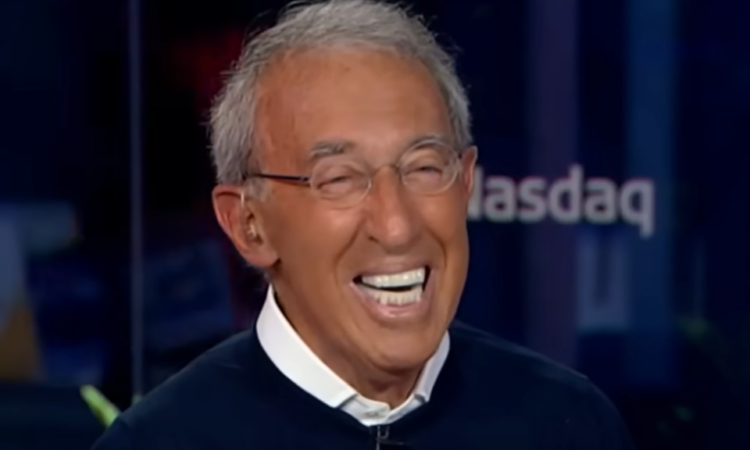

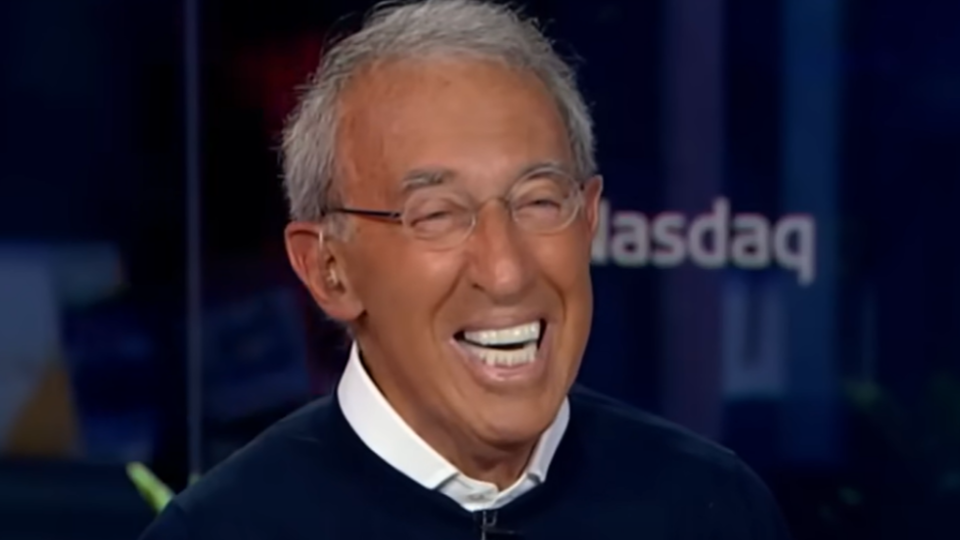

Billionaire Investor Ron Baron Says The U.S. Stock Market Will Grow Above 7% Annually Over The Next 50 Years — Or 35X Your Money. Here’s Why And What He Likes Now

Amidst the backdrop of geopolitical conflicts, escalating price levels and high-interest rates, the stock market has a lot to grapple with. But if you are in for the long haul, billionaire investor Ron Baron has some good news.

In a recent CNBC interview, Baron pointed out that despite going through “terror attacks and inflation and wars and pandemics,” the stock market “is up 34 times since 1970.”

The legendary investor added that U.S. gross domestic product (GDP) has also grown tremendously during this period. “It’s up 33 times,” he said.

Going forward, Baron sees even better days ahead for equity investors.

“Now what I think is growth is now beginning to accelerate. And over the next 50 years compared to the last 50 years, I think that you’re going to have faster growth than 7%,” he said.

In other words, investors who are willing to hold onto their shares through the decades would be handsomely rewarded.

“Assuming that you get the same 7%, that means that you’re going to have 35 times your money over the next 50 years, which means that the Dow Jones, which is now 34,000, would be 900,000,” Baron said.

Check out:

Inflation To Remain Hot

Achieving a 7% growth rate over an extended period of time is no easy feat. But according to Baron, a big component of that 7% is something that’s already happening — inflation.

“Inflation is 4% or 5% of that 7% growth, and real growth has been 2%,” he said.

The U.S. Federal Reserve has implemented aggressive interest rate hikes to tame rampant inflation. According to the latest consumer price index (CPI) report, consumer prices in the U.S. increased 4% in May from a year ago, down from a peak of 9.1% registered in June 2022.

The Fed has an inflation target of 2% — so there could still be room for further tightening. But Baron doesn’t see inflation coming down that much.

“I expect inflation to be, as it always has been, as it always has been in every single democracy that’s ever existed, 4% to 5% a year,” he said.

At that rate, consumers should brace for substantially higher price levels in the future.

“I think everything is going to be twice as expensive in 14 or 15 years as it is today,” Baron said.

He added that while inflation might go a little bit lower, “it’s not going to stay lower.”

If you are seeking inflation-fighting assets, new companies have innovated ways for people to earn passive income in the real estate market. Here’s how to invest in rental properties with as little as $100 while staying completely hands-off.

Baron’s Big Bet

Five decades is a long time. But if you are looking for something with more near-term potential, you’d still want to pay attention to Baron.

In particular, the legendary investor is bullish on Tesla Inc. (NASDAQ:TSLA).

Shares of the electric car maker have more than doubled in 2023, but that could be just a start.

“I think it’s going to be $500 in 2025 and I think in 2030, it’s going to be $1,500,” Baron told CNBC.

Considering that Tesla currently trades at $267, these targets imply an 87% upside in 2025 and a 462% upside in 2030.

Baron is putting his money where his mouth is. According to his firm BAMCO Inc.’s latest Form 13F filing with the Securities and Exchange Commission, it owned 17,606,894 shares of Tesla at the end of the first quarter. With the position valued at $3.65 billion at the time, Tesla was the largest publicly traded holding in BAMCO’s portfolio.

Read next:

Image source: CNBC interview with Ron Baron on YouTube

Don’t miss real-time alerts on your stocks – join Benzinga Pro for free! Try the tool that will help you invest smarter, faster, and better.

This article Billionaire Investor Ron Baron Says The U.S. Stock Market Will Grow Above 7% Annually Over The Next 50 Years — Or 35X Your Money. Here’s Why And What He Likes Now originally appeared on Benzinga.com

.

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.