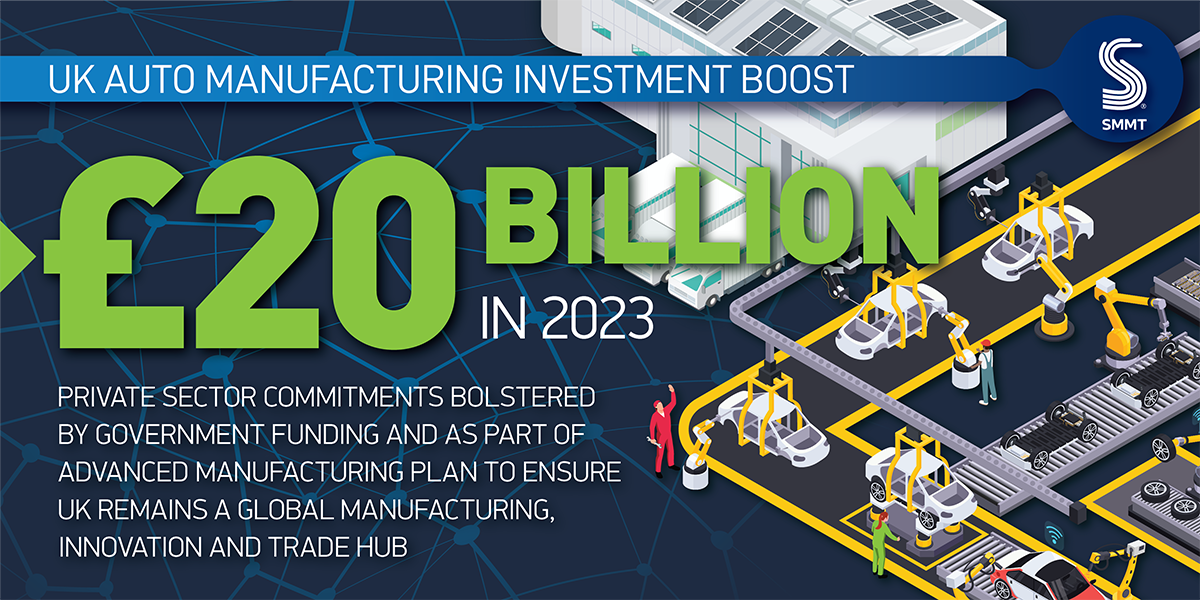

- UK automotive manufacturing secures £20 billion in investment over the course of 2023 – more than in the previous seven years combined.

- Private sector commitments bolstered by government funding and as part of advanced manufacturing plan to ensure UK remains a global manufacturing, innovation and trade hub.

- Shift to zero emission cars, vans, trucks and buses delivers decarbonisation with potential to unlock further opportunities in battery and supply chain sectors.

- Potential for tariffs on UK-EU EV trade still a threat underscoring the need for a strong domestic market.

The UK automotive industry has attracted approximately £20 billion in private investment in 2023, according to the latest calculations by the Society of Motor Manufacturers and Traders (SMMT) – meaning this year has seen more investment announced than in all the years back to 2016 combined.1

On top of industry’s backing for new and upgraded R&D and manufacturing facilities, last week the government committed a further £2 billion for the sector, backed by an Advanced Manufacturing Plan and battery strategy that will drive green economic growth and create jobs across every part of the country. With almost a million people directly relying on the sector for their livelihood, and millions more benefiting from the mobility it provides, the importance of the UK automotive industry to the economy has never been more evident.

Addressing industry leaders and politicians at the SMMT’s 106th Annual Dinner in London this evening, Alison Jones, SMMT President and Senior Vice President Global Circular Economy, Stellantis, praised the industry’s resilience and commitment to green growth, saying,

As an industry, we have moved forward despite the instability, despite legislative uncertainty, inflation and geopolitical risk. The industry has backed itself with big decisions on big investments to guarantee jobs and our future. We have seen major commitments in battery production, lithium mining, vehicle manufacturing, R&D and the aftermarket. Such investment – and our ability to remain competitive – is key to the continuation of a strong UK manufacturing base and a sector that sustains nearly a million livelihoods.

With new investment announcements coming as recently as last week, Britain has confirmed itself as a globally competitive place to manufacture zero emission vehicles, batteries and components. Factories across the country are now producing electric vehicles of every type – cars, vans, buses and trucks – while the supply chain manufactures almost every component needed for EVs. The industry is ready to return to pre-pandemic levels of trade worth more than £100 billion by the end of the year, but the challenge is now to scale up even further to seize the opportunities decarbonisation offers.

Despite this renewed vote of confidence, the industry’s potential to drive economic growth will be diminished without a deferral of upcoming Rules of Origin – otherwise, tariffs will apply, throttling trade in electric vehicles between the UK and EU. The UK government and most major European nations recognise the dangers of inaction and have called for a common sense solution to ensure the free and fair flow of EVs across the Channel. However, time is running out to secure a deal before the end of year deadline.

While exports still account for around 80% of production, the UK must also have a strong domestic market to maximise return on the investments made. Having initially grown robustly, EV uptake is now plateauing as the market begins to move beyond the ‘early adopter’ phase. Government incentives are driving the business and fleet markets, but a fair transition demands that private consumers are also encouraged to make the switch.

Mike Hawes, SMMT Chief Executive, said:

The industry is betting big on Britain, and government has rightly recognised the value that automotive manufacturing brings to the UK, backing our industrial transformation. These investments are, however, predicated on a strong domestic market. Incentives for business buyers must be matched with support for private buyers to ensure the maximum return on every penny already pledged to production. The prize for success will be a faster and fairer decarbonisation of Britain, ensuring millions have access to zero emission mobility.

Fiscal incentives for business buyers, notably in company car tax, have ensured this segment of the new EV market continues to perform strongly. To move uptake to the mainstream, however, all purchasers need to be encouraged to switch. Halving VAT on new EVs, for instance, would be a compelling and affordable measure, enabling manufacturers deliver larger volumes of zero emission vehicles and creating the conditions for greater UK supply chain investment – one of the main ambitions of the government’s newly published Advanced Manufacturing Strategy.

Combined with retention of the business incentives and measures to accelerate the roll out of charging infrastructure, the new EV market would expand and flow into the used sector, catalysing greater adoption by all drivers. This will be the fastest way to decarbonise road transport, an essential step in the delivery of Net Zero.

Notes to editors

1 SMMT calculations based on all publicly announced investment in UK automotive production and R&D from Jan-Nov 2023. Total announced investment 2016-2022 inclusive: £16.2 billion.