it’s building new infrastructure, of course. So the solution … is to use digital means to increase that capacity faster than it would be possible with the conventional ways.

|

Sabine Erlinghagen, CEO of Siemens’ grid software business. |

When you say ‘digital means,’ what do you envisage?

Increasing grid capacity means, in essence, transporting more power over the same line. We have transmission and distribution losses … and by using smarter ways of routing the electricity through the grid, you can lose less. … If you reduce those losses by one percentage point, you would save 10 power plants across the EU if you did that EU-wide.

If you look at how well-utilized the grids are today, they have quite a bit of safety buffer in there because they lack real-time visibility and transparency into what’s going on. So you … block other things from coming onto the grids to keep those buffers intact. Now, if you have visibility, if you have transparency and if you have manageability, you can actually reduce the buffers quite significantly, and you get a pretty significant increase in your free capacity by just reducing those buffers.

What kind of capital expenditure is required for the grid’s digitization?

We’re talking dimensions less on the digital side [compared with physical infrastructure]. And the thing is that the incentives for investing in digital are not right. If you look at what you can leverage for your tariffs, most digital investments are hard to be recognized for the tariff schemes, while any copper investment is easy to recognize. … You have the wrong incentive system in many places, or you are less sure that you actually get to the return on any software investment than any hardware investment. But the amount of money, I would argue, means it’s more efficient to invest in digital.

You said regulatory mechanisms to incentivize digital investments do not exist?

Correct. At least it’s harder to get those paybacks, and you need to argue more, and you are not sure your [arguments] will be followed by the regulator. While on the hardware side, you can be sure, and it’s a more straightforward rate case to be made.

To what extent do you think policymakers understand the benefits of digital grid software?

I think, by and large … the knowledge on the policymaker side is not as big because software is invisible, it’s not touchable, while a physical investment out there in my backyard, it’s something that you can see and touch and feel. So it’s potentially a matter of … educating policymakers about the possibilities of software. And also, it’s a little bit of a European versus US mindset. I think in the US, you think of software first, while here, you think like the physical and the classical ways maybe too much.

Why does understanding differ between the US and Europe?

If you look at almost all of the digital economy, be it the big cloud providers or anything, they’re all coming from the US. It’s, I think, maybe a cultural thing or that in the US, you’re much more prone to think software than to think physical solutions. It has gotten better, of course, but if we look at the efforts of the EU to digitize, then I think it’s, by and large, recognized that we are behind, that we missed some of those trends on the hyperscalers, on [artificial intelligence] and so forth. I think we shouldn’t be doing the same mistake on the grid side.

Siemens recently launched new software called LV Insights X to actively manage low-voltage grids. What other software can be deployed to improve the grid?

To lift it up one level, the software that we just released, LV Insights X, is really a key puzzle piece for building a digital twin. And what we mean by digital twin is really bringing grid planning, grid operations and grid maintenance closer together in a way to integrating between [information technology] and [operational technology], and really basing all your decisions — from plan, operate, maintain — on the same risk model. So everybody is basing off the same data and very efficiently working together and optimizing the grid together.

How can that be developed further?

I think the next frontier for especially distribution grids is flexibility. … And without transparency and without a proper network model of your distribution grid, you can’t really leverage that flexibility. So if you want to get more capacity out of your existing grid, transparency and understanding where your bottlenecks are is the first thing, and then tapping into the flexibility potential is the next thing … before you actually invest into any new copper or any new lines.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.