Both my first name and surname have always been a challenge for people to pronounce.

Throughout school, teachers would make a complete hash of it whenever I was called up to the front during assembly.

So, when I graduated from Queen’s University in Belfast, I was astounded when the vice chancellor got it right. My mum said she nearly cried when she heard it.

It really mattered to us both because names do matter. Job titles are important too.

When I set out to be a journalist, I never had any specific ambition to write about finance. In fact, as many of you know, I started off writing about utility companies.

But I do like calling myself a ‘financial’ journalist. (Yes, I know, pretentious).

Earlier this week, I read NextWealth’s latest financial advice business benchmarks report.

One of the sections I found particularly fascinating was a bit about what client-facing staff within advice firms call themselves.

Since the rollout of RDR in 2012 we have, as an industry, seen the rise of financial planning and of professionals describing themselves as ‘financial planners’.

From NextWealth’s report, it looks as though use of the term ‘planner’ is on the rise.

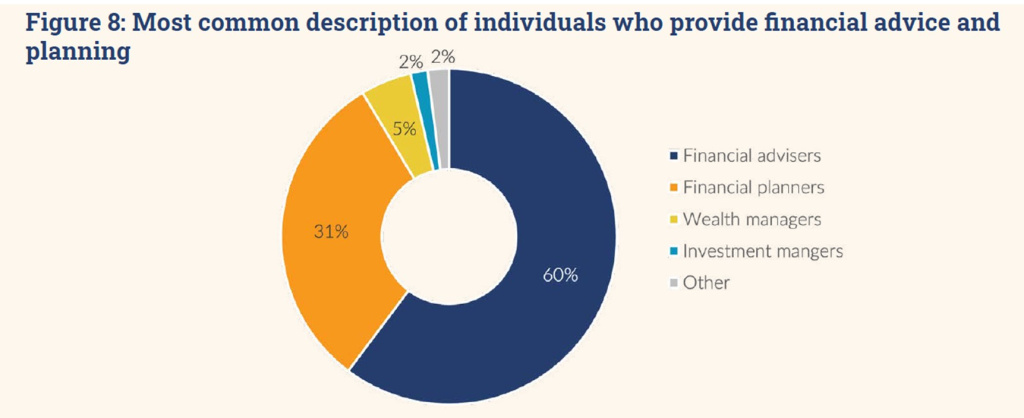

Around 31% of client-facing staff within the profession now use the term, according to NextWealth.

This is something I have noticed in my day-to-day conversations with advice professionals as well.

The term ‘adviser’ is by no means dying out, however, with 60% of staff still using it.

Creative agency Alliance’s co-director Gareth Waters says there are around 2,400 UK monthly searches for ‘financial planner’, compared with 3,600 for ‘financial adviser’.

Interestingly, ‘financial advisor’ is even more popular with 18,100 searches.

There are other terms client-facing staff use to refer to themselves as well.

NextWealth found in its report that 5% use ‘wealth managers’ and 2% use ‘investment managers’. A further 2% use ‘other’ terms.

Cavendish Ware director Roy McLoughlin calls himself a ‘financial architect’- much to the light-hearted disgust of some of his peers.

But what is the difference?

NextWealth suggests the distinction between an ‘adviser’ and a ‘planner’ is that advisers deliver a transactional service to clients, providing advice on a particular product or specific need, whereas planners take a more “holistic” view of the client’s financial and life objectives.

“For some, the financial plan is a pre-requisite for all new clients regardless of the initial query and that informs how the firm’s services are marketed and charged” it said in its report.

NextWealth managing director Heather Hopkins points out that there were some “pretty stark differences” between the two terms.

“I was actually surprised at how stark the difference was in cash flow,” she adds.

“When you segment the audience by those that call their client-facing people financial planners and advisers, there was a real split on the use of cash flow modelling.

“This was the foundation of where that term financial planner came from – planning not product advice.”

Among employees of firms that call their client-facing professionals financial planners, 54% use cash flow modelling.

This compares to 18% among those who use the term financial adviser.

Sandra Paul from Prestwood Software said: “Our founder Paul Etheridge, the ‘Godfather’ of financial planning, who died earlier this year, always used to call himself a Financial Planner (with caps) because he did lifelong financial planning with his clients.

“It was planning that requires a long-term relationship because you plan for certain goals over a period of time.

“Planners tend to use cashflow planning with all their clients, not just for drawdown scenarios.

“Advisers tend not to have this lifetime relationship with their clients, they tend to see more clients, probably because they view the financial relationship in a more product-focused, transactional way.”

Does it matter what advisers are called?

I asked Rob Schwartz, financial planner and founder of Finova Money, what he thought.

He responded with a LinkedIn post saying: “Whilst it can be a bit murky to differentiate the services of an ‘adviser’ and a ‘planner’, there are some similarities that are worth highlighting, qualification levels are the same, regulatory requirements are the same, areas we can advise on are the same.

“However, from my experience, the differences are night and day.

“For financial advisers, there’s almost always a focus on investment management (matching a client’s money to a product).

“To me, even the word ‘adviser’ feels a little presumptuous that there needs to be a product or a solution to advise on at the end of it…

“A ‘financial planner’, on the other hand, will focus on all aspects of a client’s life. They’ll go deeper on goal setting and take a holistic approach to all things money.

“Ultimately, a financial planner will help clients map out their financial future and work with them to achieve it.”

Independent financial adviser and chartered accountant Dave Robertson responded to Schwartz’s post: “I’d just add though that qualifications are not always the same – and some are very much better qualified on paper than others.

“Some also have specialist accreditations such as Society of Later Life Advisers Society of Trust & Estate Practitioners or Resolution – which means they are far better equipped than others to give specialist advice which is required in certain situations.”

He pointed out that, when it comes to implementing recommendations, some who claim to be ‘planners’ are restricted and only have access to a limited range of financial products and investments.

“And fee structures vary enormously,” he added. “Some charge explicit fixed fees, others charge percentages, so their fees vary depending on how much their clients invest, some charge in very convoluted and opaque ways that make it very difficult to work out what you are paying.

“And to make it more complicated this applies whether you are dealing with an ‘adviser’ or someone who claims to be a ‘planner’.”

I started a bit of a debate on X as well.

I have a question for client-facing staff in financial planning/advice firms: do you call yourselves planners or advisers? And why?#journorequest

— Lois Vallely (@LoisVallely) October 12, 2023

Of course, social media is not reflective of life. But it is interesting to note that most of the responses use both interchangeably.

“I used to get really bothered about the difference when I first got chartered but increasingly don’t think actual clients understand the difference or give a stuff,” writes Greg Moss.

“Either or both it really doesn’t matter,” says Ed Gibson. “There’s no universally agreed definition and there’s no policing of such terms.

“Too many people trying to make themselves out to be better than others through subjectively applied terminology none of which a client recognises as different.”

Matt Vosper adds: “Sometimes I go with financial planner (as a shorter way of saying chartered financial planner). Sometimes, as it requires much less explanation especially so in social settings, I’ll just go with financial adviser.”

To me, name and job title matter. But more important than that is how a person acts, both personally and in their professional life.

I’m sure Money Marketing readers care more about the quality of my writing than my job title.

In the same way, as long as advisers or planners or financial architects are giving good advice, I doubt most clients care what they call themselves either.