U.K. business leaders feel pressured to accelerate investments in generative artificial intelligence despite an abundance of potentially dud advice clouding decision-making, research from Ernst & Young suggests.

Meanwhile, a survey of 150 U.K. CEOs by KPMG finds that 71% see generative AI as a top investment priority, despite ongoing economic uncertainty and a lack of regulatory or ethical AI frameworks.

Jump to:

How U.K. leaders are reacting to generative AI

EY quizzed 100 U.K. chief executives as part of its October 2023 CEO Outlook Pulse survey and found that 74% feel the need to act decisively on generative AI to stop their competitors from gaining the upper hand.

EY found that most U.K. business leaders are “taking tangible steps” to embed artificial intelligence into their organizations, whether by hiring talent with applicable AI skill sets (54%) or launching AI pilots and partnerships with other companies (42%).

SEE: Tech leaders identify AI, 5G, cybersecurity, big data and metaverse as top investments in EY survey.

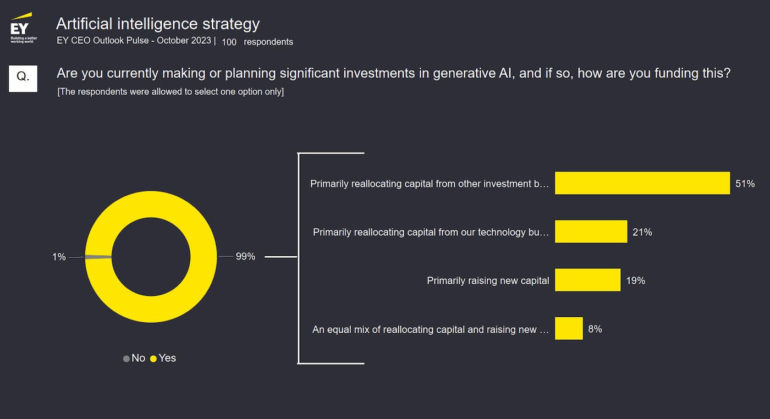

Overall, 99% of U.K. CEOs have made or are planning to make “significant capital investments” in generative AI in the next 12 months, with 51% reallocating capital from other parts of the company to fund these investments (Figure A).

Figure A

The struggle to separate hype from reality

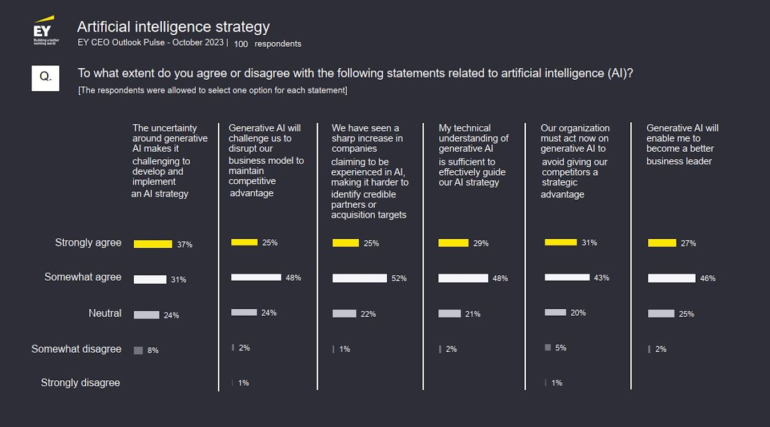

However, businesses face challenges capitalizing on generative AI as they wait for the reality to catch up with the hype. EY found that 68% of business leaders in the U.K. say uncertainty around generative AI is creating challenges for adoption, with EY noting that “a surge in companies claiming AI expertise” is making it difficult for leaders to cut through the noise and implement AI strategies.

Business leaders acknowledge that the buzz around AI, and generative AI in particular, has “hindered decision-making about credible partnerships and acquisition targets,” said EY. More than three-quarters (77%) of U.K. CEOs reported a sharp rise in the number of companies “claiming to be experienced in AI,” making it harder for them to identify good investment opportunities (Figure B).

Figure B

Silvia Rindone, UK&I managing partner for strategy and transactions at EY, commented in the report: “U.K. CEOs clearly see the huge opportunities that AI offers in its ability to drive productivity and provide a competitive advantage and, as a result, are making significant investments in AI technology. However, this optimism is also tempered with caution, with many grappling with how best to implement and future-proof AI strategies.”

Business leaders worldwide feel pressure to invest in generative AI

Data from EY indicates that AI is the top focus area for European CEOs in 2023, with 93% of European business leaders having fully integrated or are planning to integrate AI into their capital allocation over the next 12 months. This is compared to 88% globally, 89% in Asia-Pacific and 82% in the Americas.

Germany leads the pack in Europe, where 53% of companies have already incorporated AI in capital allocation, supported by the government’s plan to invest €5 billion ($5.48 billion USD) in AI research by 2025 under the “AI Made in Germany” initiative. In the U.K., 58% of companies are planning AI investments in the coming year, with France not far behind at 54%.

SEE: Microsoft invests $5 billion in Australia to boost AI, cyber security and tech skills growth.

The urgency to intensify investment is felt worldwide: 70% of 1,200 global CEOs surveyed by EY said they feel pressure to accelerate investment in generative AI, while 68% agreed that uncertainty around generative AI made it difficult to quickly identify, develop and implement AI strategies.

The survey also found that the companies most in need of gains from AI — defined by EY as those expecting to see year-on-year revenues decline in 2024 — are the furthest behind on AI adoption and the least likely to be increasing investment.

“While it makes sense that these companies have fewer resources to invest in AI, they may need to reconsider their approach. Some of the quickest gains from AI deployment are improvements in efficiency and productivity that can boost the prospects of slower-growth companies,” the report read.

Why short-term gains do not guarantee long-term success

Business leaders may also be under the impression that short-term wins in generative AI adoption translate into long-term revenue gains when this may not be the case, EY found.

Sixty-four percent of CEOs who reported seeing “a significant impact from generative AI” expect the technology to define their entire business and operating model in two years or less. CEOs of companies with deeper experience in artificial intelligence expect this to take three to five years, EY found.

EY noted that such transformative change was “significantly harder to achieve than early wins in revenue or efficiency,” indicating that business leaders may be caught up in the hype around gen AI and need to taper their expectations accordingly.

“[This] suggests that AI and gen AI are unfamiliar territory for many CEOs,” the report said. “Setting and failing to meet lofty expectations may erode the confidence of employees and shareholders, making it more difficult to transform in the long run. To avoid this, CEOs should work closely with their chief technology officers (CTOs) to ensure their expectations and strategic plans around AI are feasible given their current resources and capabilities.”

KPMG: ‘Don’t wait for all the questions to be answered’

In its own CEO Outlook Report, KPMG advised business leaders to think cautiously when investing in generative AI — while simultaneously suggesting that they “get started now” rather than waiting for “all the regulatory and ethical questions to be answered.”

PREMIUM: Businesses should consider implementing an AI ethics policy.

KPMG’s survey of 150 CEOs from the U.K. found that 71% see generative AI as a top investment priority, despite ongoing economic uncertainty.

Ian West, head of alliances and head of telecoms, media and technology sector at KPMG U.K., warned executives not to “let FOMO” (fear of missing out) drive their investment in the technology,” but rather to “think through how it could disrupt your business model and be the one driving change.”

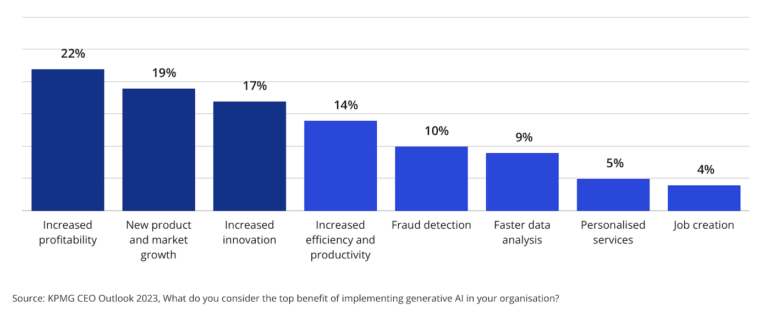

Just over one in five (22%) of executives surveyed by KPMG cited increased profitability as the top benefit of implementing generative AI in their organization (Figure C). This was followed by new product and market growth (19%), increased innovation (17%), increased efficiency and profitability (14%) and fraud detection (10%).

Figure C

“AI and machine learning are considered the most important technologies for helping businesses achieve their short-term ambitions over the next three years, according to our Global Tech Report,” KPMG’s report read.

“CEOs are committing to Gen AI over the longer-term and estimate that their investments will pay off in three to five years.”