- ISM services PMI points to an unexpected contraction in June

- Treasury yields and dollar take a dive, but Wall Street rallies

- Pound in bullish mode as UK goes to the polls amid broader risk appetite

September Rate Cut Seen More Likely

Expectations of a September rate cut got another boost on Wednesday after the fell into contractionary territory, adding to the growing signs of a slowing US economy. The closely watched PMI indicator for the non-manufacturing sector fell more than expected in June, hitting the lowest level since May 2020. The employment subindex fell further below 50.0, while the prices paid component moderated to 56.3.

The data comes on the back of a similarly weak reading of the on Monday. Furthermore, edged up last week, maintaining a steady uptrend since January.

All the evidence seems to point to an economy that’s losing steam, which is good news for inflation, and Fed officials have taken note of this “cooling”. Yet, FOMC members agreed that “greater confidence that inflation was moving sustainably toward 2%” was needed before cutting rates, according to the minutes of the June meeting published yesterday.

The remarks from the latest Fedspeak suggest policymakers’ stance hasn’t changed much since that meeting. Nevertheless, there has been a slight dovish lean, particularly from when he spoke on Tuesday, and all this has bolstered expectations that the Fed will start its easing campaign in September, with the odds rising to more than 75%.

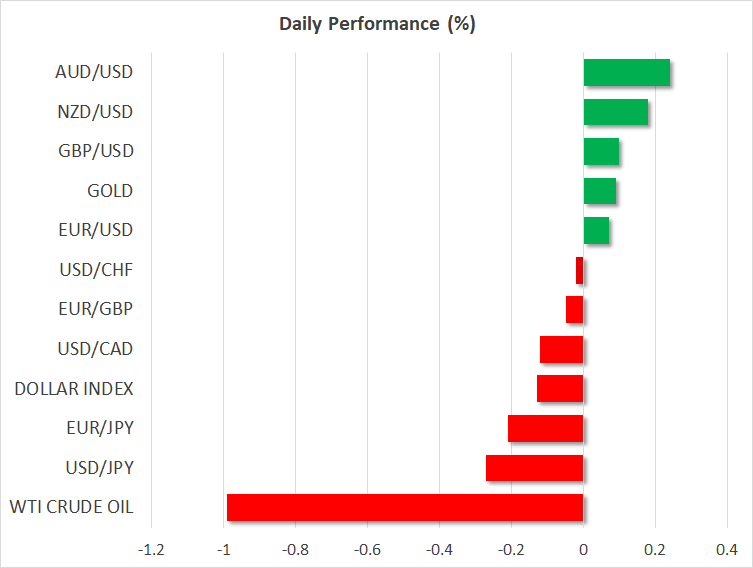

Some Relief for the Yen as Dollar Slips

Everything seems to be falling into place for the Fed to make its dovish pivot either at the July meeting or at Jackson Hole. Of course, tomorrow’s jobs report could still spoil things if the headline payrolls figure surprises to the upside again. But ahead of that, Treasury yields have taken quite a tumble, reversing some of the gains since the end of last week that came on the back of the increasing likelihood of a second Trump presidency.

With the US bond market closed on Thursday for Independence Day, the is stuck on the backfoot near three-week lows. This is helping the battered to lick its wounds after it brushed yet another 38-year low versus the greenback on Wednesday, coming just shy of the 162.00 level.

Pound Perks Up as UK Set for Labour Win

The and have also rebounded sharply. Easing fears that France’s far-right National Rally party won’t be able to achieve an absolute majority in Sunday’s second round of voting for parliamentary elections have added to the euro’s upside this week.

Meanwhile, the pound is back in the $1.2750 region on expectations that the UK’s Labour Party will win by a landslide in the country’s general election today, ending years of political turbulence. Investors are also hoping that a Labor government will forge better ties with the EU and are ignoring, for now, the possible risks of the UK turning into a one-party state should the Conservatives end up with less than 100 seats.

It’s Not All Good News for Risk Assets

In equity markets, both the and finished at fresh all-time highs on Wednesday, lifting European shares higher today. Japan’s index also closed at a new record, although the risk-on mood has yet to spread to crypto markets, where has slid to five-month lows.

are somewhat struggling today amid the prospect of a weaker US economy weighing on the demand outlook.