UK Labeling Rules for ‘Sustainable’ Investment Products Will Soon Be Finalised | Skadden, Arps, Slate, Meagher & Flom LLP

[co-author: William Adams]

The consultation period for the UK Financial Conduct Authority’s (FCA’s) proposed rules for labelling ‘sustainable’ financial products formed or marketed in the UK ended 25 January 2023, and final rules are expected to be adopted in the coming months. Investment firms that will be subject to the rules will need to start planning, as some provisions will come into effect later this year. They will also need to consider how the UK rules interact with parallel regulations in the European Union, and proposed rules pending in the United States.

The FCA’s proposals were published in an October 2022 Consultation Paper on Sustainability Disclosure Requirements and investment labels (Consultation Paper), following a November 2021 discussion paper (Discussion Paper), which outlined a regime of classification, labelling and disclosures for sustainable investment products.

During the discussion and consultation process, the EU’s broader-reaching Sustainable Finance Disclosures Regulation (SFDR) regulation, which spans the entire financial sector, came fully into force. In addition, the US Securities and Exchange Commission (SEC) issued draft rules in May 2022 on sustainable investment labels. All three jurisdictions’ regulators are focused on ‘greenwashing’ — misleadingly labelling financial products as ‘green’.

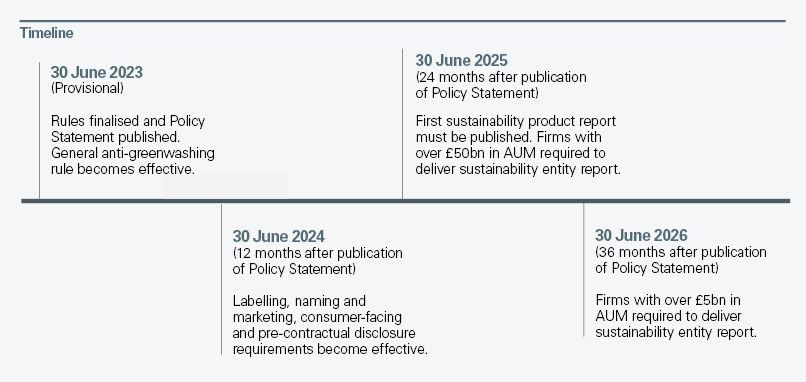

The FCA’s aims, laid out first in the Discussion Paper, are to assist retail investors to navigate the investment product landscape, to make informed decisions, and to protect them from greenwashing. In the Consultation Paper, the FCA indicated that it intends to set out the final rules in a Policy Statement by the end of the first half of 2023. Detailed requirements are due to come into effect from 30 June 2024 at the earliest, but a general policy against greenwashing will be adopted this year. The proposed implementation schedule is summarised in the timeline below.

Scope: Firms and Products

The Consultation Paper sets out the proposed scope for the new rules, which are narrower than the EU’s SFDR. Overseas products are not currently within the scope of the new rules, but the FCA intends to release a consultation paper in the future addressing how those will be treated.

The rules apply to firms and products as follows:

- ‘In-scope firms’:

- UK portfolio management firms

- UK Undertakings for Collective Investment in Transferable Securities (UCITS) management companies

- UK investment companies with variable capital (ICVCs) that are a UCITS

- scheme without a separate management company

- full-scope UK Alternative Investment Fund Managers (AIFMs)

- small UK-authorised AIFMs.

- ‘In-scope products’:

- UK-authorised funds (excluding feeder funds and funds in the process of winding up or terminating)

- unauthorised Alternative Investment Funds (AIFs), including investment trusts, that are established in the UK and marketed to investors in the UK

- portfolio management services to UK clients.

Product Classification and Labelling

The FCA’s regime establishes three classifications of investment products that qualify to carry a ‘sustainable investment label’. Firms may use these labels, but there is no obligation to do so.

Any product seeking to use one of the FCA’s three authorised sustainable labels must comply with three sets of requirements, described in the box below.

Restrictions on Names Other Than Approved Labels

The FCA is also proposing restrictions on the names used for investment products offered to retail investors that do not qualify for a sustainable label. Such products will be prohibited from using sustainability-related terms, including but not limited to:

- ESG (or ‘environmental’, ‘social’ or ‘governance’)

- climate

- impact (this restriction will also apply to products using either the Sustainable Focus or Sustainable Improver labels)

- sustainable or sustainability

- responsible

- green

- SDG (sustainable development goals)

- Paris-aligned

- net zero.

There will also be a general ‘anti-greenwashing’ rule implemented, which will require all FCA-regulated firms to ensure that the naming and marketing of financial products is clear, fair, not misleading, and is consistent with the sustainability profile of the product or service.

Detailed Rules for Labels, Graphics and Links to Disclosures

Firms that meet the criteria for their investment products and seek to use a label must:

- use the relevant graphic when displaying the label. The graphics for each label will be set out on the FCA website once the rules are finalised.

- display the corresponding label prominently on the relevant digital medium by which the product is offered (i.e., the main product webpage or the main page on a mobile application)1 .

- provide details as to where the associated consumer-facing disclosure can be found, e.g., by adding a hyperlink on the relevant digital medium.

Comparing the FCA Classifications to Those In Other Jurisdictions

When considering how a product can be labeled under the FCA rules, companies will need to consider how the product would be treated under the SFDR or the SEC’s proposed rules. The FCA has indicated in its Consultation Paper that it sees its categories corresponding to the EU and proposed US categories as follows:

EU: SFDR

- Article 6 (funds without a sustainability scope)

- Will not qualify for a sustainable label.

- Article 8 (funds that promote environmental or social characteristics)

- Can qualify for either the Sustainable Focus or the Sustainable Improvers if the FCA’s label-specific and other criteria are met. An Article 8 product will need to specify a sustainability objective in order to satisfy the FCA standards. It is unlikely that an Article 8 fund would meet the criteria for Sustainable Impact.

- Article 9 (funds that have sustainable investment as their objective)

- Can qualify for any of the three labels, so long as the product meets the FCA’s label-specific and other criteria.

US: SEC proposed rules

- Integration funds (funds that consider ESG factors alongside other, non-ESG factors)

- Will not qualify for a sustainable label.

- ESG-focused funds (funds where ESG factors are a significant or the main consideration in selecting investments or engaging with companies)

- Can qualify for Sustainable Focus or Sustainable Improvers if the label-specific and other criteria are met.

- Impact funds (a subset of ESG-focused funds, which seek to achieve specific ESG impacts or generate specific ESG-related benefits)

- Can qualify for Sustainable Impact if the label-specific and other criteria are met.

It should be noted that the SEC proposals may not ultimately be adopted in their current form.

Disclosure Obligations

All in-scope firms (except portfolio management firms) marketing in-scope products to retail or institutional investors can use a sustainable investment label, so long as they meet the qualifying criteria and make certain ‘detailed’ disclosures aimed at institutional investors in addition to the required consumer-facing disclosures.

If a firm chooses to apply a sustainable investment label to a product, it will need to comply with disclosure requirements, which vary with the type of investor.

Disclosures to Retail/Consumer Investors

When retail investors are targeted, the rules will require firms to provide a summary of the products’ key sustainability-related features in order to help consumers better understand those features, compare similar products over time and hold the provider to account for its sustainability claims. The disclosures must be made available through a hyperlink in a prominent place on the relevant digital medium for the firm (e.g., the website). Unlike the SFDR, there is no template for consumer-facing disclosures as of yet, but the disclosure must be clear, concise, take into consideration factors such as accessibility and comprehension, and must not exceed two pages of A4 paper.

All in-scope firms will need to make consumer-facing disclosures relating to:

- their sustainability objective,

- the progress towards the sustainability objective,

- their investment policy and strategy,

- their approach to stewardship,

- unexpected investments (those a consumer may not typically associate with the sustainability objective), and

- ongoing reporting on sustainability metrics/KPIs.

Disclosures to Institutional Investors

Firms will also be required to provide more granular information that will be useful to institutional investors and a broader range of stakeholders. The obligations are divided into two categories in the proposal:

Part A: Pre-contractual disclosures. Required for products that have a sustainable investment label, or that adopt sustainability-related features that are integral to their investment policy and strategy. These must cover the sustainability objective, the investment policy and strategy, the approach to stewardship and unexpected investments.

Part B: Sustainability product reports. Only required for products that qualify for a sustainable investment label. These must include disclosures relating to the sustainability objective, progress made towards the sustainability objective, and KPIs relating to stewardship and reporting on such KPIs.

The sustainability product report builds on the product report of the Task Force on Climate-related Financial Disclosures (TCFD), a private body created at the instigation of the international Financial Stability Board. FCA-regulated asset managers have been subject to the FCA TCFD rules since 1 January 2022, so they already have to make disclosures about the climate-related attributes of their products. The vast majority of these firms will be deemed in-scope firms for the purpose of these rules.

The sustainability product report must include the information required under the FCA TCFD rules (either by incorporating the contents or hyperlinking the information), and must be displayed in a prominent place on the main website for the firm. A firm may cross-refer to relevant disclosures in a third-party’s sustainability product report, provided that those cross-references are clear and the firm sets out the rationale for doing so. The rule on disclosing metrics in the TCFD rules also applies to the sustainability product report, which means that firms must use the most up-to-date information available within their reporting period when making disclosures.

Disclosures by Portfolio Management Firms

Somewhat different requirements apply to portfolio management firms. They are not required to produce consumer-facing disclosures or pre-contractual disclosures, but must instead provide a list of the underlying funds in which they invest, including the label, and hyperlinking to the individual funds’ consumer-facing and pre-contractual disclosures, as applicable. A portfolio management firm may only use a sustainable investment label if 90% or more of the value of the constituent products in which it invests comply with the criteria for a label.

Disclosures by Large In-Scope Firms (Sustainability Entity Reports)

In addition to information on the sustainability-related features of investment products, all in-scope asset managers with assets under management of more than £5 billion will eventually be required to produce a sustainability entity report. Firms with assets under management of more than £50 billion will be required to deliver this report 24 months after the publication of the FCA Policy Statement — likely in June 2025 — and firms under that threshold but over £5 billion a year later. This report will need to include disclosures relating to the resourcing and governance for the delivery of the sustainability objective.

Like the sustainability product report, the sustainability entity report builds on the TCFD entity report, and the TCFD rules regarding where it must be displayed, metrics and cross-referring also apply to the sustainability entity report. Like the TCFD entity report, the sustainability entity report must include a statement, signed by a member of senior management, confirming that the disclosures comply with Chapter 2 of the FCA’s ESG sourcebook, where the rules relating to TCFD entity reports are contained.

The detailed product-level disclosures (i.e., the pre-contractual disclosures and the sustainability product report) involve making many disclosures also mandated under the SFDR and proposed SEC rules. However, they diverge in some respects. For example, while the FCA’s product level disclosures would require more granular information than the SFDR, they do not require disclosures corresponding to those mandated by the SFDR regarding ‘do no significant harm’, taxonomy-alignment or principal adverse impacts.

Looking to the proposed SEC rules, the only difference in disclosure items is that disclosures on how ESG factors are incorporated into the investment process are not required for funds classified under the proposed SEC rules as Integration Funds.

_______________

1 There is some uncertainty at this stage as to how the displaying of the label, and the associated disclosures, on a website would work for an unauthorised AIF given the requirements of the UK Alternative Investment Fund Managers Regulations 2013 and s.238 of the Financial Services and Markets Act 2000.