Feverpitched

To get an idea of where the economy is going, let’s look at a few leading economic indicators. There are generally 5 very good leading economic indicators – yield curve, durable goods orders, stock market, manufacturing jobs, and building permit applications/approvals. When you look at these indicators, the outlook is not bright.

Yield Curve

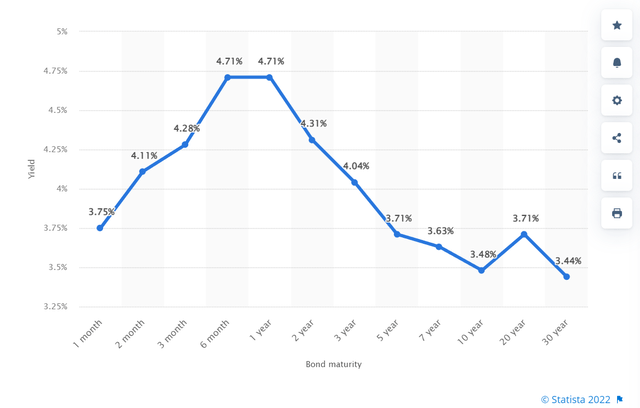

Generally, a yield curve starts out low and rises over time. It’s business as normal when a yield curve starts low and goes up with the duration of bond maturity. When it’s the opposite or inverted, that has historically been treated as a bad sign. Is it currently inverted? Yes, it is. As of Dec 8, this is what the USA yield curve looks like.

Historically, the yield curve has been a good predictor of the last 8 recessions as it is well illustrated in this article, which mentions the recession in 1970, ’73, ’80, ’90, ’01, and ’08 were all proceeded by an inverted yield curve. The yield curve did also invert in 1966, but it was not followed by a recession. On average, the yield curve is a good predictor of a recession. A good way to look at interest rates is as a trade-off for taking the risk of lending funds to a third party. If the situation becomes riskier – company is too leveraged, or economy is about to crash – the result is the same; lenders require a greater reward for the risk they take. As you can see from the curve illustrated in the graph above, lenders see much greater risk in the short term vs the long term.

Durable Goods Orders

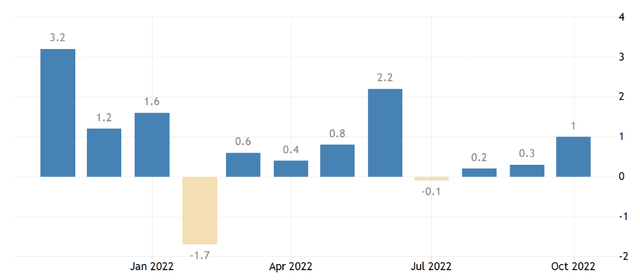

Despite inflation, durable goods orders were able to rise 1% in October 2022. As you can see from the graph below, they have been generally positive in 2022. Durable goods are those big-ticket items that require a lot of labor to produce. They include items like cars, home appliances, furniture, heavy equipment, and so on.

Growing demand for durable goods is a good indicator of business confidence. The more durable goods that are purchased, the more business labor needed to produce those products. This leading indicator is positive, but may not be enough to offset the other leading indicators.

Stock Market

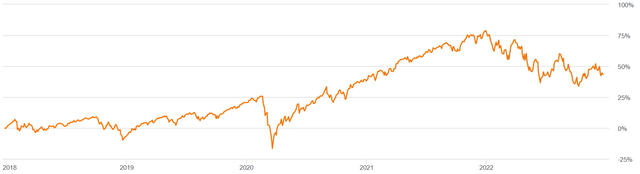

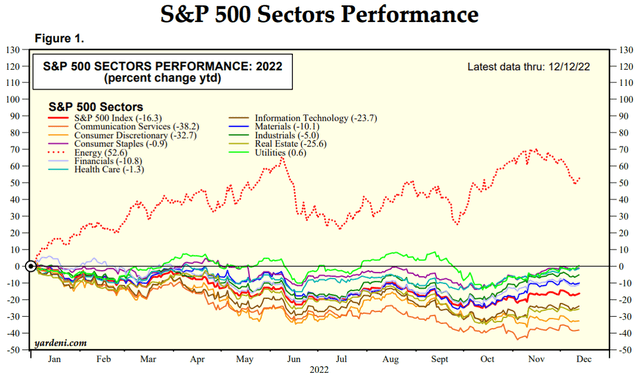

The S&P 500 has not had a good 2022. It went down from 4766 at the end of 2021 to 4019 as of Dec 13, 2022. YTD, the S&P 500 is down 15%. You can see from the graph that it was not a smooth ride down. The stock market tried to recover 3 times but just could not sustain. It’s not surprising that we have had a roller-coaster of a year. Every week, new material information hits the market – inflation, jobs numbers, cuts to gas production, and frequent war news from Ukraine.

Keep in mind what the stock market is. It’s a grouping of companies and their valuations. These valuations are derived from investors, portfolio managers, and hedge fund managers that spend all day researching companies to predict future earnings and growth rates. A decline in the stock market logically means investors are seeing red flags on the horizon. This leading indicator is negative.

Manufacturing Jobs

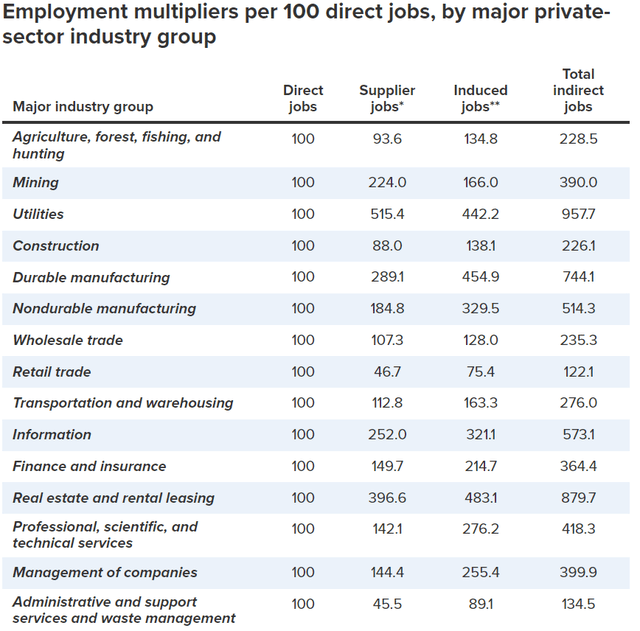

An important component of employment is the manufacturing jobs. You can see from the table below that the multiplier effect from manufacturing jobs is large. Basically, the multiplier is how many spin-off jobs one particular job supports. Durable and non-durable goods manufacturing is quite high at 7x and 5x, respectively.

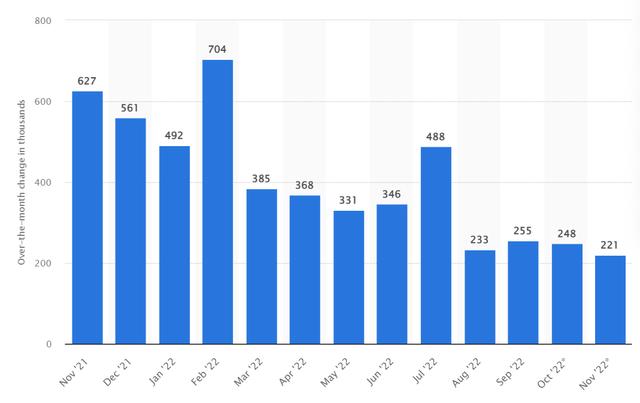

We have been getting more signals from the Federal Reserve that rates are going up and will not be coming down soon. The ADP November jobs report published this Nov 30 reports that overall, 127,000 jobs were added in November. Those extra jobs were also accompanied with wage growth. So, we are in a situation where we keep adding jobs and higher wages in one area, but at the same time, manufacturing jobs are decreasing. This robust jobs report only strengthens the case that interest rates will go up and keep pushing us closer to a recession.

The ADP jobs report states 127,000 jobs were added to the USA economy in November. Of those jobs, goods-producing industries accounted for 16,000 in natural resource and mining, -2000 in construction, and unfortunately, -100,000 in manufacturer.

The graph below shows the declining trend in new jobs filled over the last year.

Non-farm payroll growth (Statista)

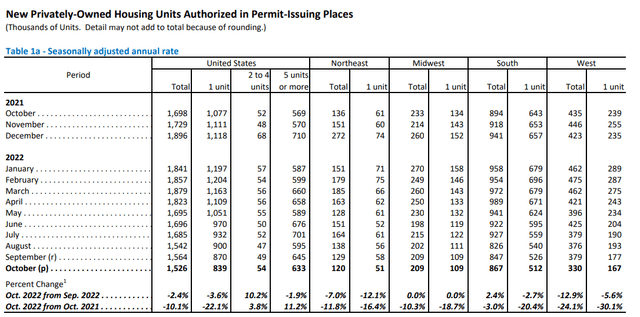

Building Permits

The real estate market is an important signal of business and consumer confidence. When consumers, businesses, or investors feel confident in the direction of the economy, they feel secure enough to make or finance large-scale investments. The more investments that are made not only affect the construction industry but banking as well. Building permits issued are a great way to gauge the demand for construction labor 6 to 9 months ahead. Falling demand for new homes also indicates a weakness in the resale market, affecting commissions and profits of many real estate firms and salespeople. We can see from the chart below that the real estate market is still heading down. The number of permits still continues to fall.

Housing permits issued (United States Census Bureau)

The Conference Board Leading Economic Index

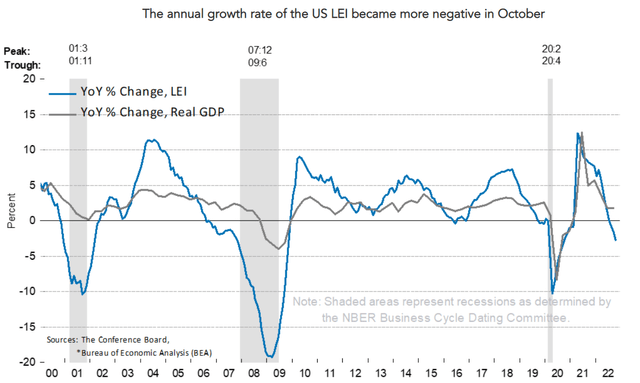

There are many good leading economic indicators. Unless you want to track each one of them yourself, the conference Board has three great indexes that track leading, coincidence, and lagging indicators. All of these can be used, but I prefer to look at the leading indicator. This is a powerful indicator of where the economy will likely go. History has shown that the Leading Economic Index predicts corrections in the business cycle by roughly 7 months.

The index is composed of various leading indicators:

- Average weekly initial claims for unemployment insurance.

- Manufacturers’ new orders for consumer goods and materials.

- ISM Index of New Orders.

- Manufacturers’ new orders for nondefense capital goods excluding aircraft orders.

- Building permits for new private housing units.

- S&P 500 Index of Stock Prices; Leading Credit Index.

- Interest rate spread (10-year Treasury bonds less federal funds rate).

- Average consumer expectations for business conditions.

Currently, the index is down 3.2 percent over the last 6 months. “The US LEI fell for an eighth consecutive month, suggesting the economy is possibly in a recession,” said Ataman Ozyildirim, Senior Director, Economics, at The Conference Board. As you can see from the graph above, the index has been successful at predicting upcoming recessions. As of recently, we have crossed into recession territory.

Where to Invest?

So, where do we invest in these difficult times. There are traditional thoughts on investing during recessions to investment-defensive stocks. Stocks that have a small Beta. A stock with a beta of 1 moves exactly with the market. So, if the market goes down 2% so does the stock with a beta of 1. If a stock has a beta of 0.5 and the market goes down 2%, then the stock with a beta of 0.5 only goes down by 1%. This works in the opposite direction as well.

So, if we predict that the market is going down, do we really want to invest in a stock that we know will not go down as much as the market, but will still go down? You can see from the graph below that all sectors other than energy have gone down during the last year’s downturn. Although I like the performance of the energy sector recently, I try to stay away since globally governments have made traditional energy companies public enemy number one. Globally, traditional energy companies have been targeted with stricter regulations, denied permits to drill or stopped from expanding pipelines. Now with healthy profits in energy, progressive representatives talk about “excess profit” taxes. In my eyes, traditional energy companies can’t win in the long run.

I’ve looked for companies that have grown their revenue and earnings consistently over the last few years. If these consistent growers did take a hit to their revenue or earnings during Covid, I would want to see a quick turnaround and continued growth up to this point. I also want to look for small companies that may have been overlooked by the majority of investors. While a lot of stocks have been falling in the last year, these stocks are still increasing in value. The following 2 stocks have been able to weather the Covid recession, making me confident in investing in them for the upcoming recession. I would also like stocks that are not similar to each other, I looked for stocks in very different industries and sectors.

So where are the opportunities?

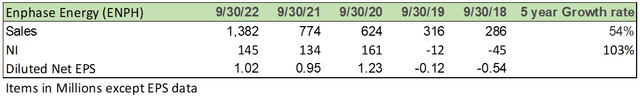

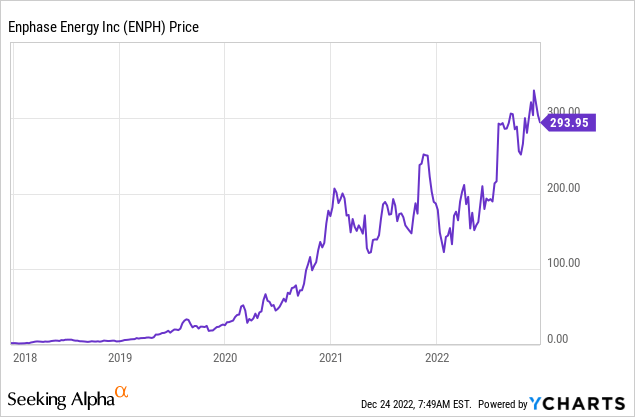

Enphase Energy (ENPH)

Zacks.com

Established in 2006, Enphase Energy is a technology company headquartered in California that develops and manufactures solar battery storage, micro-inverters, and EV charging stations. They are the first company to successfully commercialize the solar micro-inverter. Micro-inverters convert direct current power generated by a solar panel into grid-ready alternating current.

Enphase’s largest market is the USA. Over the last few years, revenue from the American market composed 70% to 80% of the company’s total sales. They also sell into Canada, Mexico, Europe, Australia, Central America, India, and other Asian markets. To date, the company has shipped more than 42 million microinverters globally.

I like the strategic road map they have outlined in their annual report.

They are looking to be best-in-class in customer experience. They look to design products that are “reliable, smart, simple and safe”(2021 10K); I feel this is something that most consumers would gravitate to. They are trying to distinguish themselves from their competitors by being a system-based provider. The 10K further states their products “manage energy generation, energy storage and control and communications on one intelligent platform”. They are heavily involved in R&D trying to increase power conversion efficiency and output power. Their “engineering team is focused on increasing the energy density of our battery capacity, reducing installation time and reducing cost per kWh to make solar-plus-storage resilient, sustainable and affordable for the masses”. This company is a perfect place to invest today because of the huge focus on renewable energy and solar that governments around the world are pushing.

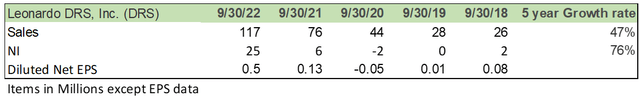

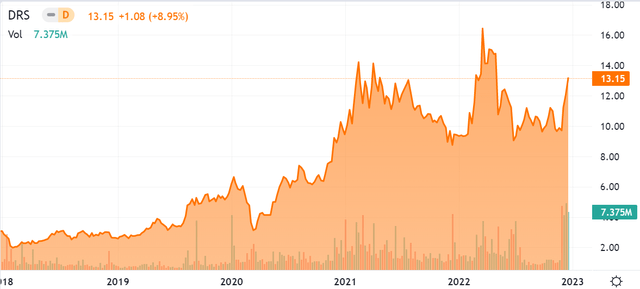

Leonardo DRS (DRS)

Zacks.com Leonardo DRS stock price (Seeking Alpha)

Defense has huge potential in the next few years. Not only was a country in Europe invaded similar to WW2 recently, which is currently consuming a lot of resources that the west is providing, but also many countries around the world are looking to increase their military spending. The current Ukraine situation is also showing the limitations the world has in controlling a nuclear power state. The west has put many sanctions on Russia but there seems to be no de-escalation in the situation.

I’ve come across Leonardo DRS, Inc. It develops and makes defense products for the USA and allies. Their product mix includes advanced sensing, network computing, and electric power and propulsion. They operate in land, air, sea, space, cyber, and security.

Even recently, as part of its National Security Strategy, Japan has committed to acquiring long-range weapons and increasing its defense budget, citing regional threats as a key factor. The expansion of military capabilities by Japan would have been unheard of just a few years back, but this is the global reality we find ourselves in right now. Closer to home, The New York Times has reported “The prospect of growing military threats from both China and Russia is driving bipartisan support for a surge in Pentagon spending”

The increased spending and the need to replenish ammunition used in Ukraine are all great signs for the defense industry.

Conclusion

With all the global tensions and recession signals flashing red, I think now is the best time to get into some niche companies which have proven their ability to grow in difficult times.