The United Arab Emirates is considering investments in Europe’s nuclear power segment, approaching several European nations to gauge their receptivity to a collaboration, sources familiar with the talks told Reuters this week.

The UAE has discussed the possibility of its state-owned Emirates Nuclear Energy Company (ENEC) investing in European power assets, including Britain’s, to become a minority owner.

According to Reuters’ sources, ENEC has aspirations of expanding its area of operations, becoming an international nuclear energy company that holds minority stakes in other countries. Its aspirations stop short of wanting to manage or operate those stakes, ending with minority ownership only. The move would help the oil-rich nation diversify its economy away from fossil fuels.

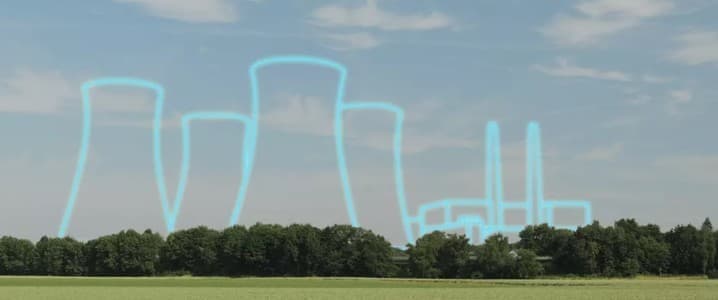

ENEC has been in discussions about such an investment in the United Kingdom, the sources said.For Britain, an investment could mean relief for its massive Sizewell C nuclear project, which it says it has successfully drummed up $25 billion in investments so far, in an effort to complete.

As part of “international growth and investment plans, ENEC is working with a multitude of partners to explore collaboration opportunities in both new civil nuclear projects and civil nuclear technologies and related clean energy technologies such as clean hydrogen,” ENEC told Reuters.

While several European nations are looking to expand their nuclear power footprint to help them reach their ambitious net-zero goals, others are divided on whether nuclear power should be classified as green energy at all.

While Britain appears to need investors for Sizewell C, UAE investors have found themselves out of favor, with Britain’s government blocking a UAE investment for the acquisition of The Telegraph and showing concern over a UAE telecom company investment, saying that it raised national security concerns.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com: