Capital expenditure (capex) by corporates is proving surprisingly resilient. We think we’re on the verge of a strong capex cycle lasting several years.

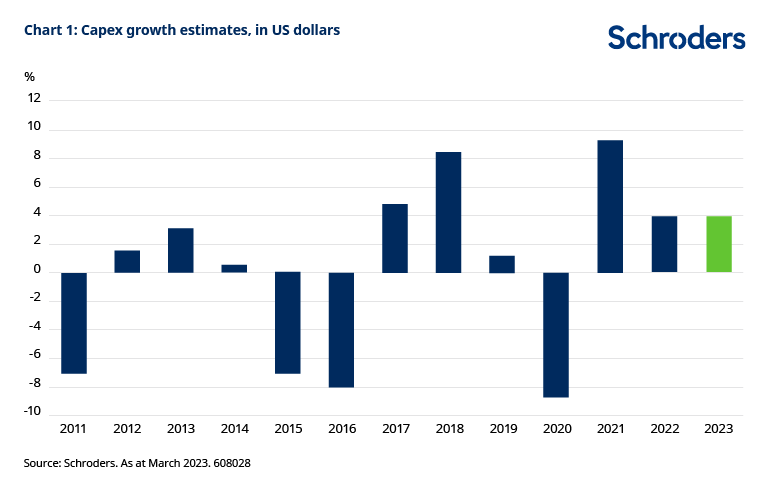

This view is borne out, in the near term at least, by our proprietary capex tracker. We updated this in March following the annual results season, and it points to 4% growth in capex in 2023. This comes in the wake of two years of very solid capex growth in a historical context. The capex tracker consolidates bottom-up capex estimates for thousands of listed companies globally, across a variety of different sectors.

On the face of it, the resilience of companies’ capex plans is a puzzle. And it may seem counterintuitive for us to talk about a period of structurally higher capex just as interest rates have risen sharply and recession remains a strong possibility for major developed markets. Capex, after all, means spending on physical assets such as plants, machinery and technology. Why would companies invest in such things if there’s a downturn coming?

The answer lies in a whole host of different factors which are leading to a regime shift. After the disruption to supply chains caused by the pandemic, companies are keen to bring production back closer to their home markets. Given increased geopolitical tension between the West and China, governments are willing to support them in this. The growth of automation and need for energy efficiency are other factors.

Above all, co-ordinated fiscal stimulus will drive increased capex. Both the US and EU are seeking to grasp the huge opportunity in clean energy and other sustainable technologies. They see this as a way to create jobs and “future-proof” the competitiveness of their economies. The list below gives a flavour of the new policies.

US

- Inflation Reduction Act – mobilisation of up to $1.5 trillion of capital into clean energy including advanced manufacturing production credits

-

Chips Act – $52.7 billion for semiconductor R&D and manufacturing / 25% investment tax credit for capital expenses for manufacturing of semiconductors and related equipment

-

Infrastructure investment and jobs act – $110 billion incentives to improve energy efficiency in homes, buildings and manufacturing facilities

EU

- Green Deal Industrial Plan – €390 billion funding to enhance the EU’s manufacturing strength in strategic technologies like solar and wind energy, heat pumps, and batteries

-

Innovation Fund – €3 billion funding for innovative clean tech

-

REPowerEU – €110 billion aimed at ending EU reliance on Russian fossil fuels by investing in renewable energy projects

Reshoring manufacturing and supply chains will undoubtedly be costly for the companies who need to do so. But smart manufacturers will be the beneficiaries of this spending.

Who are the smart manufacturers?

Smart manufacturing innovators are the facilitators of this desired manufacturing independence, by being the suppliers of sustainable new innovations in hardware, software, and new materials.

We can broadly group smart manufacturers into five sub-segments:

- Data analytics and software – an example would be a provider of software that can monitor machinery and predict the need for maintenance, thus reducing any downtime.

-

Advanced manufacturing – using cutting edge agile production systems, more advanced semiconductors, or advanced tools such as lasers.

-

Advanced materials – examples would be lightweight materials that are engineered to be just as durable but more energy-efficient than traditional alternatives.

-

Automation – using robotics can bring down the cost of switching from a low labour cost destination to a higher cost one. This may be especially important in regions where there are already labour shortages.

-

Domain experts – these companies are leaders in their respective fields and have a large existing installed base of assets, making them well-placed to monetise innovations in their specific industry. We think John Deere is a great example of a domain expert in the agriculture industry. The company is uniquely positioned to offer geo-spatial, automation and smart technologies like its sprayers that can identify weeds among the crop, to boost farmer yields. These innovations generate very fast economic returns for farmers right now due to elevated crop prices.

Semiconductor sector leading the charge

We’ve already seen the twin drivers of new regulation plus the need for resilient supply chains play out in the semiconductor sector.

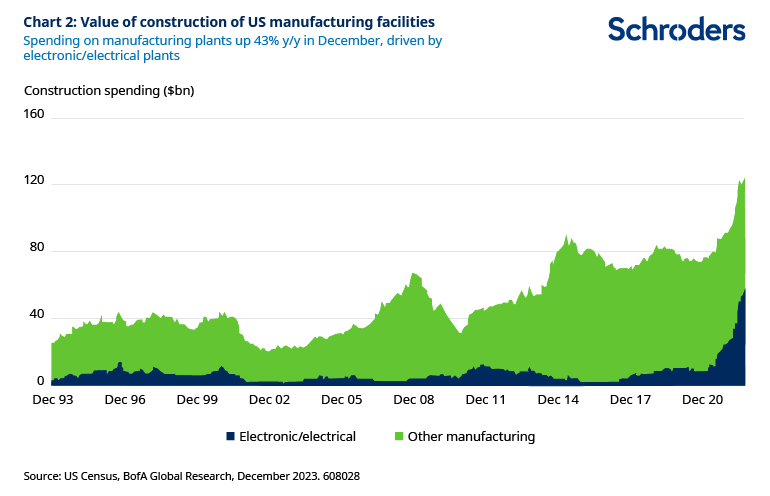

Shortages of semiconductors during the Covid-19 pandemic affected virtually every industry, underlining the importance of having enough capacity. Meanwhile, growing geopolitical tensions are resulting in the US trying to hobble China’s access to chip-making technology, hence the focus on domestic production in the Chips Act. This semiconductor reshoring is already appearing in construction data.

Where the semiconductor sector had led, others have started, and will continue to follow. The reshoring Initiative’s library of announcements made since the start of 2022 highlight $83 billion of spending across a range of industries largely excluding the $200 billion of semiconductor related investments highlighted above.

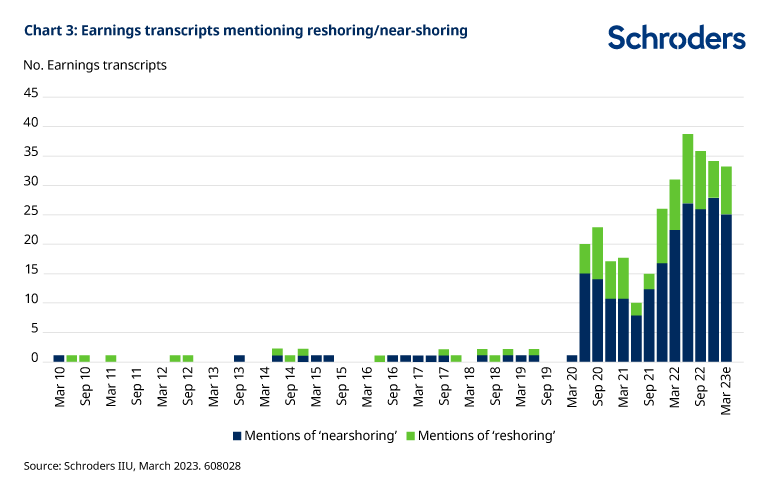

Our in-house Investor Insights Unit (IIU) team have been tracking mentions of the terms “reshoring” and “near-shoring” in company earnings transcripts in the US. As the chart below shows, there has been an uptick in such mentions over the past two years.

Conclusion: capex now has many drivers

Traditionally, industrial investors look for demand indicators to see what will drive new capital investments. When demand is elevated, companies invest in additional capacity and upgrades, but when it’s weak they don’t.

What’s changed now is that many of the capex trends we see currently are not volume or growth related. The automation, reshoring, decarbonisation, and supply chain issues are now backed up by stimulus plans. This potent mix of factors could provide long-term support for smart manufacturing companies, regardless of the overall health of the global economy.