In the last decade, the US established itself as a leader in funding climate tech ventures, with Europe trailing. Known for their willingness to embrace risk and invest heavily, US investors stand out in their approach to supporting these ventures.

The world of climate tech is marked by uncertainty: new markets are emerging, technology winners are yet to be determined, and fluctuating policies impact commercial viability. Notably, many of these ventures are developing complex hardware products, necessitating a longer path to market.

Recognising how well US investors’ perspective aligns with the climate tech sector, we were intrigued by the question of what US capital means for the growth of European climate tech startups. Analysing over 4500 such companies, we investigated the distinct characteristics of deals with US involvement, the evolving trends, and what this could mean for the future of Europe’s climate tech industry.

Trends & predictions

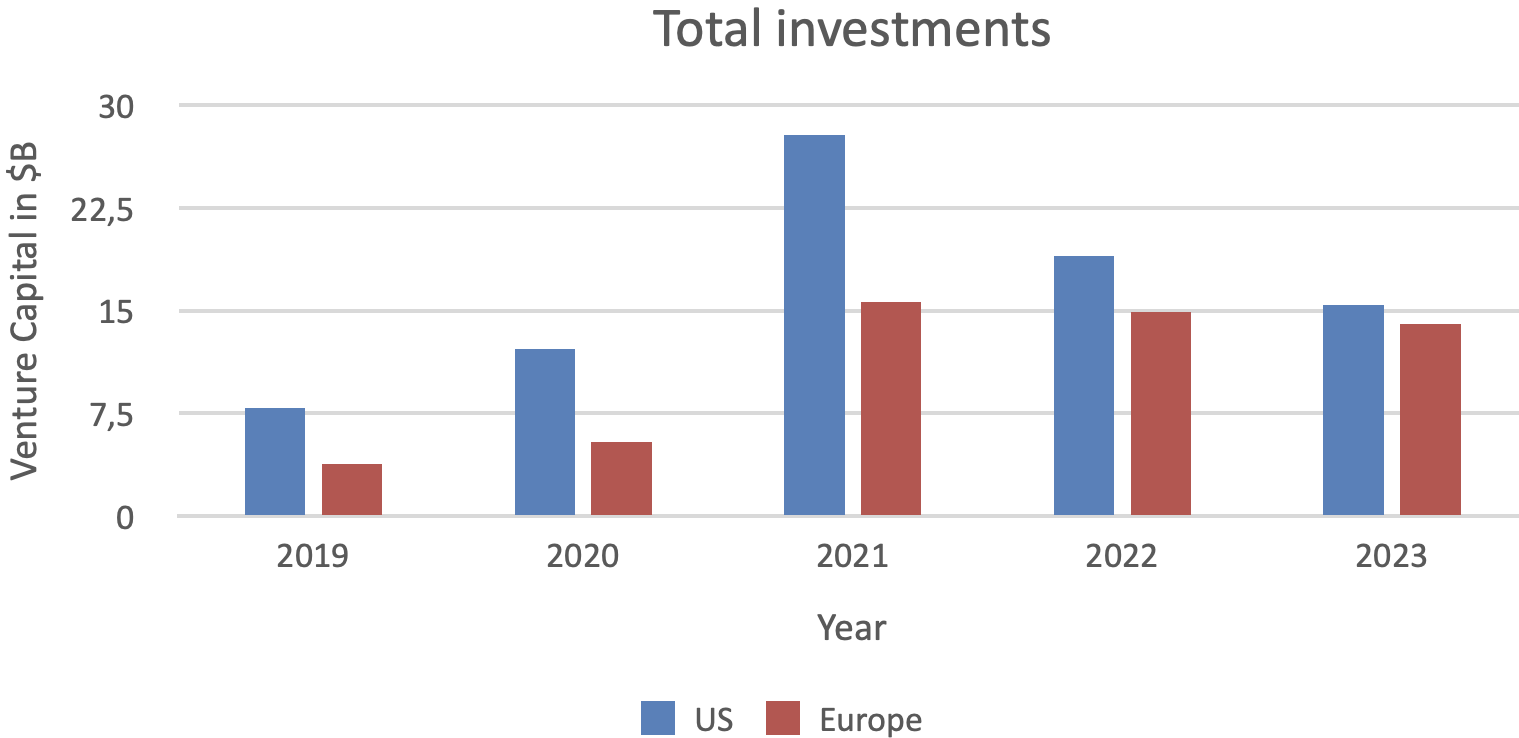

2023 presented a challenging year for venture capital globally, with a significant downturn in startup funding. European ventures experienced a 37% decline in overall venture capital compared to 2022, while the US saw a 40% drop. However, there’s a silver lining in the climate tech sector.

Unlike other industries, climate tech in the EU demonstrated resilience, with only a 6% reduction in investments. This European resilience is even more remarkable when contrasted with the US. Although total EU investment in the sector amounted to only half of US based investments in 2020 and 2021, Europe is catching up and almost equaled climate tech investment in the US in 2023.

Julia Reinaud, Senior Director at Breakthrough Energy, underscores the resilience of the European Climate Tech sector despite economic and geopolitical challenges.

This can be attributed to the strategic direction set by the Green Deal and various national commitments to climate and energy plans. In addition, the ‘Fit for 55’ package has been instrumental in defining precise targets, such as renewable energy quotas and sustainable aviation fuel goals, which have provided direction and security for the investment landscape.

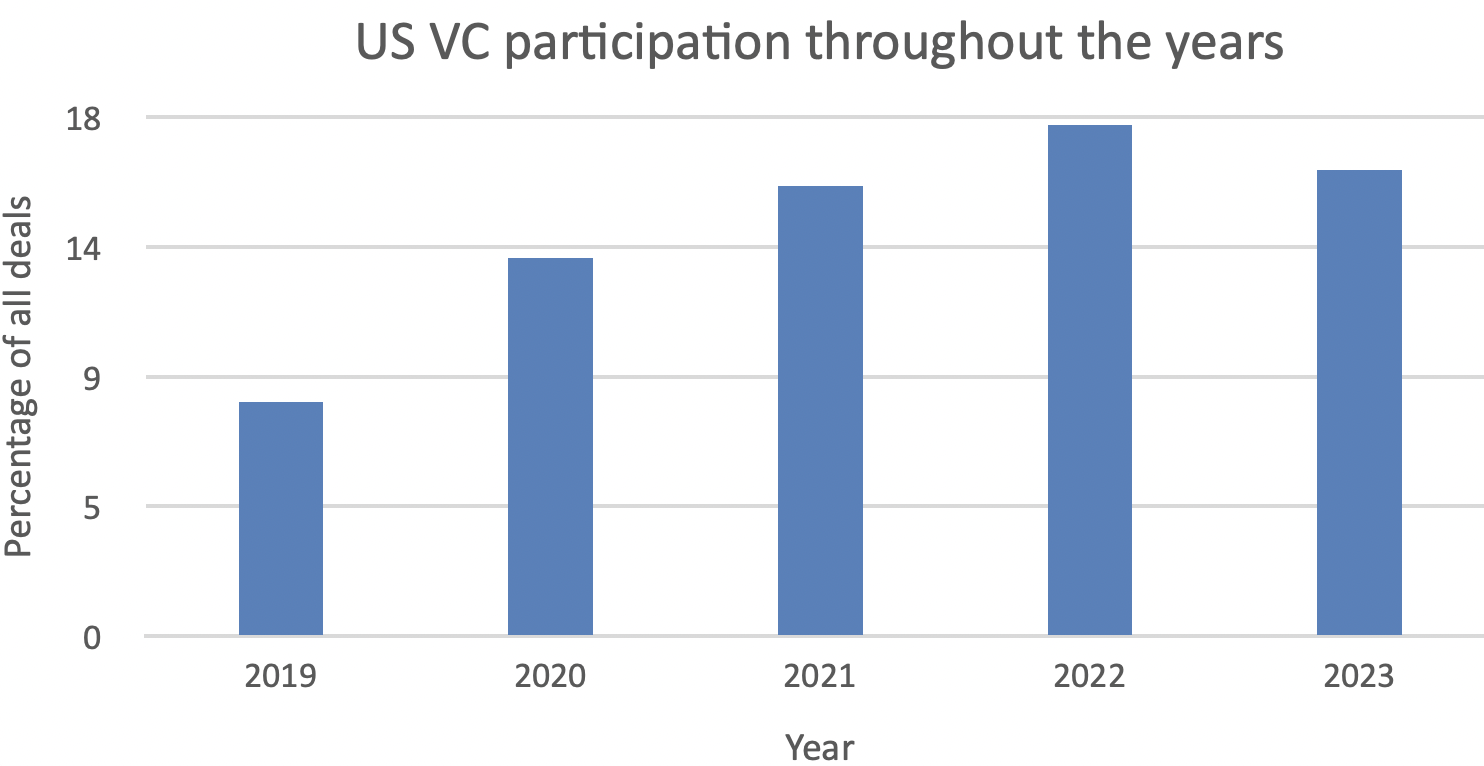

US investor participation in EU-based deals

In the past five years, there’s been a notable increase in US participation in European deals. From a modest 8% in 2019, US involvement rose to 18% in 2022, although it experienced a slight decline to 16% in 2023. A small drop compared to the 44% plunge in US investor participation in Europe across all sectors, as reported by Sifted.

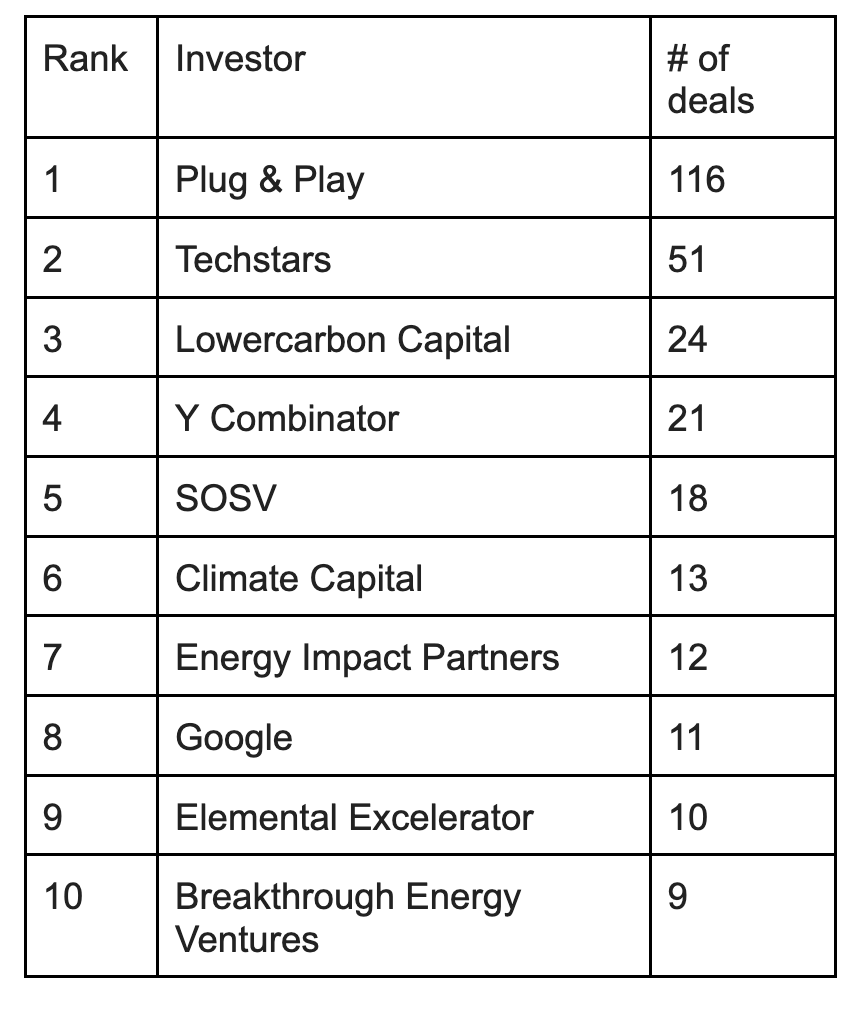

Gabriel Scheer, Senior Director of Innovation at Elemental Excelerator, one of the most active US Climate Tech investors in Europe by amount of deals, isn’t surprised by this trend. He highlights the wealth of innovation and early-stage research in Europe as a major attractor for US investors.

The supportive policy environment in Europe, exemplified by the growth in sectors like offshore wind or micromobility, presents an additional stimulant for US capital to get involved.

Moreover, Scheer points out that the unique urban design of European cities and the diverse market consisting of many different countries and cultures makes Europe an ideal testbed for scaling a company.

Scaling across Europe means learning a number of lessons, including localising to local cultures, communities, and languages; if you are able to expand within the European market, you will have learned a lot of great lessons that will be crucial in expanding to the US.

This growing interest amongst US investors creates a dynamic where once a few invest, others are quick to follow, eager for a share of Europe’s potential.

As for the drop in investment in 2023, this could be due to a combination of factors. Reinaud suggests the economic conditions in the US, including the incentives under the Inflation Reduction Act (IRA), possibly led to a greater focus on domestic over European investments in 2023. She does add the caveat that the IRA is somewhat conditional, as some of the exact ways to get tax credits are yet to be defined, whereas EU legislation generally offers a clearer direction.

Scheer also suggested a potential forward-looking element of note, which is that uncertainty around the upcoming US elections (in November 2024) could lead to a more cautious approach in domestic investments. This scenario could turn the attention of US investors towards Europe, perceived as a more politically stable environment for investment (despite similar uncertainty around the potential impacts of the European Parliamentary elections).

Reinaud also sees a clear path for European growth due to strategic initiatives, like the European Investment Fund and various national efforts, aimed at closing the fundraising gap for Series B and C rounds. These can further de-risk investment opportunities and stimulate US investors to get on board.

Ticket size

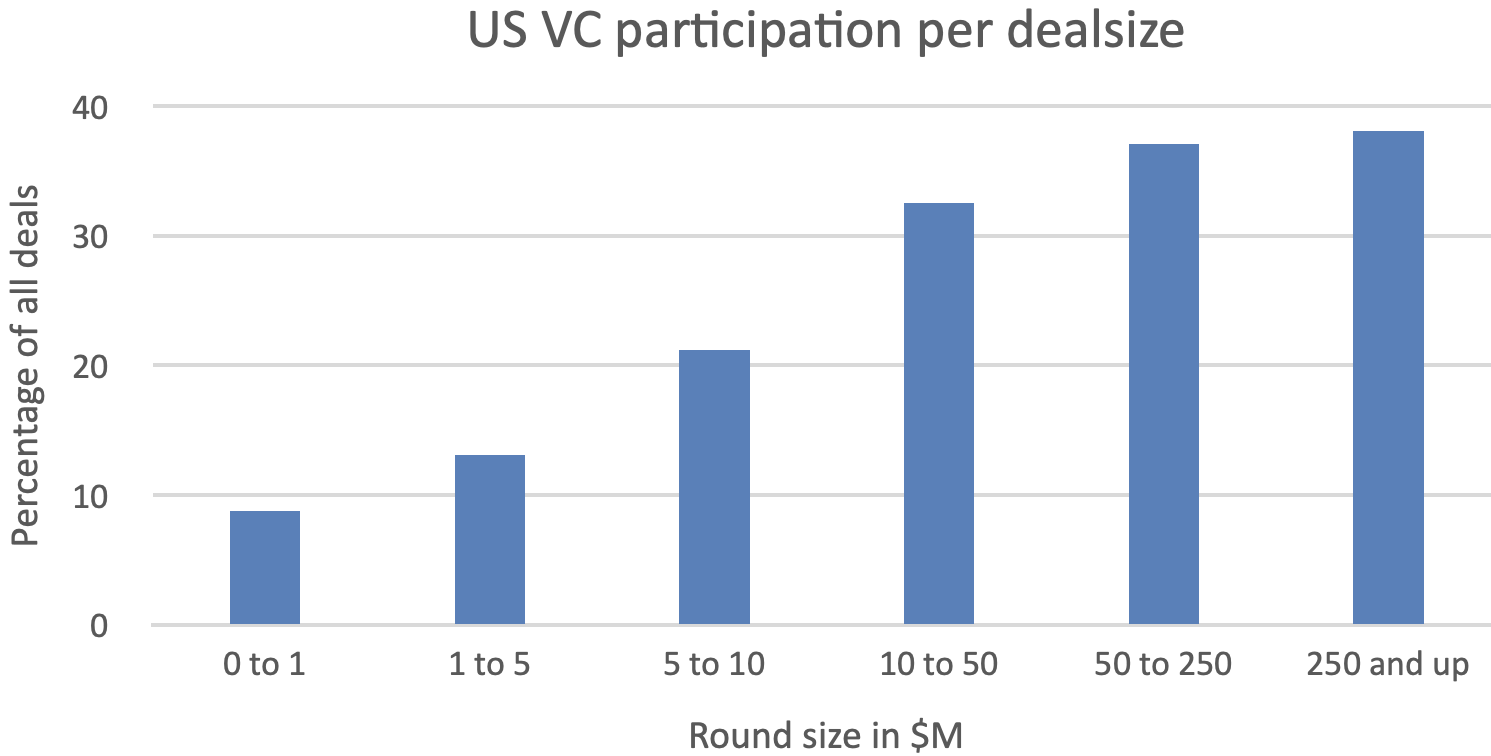

When it comes to the size of investments, the trend is clear: go big or go home. US investors tend to participate in larger deals. Looking at all deals over the past three years, US investor presence is seen in only 9% of deals valued between $0-1 million. But this figure jumps significantly for larger investments — 33% in the $10-50 million range, 37% for $50-250 million deals, and 38% for those exceeding $250 million.

This trend underscores the critical role of US capital in scaling European climate tech ventures, particularly those requiring substantial funds for production and manufacturing, a key element that’s often missing in the European ecosystem.

Reinaud offers a nuanced understanding of why US investors may prefer larger deals in Europe. She argues that physical presence and familiarity with target companies significantly influence investment decisions. And whereas smaller ticket sizes are more common in Europe, Reinaud highlights exceptions like H2 Green Steel or Northvolt, which represent the larger-scale investments that do occur in Europe, but are less frequent compared to the US.

Country differences within Europe

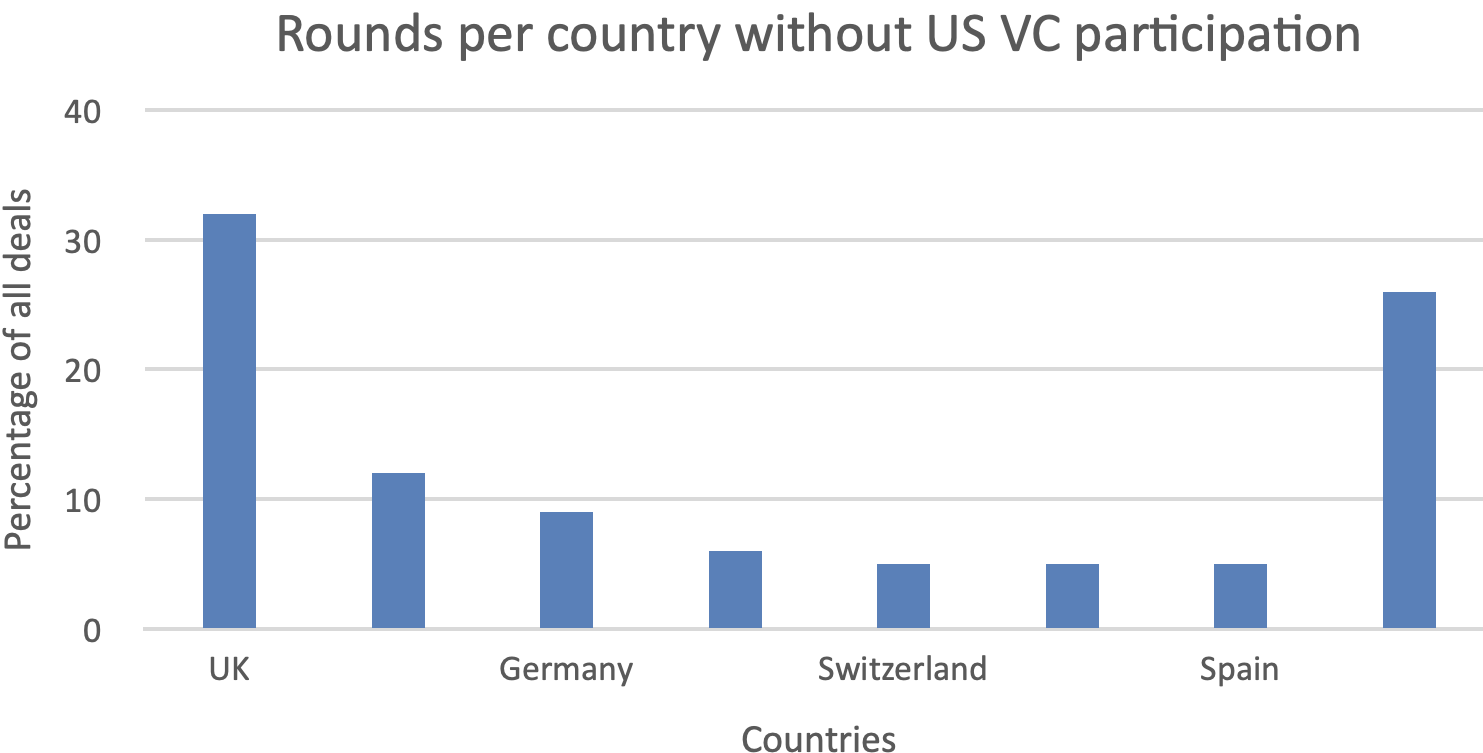

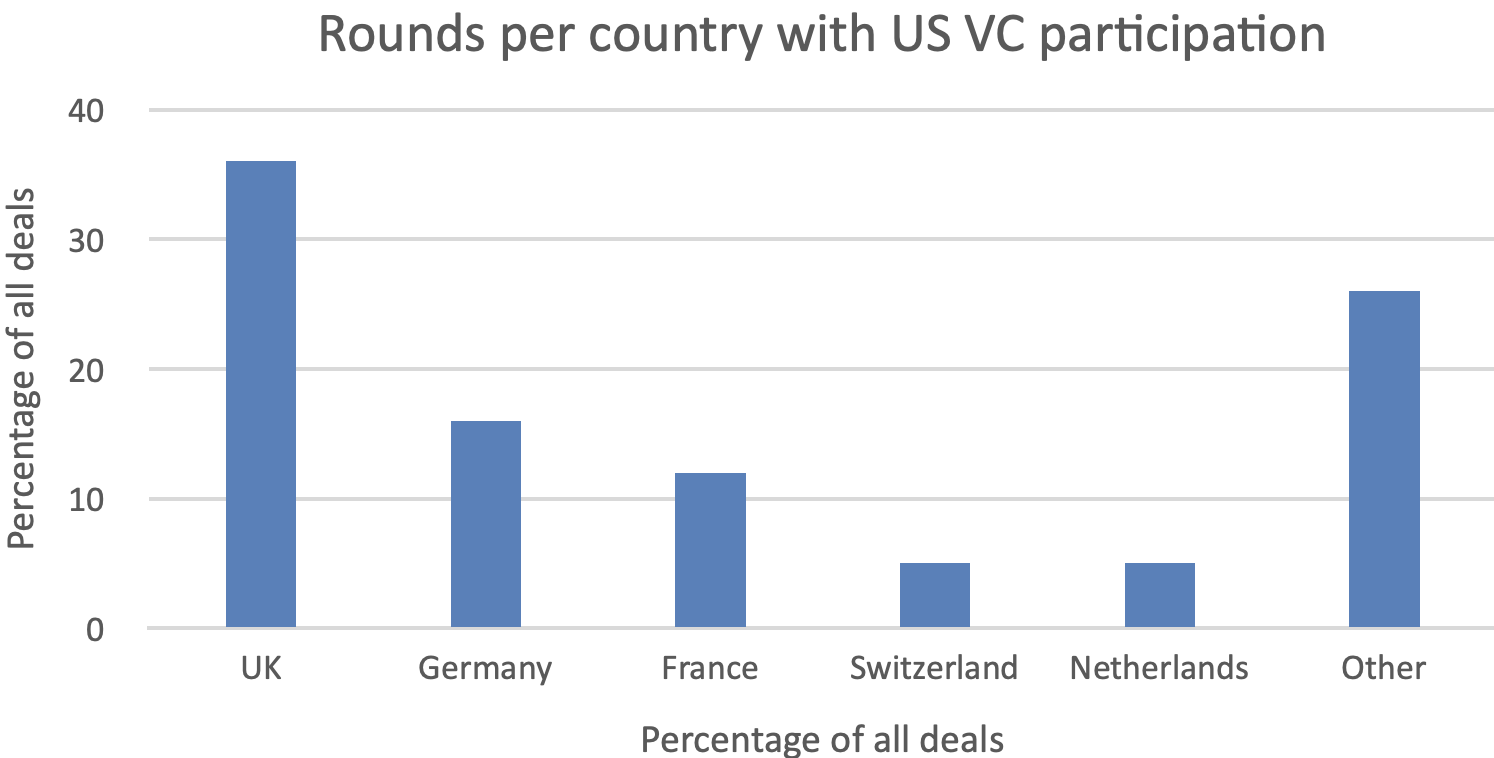

An intriguing aspect of climate tech investment is the geographical distribution across Europe. Both for ventures with and without US investments, the UK emerges as a prime destination. However, a deeper dive into the data reveals interesting nuances.

In the absence of US investors, France led with 12% of deals, outpacing Germany’s 9%. Contrastingly, the scenario flips when US investors are involved; Germany attracts 15% of such deals, surpassing France’s 12%. Following these leaders are Switzerland, Sweden, the Netherlands, Spain, and Norway, each accounting for ~5% of deals in varying orders.

How do European startups best lock down US dollars?

Understanding what US investors seek in European startups is crucial for those aiming to attract transatlantic capital. According to insights from Scheer, US investors’ criteria for European founders closely mirror what they look for in their US counterparts. Our research supports this: US investors show no strong preference for specific verticals, nor for hardware or software startups, when investing in Europe.

So what should you do as a founder to attract US capital?

Following Scheer’s advice, you first need to prove your model locally by achieving success across different European markets. This step validates your business and shows you can scale and adapt across different cultures and regulations. It’s a clear signal to US investors of your potential.

Additionally, explore a wide range of funding options beyond venture capital, especially for hardware startups. The US offers grants and other mechanisms that could be vital for your growth.

Also, seek advice from US-based VCs to get insights on the US market, which can help tailor your approach. And, as always, spend time building relationships with US investors and potential partners.

Startups need to avoid the so-called “engineer’s syndrome” by offering a vision that emphasises, not just technology, but also market impact and potential, Reinaud says. The key to success with a US VC is a deep understanding of the target market, customer needs, and dynamics.

Additionally, forming a strong team and strategic partnerships is crucial. This doesn’t just help in attracting US investment but also in navigating the global market’s competitiveness and dynamics.