Table of Contents

Show more

Show less

When it comes to investing – buying shares and funds – the gender divide is readily apparent: according to the Financial Conduct Authority (FCA) 2023 Financial Lives survey, almost half (46%) of men are likely to invest compared to under a third (29%) of women.

What are the reasons for the discrepancy?

The fact that, on average, women earn less than men over their working lifetimes could very likely have something to do with it. If you want to invest, you need money, and if women earn less than men (for whatever reason), it’s reasonable to conclude that women won’t be able to invest in equal numbers.

The traditional perception of the professional investment arena as a testosterone-fuelled bearpit may have also transferred to the retail market to some extent, encouraging some men to participate while deterring some women.

But thankfully the landscape is changing. Women are creating wealth faster than at any time in history, according to Hargreaves Lansdown’s report Why Women Invest (February 2024), and they are set to inherit 70% of the world’s wealth over the next two generations.

Are the number of women investors on the rise?

FCA data suggests growing numbers of women are investing. But the rise is slow and from a low base. The regulator found 13% of women held a stocks and shares ISA in 2022, for example, an increase of 2 percentage points since 2020.

For men, the equivalent increase was 4 percentage points, from 18% to 22%.

The amount of money invested by women has also risen. The average total investable assets women hold, including cash savings, money in ISAs and any investment funds, but excluding pension savings, rose to £34,000 in 2022, up from £28,000 in 2020. But the figures still lag behind men (more on the gender investing gap below), who held an average £52,000 in assets, excluding pensions, in 2022.

Sarah Coles, head of personal finance at investment firm Hargreaves Lansdown, says: “Two-fifths of women say society often presents investing as something for men. Although there is still a long way to go, we are seeing a generational shift in this kind of view, with 87% of women agreeing we’re more empowered to make decisions about our finances and investments than previous generations.”

What is the gender investing gap?

While the number of female investors may be growing, albeit slowly, the gender investing gap remains.

With similarities to the gender pay gap and the gender pensions gap, the gender investing gap is the differential between how much money men have invested compared to their female counterparts.

A report by the consumer money website Boring Money puts the differential as high as £567 billion (January 2024) in the UK, although this includes money invested in pensions, which accounts for a large part of the gap.

Research by the FCA into the gender split for investing activity also reveals a big divide between the genders. More than one in five men have a stocks and shares ISA (22%) compared to just 13% of women, for example.

For direct equity holdings, 28% of men hold individual company stocks, compared to 15% of women. And 14% of men use an investment platform for purchasing investment funds or investing in a pension, compared to just 4.6% of women.

The latest data compiled by HM Revenue and Customs into ISA holdings (published in June 2023) also reveals a gap between the sexes in terms of appetite for risk. While 1.7 million men hold money in stocks and shares ISAs, which invest primarily in equity-linked assets, the figure falls to just 1.1 million women.

Women instead prefer the relative security of cash ISAs, with 4.4 million holding money in here, compared to 3.1 million men.

Equities and stock market-linked investments are considered more risky than cash because investors can lose some or all of their original investment if the underlying stocks and shares they’re invested in fall in value.

With deposits and cash-based accounts, however, your cash amount won’t deplete because it is held in a savings account, not invested elsewhere on your behalf. That said, inflation erodes the buying power and overall value of cash savings over time (see What is investing? in our FAQs below)

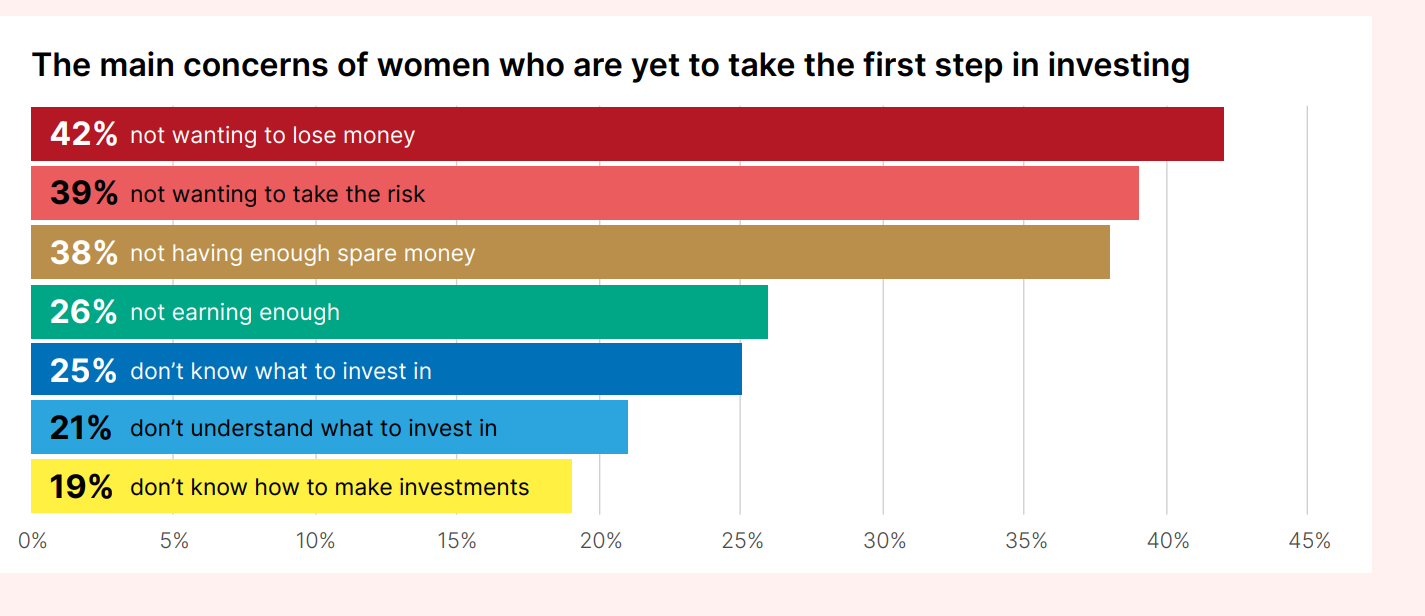

The findings of Hargreaves Lansdown’s Why Women Invest study also reveal that women, in general, are cautious about losing money through investment and don’t want to take the risk (see graph below).

The results in this study also found many women lack confidence around investing, with one quarter saying they don’t know what to invest in and 19% saying they don’t know how to invest.

Coles at Hargreaves Lansdown believes the finance industry has a role to play in making investment more accessible across the board: “Two thirds of women say financial jargon makes things harder, while others find it too dry, and still more are put off by risk warnings. Partly as a result of this, 40% of women say they’re not interested in investment.”

Why should women consider investing?

Women often cite the higher risks involved with equity investing as a concern. But financial experts say leaving savings in cash is also risky.

Simonne Gnessen, founder of Wise Monkey Financial Coaching and co-author of Sheconomics, says: “It’s important to note that cash holdings are also at risk of falling in value, particularly when inflation is high. The rates you’ll earn on deposit savings are unlikely to keep pace with inflation so, effectively, the spending power of your money is being eroded.”

Gnessen adds that, by starting small with investing, even from just £10 a month for example, first-time investors can see how markets and funds work.

“As long as you’re in the investment for the medium to long term, short-term fluctuations in values should cause less worry,’ adds Gnessen. ‘And over the long-term there could be much more significant growth compared to cash.”

Do men and women invest differently?

Although it is a big generalisation, evidence suggests that when it comes to investing, women do take a different approach to men.

As shown above in data from HMRC, women tend to favour cash ISAs, for example, over more risky stocks and shares ISA investments.

Among women who invest there is often a strong preference for Environmental Social and Government (ESG) investments. A report into women and finance by the private bank Kleinwort Hambros in 2019 found 73% of women believe men and women have different attitudes to investing and more than two thirds (67%) of women said making a social impact was of high importance.

Samantha Secomb, a chartered financial planner and founder of financial advice firm Women’s Wealth, says: “Women are more likely to want to know the maximum downside of an investment opportunity than men, who tend to concentrate on the possible upsides.

“Women also usually prefer investments that consider the environment and the impact on people, compared to men.”

Are women better investors than men?

While women are less likely to invest in stock markets and equity-linked assets compared to men, studies suggest they tend to be more successful, on average.

Analysis by Fidelity Investments of five million customer investment accounts over a nine year period (2009 to 2020), found that on average women’s holdings outperformed those of men by 0.40 percentage points annually.

And a similar study by the University of Warwick Business School also found women’s investment choices outperformed those of their male counterparts by 1.8 percentage points per year.

This could be due to the relative risk profiles when it comes to investing, with women less likely to chase short-term returns or opt for risky investments. Women also trade their investments less frequently than men, on average, potentially suggesting they are more focused on long-term returns.

Things to consider when investing

Tax treatment depends on one’s individual circumstances and may be subject to future change. The content of this article is provided for information purposes only and is not intended to be, nor does it constitute, any form of tax advice.

- your budget: how much of your disposable income do you want to invest? This should be money you can afford to lose, bearing in mind there is no guarantee of investment performance and your investments can fall as well as rise. That said, over the long term, equity investments have been shown to outperform cash savings

- investment goals and timeframe: consider what you’re investing for and your timeframe. Generally speaking, stock market and equity-linked investments should be viewed as medium term (five years or more) to ride out peaks and troughs in performance

- tax-efficient ISAs: use your annual tax-free individual savings account (ISA) allowance, which is £20,000 each tax year. This will shelter your investments from income and capital gains tax

- choosing a platform: shop around and compare different online investment platforms before you begin, looking at the range of investments on offer, the minimum investment levels, and the fees and charges. Many platforms offer plans where you can invest from just £1, so the entry level can be low. But in this case be wary of paying fixed fees, which could quickly wipe out the value of your investments

- do you need advice? Do you want to invest in a ready-made portfolio that suits your approach to risk, or do you want to set up a bespoke financial plan and investment portfolio? Depending on your needs and your budget you may choose to use a robo-advisor, for example, or get personalised advice from a professional independent financial advisor.

Investment ideas for women

Women looking to get into investing for the first time might want to consider drip-feeding money into a lower risk fund with a spread of investments.

Many platforms allow small monthly payments into their own ready-made portfolios, which are tailored by attitude to risk. Investments can often start from as little as £10 or £20 a month, for example, and investors might choose to invest via a tax-free ISA wrapper.

Poppy Fox, investment manager at investment advice company Quilter Cheviot, says: “Don’t be afraid to get started and to take some risk, depending on the purpose of the portfolio. While you should always remember you need a minimum of a five-year time horizon to invest, you don’t need to have a large amount of money.

“There are many online platforms that can help you get started, and buying a multi-asset portfolio based on the risk you want to take is a good place to begin. Regular monthly investing will build up over time, allowing an investor to benefit from compound growth (there is more on compounding in our guide to investing for beginners).

For investors looking for ESG funds, perhaps as part of a wider portfolio, Jason Hollands, managing director at Bestinvest, favours Brown Advisory Global US Sustainable Growth fund, Baillie Gifford Responsible Global Equity Income fund and Stewart Investors Global Emerging Markets Sustainability.

With regard to Stewart Investors Global Emerging Markets, Hollands says: “The investment team believe that by investing in the highest quality, strongest sustainability companies, the fund will be well placed to benefit from and contribute to a more sustainable world, and at the same time achieve long-term capital growth.

“This is a core option for investors looking to invest in an ethical/ sustainable emerging markets mandate.”

Frequently Asked Questions (FAQs)

What is investing?

Investing is buying an asset (shares or bonds, an investment fund, gold or other commodities), in the hope it will rise in value over time. The key difference with investments compared to cash savings is that, with the former, you could lose your original investment, so it is considered more risky than cash.

Our guide to investing talks more about how investing works, the risks and potential rewards, and how to get started.

Should I invest in my pension or an ISA?

There are different considerations for investing in a pension versus an ISA, including the maximum annual investment levels, flexibility and access to your money, and the relative tax benefits, so it’s best to weigh up what you’re investing for to see which wrapper suits your needs.

Many investors want both a pension and an ISA, where the money is being invested for different financial goals.

How much should I invest each month?

How much you want to invest each month will depend on the available cash you have after all the bills are paid. The money you use for investment should be viewed as money you could manage without, or that you can afford to lose. That’s because investing carries risk. Although you can make money when you invest, you can also lose it.

Where can I start investing if I can’t afford financial advice?

Many first-time investors opt for a stocks and shares ISA that invests in a ready-made portfolio tailored to your level of risk appetite.

Many investment platforms offer a guided advice service through what’s known as a robo-advisor, which uses technology to tailor an investment portfolio to suit your goals and risk profile. Although there are fees attached to robo-advice, it is likely to be much cheaper than using the service of a financial advisor.