(Bloomberg) — Financial investors believe Britain’s Labour opposition will renege on its promise not to raise income or corporation tax if it secures a big majority in the election, Nomura said in report based on a survey of its clients.

Labour is unlikely to increase spending substantially, though, and its policies will have no impact on the Bank of England’s rate cutting plans, the survey of 71 market participants and financial institutions found.

Markets are expected to be untroubled by a Labour victory because the party’s poll lead is so strong that investors are already anticipating the outcome. Labour leads the Conservative government by more than 20 points, which would give the opposition a majority in Parliament for the first time since 2010. The election will be held on July 4.

Clients surveyed by Nomura, at least four-fifths of whom are based in the UK, overwhelmingly expect a Labour majority of 75 seats or more, which would give the party considerable legislative power. Just over half, 52%, expect corporation or income tax to be raised to support public services. Only 45% believe there will be a substantial increase in all spending excluding debt interest.

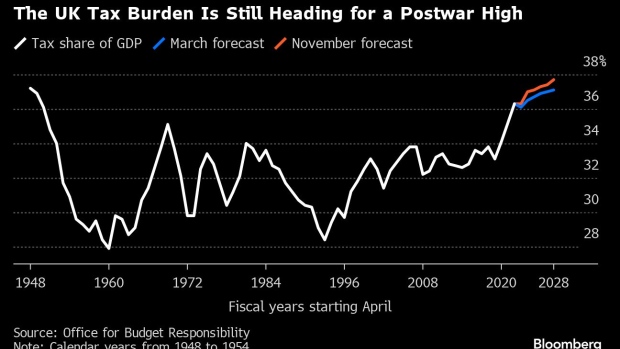

On current forecasts, unprotected departments like justice face a 19% budget cut after 2025, according to the Resolution Foundation think tank. The International Monetary Fund has said taxes may have to rise by around £30 billion in the next parliament to spare public services another round of punishing austerity.

A recent Ipsos poll found that voters expect higher taxes regardless of whether the Conservative or Labour party wins.

Neither the election campaign nor the outcome will affect the BOE’s rate decisions, according to 72% of those surveyed. The monetary policy committee next decides on June 20, when it is expected to keep rates on hold at 5.25%. There is a one-in-three chance of a rate cut in August, after the election, and a quarter point reduction is fully priced in for November.

However, a small majority of those surveyed expect a currency reaction, “but there is no great conviction about whether sterling ends up stronger or weaker,” Nomura’s European economist George Moran said. A minority of clients expect a reaction in rates markets, with three quarters of those seeing a selloff.

(Corrects to show source of survey is Nomura.)

©2024 Bloomberg L.P.