Patient U.K. investors who have long been invested in local stocks must being enjoying the independent highs achieved this month.

The significance of this shouldn’t be overlooked. Even during 2022, while many of the global markets experienced a solid bear-market, both the German and the UK’s indices handled the global correction with a lot more grace, and held their ground in outstanding fashion.

It’s normal for investors to ask themselves if investing in non-U.S. stocks is worth it, since the U.S. market is the largest in the world, and historically is recognised as most likely to drive all the other global indices.

But, in the last few years, even though growth in the FTSE100 hasn’t matched the U.S.’s, it has at the same time been more stable.

Individual constituents have also performed on par with U.S. stars, so all is not lost.

My point is, that although one can make a living from U.S. stocks alone, one doesn’t have to when looking for variety.

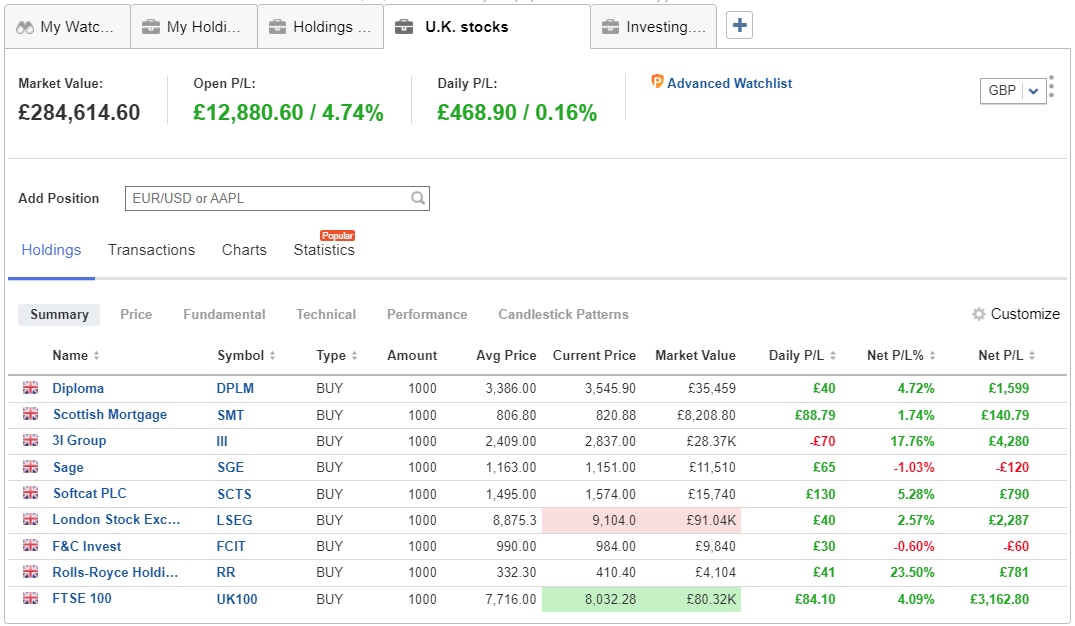

I’ve covered U.K. stocks in other articles here, and am tracking their performance in a tracking portfolio. Here’s what they look like at the time of writing:

I’ll continue to look for opportunities during this new bull market, and market corrections, such as the one the markets are going through right now, can provide excellent entry opportunities.

Like this article? Read more from my Investing.com profile here:

https://uk.investing.com/members/contributors/256252463

Disclaimer: Any content in this article is purely financial markets discourse and not financial advice. Please consult a regulated professional before making any financial decisions.

remove ads

.